South Simcoe Police Service Now Omitting and Falsifying Evidence to Protect Loan Sharks

At what point do the one-sided and blatantly biased actions of a police department become an act of obstruction of justice, and when does a detective become so motivated to help the criminals that he becomes an accomplice after the fact?

These are the questions we are now researching and bringing to light after a special fraud detective assigned by the South Simcoe Police Service to review the case of usuary committed by the wealthy brokers of Verico the Mortgage Station told our producer that he is omitting key evidence based on nothing but his personal desires while also knowingly using the wrong mathematical formula that will alter the rate of interest charged so that it does not appear to be usury or loan sharking. The first action is unethical, while the second is a crime.

On Friday, August 4, 2023, our producer, an internationally experienced journalist and former technical specialist for private investigations, met with Detective Muto at the South Simcoe Police Service precinct in Bradford. It did not take long for the experienced researcher to understand that the true purpose of the meeting was for the detective to justify, at least in his own mind, the fabrication of inaccurate calculations. He also made it clear that he was going to dismiss vital evidence to excuse the crime of usury, or loan sharking, that was committed by Renee Dadswell, with the assistance of David Flude and Lisa Purchase, all brokers at Verico the Mortgage Station.

Muto began by manipulating the amount of interest charged. To do this he used a formula that can only be used to calculate a percentage, not a level of interest. Math is pure science, and no ethical person will manipulate the results by using whatever formula will give them the results they want rather than the true calculation. This is especially true when dealing with evidence in a criminal matter. Muto's methods are comparable to using the Pythagorean theorem or the Theory of Special Relativity to calculate the weight of an elephant. It is the wrong formula, and this specially trained financial investigator should know it.

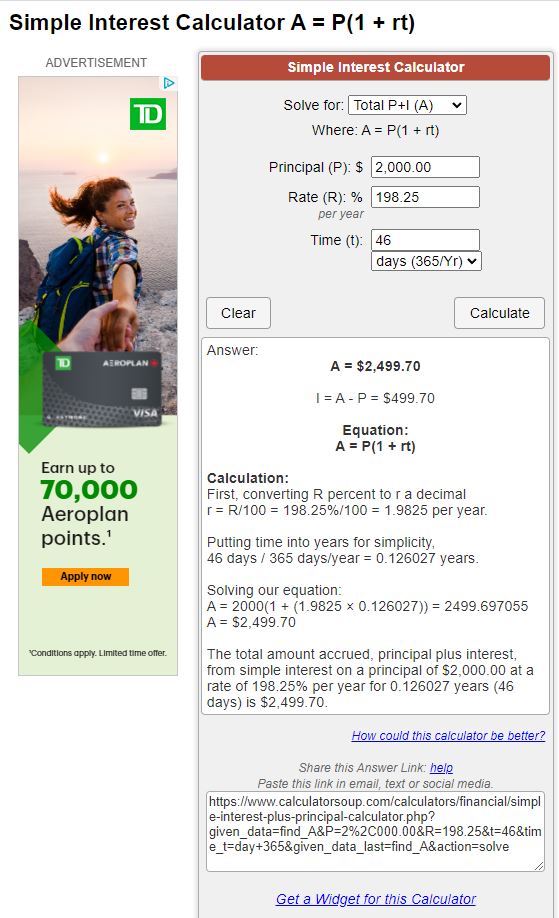

A percentage is a static calculation, like a snapshot of the moment, while interest is affected directly by time. Muto stated that he had calculated interest by a formula of principle divided by the interest paid which equals the interest rate. Using that formula, Muto could say that two thousand dollars divided by four hundred and ninety-nine dollars and seventy-five cents equals approximately twenty-five per cent interest. The results of this fundamentally flawed calculation allow the detective to fraudulently claim that the brokers of Verico the Mortgage Station did not exceed the sixty per cent threshold required to support a charge of usury, and we can think of only one reason why this specifically trained fraud detective would be knowingly fudging the figures.

A quick Google search confirmed that Muto is using the wrong formula to calculate the interest charged. We can only speculate what has motivated this specially trained financial detective to be so supportive of the brokers of Verico the Mortgage Station that he is willing to submit false evidence to exonerate them regardless of the truth and the evidence provided while working in a field of analysis that is supposed to be his area of expertise.

Even the loan shark mortgage broker admitted that time is a component of the calculation of interest, so why is Muto insisting that the formula he is using is the correct one, and that he cannot be wrong?

The ethics of the South Simcoe Police Service must now be called into question as their detectives have taken multiple actions, including omission and falsification of evidence, to fraudulently absolve the brokers and eliminate the stain of fraud that now spreads across three very profitable corporations. If such action was taken by a civilian, they would be charged with omission and obstruction of justice.

