Learning It Is Not Paranoia If They Really Are Watching You - HomeEquity Bank

Yesterday, Monday, August 27, 2024, was one of the busiest days on our website during the past six months, and much of the credit would seem to go to researchers or executives of the Ontario Teachers' Pension Plan (OTPP) which holds the HomeEquity Bank as an asset within its massive international, quarter-trillion-dollar holdings. They did not appear to be scanning our pages in search of content about the Schedule 1 Canadian Chartered Bank. Their interest appeared to be rooted in what we have had to say about the Ontario Teachers' Pension Plan (OTPP). It is only speculation, but it would appear from their content choices, that the big dogs are most interested in how Katherine Dudtschak has handled, or mishandled, her response to our fully supported allegations of loan sharking by the brokers of Verico the Mortgage Station which were committed while they were arranging a CHIP Reverse Mortgage sold by the HomeEquity Bank. We can only guess that the Ontario Teachers' Pension Plan (OTPP) is concerned about why they are now being discussed, and what harm the truth can do to their corporation as we are now openly reporting about the mega-corporation that holds the bank's leash. Some of the articles they reviewed include:

- Motivating Members of the Ontario Teachers' Pension Plan (OTPP)

- A Question of Character - Verico the Mortgage Station

- Letter To Katherine Dudtschak, President and Pending CEO, HomeEquity Bank

- Letter Follow Up to Katherine Dudtschak HomeEquity Bank - Human Rights Complaint

- Climbing the Corporate Ladder - Verico the Mortgage Station

- Did Lisa Purchase Jump Ship, Abandoning Verico the Mortgage Station?

- To Those In Hiding, A Genuine Offer Of Detente - Verico the Mortgage Station

- Verico the Mortgage Station 'Loan Sharking Seniors' Expose Documentary

- Reports and Videos

- There were multiple visits by various proxy server protected visitors on each of these pages.

Nobody likes to have their name associated with sleazy activity like loan sharking seniors and veterans, and defunding through fraud a charitable cause that donated all services to any charity, not-for-profit, or benevolent community group that asked. We are sure that kind of very public image is not helping Lisa Purchase, the now former broker at Verico the Mortgage Station, who either bailed on her fellow loan sharking brokers in her own best interests or was thrown under the bus as a scapegoat to dissuade public concern. Our exposure of these criminal and ethical abuses of trust is also affecting their third-party collaborators, with whom we had no grievance before they refused to act responsibly and chose to disregard industry regulations and their own publicly touted 'policies' that they apparently ignore whenever doing something could cause them inconvenience, or heaven forbid . . . profit.

The Criminal Code of Canada, Section 341 - Fraudulent Concealment states:

341 Every person who, for a fraudulent purpose, takes, obtains, removes or conceals anything is guilty of

- an indictable offence and liable to imprisonment for a term of not more than two years; or

- an offence punishable on summary conviction.

We don't know W. Mark Squire at Verico Financial Group Inc. nor Katherine Dudtschak the now established CEO and President of HomeEquity Bank, so why would we make such claims against them unless they are true? Regardless of their hiding and denial, it is now obvious to everybody following this story that despite their multi-million and multi-billion-dollar status, the people who run these corporations are terrified by the prospect of challenging the claims because they know we are telling the truth, that we have the evidence to support our allegation, and our team has extensive personal experienced and a 100% success rate defending against and exposing corporate abuses of our civil court system such as SLAPP lawsuits, which are used exclusively by the wealthy and well-connected to silence the truth about their own criminal and ethical abuses of trust.

We have openly challenged all three of these wealthy entities to sue our small not-for-profit media service if they truly believe we are publishing inaccurate allegations, but they have declined to act or even reply.

Based on their reaction, that being chronic denial, we can only conclude that the loan sharking brokers of Verico the Mortgage Station and their collaborators at Verico Financial Group Inc. and HomeEquity Bank are afraid to testify under oath in a court of law against our evidence; which in our opinion, and that of several lawyers, is more than enough to prove that the brokers of Verico the Mortgage Station committed the indictable offense of usury, also known as loan sharking, by charging the illegal interest rate of 198.25% in interest and fees to a senior and veteran on short term bridge financing, the need for which was manufactured through unexplained delays and excuses, which extended the closure of the mortgage from a promised three weeks to nine.

More than two years have passed since we started reporting on these criminal and ethical abuses of trust; however, nobody, including the South Simcoe Police and the County of Simcoe, has contested our allegations.

Court action, which has been threatened anonymously but never filed with the court, will also allow us to draw considerable focus to the investigation undertaken by detectives of the South Simcoe Police Service who omitted key evidence of the crime and fabricated figures to enable the multi-million-dollar brokers to avoid prosecution. That meeting was recorded on both audio and video, and it can be used as evidence in a court of law, as can an email sent to Detective Constable Jason Muto by our Producer, a former international journalist, private investigator, and college professor, advising the 'specially trained detective' of his 'errors' after the fact which included details of standard accounting practices when calculating interest instead of percentage. Somehow, the detective was 'motivated' to ensure the wealthy brokers received a 'Get out of jail free' pass on the indictable offence that carries with it upon conviction a prison sentence of up to five years.

The Criminal Code of Canada, Section 347 - Criminal Interest Rate:

347 (1) Despite any other Act of Parliament, every one who enters into an agreement or arrangement to receive interest at a criminal rate, or receives a payment or partial payment of interest at a criminal rate, is

- (a) guilty of an indictable offence and liable to imprisonment for a term not exceeding five years; or

- guilty of an offence punishable on summary conviction and liable to a fine of not more than $25,000 or to imprisonment for a term of not more than two years less a day, or to both.

