A Story of Mortgage Fraud and Loan Sharking in Simcoe County - Verico the Mortgage Station

As is the case for those who hurt children or animals, there should be a special place in hell for people who swindle senior citizens. Those are the people who built our country, who for decades paid their taxes and covered their bills, and who have worked their whole lives in the hopes of enjoying a bit of freedom and financial security during their retirement.

Sadly, that all too often changes when a smooth-talking suit hooks into them and robs them of their money, their dignity, and their hard-earned sense of financial security. We have all heard the stories and wondered why the police or government seem to do nothing to protect our most vulnerable citizens.

We found out the hard way that those protections simply do not exist, and we live in a world in which every potentially vulnerable senior citizen can only count on themselves.

This video is from 2019, but is still an accurate view of our social enterprise community channel.

We know some colourful stories are being told about our producer and crew, as some of them have made their way back to us. Lying is what the guilty fall back on when they build a box of deception around themselves and then cannot figure out how to get out.

The easily established truth is that our producer, John Ironside, is a 58-year-old veteran of the Canadian Armed Forces. During the 1990s, he was the photojournalist and then Deputy Editor for a National European newspaper owned by the Washington Times. That led to work as an international news and documentary video producer, establishing credits in places like Bosnia during their civil war and the Middle East during the first Gulf War. John has also shared his knowledge and experience as a teacher of media studies at three colleges in Ontario and British Columbia. Now he is a local small business owner and employer.

The value of these donations, over a nine-year period, exceeds seven hundred thousand dollars. In 2021, during the height of the pandemic, our Producers were acknowledged for their contributions to Simcoe County by being voted to the highest levels for an award for altruism that was presented by the Greater Barrie Chamber of Commerce and the City of Barrie (See the video below). Our producer also spends his mornings three days a week setting up tables and providing breakfast and other services to those entrapped within the homeless community . . .

. . . because when you cut through the lies and deception, that is truly who we are.

In March 2022, we wanted to use the last of the downtime to finish construction of a studio we had started to build so we could produce more community programming. It was the end of the pandemic and we needed to refinance, as was the case for many who had been forced out of work for an extended period.

We thought we knew Lisa Purchase, a broker at Verico the Mortgage Station, as we had produced for her through our commercial company a series of videos for her self-promotion. We thought we could trust her, but learned we were very wrong. Everything started normally enough. Lisa took John's information and promised the process would take three weeks.

Eventually, Lisa Purchase convinced her client to accept a CHIP Reverse Mortgage offered by HomeEquity Bank, which seemed to be the best immediate deal.

That is when the games started.

Three weeks became five, then six, and seven, and there was always a new excuse as to why the timeline was being extended. Then came the offers of mortgages from higher interest rate lenders who could conveniently provide the money right away. In an email dated May 9, 2022, Lisa Purchase responded to her client's concerns with excuses rather than answers:

"I still agree with everyone you've said. I have never dealt with this level of poor service from either this lender or FCT. I have also been repeatedly given timeliness that have not been met."

While our team waited on the financing, the existing mortgage and bills still needed to be paid, and the studio could not be used to bring in income.

So, we found ourselves in a situation of money flowing out and nothing coming in.

Lisa Purchase knew this, but all we heard was excuses.

In the end, with no other way of covering the existing financial obligations, and as the house's kitchen had been removed in anticipation of funds that were supposed to have been made available several weeks earlier, and as the studio could not be completed to earn income, the brokers at Verico the Mortgage Station offered to provide their mark with a loan for $2,000.00, which was being offered by another broker named Renee Dadswell who John had never met.

As he was dealing with supposedly ethical professional brokers, John expected the rate of interest to be in line with standard lending rates, but that turned out to be far from reality, as he was dealing with loan sharks.

Renee Dadswell made the money available by direct deposit literally the night before the outstanding original mortgage payment was due, and much to his surprise, when Lisa Purchase presented the loan agreement, John learned that the terms were conditional upon the victim of their confidence scheme "agreeing"to pay a rate of interest that is illegal under Section 347 of the Criminal Code of Canada, that was an act of usury, or loan sharking, which is an indictable offence that is punishable by a prison sentence of up to five years.