The track record of this case shows an organized plan of denial and dismissal on the part of the South Simcoe Police Service.

Our producer provided more than 100 pages of evidence to a uniformed officer, who reviewed the materials and saw merit in the claims. He then forwarded the files to the criminal investigations division of the South Simcoe Police Service, which was supposed to investigate the claims and evidence. However, instead, the evidence and allegations were ignored for a full year. Then, when we started reporting on this story a Detective named Smith was assigned to review the materials. Without explanation, Smith supported the brokers of Verico the Mortgage Station so completely that he dismissed the allegations without even speaking with the victim or asking for any further evidence. That is when we went public and showed the world through the presentation of real evidence the truth that Smith was apparently hoping to conceal. We also sent our evidence and allegations to all members of the Innisfil Mayor and Council. It was only then that Chief John Van Dyke and Inspector Julio Fernandes of the South Simcoe Police Service, who had been condescending and insulting to our producer, suddenly became apologetic and offered to assign Muto to review the file.

In an email, Fernandes claimed: "Detective Constable Muto has extensive training and experience involving high level, high monetary value, and complex fraud investigations both from our police service as well as from his time with a previous police service for several years."

The standard formula for calculating simple interest, as is accepted across the banking and financial world, is I equals P times R times T, or Interest equals Principal times Rate of Interest times Time. By choosing to remove time as a contributing and important factor, Muto skewed the results, which appears to have been the intent. A simple Google search of the words "calculate simple interest rate"will confirm our claims regarding the authenticity and uniform acceptance of the formula we present here for all to see.

Mathematical formulas are not adjustable, and no ethical person would alter them to make the numbers work for them. In this case, doing so could be considered an act of fraud and obstruction as this is a criminal investigation. There is also no excuse for Detective Constable Muto not knowing this formula given the high praise noted by Inspector Fernandes. We found the truth through a simple Google search that then led us to fact-check our findings through dozens of independent pages that confirmed the exact same formula as being the only valid calculation when determining a rate of interest.

We also found interest calculators on reputable websites run by brokers, mortgage companies, and banks, and all of them confirmed our position that when the time was included in the calculation, as is required, the brokers of Verico the Mortgage Station easily exceeded the legal level of usury, also known as loansharking. It seems highly unlikely that Detective Constable Muto, who has had several weeks to prepare for this meeting, honestly believes that his calculation of twenty-five per cent interest is in any way accurate.

Detective Constable Muto also tried to convince our producer that the law permitted him to extend the time of only one component of the offence so he could amortize the rate of interest charged over a year. He also unilaterally removed $450.00 per month of established charges simply because he felt the brokers of Verico the Mortgage Station would not charge them again. There was no evidence to support that apparently motivated conjecture, and feelings are not admissible as evidence in a court of law. The only evidence is that they did charge those fees; end of story.

This supposedly special financial detective tried again to fudge the figures by saying he could extend the timeline to 365 days while ignoring the bulk of the costs associated with the cost of borrowing that is established by the evidence. The offence was committed within a specific period, and it is interest-based, which relies on time as part of the calculation. As such, the specific time frame must be included as part of the calculation of interest charged.

The Criminal Code of Canada section 347(2) explains clearly that "Interest means the aggregate of all charges and expenses, whether in the form of a fee, fine, penalty, commission or other similar charge or expense or in any other form, paid or payable for the advancing of credit under an agreement or arrangement, by or on behalf of the person to whom the credit is or is to be advanced, irrespective of the person to whom any such charges and expenses are or are to be paid or payable . . ."

However, to make his math appear to work, Muto demanded that he has the right to remove the four hundred and fifty dollars a month in fees that were charged as part of the scheme of usury. According to our research, which we crossed referenced from multiple sources, eliminating evidence in this manner would violate the law that is supposed to apply to everybody, forming grounds for a charge of omission as well as possibly obstruction.

As always, we are presenting our evidence here for all to see. Included on the page of this video are the results of our calculation of interest which is generated by a credible interest rate calculator that is financially supported by multiple mainstream Canadian banks. National banks would not advertise on this service if the formula used, or the programming of the calculator was flawed. We have also provided a link to this calculator so our followers can confirm our findings for themselves. We have nothing to hide.

Does anybody really believe that the detectives are so incompetent as to not know the difference between percentage and interest?

This kind of openly biased investigation suggests a reason why the brokers at Verico the Mortgage Station, the managers of Verico Financial Group, and the board of directors of HomeEquity Bank have not sued us, nor sought a cease-and-desist order or other injunctive relief, especially when you consider that we are a small not-for-profit community channel, and they are multi-million and multi-billion dollar corporations.

For what possible real-world reason would any of these companies just sit back and allow us to make these claims about them without at least trying to silence our allegations if we are not reporting the truth? The answer is they know we can easily support our allegations with evidence in a court of law. So far, we have not received so much as a sabre-rattling legal threat or even an angry email.

