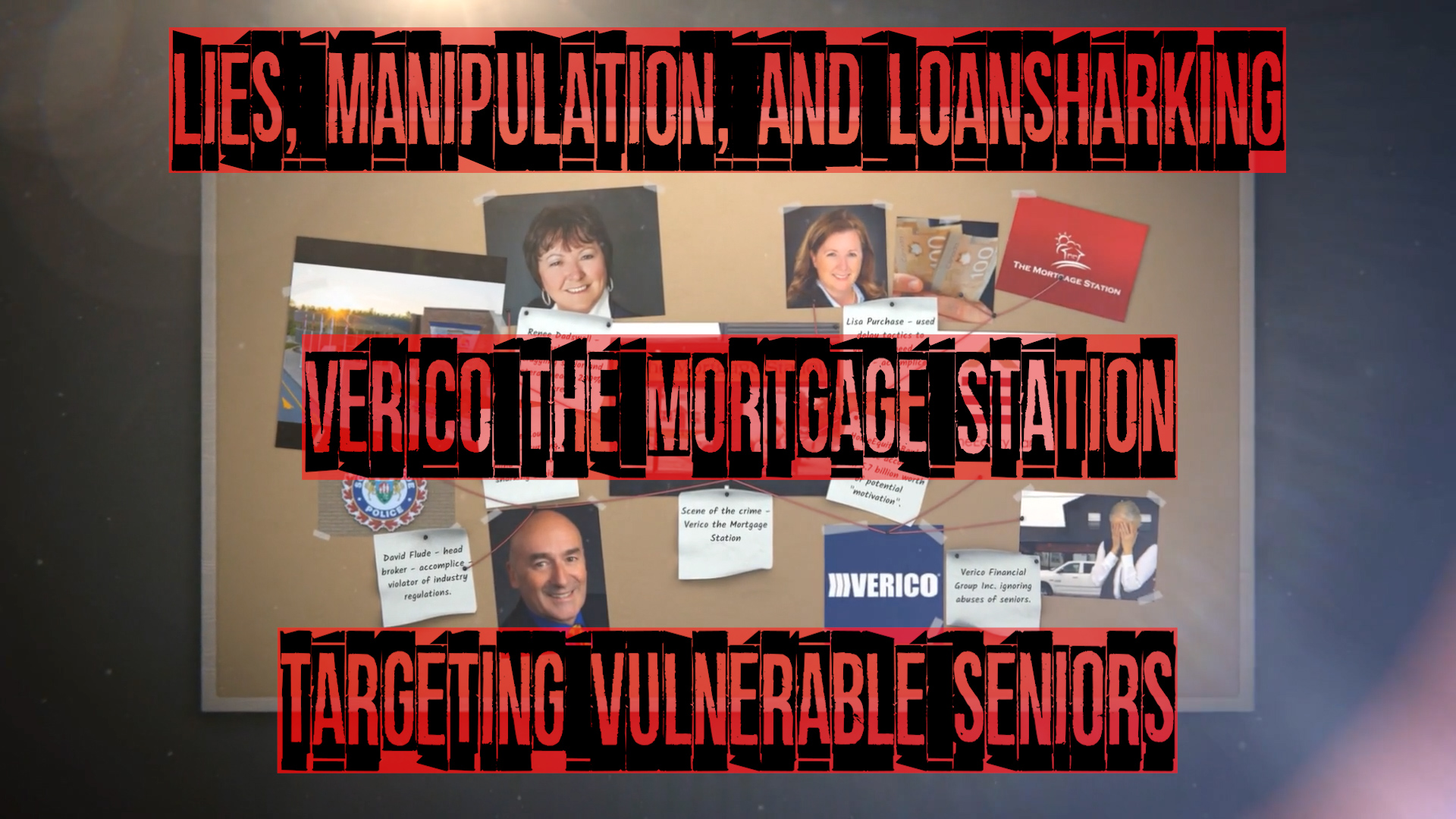

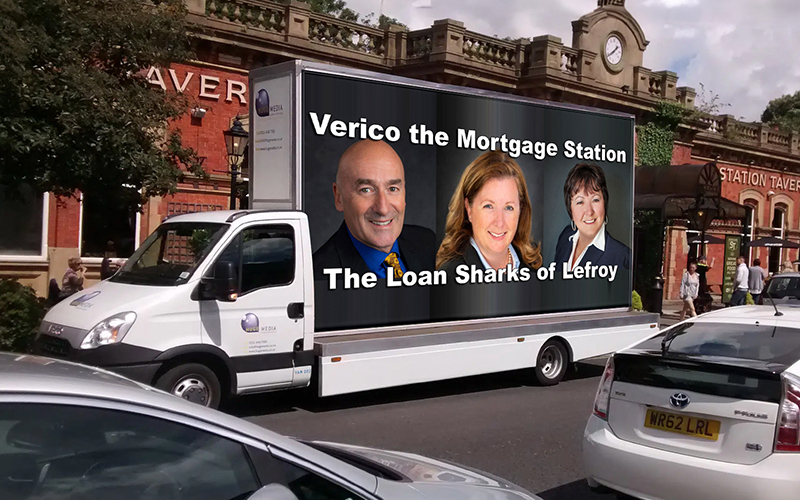

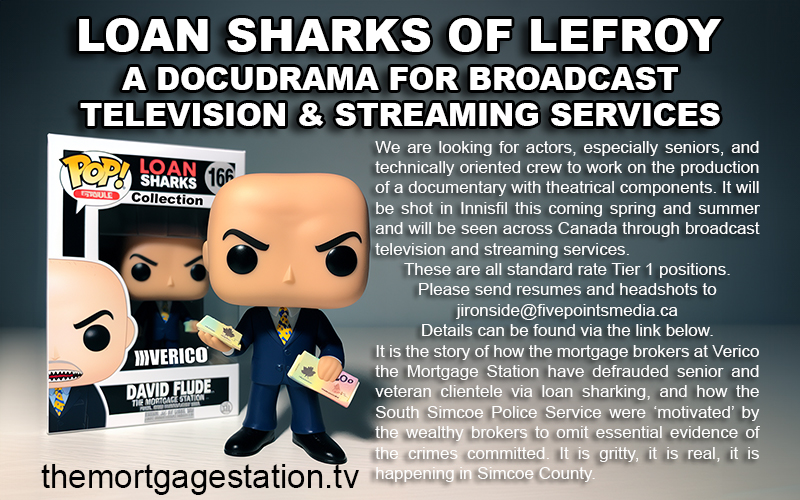

Verico the Mortgage Station 'Loan Sharking Seniors' Expose Documentary

Welcome to Latest News for the most recent articles and videos.

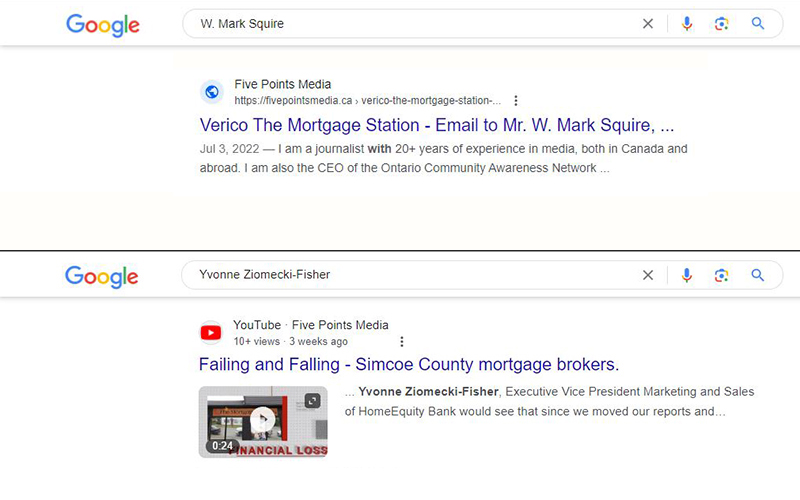

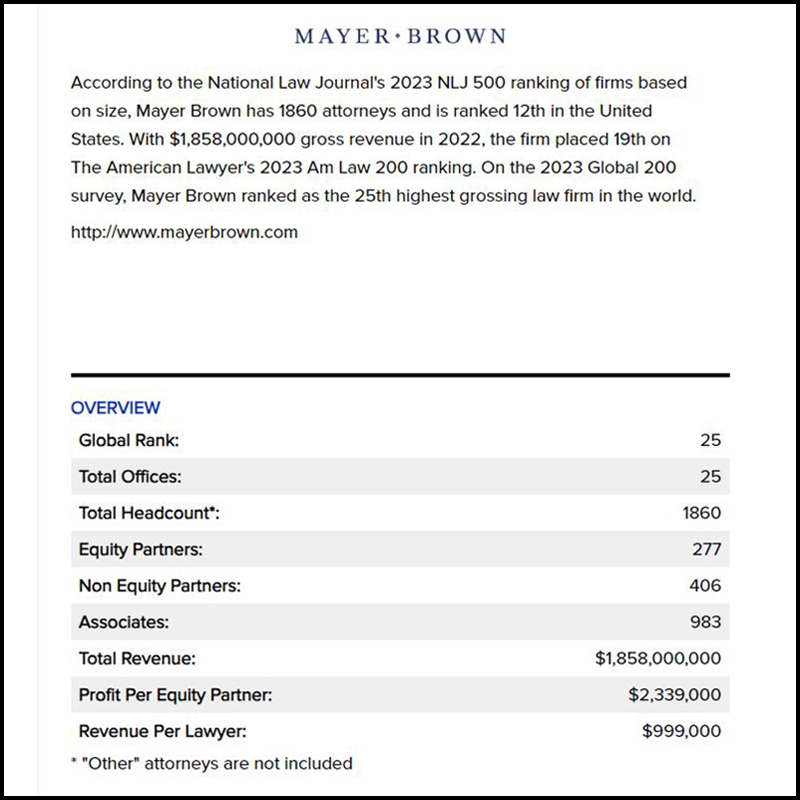

This website is dedicated to promoting an expose documentary that pulls back the curtain on the crimes committed at Verico the Mortgage Station, where brokers not only defrauded a senior and veteran by usury, or loan sharking, but also through their methods of manipulation caused the virtual closure of a not-for-profit media service that for more than 11 years has donated all services to more than 180 charities, not-for-profits, and benevolent community groups through the donation of 350+ fundraising and informative videos valued at more than $700,000.00. That service was deemed so valuable to the community that in 2020, at the height of the pandemic, the producer and crew were nominated and voted to the highest levels for an award for altruism presented by the City of Barrie and the Chamber of Commerce. The purpose of our documentary, which is being produced for broadcast television and streaming service, is to warn local seniors about the risk of doing business with the brokers at Verico the Mortgage Station and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank.

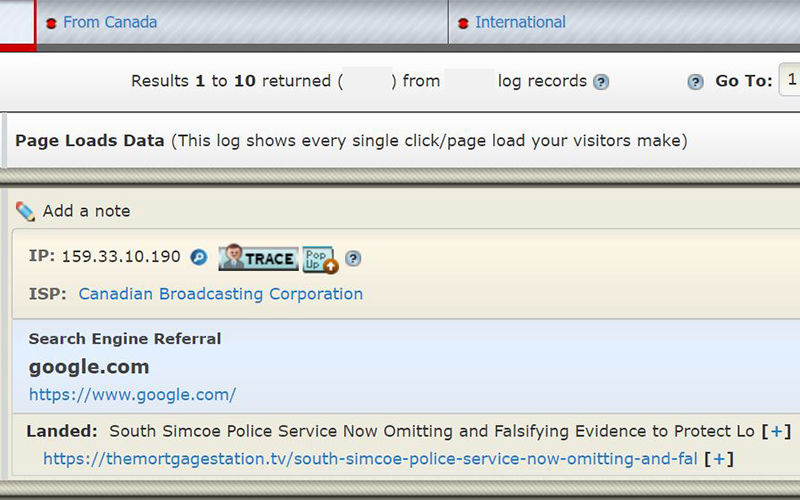

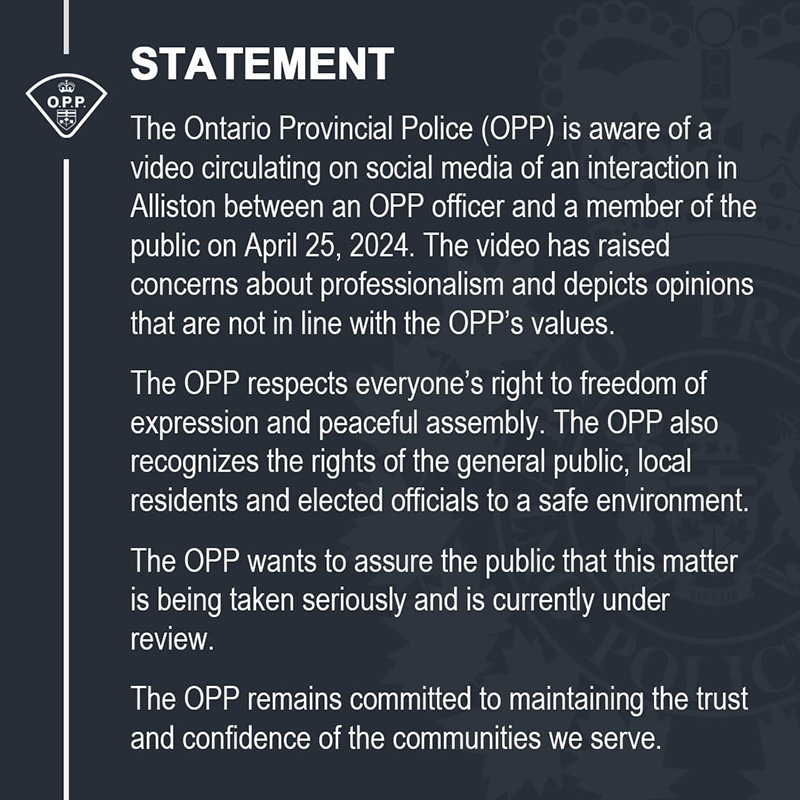

As part of our story, we also focus on the apparent breach of public trust committed by detectives of the South Simcoe Police Service, who assisted the multi-million and multi-billion-dollar corporations by omitting evidence and falsified figures so they could avoid laying charges of an indictable offence punishable by up to five years in prison. We are also exposing how every member of Simcoe County Council not only did nothing to protect seniors from the wealthy brokers, they also refused to even acknowledge receipt of our evidence, which included a bank statement and mortgage funds disbursement record that confirm a rate of borrowing of 198%, when the legal limit is 60%.

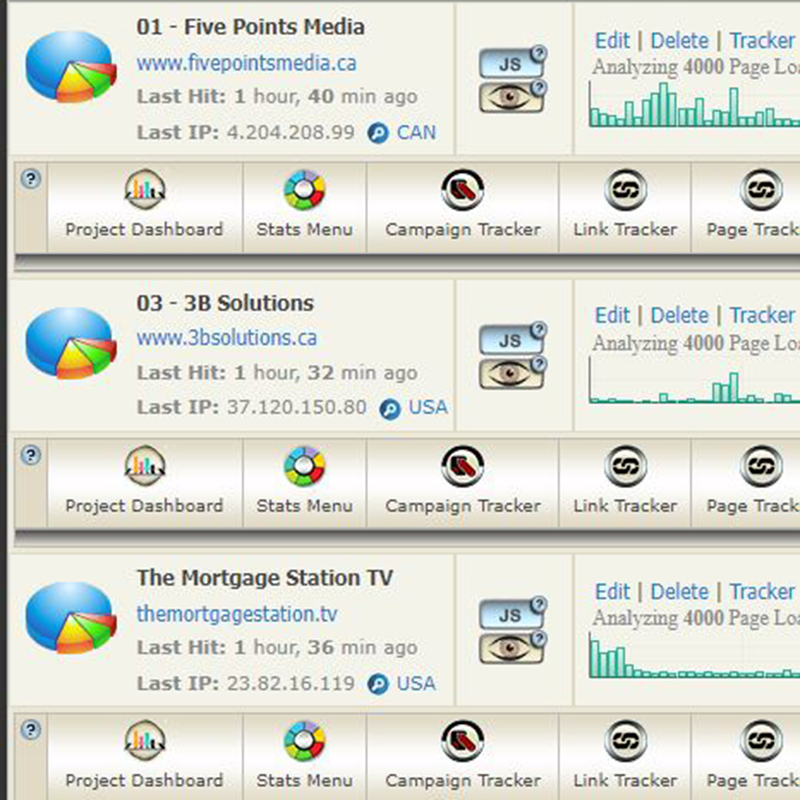

The above counters show how long we have been reporting on this story, and how long ago the brokers at Verico the Mortgage Station demanded from anonymity through a lame, legally unsupported claim of libel that we stop reporting on this story under threat of civil action via an unscrupulous and reprehensible Strategic Litigation Against Public Participation (SLAPP) lawsuit. Despite our written refusal to comply, and our decision to continue exercising our right to tell the truth of this story, that has been boosted to hundreds of thousands of people by an anonymous search engine optimisation expert, none of these massively wealthy corporations, nor any of the supposedly 'libelled' financial 'professionals' involved, has filed any kind of legal action against our small, not-for-profit, social enterprise that donates all services to those in the greatest of need in our community.