They closed the lid on the scam by telling their mark in writing that John could not borrow money from a third party without hindering and further slowing down the mortgage process.

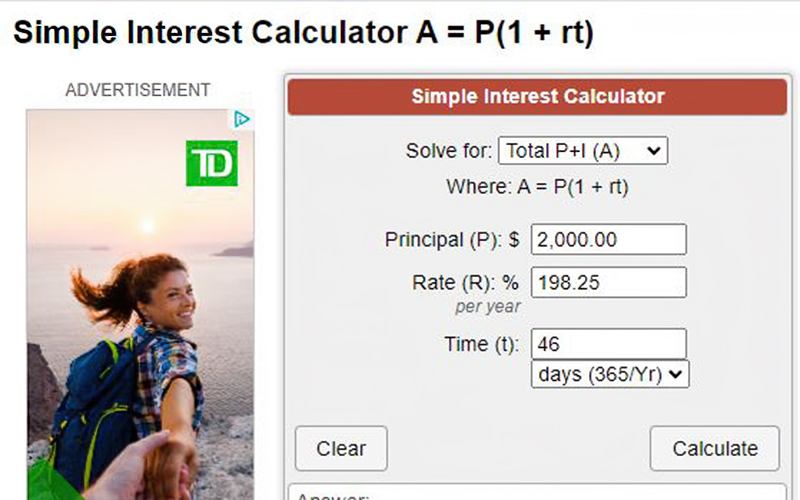

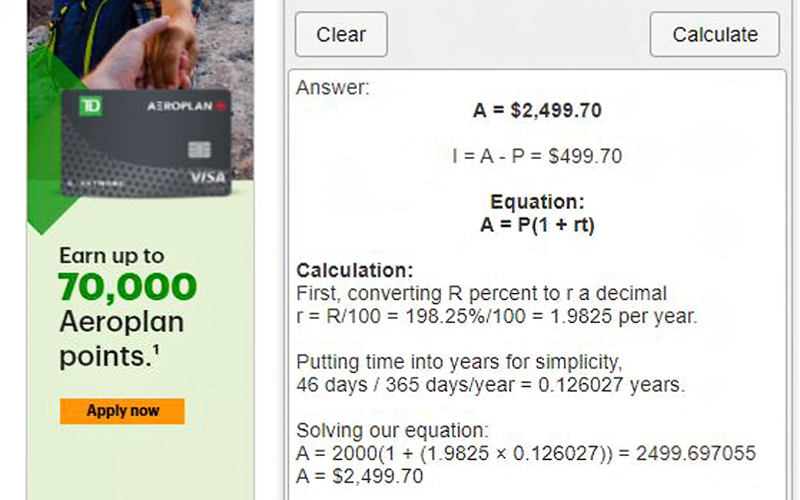

The official rate of interest was twelve percent per year, which would have been fair and reasonable. However, attached to it was a never discussed 'administrative' fee of $200.00 and a late pay out fee of $250.00 more. Lisa Purchase controlled the speed at which the mortgage moved forward, and part of the scam involved dragging the process out from three weeks to nine, which would be well past that due date. That never-explained series of delays enabled the loan sharks to also charge the late fee. When added together, as is done when calculating any illegal rate of interest, the $450.00 in fees added to the official interest rate of twelve percent on a loan of $2,000.00 that was outstanding for only 46 days added up to a cost of borrowing that exceeded 198 percent.

The legal limit under the law is sixty percent, and that is only charged in extreme cases, which is not the case when a house is used as collateral.

When the mortgage finally closed, 46 days after the loan was received, the brokers of Verico the Mortgage Station helped themselves to $2,499.75 from the mortgage funds disbursement, which was $49.75 in uncontested interest, plus the $200.00 'administrative fee', plus the $250.00 'late fee' that only applied because Lisa Purchase dragged the three weeks promise into a nine week nightmare. Their client contested the interest rate, and even told them it was loan sharking, but the brokers simply skimmed what they believed was "their cut" out of the mortgage disbursement, evidently believing there was nothing he could do about it.