Instead, the HomeEquity Bank took the sleazy route and is accused by Facebook of trying to sensor our story on social media claiming copyright violations that do not apply to journalists. Meanwhile, the various detectives of the South Simcoe Police Service seem determined to assist the brokers of Verico the Mortgage Station to evade prosecution for these crimes and have now progressed from denial and deflection to relying on knowingly fraudulent figures manufactured via a fundamentally flawed calculation that serves only to manufacture false evidence in support of protecting the loan sharks.

Why are these massively powerful corporations clearly scared to take the matter before a judge, and why will the South Simcoe Police Service not evaluate this case in an unbiased and balanced manner based on the evidence as is required of them by the Police Services Act? Why are we the only ones standing in the light of day presenting our evidence openly in our own names?

Due to the growth of this story, we have extended the timeline of our production. We may also change the format of the proposed series so that the multifaceted story of Verico the Mortgage Station, Verico Financial Group, HomeEquity Bank, and the South Simcoe Police Service becomes a standalone feature-length report about all the key players. We are also reaching out to socially-active directors and producers like Michael Moore seeking advice, guidance, involvement, and other resources. We fully expect to be reading components of our story in the mainstream media very soon.

Below is the content of the email sent by our producer to Detective Constable Muto after their meeting.

Sent August 6, 2023 - As of today's date, there has been no reply.

Detective Constable Muto

Following our meeting at your Bradford detachment on Friday, August 4, 2023, I conducted research regarding your claim that the time period of the loan does not affect the calculation of interest. According to your claims, interest is calculated by a formula of principle ÷ interest paid = interest rate. By your calculations, $2,000.00 ÷ $499.75 = 25% interest (approximately). At that time, I tried to explain to you that time is an essential component in the calculations, but you simply would not listen and stubbornly stuck to your error or deliberate deception.

My research shows that your assessment of the amount charged is indeed incorrect as your calculation is fundamentally flawed. The standard formula for calculating simple interest, as is accepted across the banking and financial world, is I = P * R * T, or Interest = Principal x Rate of Interest x Time. By choosing to remove time as a contributing and important factor, you skewed the results, which I believe was the intent. A simple Google search of the words "calculate simple interest rate"will confirm my claims regarding the authenticity and uniform acceptance of this formula.

As we discussed, under the Criminal Code of Canada, section 347(2) - Definitions:

"Interest means the aggregate of all charges and expenses, whether in the form of a fee, fine, penalty, commission or other similar charge or expense or in any other form, paid or payable for the advancing of credit under an agreement or arrangement, by or on behalf of the person to whom the credit is or is to be advanced, irrespective of the person to whom any such charges and expenses are or are to be paid or payable, but does not include any repayment of credit advanced or any insurance charge, official fee, overdraft charge, required deposit balance or, in the case of a mortgage transaction, any amount required to be paid on account of property taxes;"

So, regardless of whether the amount taken at recovery was claimed as legitimate rates of interest or as fees, such as the "administrative"fee or the contrived late fee, the $499.75 is the amount considered to have been charged as the true cost of borrowing. You confirmed this when you erroneously calculated the interest charged as being $2,000.00 ÷ $499.75 = 25% interest. You also attempted to amortize the offence over an extended period of a year, but without including already established fees. This also served only to skew the evidentiary calculations to the advantage of the wealthy and influential brokers at Verico the Mortgage Station who I have shown with real evidence defrauded me.

The offence is contained within a specific period, 46 - 48 days (depending on whether you include the day of the loan and the day of repayment or not), and you cannot water down the amounts taken by trying to extend the timeline of only one part of the calculation past that of reality. Doing so only serves to fraudulently nullify the offence, which seems to have been your intent.

You also rely upon the use of unprovable assumptions to excuse the brokers of Verico the Mortgage Station. You assumed that Renee Dadswell was not going to charge the administrative and late fees again had the loan been forced to continue due to their stall and delay tactics, even though she did charge both fees and you showed no evidence to support that she would not do so again. A legitimate investigation is undertaken based on the available evidence and is never based on your feelings or assumptions. The loan was expected to be paid back within one month, so Renee Dadswell did not explicitly say the fees would or would not be repeated. All you can apply to this matter is the fact that she charged fees of $200.00 and $250.00 for the loan that was intended to be for one month. The only viable extrapolation is that the practice would have continued as you have no evidence to the contrary.

According to 2019 statistics by Stats Canada, recidivism in financial crime is extremely high. In fact, white-collar fraud holds amongst the highest rates of repeated offence, especially if the perpetrator is not caught. You are required to assess the validity of these allegations based solely on available evidence, not your feelings or speculation about what you think they would have done if not challenged. The only reason for you to interject such frivolous hypotheticals is to muddy the waters and generate an excuse to see this matter in favour of the wealthy and influential brokers of Verico the Mortgage Station. The evidence does not support your position so you will simply create what works for you.