Only tangible evidence of financial crime would hold back three multi-million and multi-billion-dollar companies that are licensed based on their ethics, and which refuse to stand up and defend against our allegations.

We Simply Don't Care . . . or that's really what we want you to believe

The loan sharking brokers of Verico the Mortgage Station, and their corrupt corporate collaborators at Verico Financial Group Inc. and HomeEquity Bank, have put considerable effort into trying to make us believe that they don't care about our ongoing reporting, through which we are exposing their criminal and ethical breaches of trust by fraud through usury, or loan sharking, as is focused on their senior and veteran clientele. Their denial is of no concern, as due to our ongoing efforts, and those of their competitors, we are very successfully reaching the potential victims of these abusers of trust, who understand why these corrupt multi-million and multi-billion-dollar corporations have been hiding from our evidence for more than two and a half years, rather than challenging our allegations, and that these "ethical professionals" are losing tens of millions of dollars in potential income, laying off staff, and even selling off their newly built custom built office space as a result of their inability to disprove our claims.

The directors of these corrupt corporations seem to believe their potential clients are all idiots.

These panic attacks by the directors of Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank just reek of desperation.

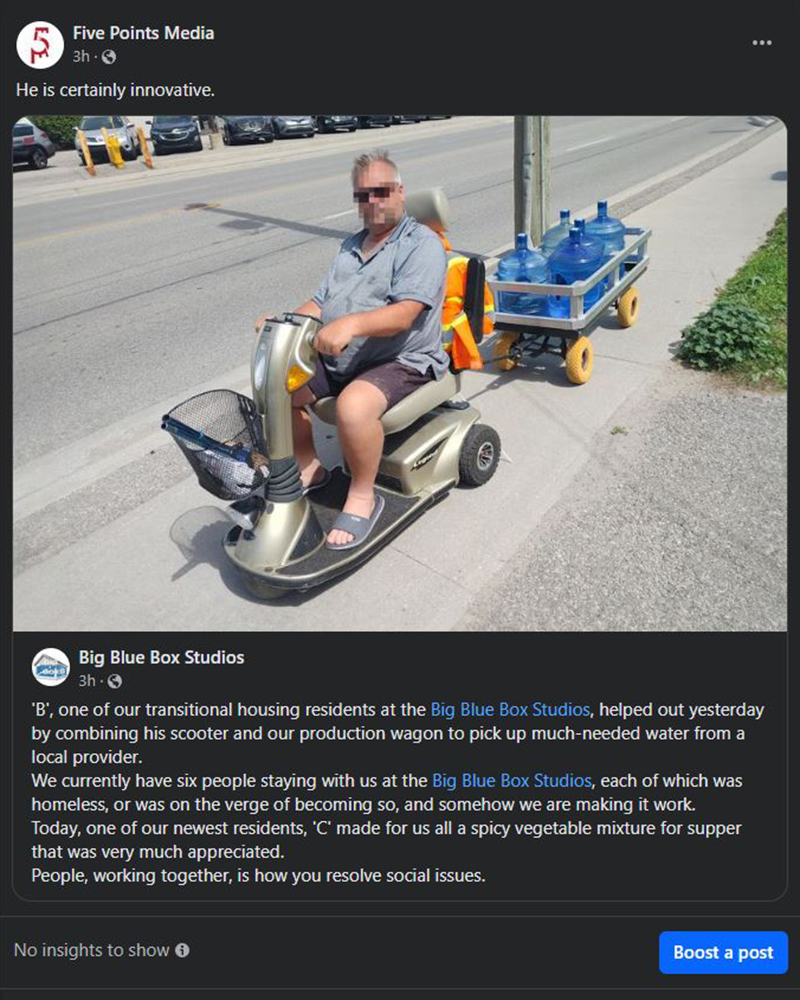

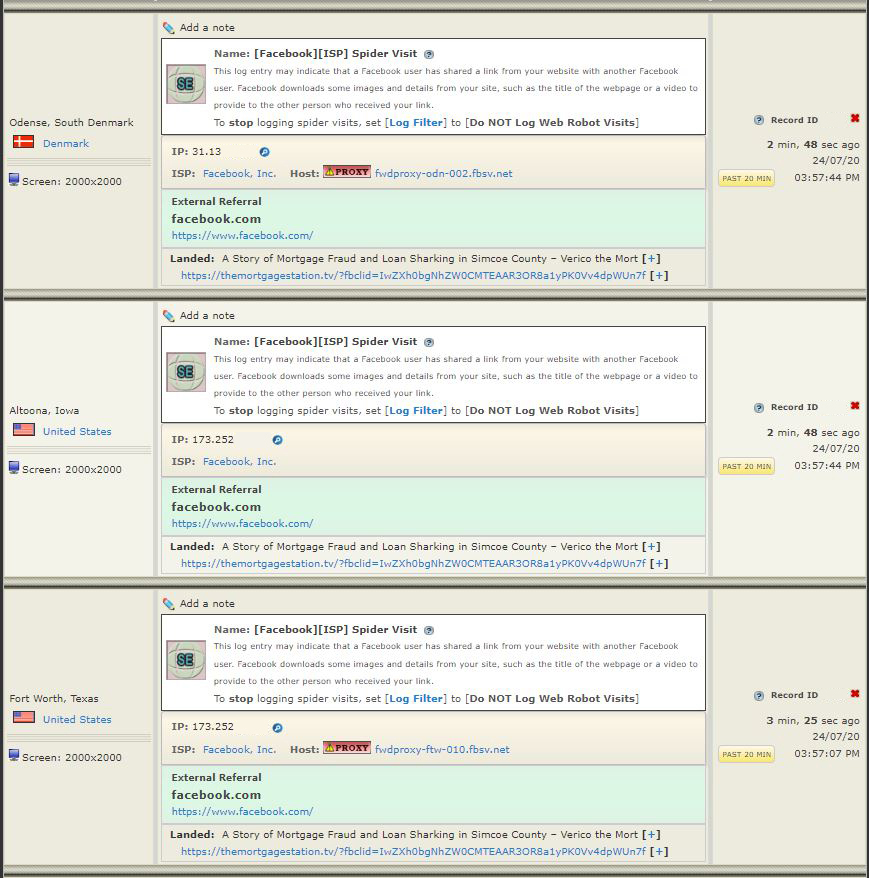

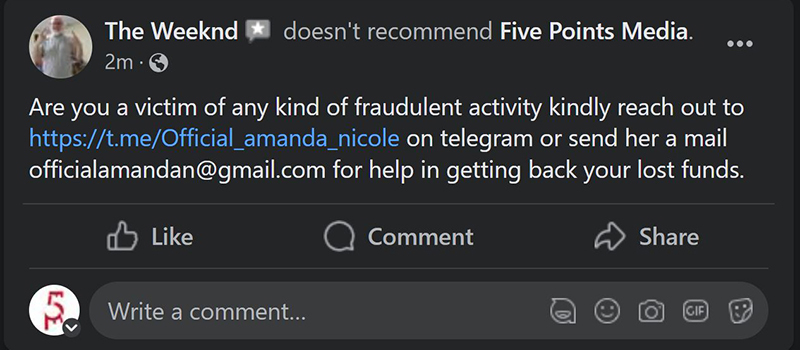

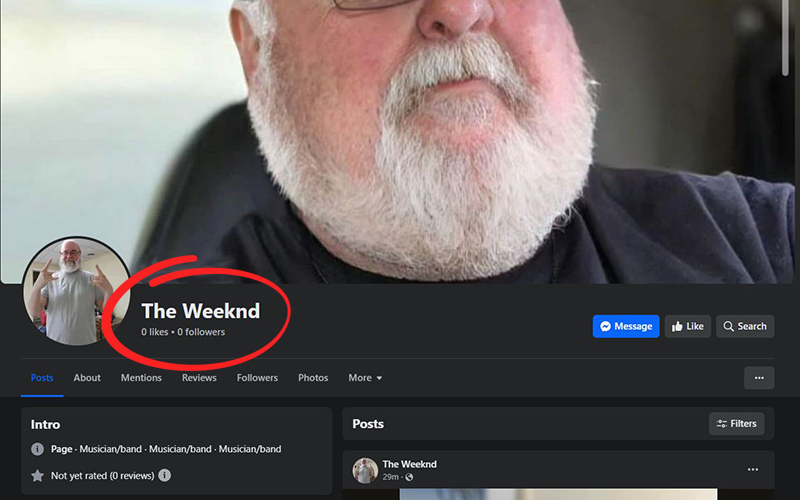

Despite their "nothing to see her folks" mentality, out of the blue this happens, at least twice a week, and frequently more often, as visitors suddenly flock, as if directed, to our long dormant former social media account for this project, which has not been updated for more than a year, social media content for our commercial media company that is not in any way associated with this documentary, other than we are using our two broadcast studios, location production equipment, and other state of the art media facilities to produce the finished content. They even rush on masse to the Facebook page associated with our transitional housing sanctuary for unsheltered people and their dogs, which quite obviously has no connection to this project.

We are not sure what the directors of Verico the Mortgage Station, Verico Financial Group Inc., and HomeEquity Bank are hoping to find in these mostly charitable pages, but 32 visits in one day just reeks of desperation.

AI Is Now a Major Tool in Our Quest to Expose Mortgage Loan Sharks and a Corrupt Bank

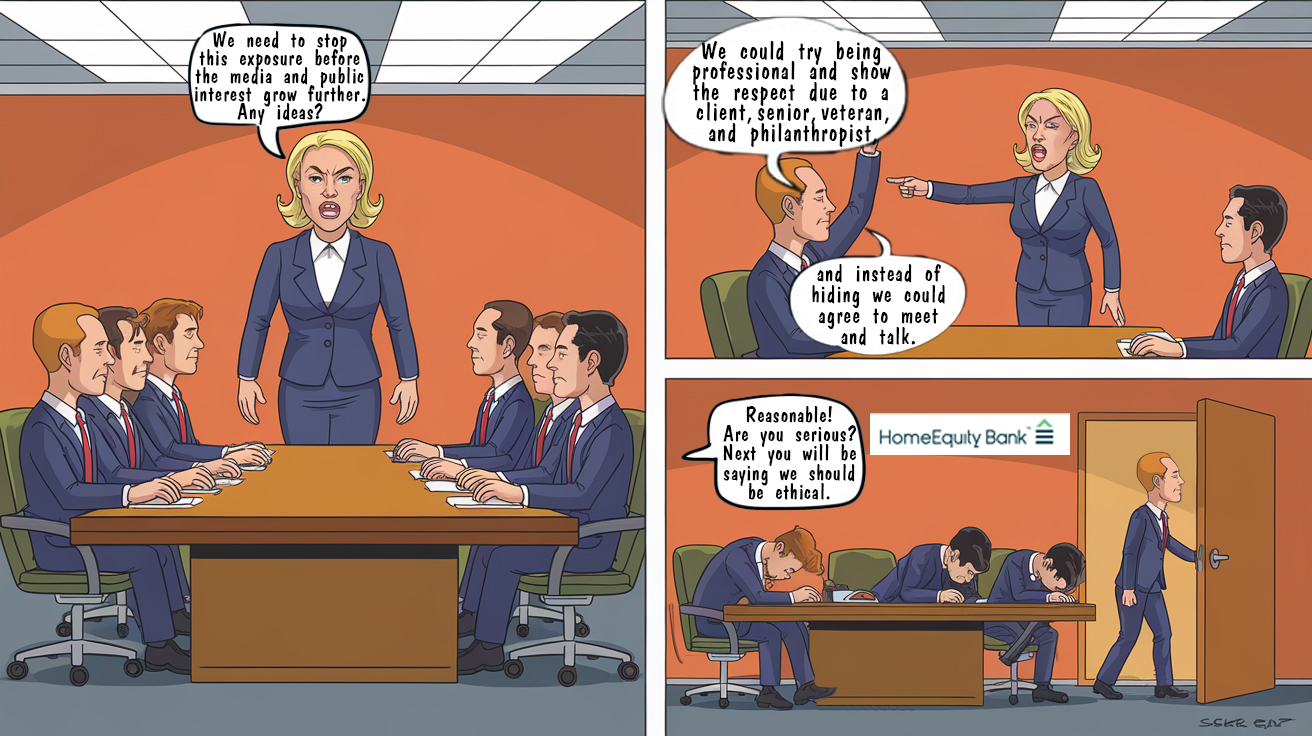

As we have noted in past articles, we have dabbled in AI technology, especially when producing original custom art. However, we have not used it for much more. During the past few weeks, as we have worked on the story of ethical abuses and corruption in the office of the mayor in Barrie, we have started using it more for research and writing.

Our claims and evidence have never been challenged.

We started with ChatGPT, which is a nice little interface for creativity. However, as our needs grew, we started looking at other options, and while ChatGPT can be compared to a nice little family car, we discovered we could sign up for services provided by metaphorical monster trucks and Ferraris.

The power of some of the AI interfaces is frankly off the charts, and we have spent a lot of time learning how to make them work for us most effectively.

We will start by noting how we can now graft the actual faces of our subjects onto the art we create about their criminal and ethical abuses of trust. They are not perfect, but with a couple of samples each, the AI renders a pretty good likeness.

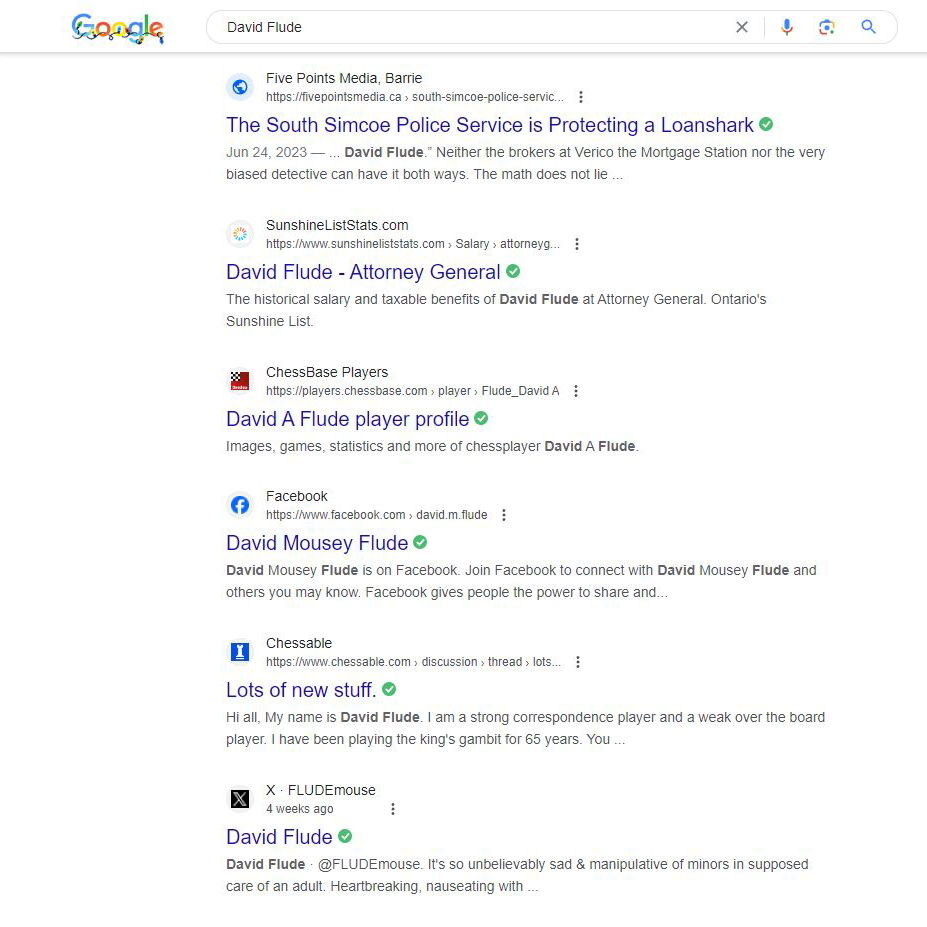

The facial accuracy of this image is based on one photo each of David Flude, Renee Dadswell, Lisa Purchase, Katherine Dudtschak, W. Mark Squire, and Jo Taylor.