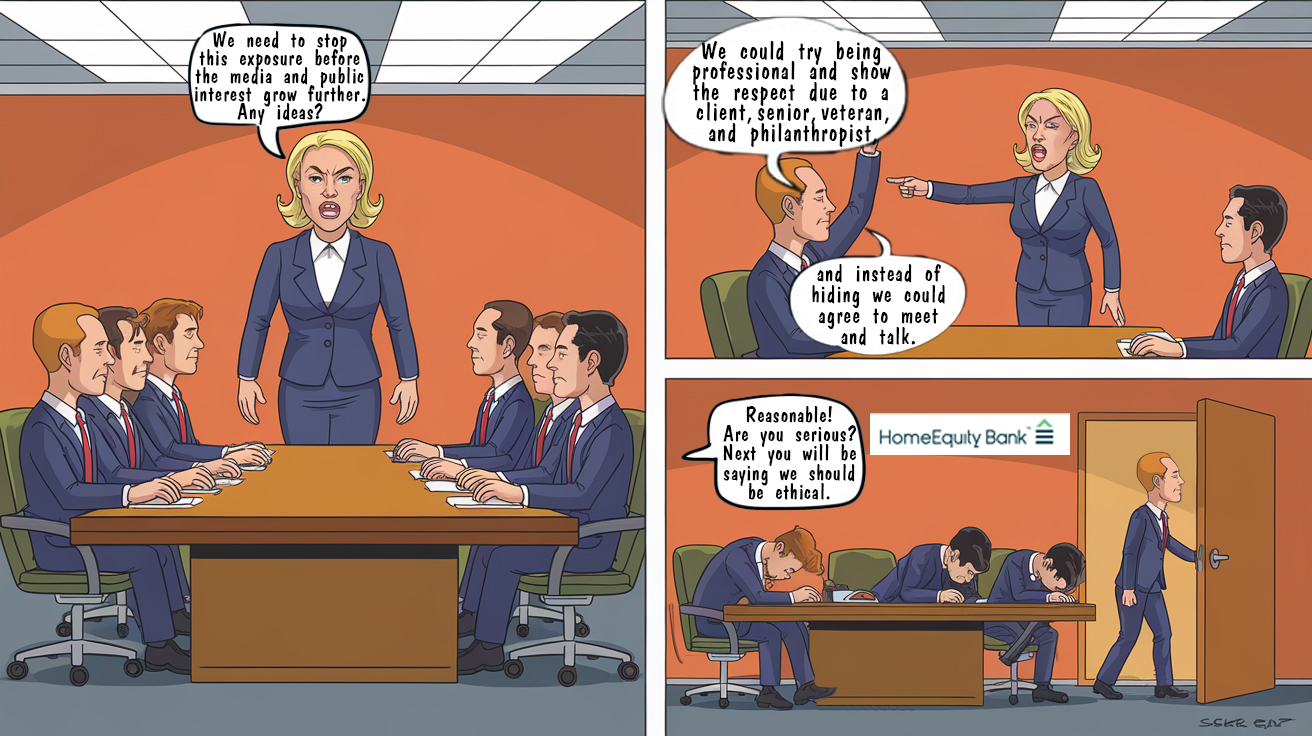

Instead of facing the truth or challenging our allegations, the loan sharking brokers of Verico the Mortgage Station and their collaborators at Verico Financial Group Inc. and HomeEquity Bank have all chosen to hide, refusing to even talk about our fully supported allegations on the phone. That overwhelming level of denial seems to be drawing the attention of those who are higher up the corporate food chain, who don't want to see their financial empire dragged down a rabbit hole by the members of their pension plan, many of whom already have issues regarding the ethics of the board of directors of the Ontario Teachers' Pension Plan (OTPP).

At their annual general meeting, members of the OTPP expressed impassioned concern that their pension is being used to invest in making the weapons being used to slaughter Palestinian women and children.

We know that our letter to the CEO and President of that quarter-trillion-dollar corporation, entitled "Jo Taylor, President and CEO, OTPP, Notified of Corporate Loan Sharking" has already been viewed by various mainstream media services and the competitors of HomeEquity Bank, as was true of our posted letters to Katherine Dudtschak "Letter To Katherine Dudtschak, President and CEO, HomeEquity Bank" and "Letter Follow Up to Katherine Dudtschak HomeEquity Bank - Human Rights Complaint". In a transparent case of negligence, Katherine Dudtschak has chosen to ignore the fully supported allegations of her client, a senior, veteran, and philanthropist, to investigate the loan sharking of seniors at Verico the Mortgage Station, regardless of the fact that nobody has challenged the allegations that are now VERY public. This to many, would suggest that profit is the ONLY thing of importance at HomeEquity Bank, and that despite their grandiose claims, they don't truly give a damn about their clients and the cardboard cutout of a contrived corporate culture that is in truth a facade used only to deceive potentially vulnerable seniors who they dupe through shady brokers to sell, sell, sell, as was claimed repeatedly and corroborated by dozens of former employees of the rogue Schedule 1 Canadian Chartered Bank.

Each of these people, and the corporations they represent, chose a path of denial and deception, and they are solely responsible for whatever facts we report about the fully supported truth of what they have done that threatens potentially vulnerable seniors, like your parents and grandparents, right across Canada.