According to your calculations, the rate of interest charged to me for the 46-48 days of the loan on a principal of $2,000.00 is 25%. When the value of time is included, as is standard accounting practice, and that period is calculated as being approximately 12.5% of a year, the true interest rate on an annual basis is shown to be eight times what you calculated or approximately 200 per cent. Please see the attached file "interest calculator.jpg", which is a screengrab of a true calculation. This calculator can be found at: https://www.calculatorsoup.com/calculators/financial/simple-interest-plus-principal-calculator.php

For reasons that I will now be researching much more vigorously, the South Simcoe Police Service seems determined to make this matter simply go away, rather than protecting the financial security of the seniors who are amongst the population whom your officers are sworn to serve and protect. This is understandable when considering the resources that are available to the people I am exposing. The truth, as I am presenting it, also explains why a brokerage that boasts sales of $5-6 million a year and a bank that claims assets of $5.7 billion will not take a small not-for-profit community channel to court to seek a cease-and-desist order, damages, or other injunctive relief. Your flawed assessment of the facts of this matter is just another example of the ongoing pattern of denial and deflect tactics used by all exposed parties thus far.

It also seems clear that your motivation is to protect one of your own, that being Detective Smith who conducted the first investigation but did not even bother contacting me. Your goal also seems to be to ensure that the South Simcoe Police Service is not seen publicly to be corrupt, or incapable of handling sophisticated crimes committed by locally influential and wealthy members of your small community. That is an assumption based on my feelings, which carries exactly the same level of value in this story as the evidentiary theories created by you. Assumptions can be dangerous things, but I am not insisting that others must accept my conclusions based on nothing but speculation. When I express an opinion I say so, and I do not falsely present conjecture as being fact.

Your decision to misrepresent the math by using a fraudulent formula will not help the image of the South Simcoe Police Service nor convince those following our story that a true investigation has been undertaken. The pattern of deception and misrepresentation has only succeeded in making our story much more interesting. Now, instead of a story about a corrupt brokerage that seemed to be working on its own, we have a story about apparent accomplices at a bank that will do nothing to protect its senior clients and a police department that seems far more interested in manufacturing fraudulent reasons to close this case than truly investigate it. People are seeing the dots connecting, and drawing their own conclusions regarding what is motivating this loyalty.

If you file your results based on the now exposed fraudulent formula, I will call for a review by the Office of the Independent Police Review Director. I will also call for a true investigation by the Ontario Provincial Police Fraud Financial Crimes Division. I will also, if necessary, file an action in the Superior Court seeking damages pursuant to dereliction of duty under the Police Services Act. I am now researching case law through my account on CanLII, which is provided by the Federation of Law Societies of Canada. In time, I will be posting relevant rulings for the public to see so they can assess the truth or deception of your findings and speculations.

Inspector Julio Fernandes advised me that you are a highly qualified financial examiner, and as such I cannot comprehend how you do not know the formula for calculating simple interest rates when you are investigating a case of usury. Either you are not truly qualified to undertake this investigation, or you are not skilled at your job, or you are deliberately misrepresenting the evidence to protect one of your own and the brokers at Verico the Mortgage Station. There really is no fourth option. Should you choose to perpetuate this false narrative, now that you know your calculation is in error, then the answer becomes obvious. I will allow my followers at Five Points Media to make their own conclusions, as well as the representatives of mainstream media who are now frequently visiting our reporting.

I reserve the right to forward a copy of this evidence to the Financial Services Regulatory Authority of Ontario (FSRA), the Canada Revenue Agency, HomeEquity Bank, Verico Financial Group Inc., mainstream and independent media, the Ontario Provincial Police, and the Office of the Independent Police Review Director.

I also reserve the right to include the contents of this evidence as part of our documentary in progress and to include it in full or in part as content supporting our production in progress.

Regards,

John Ironside

Producer / Director

Five Points Media

A division of the Ontario Community Awareness Network

A registered not-for-profit

Big Blue Box Studios

1-310 Innisfil St. (corner of Essa Rd.)

Barrie, Ontario, L4N 3G3

Studio: 705-828-5605

Cell: 416-996-2786

Email: jironside@fivepointsmedia.ca

Web: www.fivepointsmedia.ca

FB: https://www.facebook.com/FivePointsMedia/

Throughout 2014-2023, our crew at 3B Solutions and Five Points Media has been identified as the "Best Videography in Barrie"by Three Best Rated; an independent consumer advocacy group that bases their ratings on testimonials and referrals from local businesses.