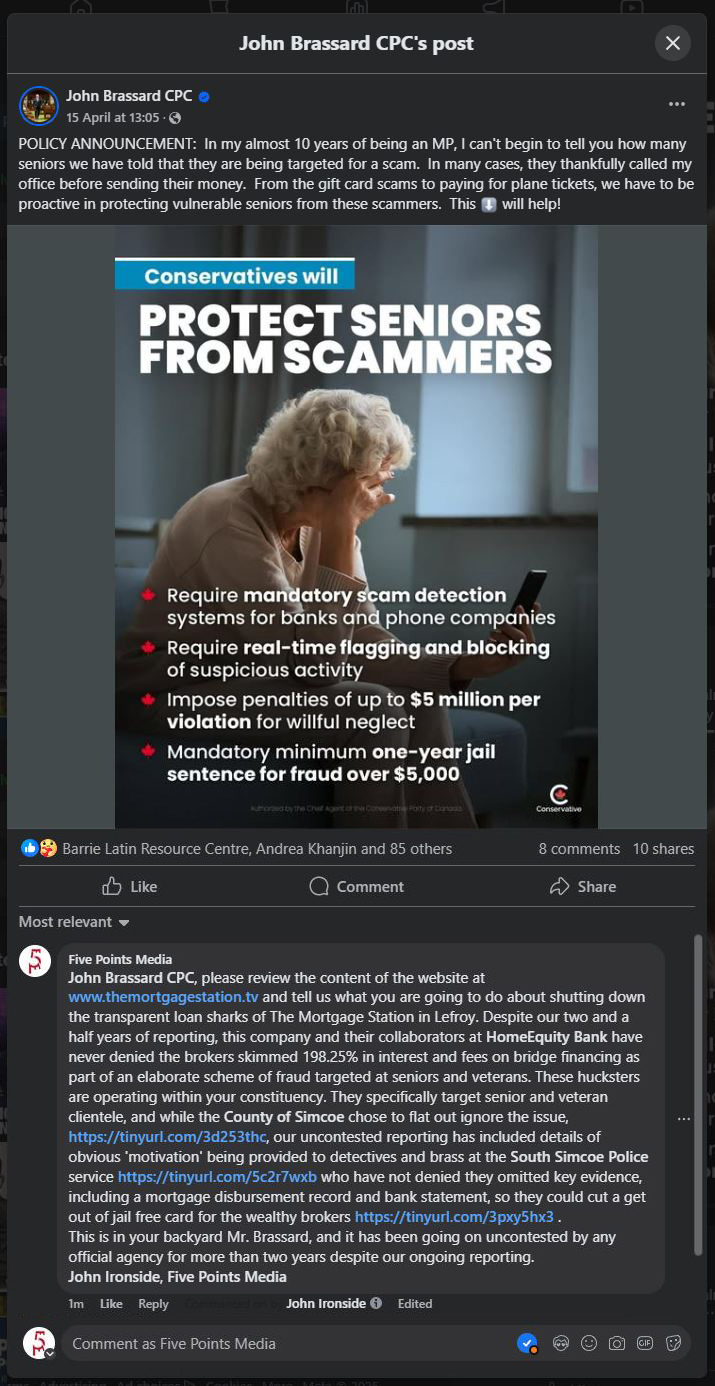

Conservative MP John Brassard Challenged Over Campaign Promise To Protect Seniors From Fraud

On Tuesday, April 15, 2025, Barrie-Innisfil Conservative Member of Parliament John Brassard posted on Facebook a party election promotion entitled "Protect Seniors From Scammers". The message of the post was:

"POLICY ANNOUNCEMENT:

In my almost 10 years of being an MP, I can't begin to tell you how many seniors we have told that they are being targeted for a scam. In many cases, they thankfully called my office before sending their money. From the gift card scams to paying for plane tickets, we have to be proactive in protecting vulnerable seniors from these scammers. This will help!

Although we do not support the Conservatives, we have always been happy to work with John Brassard, mostly crossing paths at community events.

On Friday, April 18, 2025, our Producer, John, an internationally experienced journalist and former private investigator, responded to what sounds like an excellent idea, publicly posting:

"John Brassard CPC, please review the content of the website at www.themortgagestation.tv and tell us what you are going to do about shutting down the transparent loan sharks of The Mortgage Station in Lefroy. Despite our two and a half years of reporting, this company and their collaborators at HomeEquity Bank have never denied the brokers skimmed 198.25% in interest and fees on bridge financing as part of an elaborate scheme of fraud targeted at seniors and veterans. These hucksters are operating within your constituency. They specifically target senior and veteran clientele, and while the County of Simcoe chose to flat out ignore the issue, https://tinyurl.com/3d253thc , our uncontested reporting has included details of obvious 'motivation' being provided to detectives and brass at the South Simcoe Police service https://tinyurl.com/5c2r7wxb who have not denied they omitted key evidence, including a mortgage disbursement record and bank statement, so they could cut a get out of jail free card for the wealthy brokers https://tinyurl.com/3pxy5hx3 . This is in your backyard Mr. Brassard, and it has been going on uncontested by any official agency for more than two years despite our ongoing reporting."

The response took about an hour, and it is reasonable to say that this story may become a subject of interest in a few campaigns, and a cause for action in the House of Commons after the votes are counted. Candidates or staff for multiple constituencies from various parties dropped by our website at www.themortgagestation.tv, with specific interest being shown in the stories to which we had provided links in our public post. Then some moved on to other stories and videos, with many spending an hour or more researching the truth of the fraud being conducted directly under the nose of the incumbent Conservative Member of Parliament for a new riding that represents a prosperous and growing sector of Ontario. We are now preparing a press release to send to all of the Liberal candidates, so they can call out the hypocrisy in interviews and at debates.

John Brassard is a Canadian politician and member of the Conservative Party, serving as the Member of Parliament (MP) for the Ontario riding of Barrie-Innisfil since its creation in 2015. Born on May 11, 1964, in Montreal, Quebec, Brassard began his public service career as a firefighter before entering politics. He served on the Barrie City Council from 2006 to 2015. In Parliament, Brassard has held several key roles, including Deputy Opposition Whip from 2017 and Opposition House Leader in 2022 under interim Conservative leader Candice Bergen. He also served as the Shadow Minister for Veterans Affairs from 2016 to 2017. The riding of Barrie—Innisfil, which encompasses parts of the City of Barrie and the Town of Innisfil in Simcoe County, was established in 2013 and first contested in the 2015 federal election. Following the 2022 federal electoral redistribution, the riding is set to be renamed Barrie South—Innisfil. Brassard resides in Barrie, Ontario, and continues to represent his constituents in the House of Commons.

Regardless of who wins the election, political interest is now being drawn to the story of loan sharking by a provincially licensed brokerage that targets seniors who are being actively assisted to conceal their criminal and ethical breaches of trust by a Schedule 1 Canadian Chartered Bank that targets seniors.

Honourable People Neither Lie nor Hide from Public Exposure - HomeEquity Bank

We recently came across this short video by Rachel Maddow, a highly respected journalist who is known for championing the simple concept of justice being applicable to all, rich and poor alike. It is honourable and ethical journalists like her that have inspired us to take on this story, in our own name, openly to the public.

Our exposure is ethical, honest, and effective.

In sharp contrast, the loan sharking brokers of Verico the Mortgage Station, who target senior and veteran clientele for fraud by usury, and their multi-million and multi-billion-dollar corporate collaborators at Verico Financial Group Inc. and HomeEquity Bank have taken every possible action to evade accountability and to avoid the presentation of evidence in any court of law.

We have done everything short of beg them to take our allegations before a judge, were evidence rules.

Their tactics, which are antithetical to what we are taught to expect from financial service professionals, have included hiding from a small not-for-profit social enterprise, refusing to meet with their shared client who they defrauded, 'motivating' a young police officer to omit key evidence of their crimes and falsify figures so he could cut them a get out of jail 'free' card after committing and covering for an indictable offence that carries a prison sentence of up to five years, vacuous threats of abusive SLAPP litigation that they were too afraid to file, and unethical and illegal censorship of our social media and our website.

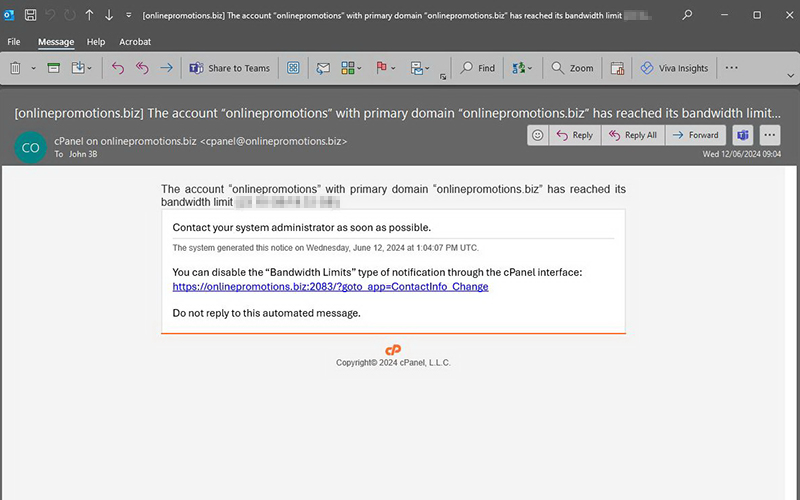

New Techniques of Exposure Already Working

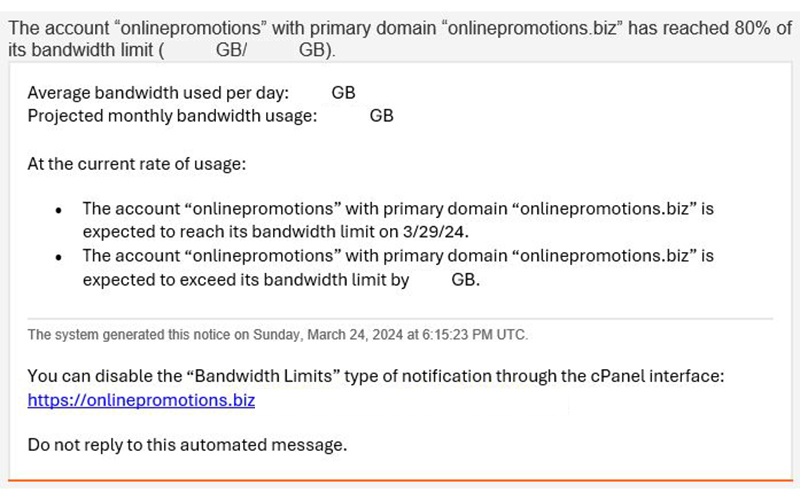

It certainly seems like the most recent attempt at censorship by the loan sharks of Verico the Mortgage Station, or their corrupt corporate collaborators at Verico Financial Group Inc. and HomeEquity Bank will be short lived and easily exposed for being the criminal and ethical abuse of trust that it is.

Just more huff, puff, and bluff.

As noted in our newest article, "Further Illegal and Unethical Censorship Results In A Whole New Battles On Multiple Fronts", either Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank have once again reduced themselves to bottom feeders by trying to censor our ability to tell the truth of their criminal and ethical abuses of trust, that they won't try to disprove through court action, nor even address through professional communications.

