Plans in Play to Use Social Media to Ensure the Greatest Exposure

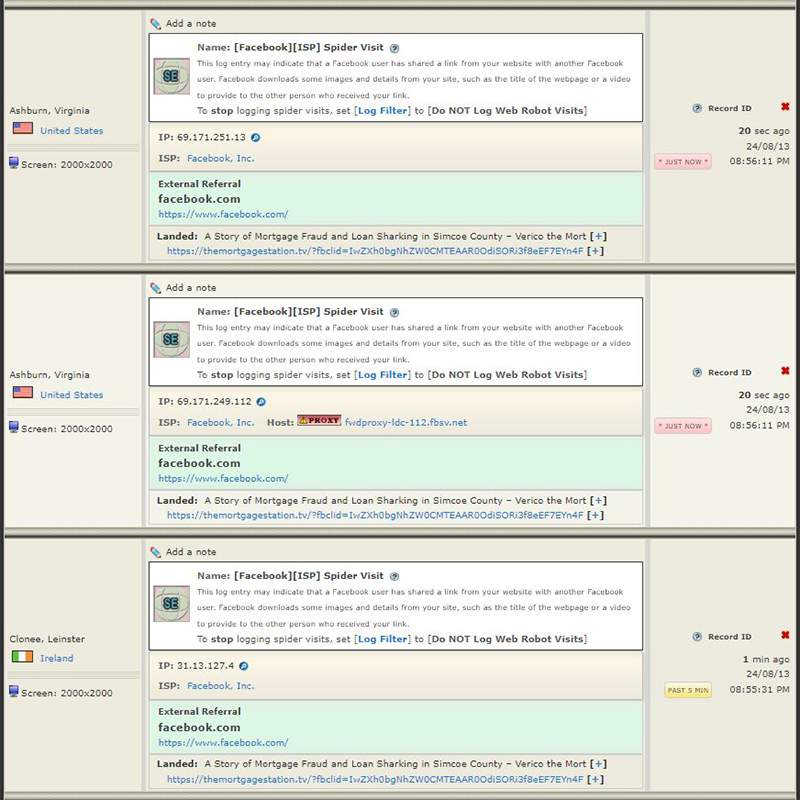

Last night, we were notified for likely the tenth time this week that somebody had shared content from our website to their Facebook page. This time, the person posting our content was behind a proxy server, which we understand given the subject matter and the fact that one of the corporations being reported on is the quarter-trillion-dollar Ontario Teachers' Pension Plan (OTPP), which holds the HomeEquity Bank in its dossier of assets. In the notification, Facebook advised:

This log entry may indicate that a Facebook user has shared a link from your website with another Facebook user. Facebook downloads some images and details from your site, such as the title of the webpage or a video to provide to the other person who received your link.

Although we are happy with the traffic to our website, we think now is the time to push on social media.

Last year, we used Facebook to boost our videos and stories about the 'motivated' investigation by South Simcoe Police Service in which the detectives ignored the allegations for a full year, and then spoke only with the accused and not the victim, and then omitted from the evidence key financial documentation, all so they could cut a 'get out of jail free' pass for the multi-million-dollar brokers. The result was more than 40,000 views on the story "South Simcoe Police Service Now Omitting and Falsifying Evidence to Protect Loan Sharks" and more than 30,000 on the follow up, "South Simcoe Police Service Cook the Books to Help Rich Crooks". We then saw similar results when we published "HomeEquity Bank Turns To Censorship - Far Too Little, and Much Too Late", about a legally unsupportable means of censorship used by the HomeEquity Bank, which also reached more than 30,000 people.

We will now be adding 'Share to Facebook' and possibly other 'share to' buttons on all new stories and we will start working our way back in time to include existing past issues.

We are moving forward with plans to boost several videos within the top five social media platforms to hundreds of thousands of potential victims living in the six most populated regions of Canada.

On July 19, 2024, we announced our plans to launch a promotional campaign on social media focused on the top six population centres in Canada. Our intent will be to warn potential victims of the risks of mortgage brokerage loan sharking. That particular indictable criminal offence, which is punishable upon conviction by a prison term of up to five years, would appear to be so prevalent within the mortgage industry across our country that the board of directors of HomeEquity Bank have seemingly done NOTHING to prevent the abusive behaviour when brokers are selling their CHIP Reverse Mortgage, and have chosen instead to hide from their responsibilities and do NOTHING to protect their especially vulnerable senior clients.

Either they are powerless to prevent the indictable offence, and lying by claiming they can resolve complaints, or they are collaborators who turn a blind eye to let their brokers defraud, skim, and steal money from seniors.

Those videos are finished, and ready to post, but we have chosen to wait for summer to fade to autumn, when the people we are trying to reach are home from vacation, the temperature drops keeping them in at night, and about three times as many people are frequently online. Our best guess is September 15, 2024, but our release date could be as late as October 1st. We want to get the best bang for our buck, and as we are committing tens of thousands of dollars from the budget to attract more interest in this story, we need to crunch some numbers, watch the regional temperatures, and follow some data streams to decide when we will reach the most people.

Currently, six short, dynamic videos will attract to our story more potential victims, as well as journalists, law enforcement officials, competing brokers and lenders, and the decision-making adult children of seniors.