Apparently, the brokers of Verico the Mortgage Station felt it was their right to steal whatever they wanted, and soon enough we found out why they felt so untouchable.

After the mortgage cleared and the financing was released, our producer wrote to David Flude, the Principal Broker at Verico the Mortgage Station, advising him of the usury and asking for a meeting to discuss how he was defrauded. David Flude put the meeting off multiple times, coming up with various reasons to avoid the conversation. On May 16, 2022, three days later, David Flude wrote, "We'll be in touch again after we do a review of things in some detail. My goal is to have an accurate and honest review so that we can have a full discussion of this from start to finish."Then, two weeks later, on May 30, 2022, David Flude lied, "You have not been kicked to the curb . . . We have to address this and report to our regulator so no chance of it being ignored . . . As a reminder, this is a regulatory requirement, so it won't be pushed aside."However, on June 9, 2022, after our producer pushed again for the meeting, he received an indignant reply from David Flude who brushed off the meeting, stating that the complaint to the Financial Services Regulatory Authority of Ontario (FSRA) was now the client's responsibility, and regarding the indictable offence of usury, he noted:

"This short term loan provided to assist you in making your previous mortgage payment obligation, in my opinion was a generous and helpful deal."

This sudden reversal regarding David Flude's desire to maintain compliance with the "regulatory requirements" of the Financial Services Regulatory Authority of Ontario (FSRA) showed our producer that he, along with his fellow provincially licensed and supposedly regulated brokers, Lisa Purchase and Renee Dadswell, were willing to simply ignore the law and the rights of their potentially vulnerable senior clients whenever they saw an opportunity to skim some grift.

These actions also showed that the loan sharks of Verico the Mortgage Station were at the very least dishonest and untrustworthy.

As David Flude was the senior person at Verico the Mortgage Station, John turned to the corporate headquarters of the brand, Verico Financial Group Inc., and the HomeEquity Bank that provided the financing. From both he sought an investigation into the transparently obvious criminal abuse of trust and fraud by usury. Much to his surprise, the attitude from both was one of 'we don't care' as neither stepped up to protect the rights of their client. Evidently, this kind of scam was so common that neither the complaint nor the evidence caused the slightest concern. The latter came as a bit of a surprise as the HomeEquity Bank is owned by the Ontario Teachers' Pension Plan Board.

Most people would think that such a large and diverse group of retirees would care about other senior citizens being defrauded, but apparently the management team don't give a damn.

John's next steps were to write an article and post it on our media website, warning others of the risks associated with arranging a mortgage through the brokers at Verico the Mortgage Station. The content was never contested. However, that was when we started receiving interesting stories from others who had not experienced the best customer service from the brokers of Verico the Mortgage Station and we were told about various other abuses that were claimed to have been committed against other clients, many of them seniors. The stories were mostly corroborated, and we stated feeling like we had a real story to tell about abuse of trust and the defrauding of often vulnerable seniors. John also filed a complaint of usury with the South Simcoe Police Service. That was done through a uniformed officer who said he saw merit in the complaint and that he would forward the hundred plus pages of evidence, mostly emails, to the Criminal Investigation Division.

That evidence included a bank statement showing when and how much was deposited by Renee Dadswell, and the mortgage Funds Disbursement Record that showed how much and when she skimmed based on usury.

John also wrote several times to Lisa Purchase advising her of his intent to file civil action in Small Claims Court, and to file a complaint for usury with the South Simcoe Police Service and the Financial Services Regulatory Authority of Ontario (FSRA). Eventually, about a month after stealing the money, Renee Dadswell very reluctantly and begrudgingly returned $200.00 of the $450.00 she had illegally seized by loan sharking.

However, even that act of self-preservation did not undue the crime she had committed.