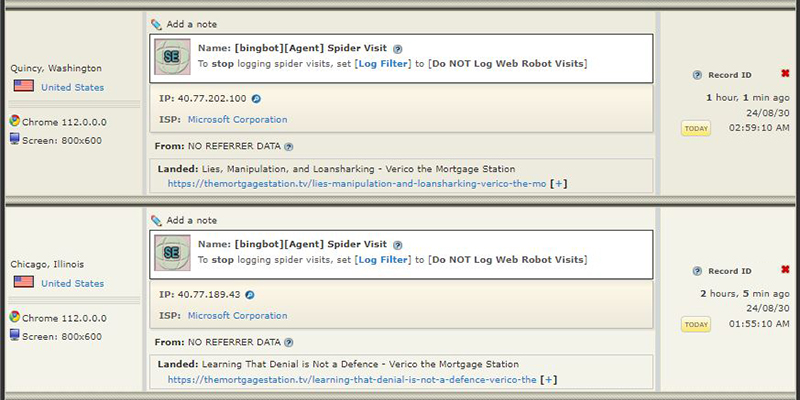

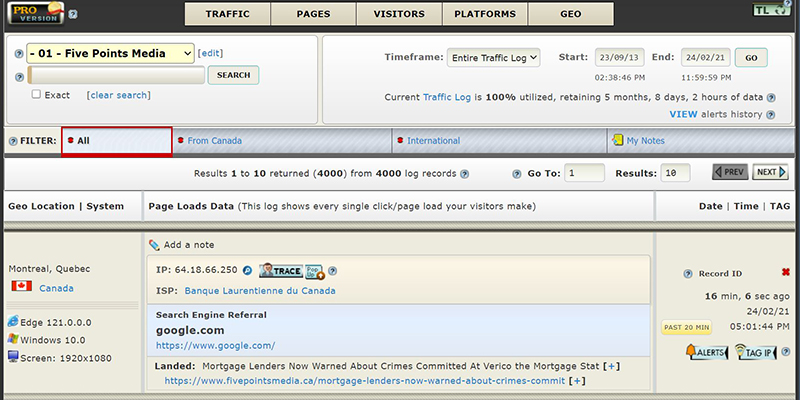

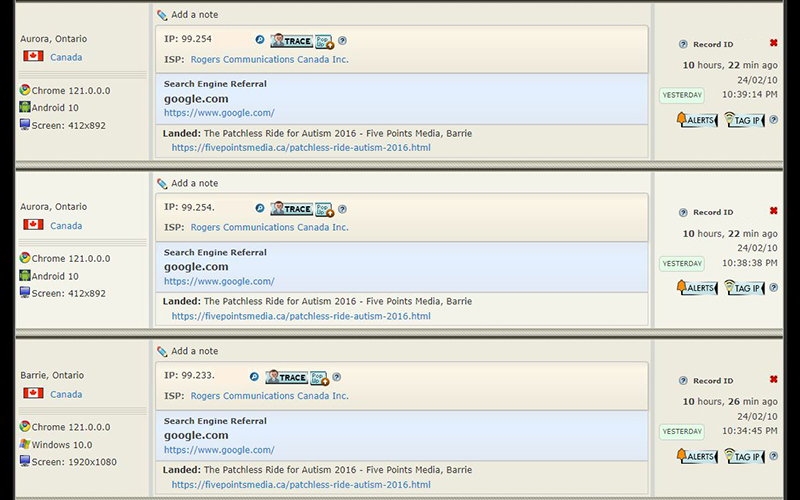

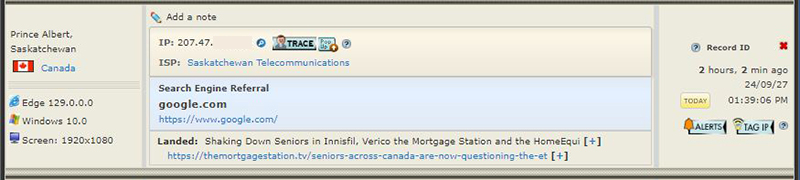

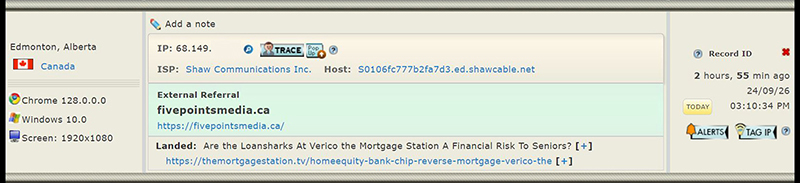

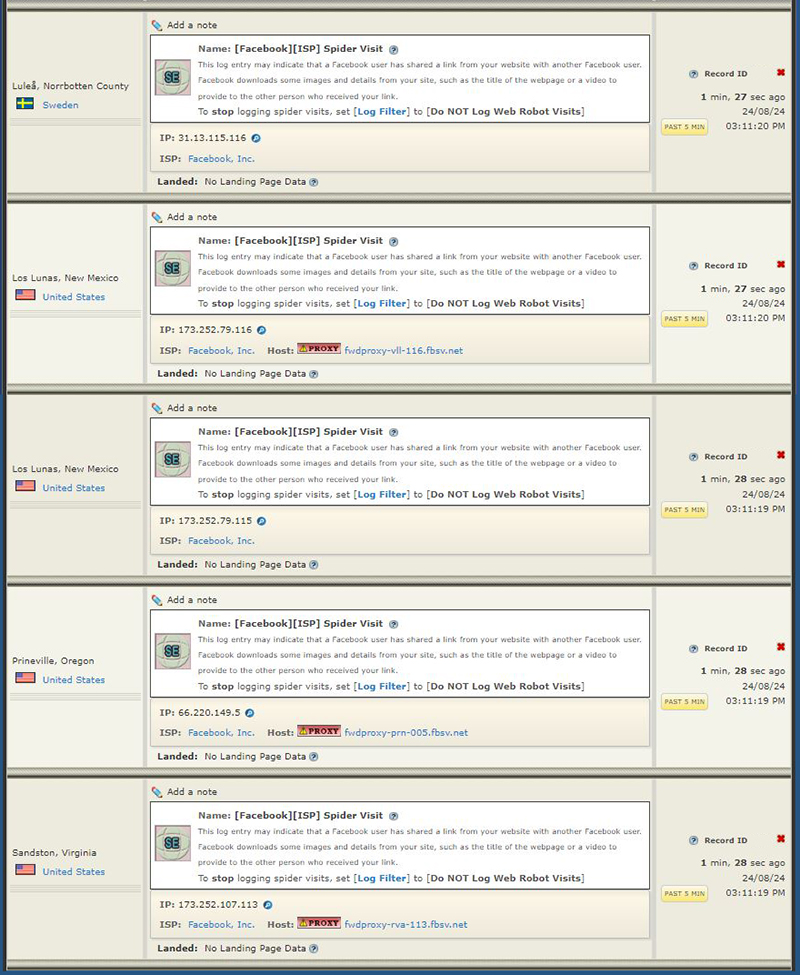

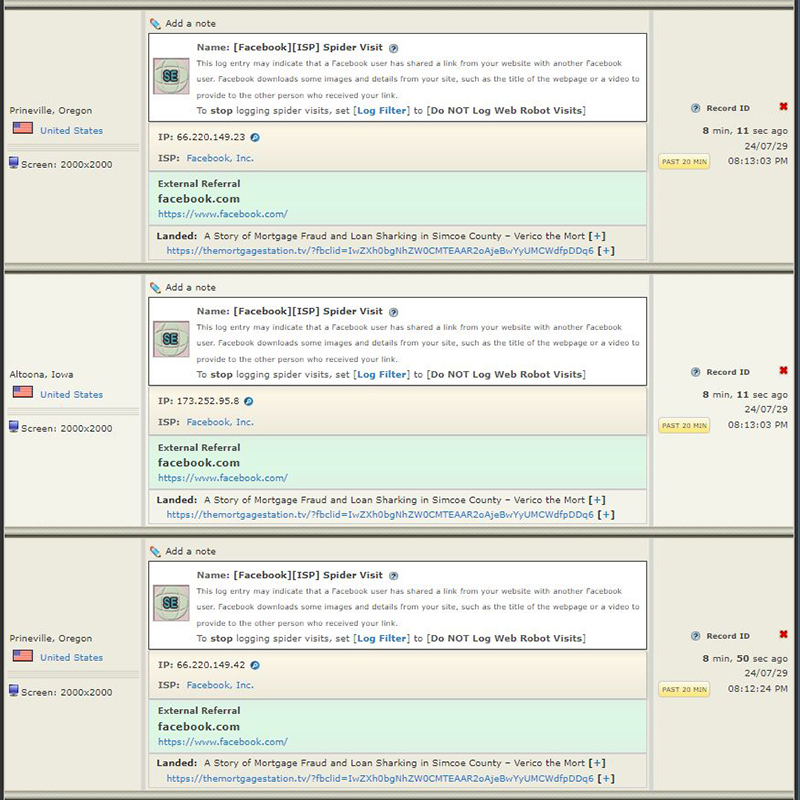

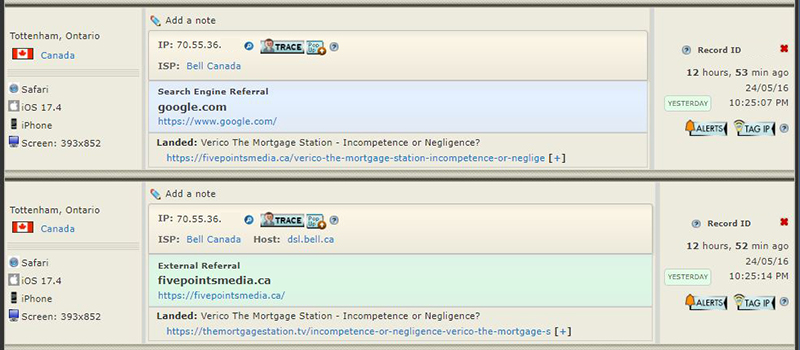

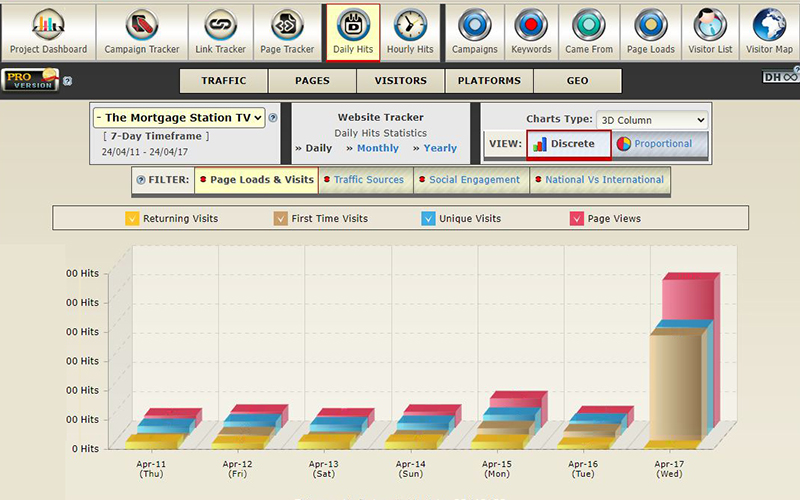

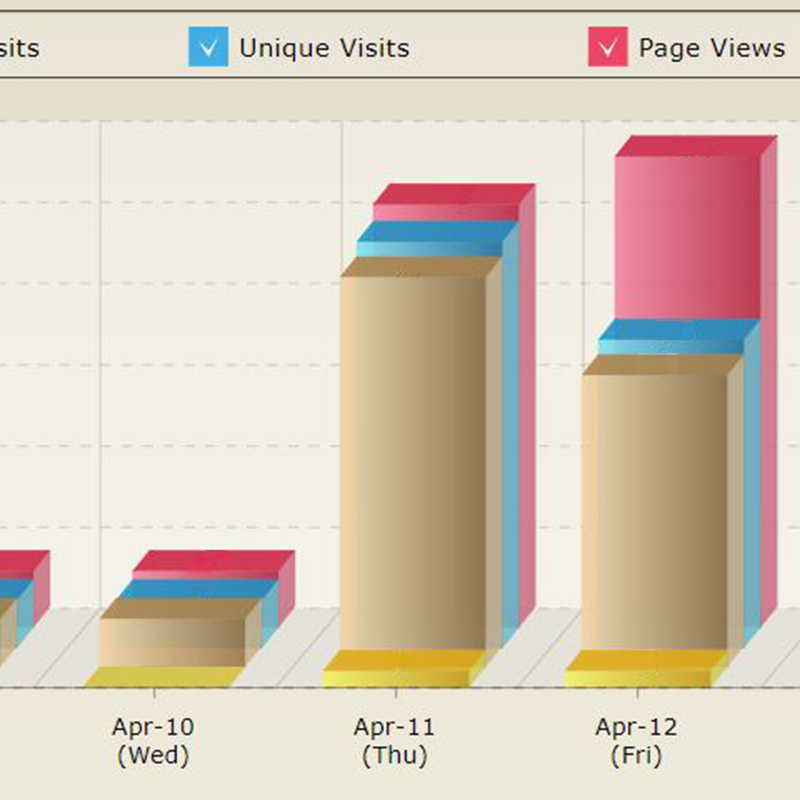

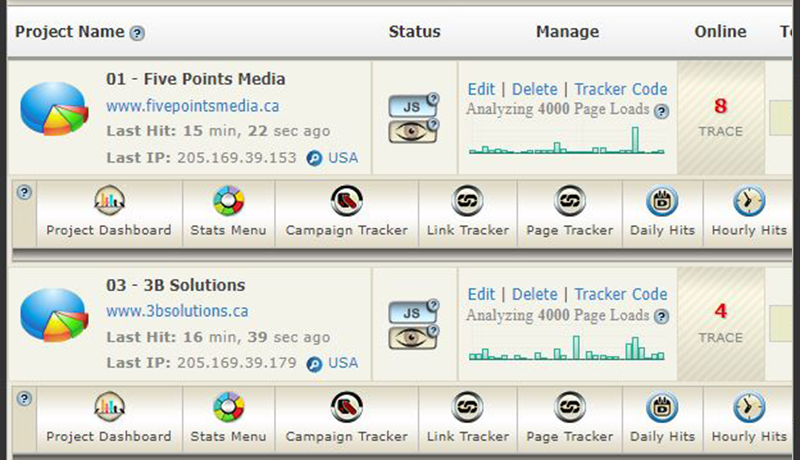

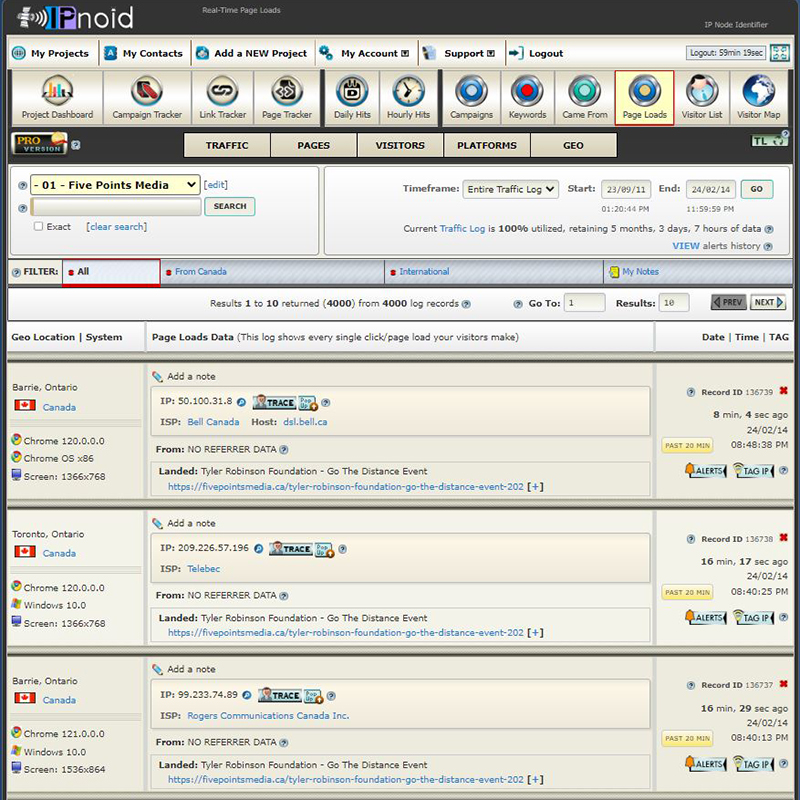

We hadn't seen the search engines on our page in a while, but suddenly they were everywhere.

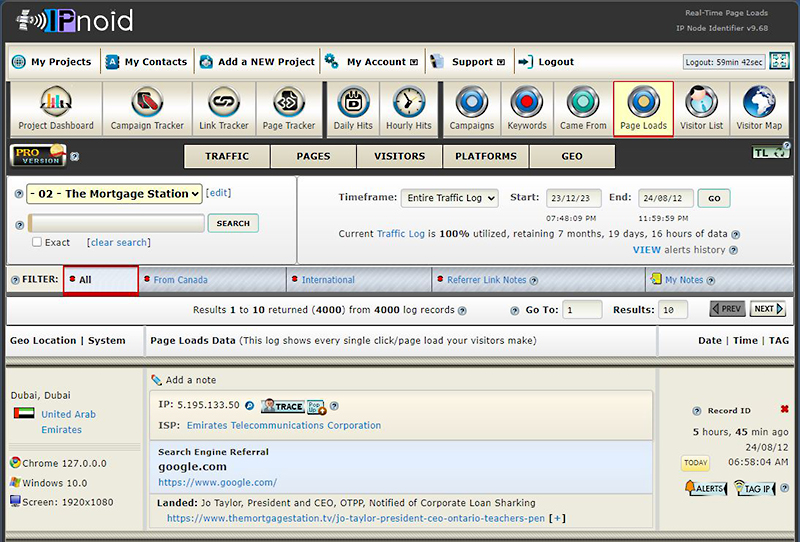

Despite their best efforts to prevent potential victims from learning about their fraud by usury against senior and veteran clientele, and also a concentrated campaign of concealment after the fact, one of the multiple tools being used by us to ensure exposure of these criminal and ethical breaches of trust is already working to create a significant difference in our exposure. As can be seen in this screengrab of our traffic monitoring utilities, from March 25, 2025, the content of our website was suddenly and without alternative explanation scanned by both Google and Amazon, and we have not seen their spiders or robots in considerable time. Now we get to find out what our other new toys can do to expose the truth.

What this snippet of time does not show is the 284 other pages that were then scanned on both this website and on the one for our production company, which still contains content about our documentary.

What this snippet of time does not show is the 284 other pages that were then scanned on both this website and on the one for our production company, which still contains content about our documentary.

Further Illegal and Unethical Censorship Results In A Tsunami Of New Battles On Multiple Fronts

Once again, the loan sharking brokers of Verico the Mortgage Station or their corrupt corporate collaborators at Verico Financial Group Inc. and HomeEquity Bank, are using censorship to prevent potential clients from learning the truth about their criminal and ethical breaches of trust that were committed against vulnerable senior and veteran clientele. Their first attack was against social media, and the second was against the search engines. The reason they continue to sink to this level, of using illegal and unethical tactics to suppress our reports, videos, and evidence, is because the multi-million and multi-billion-dollar corporations are afraid to argue against our evidence in any court of law even though we are nothing but a small, not-for-profit, social enterprise that donates all services to any charity, not-for-profit, or benevolent community group that asks for help.

In Canada, it is a crime to suppress the truth about criminal felonies committed by corporations.

These deep pocket corporations have shown repeatedly that hiding from their own criminal and ethical breaches of trust is their only means of 'defence'. They have also invested phenomenal resources in their ongoing, months long plan to silence the truth. Now they are going to find their one and only strategy very hard to maintain, as we have spent the last two months researching the best ways to reach the potential victims of the calculated fraud that they are so desperately evading.

Katherine Dudtschak, David Flude, and W. Mark Squire now face unknown territory as they try to silence the truth of their own criminal and ethical abuses of trust with no idea of how we are reaching the vulnerable seniors and honoured veterans they target for fraud.

These entrusted brokers and bank, who have conspired to defraud their senior and veteran clientele, seem compelled to do things the hard way, which has already cost them much more than facing their crimes.

Loan Sharks and Collaborators Just Keep Riding A Dead Horse

The "Dead Horse Theory" is a satirical metaphor that illustrates how some individuals, institutions, corporations, and even nations handle persistent, problems, that due to their limited perspective appear unsolvable. Instead of facing reality, they cling to justifying their actions while denying any viable alternative means of resolution. The core idea is simple: if you realize you're riding a dead horse, the most sensible thing to do is dismount and move on with a new option.

No matter how much you poke, kick, yell at, or pull the reigns, the dead horse is never getting up.

In practice, the opposite often happens, as those in positions of authority are often arrogant, narcissistic, and limited with regards to the flexibility of their thinking. They convince themselves that they can do no wrong, and they stand beside the dead horse believing it will come back to life because they command it to do so.

Instead of abandoning the dead horse, people take actions such as:

- Buying a new saddle for the horse.

- Improving the horse's diet, despite it being dead.

- Changing the rider instead of addressing the real problem.

- Firing the caretaker and hiring someone new, hoping for a different outcome.

- Holding meetings to discuss ways to increase the dead horse's speed.

- Creating committees or task forces to analyze the dead horse problem from every angle. These groups work for months, compile reports, and ultimately conclude the obvious: the horse is dead.

