Lisa Purchase Moves On, Again, But Cannot Hide From Her History of Loan Sharking and Fraud

When Lisa Purchase suddenly departed from Verico the Mortgage Station, we could not tell if her decision was indeed hers, or if David Flude and Renee Dadswell had 'thrown her under the bus' to protect themselves against repercussions for their own criminal and ethical breaches of trust.

To go from an office in a brokerage to working as an online broker seemed like a big step down.

At first, Lisa Purchase started working with the uber-professionally named MortgagePal. It is an online component of Verico Paragon MortgagePal Inc. DBA MortgagePal Inc., a Verico brokerage located in Burnaby, BC, which according to their public list of lenders, found on their home page, does not appear to sell the CHIP Reverse Mortgage for HomeEquity Bank.

The plot thickens for the 'under the bus' scenario.

Now, just a few days after we released a brief update (see Latest Updates - August 12, 2024 - "Industry Source Claims Lisa Purchase Was Thrown 'Under the Bus'") Lisa Purchase is reporting that she is working as a broker for Tango Financial, which boldly states "We are one of the largest and fastest growing super brokerages in Western Canada, and an industry leader in technology and innovation."

There is nowhere to run or hide as the truth is discovered by more potential victims of fraud and usury, who are swiping left on the loan sharks of Verico the Mortgage Station.

At first, we did not see any connection between Tango Financial and the Verico branded MortgagePal, but a little online digging brought up the connection.

As can be seen in this social media post from May 2021, MortgagePal is part of Tango Financial. If that post suddenly disappears, you can see the post here. We found multiple other connections, but this article is long enough already. Also, here, on the broker page for an agent of MortgagePal, we see that HomeEquity Bank is listed as a source of funding on the bottom of the page, on the third tab.

We know all this because we have recently acquired a very powerful utility for online investigation that lets us dig into as many as twenty search engines at one time before viewing the data that is filtered and optimized by artificial intelligence. The new technology also allows us to bypass the ban on media posts currently still active on order of our federal government. It also gets smarter every time we use it, as it learns what we are looking for. We searched for "Lisa Purchase Mortgage Broker". That is when we learned that when you look past the first three posts, most likely paid links, you see just how many of our pages show up on page one of Google associated with her name. We also learned that Lisa's page on the Verico Mortgage Web is similar now to the one we reported on belonging formerly to Jessica Dadswell, now Jess Dadswell-Marshall, the daughter of loan shark Renee Dadswell, and if that link suddenly disappears, you can see a screengrab here.

We then ran the names of other key figures in this story and found similar results.

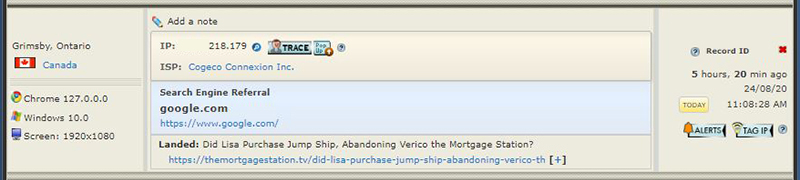

Yesterday, this visitor from Grimsby, near Hamilton, came to our site. They visited one page, 'Did Lisa Purchase Jump Ship, Abandoning Verico the Mortgage Station?' and then disappeared. They also came from a direct search result in Google, and according to our visitor logs they had never been to our story before. The visitor also used a PC, running Chrome, which is very unusual for anybody associated with Verico the Mortgage Station, Verico Financial Group Inc., or HomeEquity Bank.

This drive-by visit has all the trait marks of a client for Lisa Purchase learning of her history and true nature.

So, last week Lisa Purchase was working for MortgagePal, under the flag of Verico Financial Group Inc., but then, after we reported that she is still working under that corporate banner, despite apparently being used as the scapegoat for the loan sharking and fraud committed by the brokers of Verico the Mortgage Station, whose action were then protected by Verico Financial Group Inc. and HomeEquity Bank. Lisa Purchase is suddenly 'jumped ship' again, to begin working with the covertly associated Tango Financial, which displays no connection with Verico Financial Group Inc. on their website, but owns or partners with MortgagePal, which does.

It seems like somebody is making it look like Lisa Purchase was excommunicated from the 'family' so they had a scapegoat, but is also arranging it so minimal harm is done so she does not blow back on them.

This mysterious shuffling of the deck all seems a bit dodgy. After leaving Verico the Mortgage Station, for whatever reason, and bringing with her a great deal of easily discoverable shame, Lisa Purchase instantly lands on her feet to start working at another Verico brokerage where she can still sell CHIP Reverse Mortgage for HomeEquity Bank, but the brokerage is not advertising that they sell it. Then, Lisa Purchase moved again, a week later and right after our update, to join another brokerage that posts no public affiliation with Verico on their website, but is joined at the hip with MortgagePal, which does. It is almost like the collaborators want to pull the wool over the eyes of their clients, and us, so they can have a convenient scapegoat to blame for the loan sharking and fraud, but not lose a trained and top earning broker who they think they can sneak back into the fold later to continue defrauding especially vulnerable seniors.

Sorry folks, but you underestimated us once again, and we will continue to inform and update our growing audience about your apparent underhanded schemes to defraud especially vulnerable seniors.

Another legitimate question is why did Lisa Purchase have to go as far as British Columbia to find a position as a mortgage broker, when there are literally dozens of Verico brokerages between Toronto and Barrie? Could it be the same reason why Jessica Dadswell, now Jess Dadswell-Marshall, appears to have left the mortgage brokerage industry completely? Lisa Purchase is listed in our story as an active co-conspirator of the criminal activity, and Jessica Dadswell, now Jess Dadswell-Marshall, carries the same name as her loan shark mother, Renee Dadswell.

Could the public stain of the criminal and ethical abuses committed by the brokers of Verico the Mortgage Station and their collaborators be so bad that nobody in the local industry wants anything to do with them?