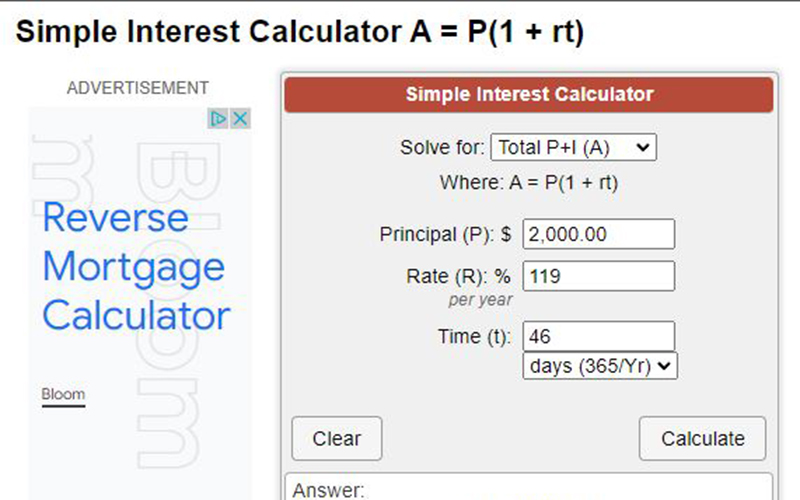

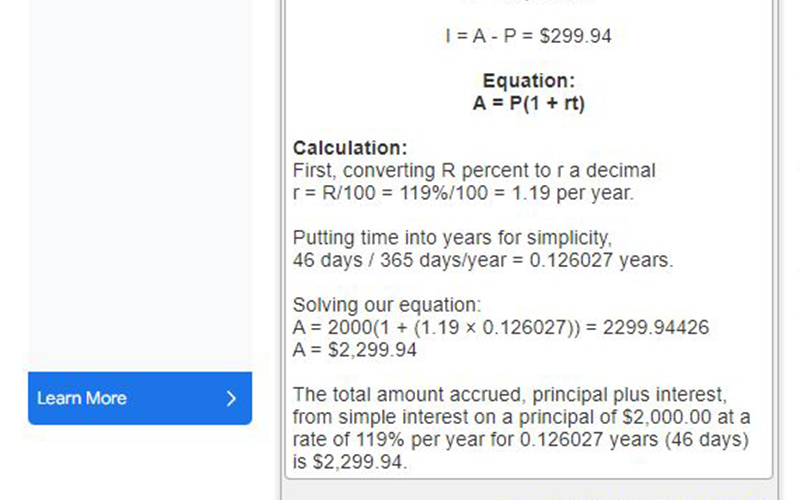

All she accomplished was to reduce the level of the crime from 198.25 percent to 119 percent, which is still usury, or loan sharking, as section 347 of the Criminal Code of Canada limits the interest rate to 60 percent in extreme situations. A year later, when the South Simcoe Police Service finally got around to 'investigating' and then whitewashing the crimes committed, Inspector Julio Fernandes tried to brush off the crime by saying she had paid back the 'mistake' by returning less than half of what she had stolen. That apparently 'motivated' claim was not based in reality, and it served only to exonerate the wealthy loan sharks at Verico the Mortgage Station.

The return of less than half of what was stolen could in no way eliminate the indictable offence Renee Dadswell had committed with the assistance of Lisa Purchase and the awareness of David Flude.

You will have to come to your own conclusion regarding what 'motivated' the officers and brass at the South Simcoe Police Service to so strongly assist the loan sharks of Verico the Mortgage Station, who boast sales of five to six million dollars a year.

Then, a full year passed without any kind of follow up from the South Simcoe Police Service, Verico Financial Group Inc., or HomeEquity Bank. David Flude also made no attempt to arrange the meeting to file the report of usury, or loan sharking, with the Financial Services Regulatory Authority of Ontario (FSRA). When pushed, the South Simcoe Police Service told our producer that they had simply abandoned the investigation. It was becoming clear that the brokers at Verico the Mortgage Station were well connected within the community, . . .