- Justifying efforts by comparing the horse to other similarly dead horses, concluding that the issue was a lack of training.

- Proposing training programs for the horse, which increases expenditure.

- Redefining the concept of "dead" to convince themselves that the horse still has potential just as long as they keep doing what has failed repeatedly.

HomeEquity Bank just keeps poking the dead horse hoping for a change in its condition.

No matter how big they are, or the extent of their resources, the group or individual must one day accept that Mr. Ed is dead and take alternative action that if done earlier would have saved them a lot of stress and money.

HomeEquity Bank Goes Back To Hiding In Shame

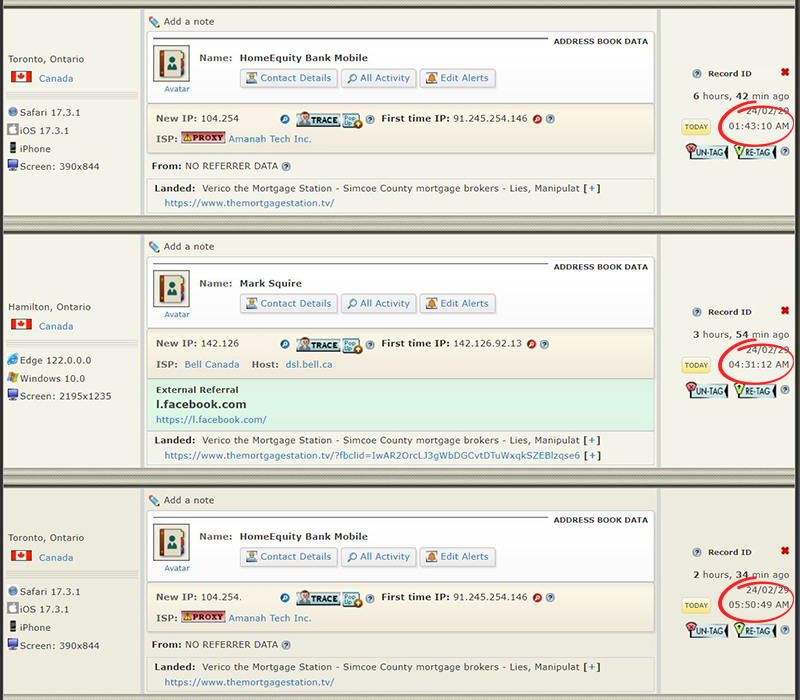

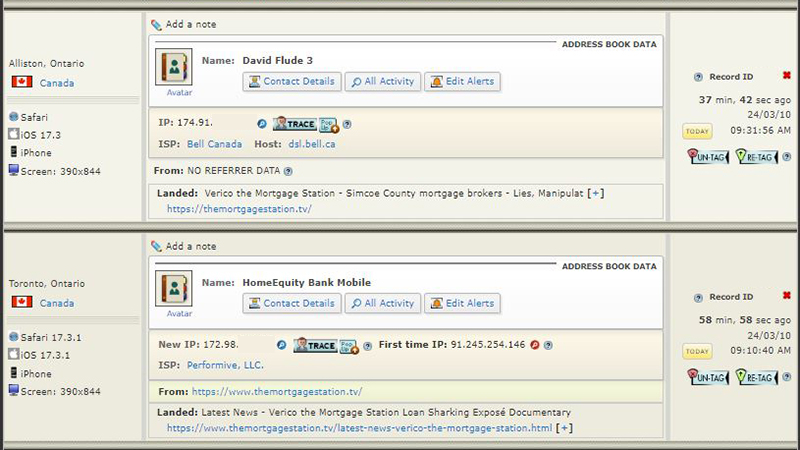

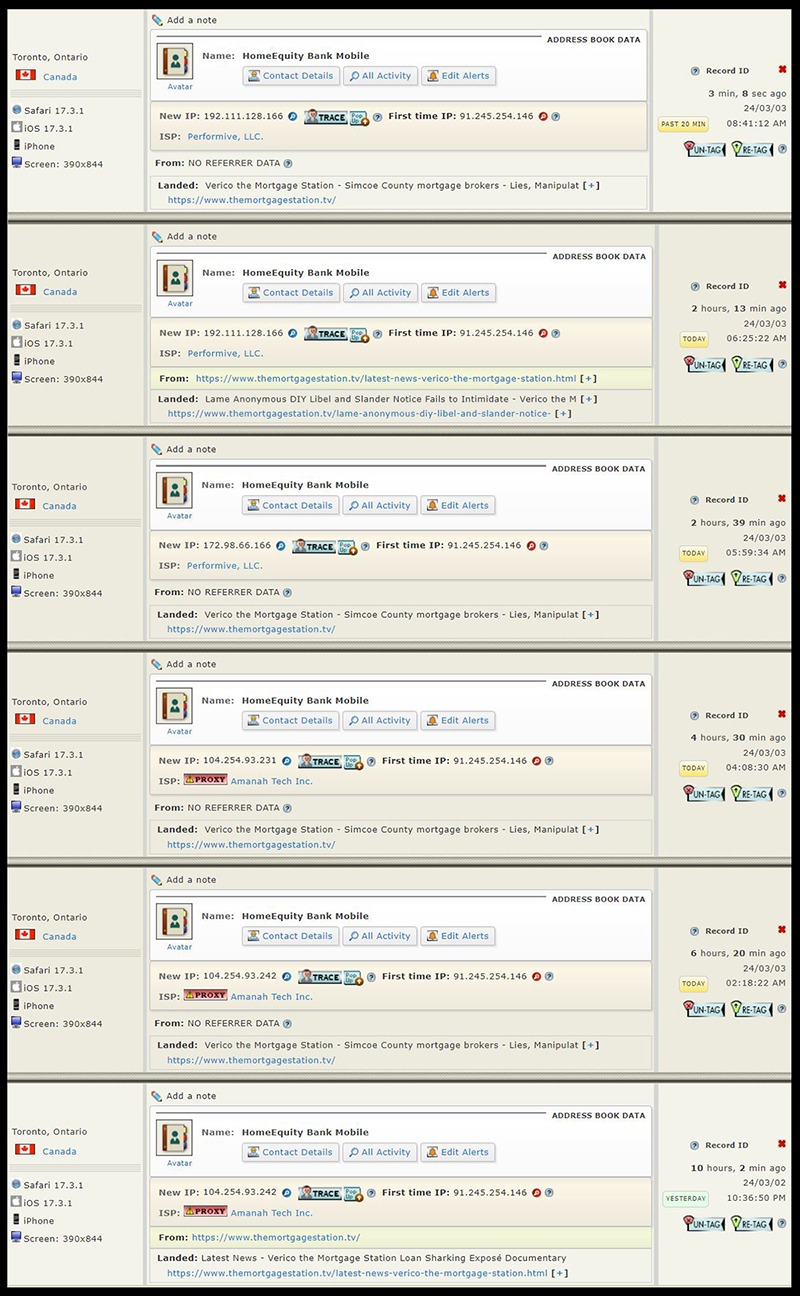

On February 19, 2025, we published the article "Sharks Are Circling Around HomeEquity Bank" in which we noted that when our Producer challenged management at HomeEquity Bank to live up to their threat of defaulting on the mortgage of the studios from which we produce our community programming, there was suddenly a massive surge of interest from various previously identified and electronically tagged agents of Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank. Then, as we predicted, "We fully expect this practice to end now suddenly, at least for a week or two, as the three conspiring corrupt corporations try to convince us, once again, that they don't care what we have to say, and there is 'nothing to see here folks'."

As predicted, all three multi-million and multi-billion-dollar corporations immediately returned to hiding from our benevolent not-for-profit social enterprise.

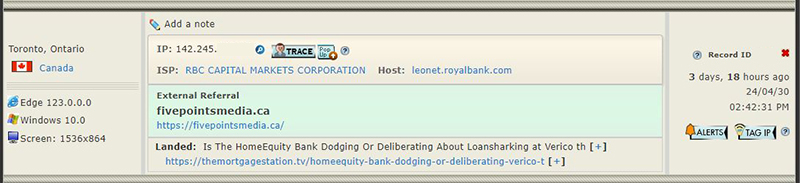

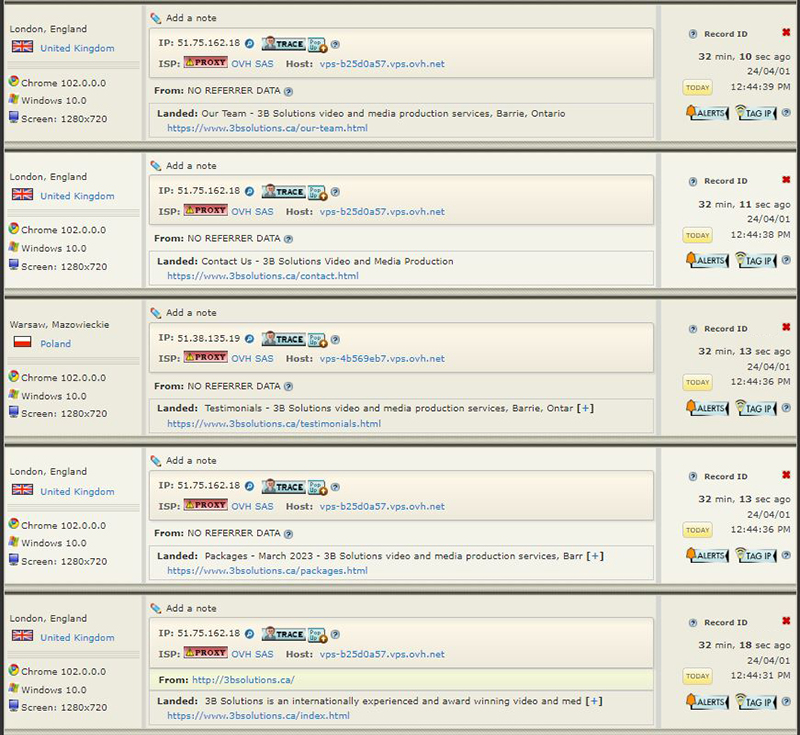

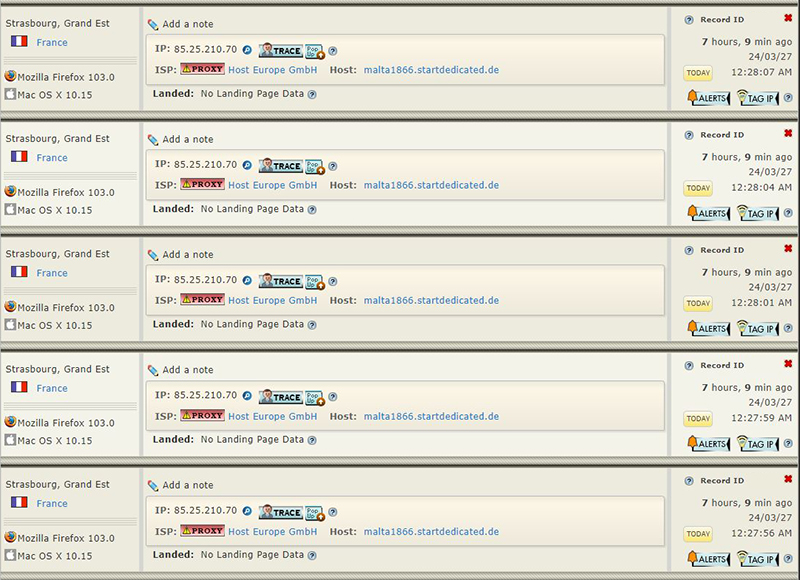

Then, day by day, those legal or research auditors returned, sifting heavily through the content of our community channel, and then slowly but surely returning to this website, apparently thinking we could not see them. Apparently, they don't understand that proxy servers can hide your location, but they do not make you invisible, and they do not hide your Mac address.

Katherine Dudtschak, CEO and President of HomeEquity Bank, can order her staff to scatter and hide, and to ignore our reporting for days on end, but we know the level of harm that is being done to their reputation, caused by their own criminal and ethical abuses of trust.

It is like when a kid runs away after breaking a window at their own house, and then creeps back an hour later, hoping their parents don't know they did it or that they had forgotten about it.

HomeEquity Bank Panics After Threatening The Charitable Service They Helped To Defraud

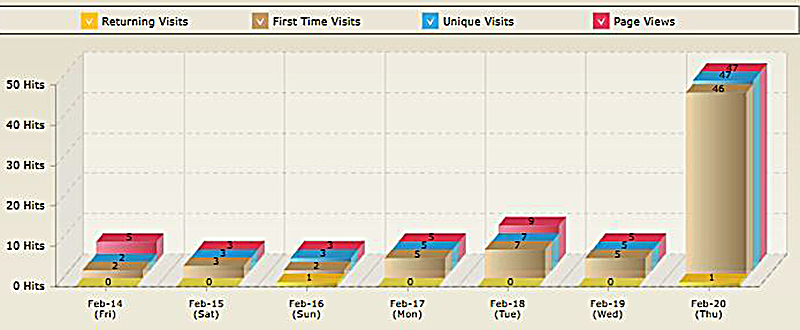

This is what happened on Thursday, February 20, 2025, after our Producer advised HomeEquity Bank that if they wanted to default on our mortgage, as they have now threatened to do after two years of hiding from our evidence, they will have to do so through legal action. It is only there that the evidence will be brought before an impartial Justice of the Superior Court, who will not be so easy to 'motivate' as was a young detective of the South Simcoe Police Service, who arbitrarily chose to omit key evidence and falsified figures so he could create a 'get out of jail free' card for Renee Dadswell, Lisa Purchase, and David Flude, the loan sharking brokers of Verico the Mortgage Station who defrauded a senior, veteran, and philanthropist by skimming 198.25% interest for short-term bridge financing, from the mortgage payment owed to their trusting client.

That is what happens when small town cops deal with multi-million and multi-billion dollar corporations.

This sudden massive increase in interest by known agents for Verico the Mortgage Station, Verico Financial Group Inc., or HomeEquity Bank is a strong indicator of panic.

Sharks Are Circling Around HomeEquity Bank

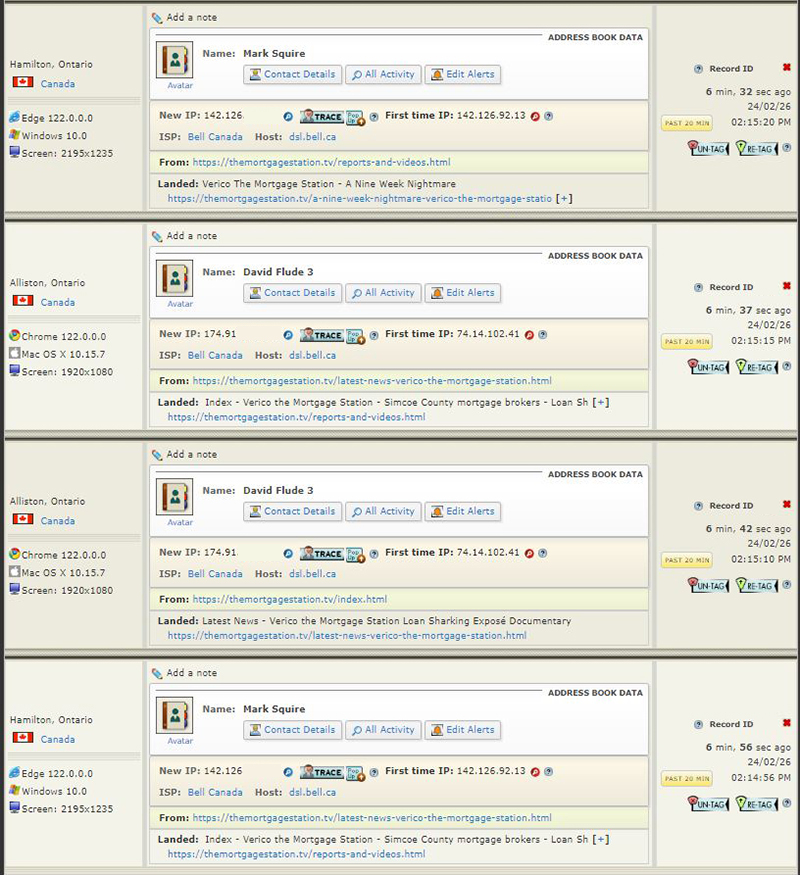

One side effect of posting less is an increase in traffic, with much of it coming from legal or other agents for either the loan sharking brokers of Verico the Mortgage Station, or their criminally culpable allies at Verico Financial Group Inc. and HomeEquity Bank, who are clearly trying to figure out what we are doing now.

Sadly for the managers of these corrupt corporations, they will never again know until it happens.