. . . and that a lot of people, both business associates and public servants, were being 'motivated' to cover for their crimes.

This became more obvious as our producer reached out to all parties reminding them of his concerns. The South Simcoe Police Service reluctantly assigned the case to a detective named Smith who was so blatantly biased in his investigation that he spoke only with the brokers at Verico the Mortgage Station, and completely ignoring the complainant. He then dismissed the allegations as being without merit, even though he made no attempt to attain any evidence or statements from the victim of the crime. When John enquired about the results, Inspector Julio Fernandes was downright offensive, which is an uncommon response for any professional when they have nothing to hide. Our producer then pointed out that the illegal fees of $200.00 and $250.00 had to be included within the cost of borrowing, and he sent his rebuttal to the mayor and council of Innisfil. That action resulted in apologies from Inspector Julio Fernandes and Chief John Van Dyke, and the promise of a revised investigation by a detective they claimed was specially trained in financial investigations.

That turned out to be another lie.

The Detective, Jason Muto, the 'specially trained financial investigator', told our producer that he did not know the difference between percentage and interest, and in addition to manufacturing inaccurate figures that served only to exonerate the wealthy brokers at Verico the Mortgage Station, he also chose on a whim to simply dismiss all the financial documents that substantiated the allegations.

Then, after having deleted the evidence, he claimed there was 'insufficient evidence' to lay charges of usury or any offence. That farcical abuse of public trust is now being reviewed by the Office of the Independent Police Review Director and will most likely be investigated by the Ontario Provincial Police Financial Crimes Division.

Keep in mind that usury, or loan sharking, carries a prison sentence of up to five years, so the crime is considered serious and is worthy of much better police work than that demonstrated by the Keystone Cops of the South Simcoe Police Service.

It is also a fact that despite our very public allegations against them, that we have presented in two articles and accompanying videos, nobody from the South Simcoe Police Service has contested our reporting.

The web of deception and corruption proved insurmountable, so our producer, a journalist and documentary producer, used his skills to take the story to the residents and voters of Simcoe County through a documentary that will be shown on both broadcast television and streaming services. We have also produced a variety of short videos that explain the facts and why we are challenging the powers that be to protect the financial security of seniors . . .

. . . and not simply kowtow to whoever has the most connections and ability to motivate loyalty.

We have been telling this story for more than 18 months, and we are reaching thousands of Simcoe County residents. That includes seniors and the family members who care for them. Our purpose is to forewarn them to be aware of the risks associated with trusting the brokers of Verico the Mortgage Station, or their equally responsible allies and abettors at Verico Financial Group Inc. and HomeEquity Bank. From the feedback we are receiving, it is working. Regardless, neither the brokers of Verico the Mortgage Station, the directors of Verico Financial Group Inc., nor the management of HomeEquity Bank have taken any action in civil courts, such as applying for a cease-and-desist order or injunctive relief from the Superior Court. Keep in mind that they are multi-million and multi-billion dollar corporations, and we are a small, not-for-profit media channel that exists to help the poor, hungry, disabled, and marginalized members of our community. That should speak volumes.

The reason for that is we have the evidence to support our claims, which is why they are all hiding from our cameras and the truth, while we are standing in the light.

Finally, after more than 550 days of reporting and the release of about two dozen videos we received a purported "Notice of Slander and Libel" that came to our producer's email from an anonymous source using the generic email address of info@themortgagestation.ca. There was no signature, no name associated with it, and no reference to a lawyer or legal firm. It was simply a penny-pinching and pathetic Do-It-Yourself attempt to frighten our crew off from reporting the truth and presenting the evidence of this story. Although likely intended to project strength, the document was little more than a mixture of whining about our reporting about their loan sharking and attempts at gaslighting. We welcome our followers to read it. We have also posted our producer's response, that is signed, that does bear his name, and which was sent from his very public email address.