Yesterday, just like most other days throughout the past two months, we were visited by dozens of clearly connected agents visiting all three of our websites, coming to our reports and videos from across Ontario, and many pretending to be coming to our website from foreign nations by hiding behind proxy servers. We fully expect this practice to end now suddenly, at least for a week or two, as the three conspiring corrupt corporations try to convince us, once again, that they don't care what we have to say, and there is 'nothing to see here folks'. They have played that game multiple times over the past two and a half years that they have wallowed in the darkness, hiding from their criminal and ethical abuses of trust.

The fact that these multi-million and multi-billion-dollar corporations need to hide from a small, not-for-profit, community media service speaks volumes.

David Flude, W. Mark Squire, and Katherine Dudtschak are now trapped by their own cowardice and lack of ethics, and the sharks are circling.

Promulgating Potential Political Profiteering

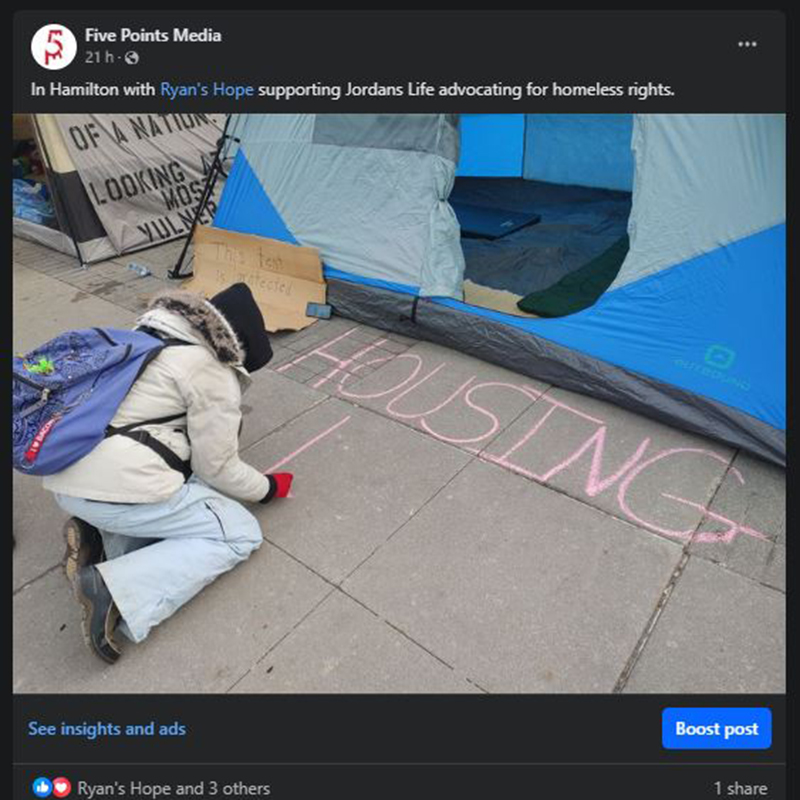

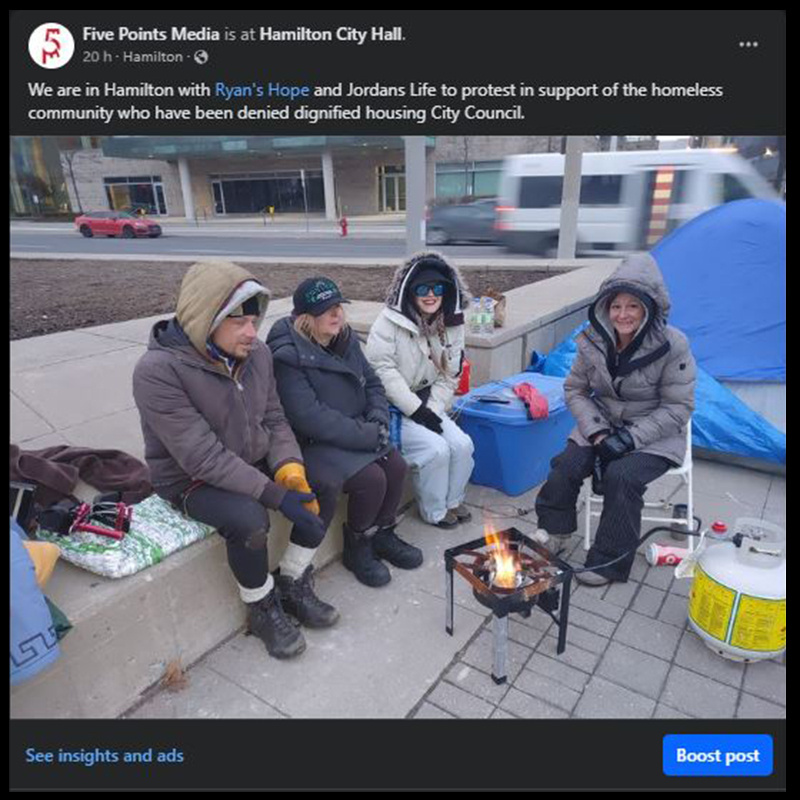

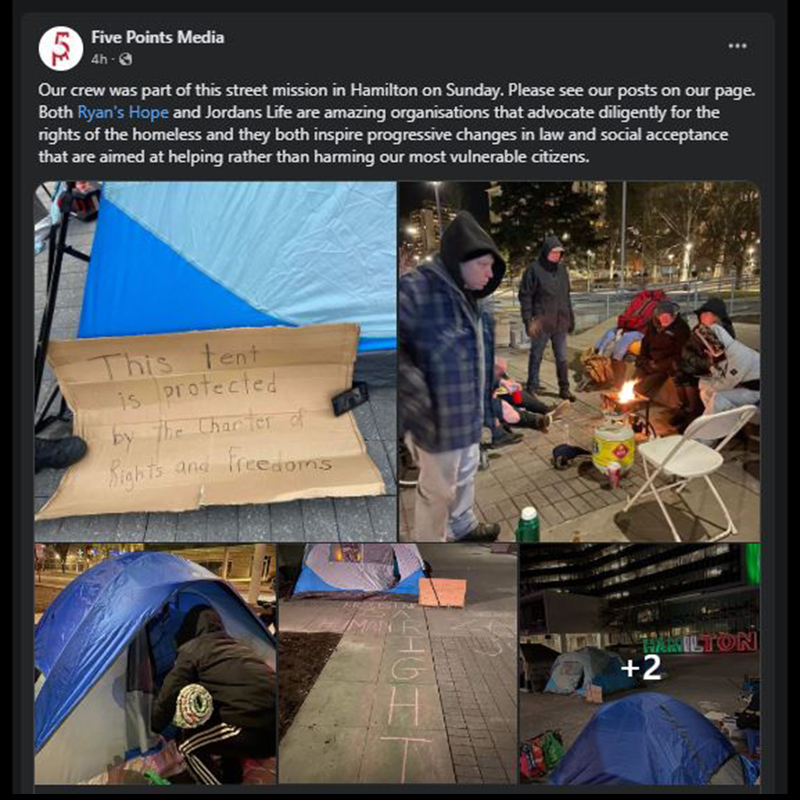

Anybody who knows our socially active media service, Five Points Media, knows that we wear our political ideology on our collective sleeve, and especially so on social media. We are known for supporting working people, assisting charities, helping the poor and homeless, and for reporting about the ethical and legal abuses of self-serving politicians, big business, and abusers of trust.

We report the facts that we support with evidence.

It is for this reason that we have a 100% success rate of defeating abusive attempts to silence the truth, either through vexatious SLAPP litigation or an abuse of the criminal justice system. That is why Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank, all of which are multi-million and multi-billion-dollar corporations, will not challenge our allegations, despite being literally hundreds of thousands of times richer than our small, benevolent, not-for-profit social enterprise that donates all services to local charities, not-for-profits, and benevolent community groups. We have called on all of them to challenge our evidence in a court of law, and we know they are collectively losing tens of millions of dollars due to our exposure, but for more than two years they have hidden in a corner, in the dark, refusing to contest our allegations in any way.

Yesterday, we got the opportunity to open a potential door to higher level scrutiny.

Yesterday found us working with one of the challenging non-Conservative candidates, for whom we are producing a promotional video for their campaign. Details can be found here. Following the shoot, our Producer spoke candidly with the candidate about our ongoing documentary about mortgage fraud that features Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank. It was agreed that based on the evidence, there are some shady dealings going on in Simcoe County, and that widespread 'motivation' by these mega-wealthy corporations was likely the reason why ALL members of Simcoe County Council ignored our advisory about how detectives of the South Simcoe Police Service had so brazenly omitted key evidence and manufactured false figures so they could cut a pass to the wealthy brokers who have multi-billion-dollar friends, and that NOBODY, including the County of Simcoe and the South Simcoe Police Service has ever raised any concern about our reporting.

It seems likely that this corruption goes a long way up the food chain in Simcoe County, and that those in power who are all currently Conservatives, turn a blind eye to maintain the most prominent spot at the trough.

Back In The Trenches On Multiple Fronts

Although we have no doubt that the loan sharking brokers of Verico the Mortgage Station, and their criminally liable collaborators at Verico Financial Group Inc. and HomeEquity Bank had hoped we had just gone away, we are happy to disappoint their expectations. We have in truth been very busy on multiple fronts.

Clearly, these less than courageous con-artists believe they can hide forever, and we are about to change that.

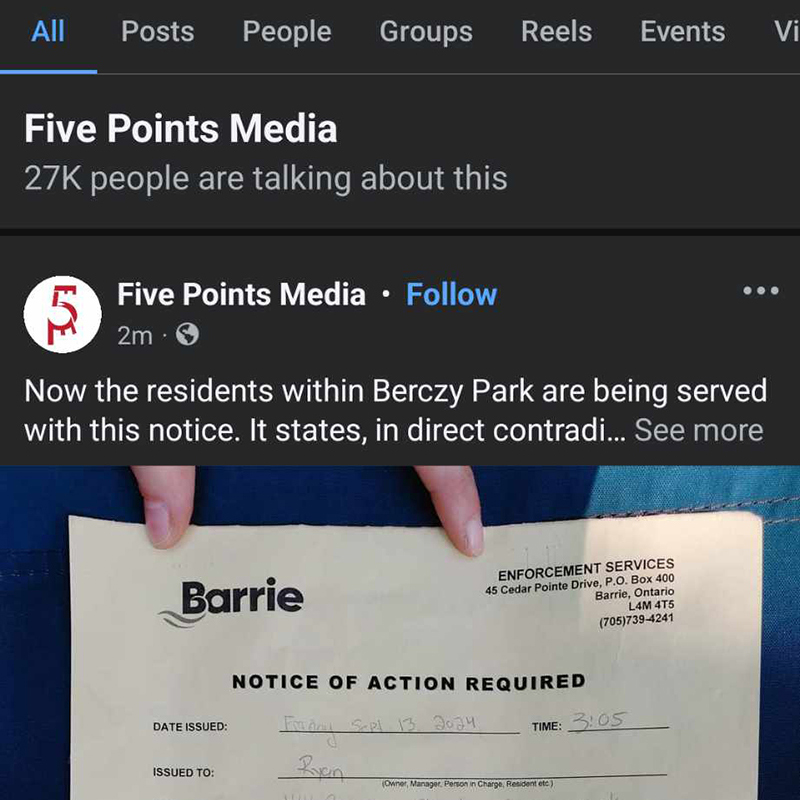

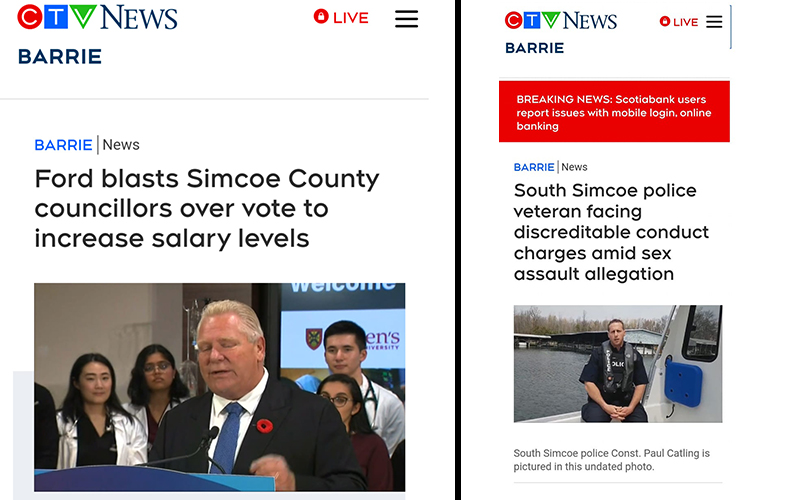

We have in the past made the mistake of foretelling our plans, but that will no longer be the case. Now, every new action will be a surprise, to be enjoyed or endured. We can report what we have been doing, as that is no secret. We have produced another video about the actions of Barrie Mayor Alex Nuttall and his council of sycophants, which is now drawing respectable attention from mainstream media throughout Ontario. Alex Nuttall was the author of the letter asking Doug Ford to abuse the Notwithstanding Clause of the Charter of Rights and Freedoms so they could disregard the rights of the homeless. In our video, we expose many of the abuses of power used by Nuttall when unlawfully evicting the unsheltered from a protected encampment while the rights of the homeless were still in good standing.

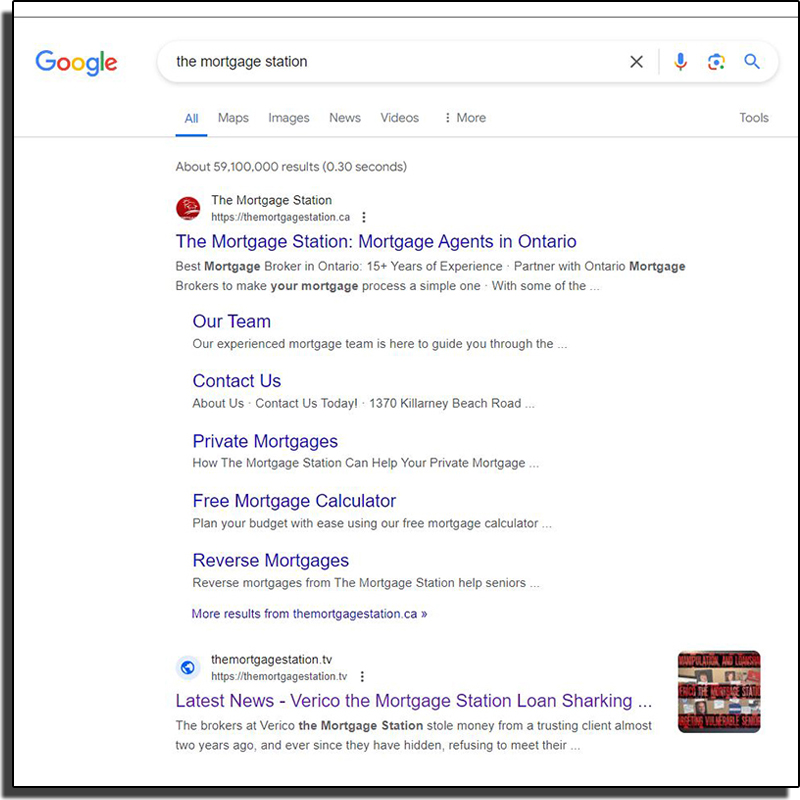

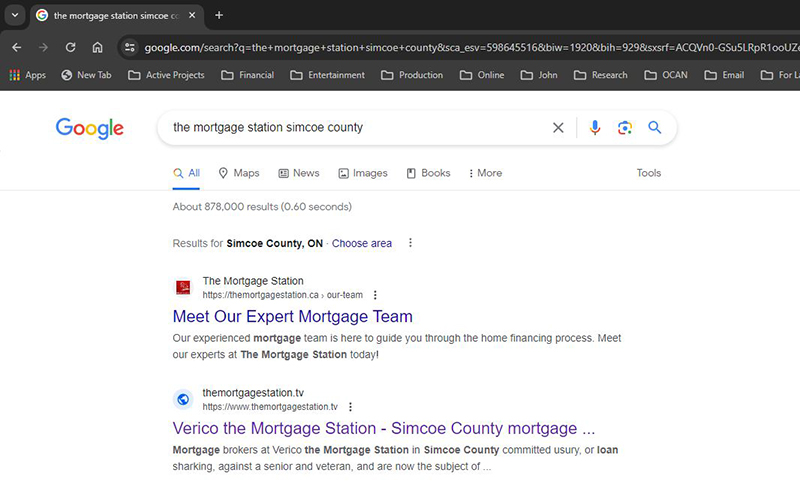

This has led to exposure of our benevolent media service, with searches linking us directly to this story of mortgage fraud by usury, as committed by the brokers of Verico the Mortgage Station and supported by their allies at Verico Financial Group Inc. and HomeEquity Bank.