Evidently, the brokers at Verico the Mortgage Station believe they can fool all of the people all of the time, but the truth about their criminal abuses is spreading and we and the truth are not going anywhere.

This story is not about a $450.00 grift. Our goal is to expose how our society is letting down its seniors by refusing to enforce obvious transgressions of the law. We had no desire to go public with this story, which is why we first reported the crimes of the brokers of Verico the Mortgage Station to Verico Financial Group Inc., the HomeEquity Bank. Only after they ignored us did our producer take the facts and evidence to the South Simcoe Police Service. It was their collective and self-serving decisions to ignore or cover for this crime that resulted in us seeking out and finding funding for a documentary to be aired on standard television and streaming services. These companies and public services have all forced our hand and compelled us to tell the whole truth with supporting evidence to a growing audience simply because they would not take appropriate action to investigate fraud committed against the clients or residents they had sworn to serve with honesty and integrity. Nobody is supposed to be above the law, but here, in Simcoe County, home of countless senior citizens, credible bank and broker financial evidence of loan sharking was simply omitted by the South Simcoe Police Service and ignorned by Simcoe County Council to protect wealthy loan sharks.

A couple of months ago, we noticed a dramatic increase in our placement on Google and other search engines, as we were suddenly hitting page one when testing almost every article and video. It did not take long to determine that somebody, likely for their own best interests, was promoting our stories through advanced techniques of Search Engine Optimization. The online promotions guru was likely hired by a competing broker or lender who saw an opportunity to boost their business based on the ongoing public scandal of the brokers of Verico the Mortgage Station.

This assistance, that was not solicited, is having a phenomenal effect on our following. We have also become a subject of considerable scrutiny, most likely by lawyers who the brokers of Verico the Mortgage Station are trying to hire, but who seem reluctant to touch this story with a ten foot pole. Our producer is experienced and has proven to be a very formidable self-represented litigant in the Superior Court of Justice. He has also argued against and defeated various vacuous threats of Strategic Litigation Against Public Participation (SLAPP) lawsuit.

We also have far too much evidence for Verico the Mortgage Station, Verico Financial Group Inc, or the HomeEquity Bank to try to muscle past, and Justices of the Superior Court do not like it when wealthy corporations abuse civil litigation in an attempt to scare off those who have been wronged by them. It is also a criminal offence to abuse the true purpose and intent of civil litigation in order to coerce somebody to not report crimes you have committed. The court's have also shown new determination to limit or eliminate Strategic Litigation Against Public Participation (SLAPP) lawsuits, and on September 23, 2021, the lawyer's oath in Ontario was updated as follows:

"I . . . accept the honour and privilege, duty and responsibility of practising law as a barrister and solicitor in the Province of Ontario. I shall protect and defend the rights and interests of such persons as may employ me. I shall conduct all cases faithfully and to the best of my ability. I shall neglect no one's interest and shall faithfully serve and diligently represent the best interests of my client. I shall not refuse causes of complaint reasonably founded, nor shall I promote suits upon frivolous pretences. I shall not pervert the law to favour or prejudice any one, but in all things I shall conduct myself honestly and with integrity and civility. I shall seek to ensure access to justice and access to legal services. I shall seek to improve the administration of justice. I shall champion the rule of law and safeguard the rights and freedoms of all persons. I shall strictly observe and uphold the ethical standards that govern my profession. All this I do swear or affirm to observe and perform to the best of my knowledge and ability."

We know the laws are different in Canada and the US, but just ask Donald Trump how that tactic of litigation for purposes of intimidation has worked out for him.

Finally, the crimes committed by the brokers at Verico the Mortgage Station led us to financial support for our documentary. When including the budget for pre-production and production phases, and then the income from post-production sales, we will earn more than enough to maintain our benevolent community channel for several years to come.

We did not expect this to happen, as we thought the brokers at Verico the Mortgage Station would be smart enough to just admit their 'errors', as they have all done in emails, or that the management teams of Verico Financial Group Inc. or HomeEquity Bank would have pushed them to be responsible. Instead, they all sunk their heads in the sand and wallowed in denial for 18 months as we reached more people.