We are also drawing considerable attention from opposition political candidates who appear interested in exposing the various provincial level officials who have quite obviously been 'motivated' to protect the corporate loan sharks who targeted their senior and veteran clientele for fraud by usury.

Conflict of Credibility

Deception and misdirection only work for so long before customers, investors, and creditors start to question the credibility of the person or company they have entrusted. That is what is happening now on an ever-increasing scale as those who have been lied to, likely multiple times, are coming to us to see who we are for themselves. Last week, we suddenly, all in one day, experienced more than a dozen individual visitors to the 'About' page of our Five Points Media website.

All of those visitors came directly to that specific page as if they had been provided with a link in an email.

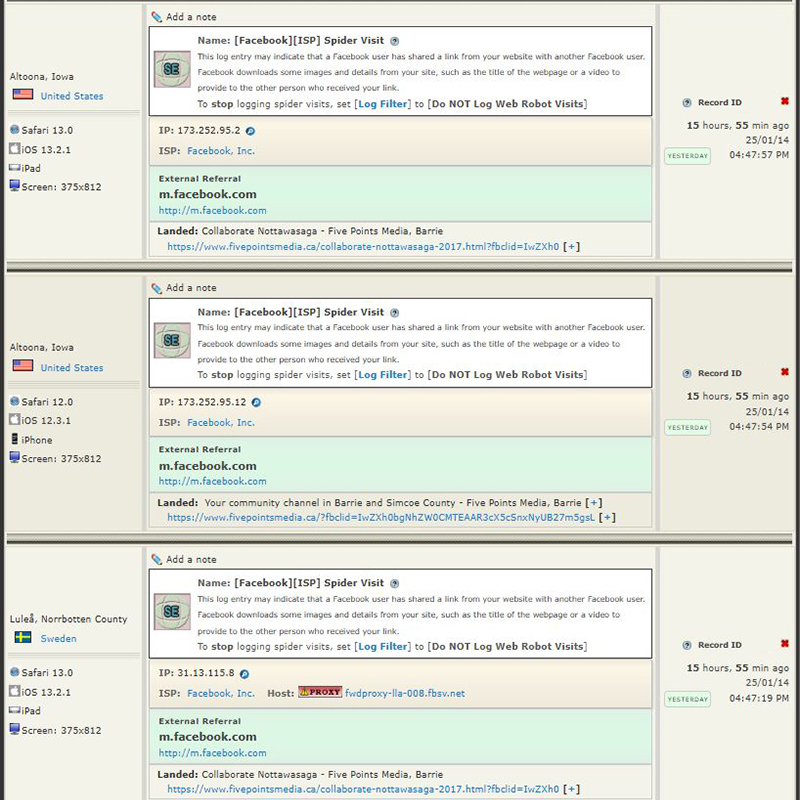

More recently, those same people, and others, are visiting multiple pages on our website, with a lot of interest being shown in a project we produced called Collaborate Nottawasaga, through which we worked with the Ontario Provincial Police - Nottawasaga, Adjala Tosorontio Fire Department, Parole and Probation, Ontario Works, CMHA - Simcoe County, and a total of about 20 community services ranging from mental health, to hospitals, to homeless shelters, and family services.

Official projects, and interviews with politicians of every stripe and level, seriously discredit David Flude's lie that our Producer is a 'serial agitator'.

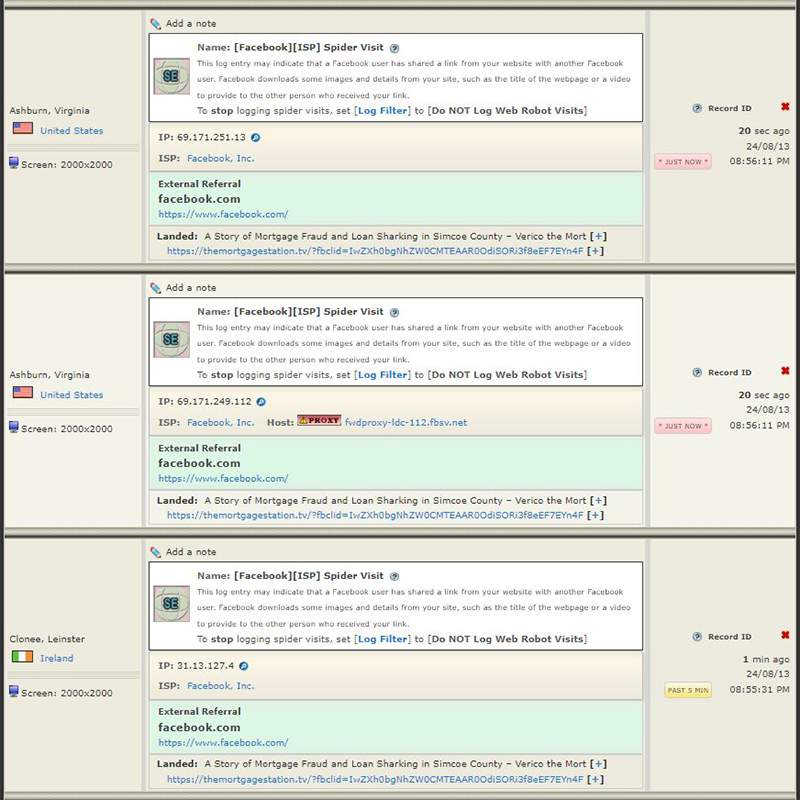

Imagine investing millions of dollars in a business only to learn they are loan sharks who defraud seniors, and that they will not defend their actions. Not all banks are like HomeEquity Bank, a trusted Schedule 1 Canadian Chartered Bank that chose profit over ethics by siding with loan sharks and choosing to ignore both the crime and their client in the name of reaping future profits. The flip side of that is the active and retired teachers of the Ontario Teachers' Pension Plan Board (OTPP) who are becoming aware that their investment in a retirement fund was used to purchase a corrupt bank and that Jo Taylor, the President and CEO, OTPP, has been Notified of the Corporate Loan Sharking, but has done NOTHING to protect their fellow retiring seniors and veterans from this criminal abuse of trust that has also hurt dozens of charities and benevolent community groups.

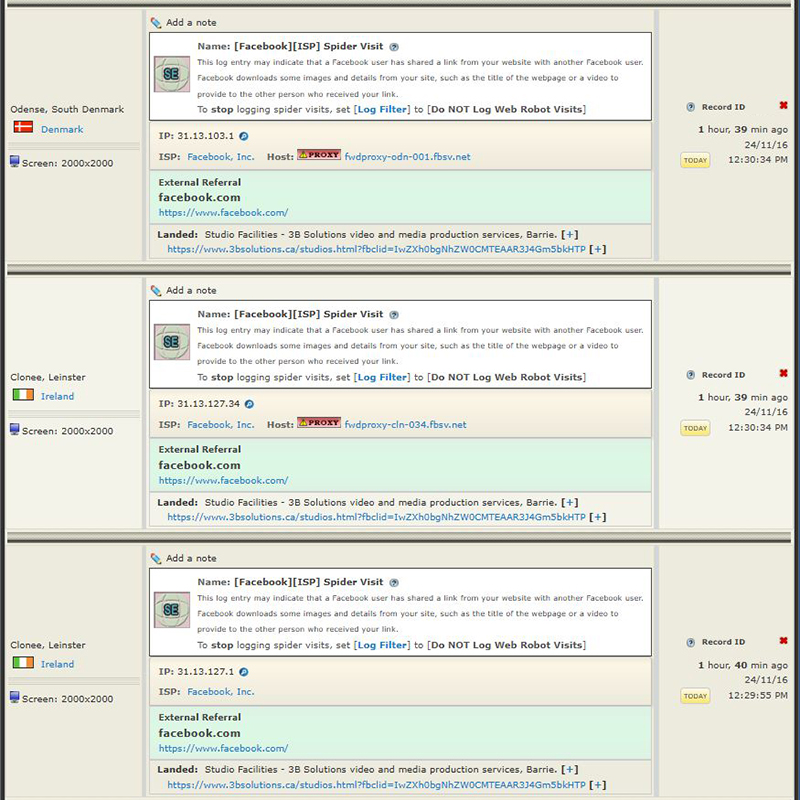

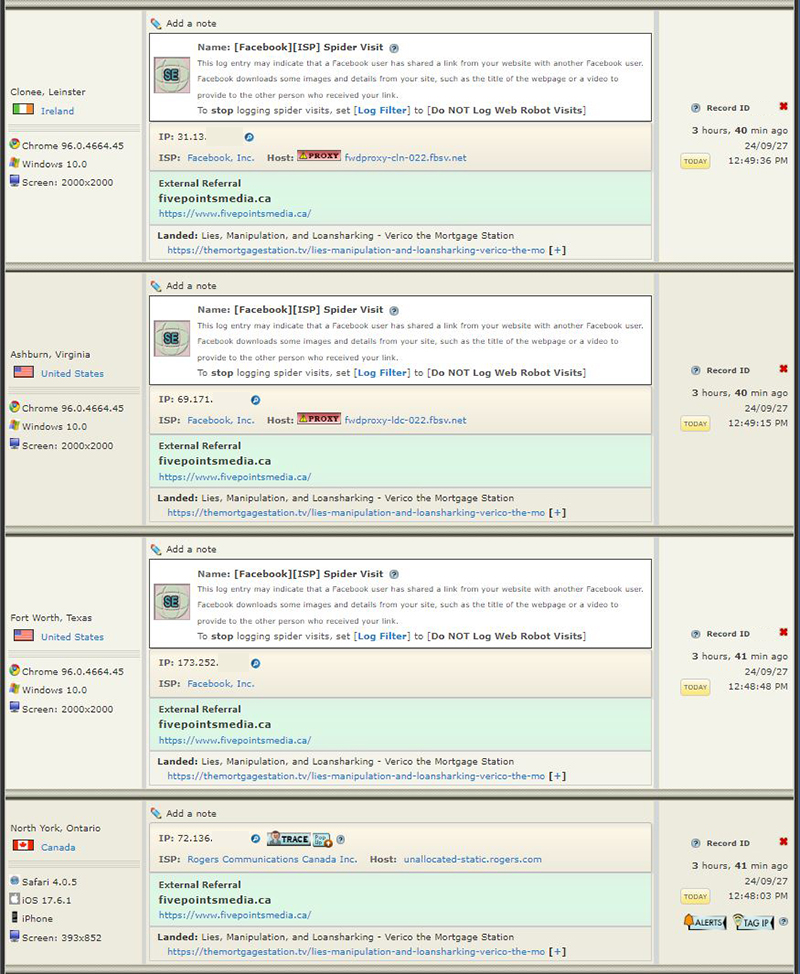

All of these links came via Facebook, as clearly a competitor or interested group is now sharing the truth about these multi-million and multi-billion-dollar companies that shake in fear of challenging a small, not-for-profit, social enterprise that donates all services to local charities.

That lack of care or concern for people just like themselves speaks volumes to people who have dedicated their lives to educating our next generations of leaders. If they have not committed the crimes of which we have accused, there is no benefit to the directors of Verico the Mortgage Station, Verico Financial Group Inc., and HomeEquity Bank hiding, as we have offered in good faith that if they can show through the use of tangible evidence that we are wrong, we will cancel the documentary and take down this website. David Flude, Renee Dadswell, and Lisa Purchase, the loan sharking brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Katherine Dudtschak President and CEO of HomeEquity Bank, choose to wallow in denial because their lawyers have evidently told them that given the evidence and our background of defeating Strategic Litigation Against Public Participation (SLAPP) lawsuits and other forms of abusive litigation used by the wealthy to silence the truth, hiding is their only option.

Eventually, they will have to come out of the darkness and into the light, as our fully supported reporting, which is not going anywhere, reaches more people, and they have now run out of ways to censor the truth.