The writer of the anonymous and unsigned 'Notice of Libel and Slander' noted the losses they had suffered, and David Flude said likewise when a potential client named Elizabeth humiliated him, calling him a liar etc. and supporting our producer while ensuring the Principal Broker at Verico the Mortgage Station that she was taking her business, which came on referral, to a different broker. In her email, dated October 26, 2023, Elizabeth noted:

"Mr. Flude. You truly must think people are stupid, and your explanation is insulting. After receiving your response I read everything Ironside posted about you and I watched all of his company's videos. His work is clean well produced and professional, unlike your accusations that appear vacuous unsupported and offensive to the intelligence of other people. If he was what you claim he would not be putting his name on his work, and you would have sued him a long time ago as he openly taunts you to do more times than I could count. I even went back to watch some of his other videos. The man has credentials from work all over the world and he was selected for an award for altruism in Barrie. nonetheless, you paint him as simply an agitator. You insult me sir as you do anybody to whom you tell that lie. You also fail to mention that those people he - agitated - all lost to his eviednce and several were convicted or fined as criminals. That means he was right, and it is why you will not fight him in court.. Have you watched any of the videos he has produced for the hundreds of charities that are not about your company? I doubt it, but I did. Not all 300 plus of them, but enough. He has worked with everybody from multiple mayors to the chiefs of police. That is one well-connected agitator. I once worked in the courts many years ago and clearly, your agitator is somebody who stands up as we all wish we could. I read through your cover story like you are stamped on tracing paper. As you can see I have copied this email in full to your agitator and i am granting Mr. Ironside my consent to use it as he wishes. I think he is doing a damned good job exposing you and your agents and I would even be happy to chat with him on camera. I am ever so glad I found his reporting about your business. I will also be asking if he can recommend an honest broker. Do not insult me again by trying to whitewash your actions. I will advise my friend of what I have learned and I doubt they will be coming to you for any renewals. i admit I have been angered by your deceptive response as i do not like being lied to. I do not want to hear back from you again." E.

Based on commission rates for mortgage brokers, that decision likely cost David Flude between $4,000.00 and $8,000.00 in personal income, and all because he turned a blind eye to $450.00 of grift by one of his brokers.

Regardless, despite the vacuous threats of the writer of the anonymous and unsigned 'Notice of Libel and Slander' to which our producer replied, and included his name and contact information, and went out of his way to affix his signature, neither the brokers at Verico the Mortgage Station nor the management teams of Verico Financial Group Inc. or HomeEquity Bank have filed civil action, sought injunctive relief to stop our expose documentary, or even denounced any of our claims and allegations. In fact, the only action they have taken is to send that flaccid, anonymous, and unsigned whiney 'Notice of Slander and Libel' which they did only after 550 days of hiding from the truth. It is also a fact that despite our choice to ignore the deadline set in that Notice, the amount of time since can be seen in the counter below, there has been no rush of activity on our website to suggest an army of lawyers or law clerks have sprung into action.

The story of Verico the Mortgage Station is not the only area of interest for our expose documentary, but it is the personal event that makes the commentary more relatable. We are researching stories now of similar abuses in Toronto and other communities, including attempts by developers and lenders to seize homes from seniors in a manner that is not supported by the law. We even have claims of physical intimidation being used when a senior's refusal to sell their house became a nuisance to developers who wanted to build condos or other expensive projects on the land. There were also multiple cases during the pandemic of developers choosing to charge more outside of the contract for houses under construction. These will all be addressed on the backdrop of our producer's experience. We will also be looking into other related stories of abuse by police officers of various jurisdictions.

It is an example of karma that while the wealthy brokers at Verico the Mortgage Station have pulled every string to evade responsibility for their crimes, it is their intended victim and our community that stand to benefit from relaying the facts while the loan sharks suffer from lost opportunities.

Please visit Latest News, and Reports and Videos.