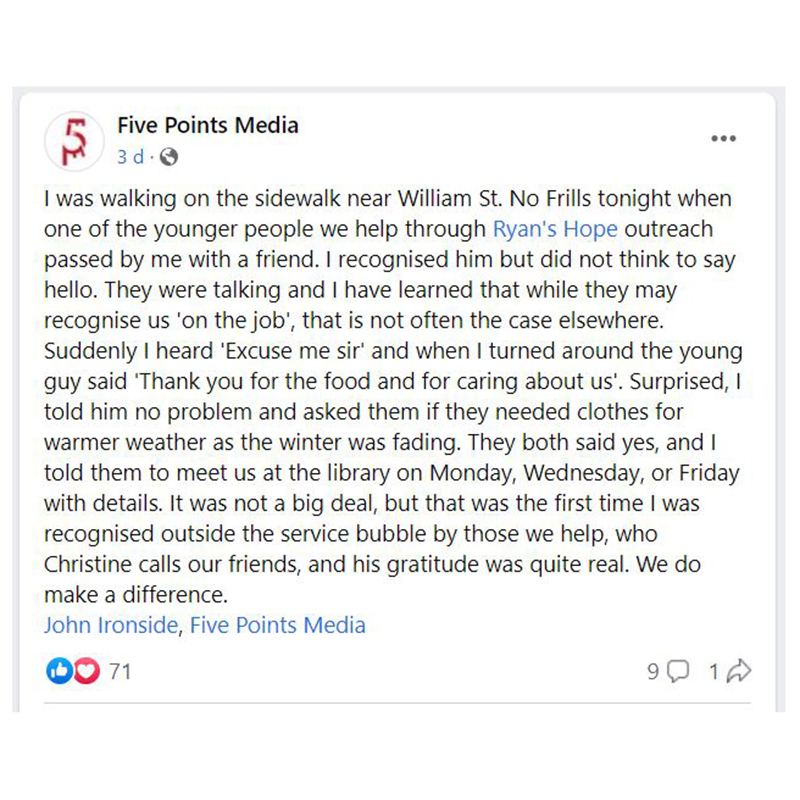

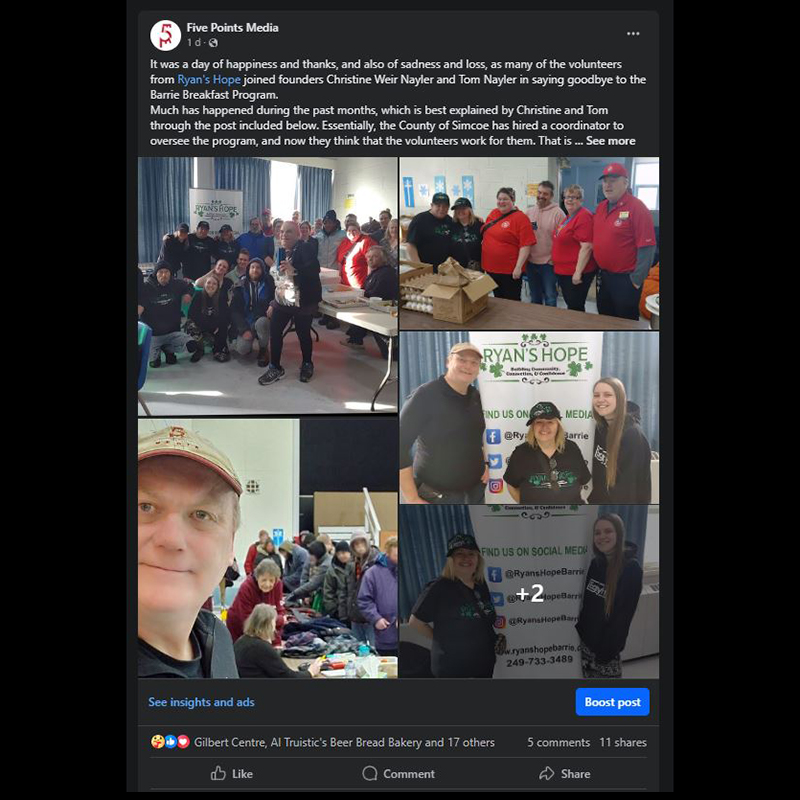

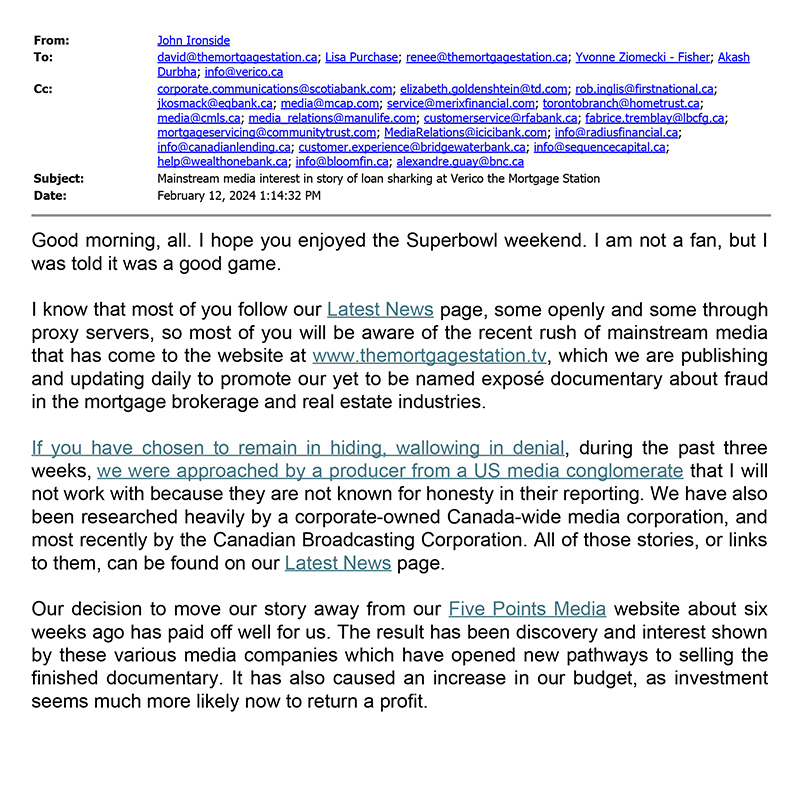

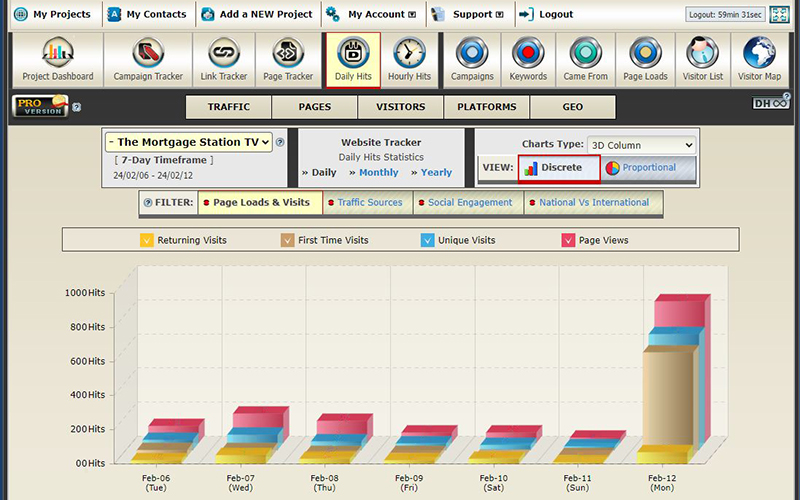

Social Media Post Reaps Appealing Results

About a year ago, when we moved this story from the Five Points Media website to this standalone domain, we chose to limit discussing this project on our community programming social media. We wanted to see how the subject matter would stand on its own, and we are happy with the results. Yesterday, however, gave us little choice but to mention this documentary, as it is not every day that the County of Simcoe scours our domain, and given the crossover of issues about which we are currently focused, those being mortgage fraud and homelessness, and how they inevitably affect each other and the County of Simcoe, we needed to be open about why they might be visiting. That post can be found here.

The result was the most traffic we have seen in a single spike in many months, and it has inspired us to open 2025 with a bang through social media exposure. Let's see how well and for how long the loan sharking brokers of Verico the Mortgage Station, and their collaborating associates at Verico Financial Group Inc. and HomeEquity Bank can hide from multiple posts on a variety of platforms. Our previous posts on Facebook, that we boosted across the County of Simcoe, were viewed by between twenty to nearly fifty thousand people. Now, as Verico the Mortgage Station slowly fades into history, we will be boosting videos to densely populated regions acrosss Canada where seniors and veterans buy the CHIP Reverse Mortgage from HomeEquity Bank.

We have no doubt that the County of Simcoe and the South Simcoe Police Service want the public embarrasment of our reporting on this story to end, but the simple fact is that the councillors of the County of Simcoe chose to do nothing to protect seniors when we reported the facts and provided the evidence directly to them, and the South Simcoe Police Service first refused to investigate, then talked only with the multi-million-dollar brokers, and then omitted key evidence and falsified calculations so they could cut a break to the wealthy and well-connected corporation that apparently due to our reporting is now losing staff like water through a sieve, converting offices meant for an expansion into apartments for cashflow, and selling their newly constructed custom built offices at a fire sale rate of a million dollars less than their initial price. Meanwhile, based on the data derived from our website and YouTube visitor logs, the latter of which shows reduced numbers due to data screening on our part, HomeEquity Bank is losing upwards of $80 million a year in lost potential.

People looking to invest their life savings with a broker or bank tend to be skittish when they read fully supported allegations of fraud that the multi-million and multi-billion-dollar corporation will not defend.

Why These Multi-Million and Multi-Billion Dollar Corporations Will Not Challenge Us

It doesn't require Mensa membership to understand that the brokers of Verico the Mortgage Station, and their collaborating counterparts at Verico Financial Group Inc. and HomeEquity Bank, are so transparently afraid of us that they won't even hold a conversation, never mind challenge in court the allegations of loan sharking and Fraudulent Concealment made by our small, not-for-profit, social enterprise, community media service that donates all services to any charity, not-for-profit, or benevolent community group that asks.

They fear the public blowback of corporate loan sharks and collaborators attacking benevolent protectors of seniors and veterans.

The dichotomic difference between these corrupt corporations and our benevolent support of our community is sufficient to make one side of this story an antithesis of the other. The brokers of Verico the Mortgage Station have never shown the courage to defend against our allegations of defrauding their senior and veteran clientele through loan sharking, and their corrupt collaborating corporate cousins at Verico Financial Group Inc. and HomeEquity Bank have never contested trying to cover up for the crimes of their financially motivated colleagues.

In this image, our Producer, John, who David Flude labeled 'a serial agitator', walked several miles during a quiet moment in a blizzard, to deliver life saving sleeping bags to a homeless couple, one of whom needs surgery.

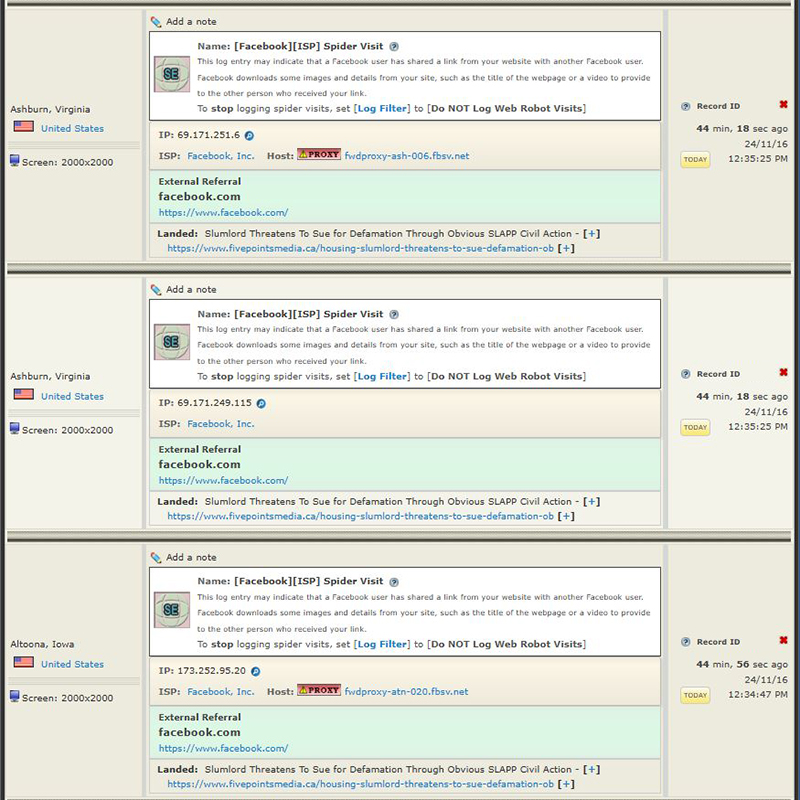

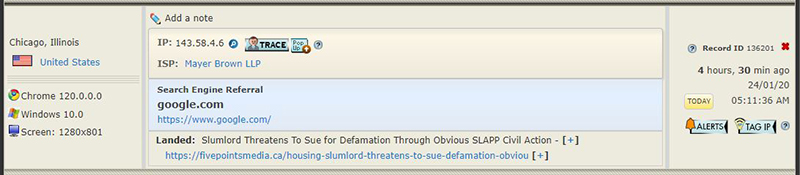

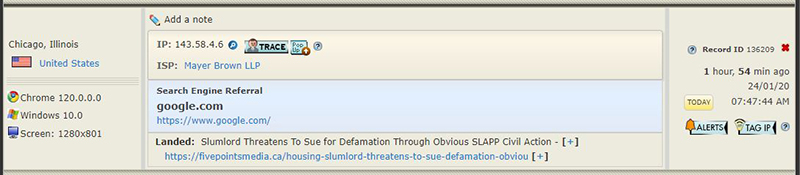

Our History Of Legal Victories Over Abusive Civil Litigation Under Scrutiny

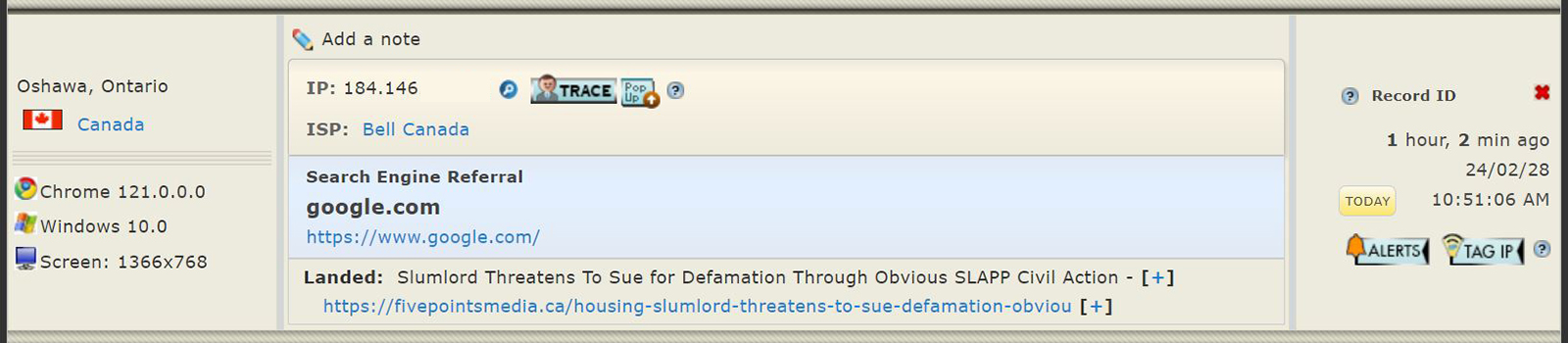

Given that we have now exposed, and nullified the most recent attempt at censorship undertaken by the brokers of Verico the Mortgage Station, and/or their collaborating corrupt corporations Verico Financial Group Inc. and HomeEquity Bank, and we have returned to regular reporting after focusing our time and resources to another humanitarian cause, it comes as little surprise that the likelihood of another vacuous threat of abusive Strategic Litigation Against Public Participation (SLAPP) litigation, a full year after the first was utterly crushed by a single email, could be on the horizon.

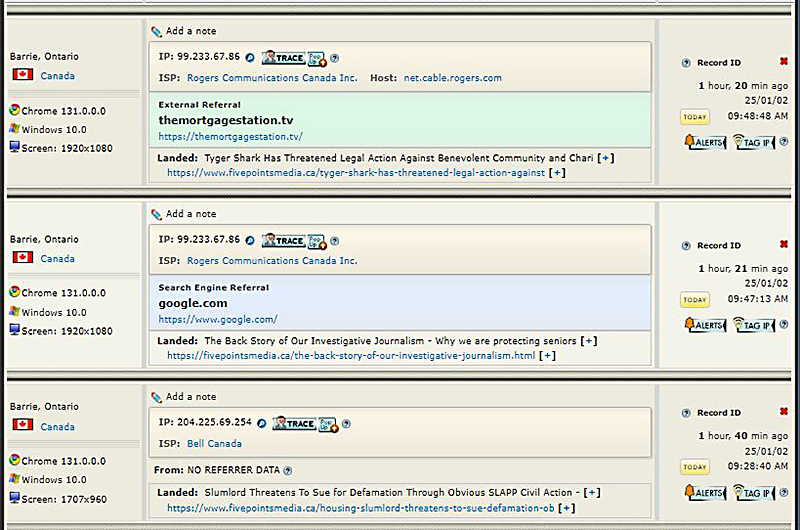

This morning, somebody from Barrie, likely a lawyer, combed through the stories of our history of success legally defending our right to tell the truth.

Their focus was just three stories, all of which were about how we exposed and defeated corrupt companies and people who threatened to abuse the true purpose of civil litigation to silence our guaranteed Charter right to report the truth. The first one they looked at is entitled "Slumlord Threatens To Sue for Defamation Through Obvious SLAPP Civil Action, 2022", the second is titled "The Back Story of Our Investigative Journalism", and the third is headlined "Tyger Shark Has Threatened Legal Action Against Benevolent Community and Charity Service"

The visitor was interested in three, and only three stories, all about how we have defeated abuses of our civil court system in a lame attempt to silence the truth of their own abuses.

This visitor was only interested in our history of defeating abusive litigation, such as that which was threatened a year ago by David Flude of Verico the Mortgage Station, which leads us to believe they are a lawyer.

The potential likelihood of an abuse of our civil court system comes as no surprise, and we welcome it. Our goal is to get to the truth, and once the process is started, there will be no more hiding or abuses like censorship of our website or social media. After all, they threatened similar action a year ago but failed to muster the courage to file the claim after we debunked their threats with a single email. The extended timeline of our ability to tell the truth, which has been created by them, and our determination to hold these corrupt corporations accountable is leaving them with few viable options.

It is due to their collective arrogance and denial that these multi-million and multi-billion-dollar corrupt corporations have turned a criminal act of greed by one person into a public relations disaster for themselves.

According to their own posts, after two and a half years of hiding and evading responsibility for their criminal acts of usury, or loan sharking, Verico the Mortgage Station is failing due to being abandoned and alone, and losing money so badly due to our exposure of their criminal and ethical abuses of trust that, they are losing brokers and agents at a phenomenal rate and are not replacing them, they are converting offices intended for an expansion into apartments, apparently to generate much needed cashflow, and they are once again selling their newly constructed custom built offices, but this time for one million dollars less than their original price. Meanwhile, according to our visitor log data, which has not been contested, HomeEquity Bank is losing upwards of $80 million a year as people across Canada are finding our website and videos and choosing to look at other options rather than buying a CHIP Reverse Mortgage, which is the only product they sell.

We stand ready to defend against any proposed abuse of the authority of our civil court system, as we have publicly stated has been our position throughout the past eighteen months as these multi-million and multi-billion-dollar corporations have hidden from our small, not-for-profit, social enterprise, community service.

The New Year Heightens The Riddle, Wrapped In A Mystery, Inside An Enigma

One of the most frequently asked questions sent to us by followers and mortgage industry professionals alike is: 'Why didn't Verico Financial Group Inc. and HomeEquity Bank act in their own best interests, and simply, publicly, cut all ties with the loan sharking brokers of Verico the Mortgage Station as soon as we exposed them, and provided both with tangible evidence?' We don't have the answer, at least not yet, but we are scheduling interviews with various former members of management and staff from both companies. We are hoping those who were on the inside, as recently as a few months ago, can shed some light on this frankly bizarre level of loyalty to loan sharks that has brought to them financial harm in the way of lost opportunities, and damage to their respective reputations.

If either had done no wrong, they could have cleared their names through a simple interview.

Both 'professional financial corporations' have now seemingly cut all ties with Verico the Mortgage Station, albeit two years too late. However, we have discovered that Lisa Purchase, who set up the scam to compel their target to accept usury levels of interest, is now back in the fold, working as an agent for Verico Financial Group Inc., and selling the CHIP Reverse Mortgage for HomeEquity Bank.

We will be exposing the full details of that malicious public deception during the next few days.

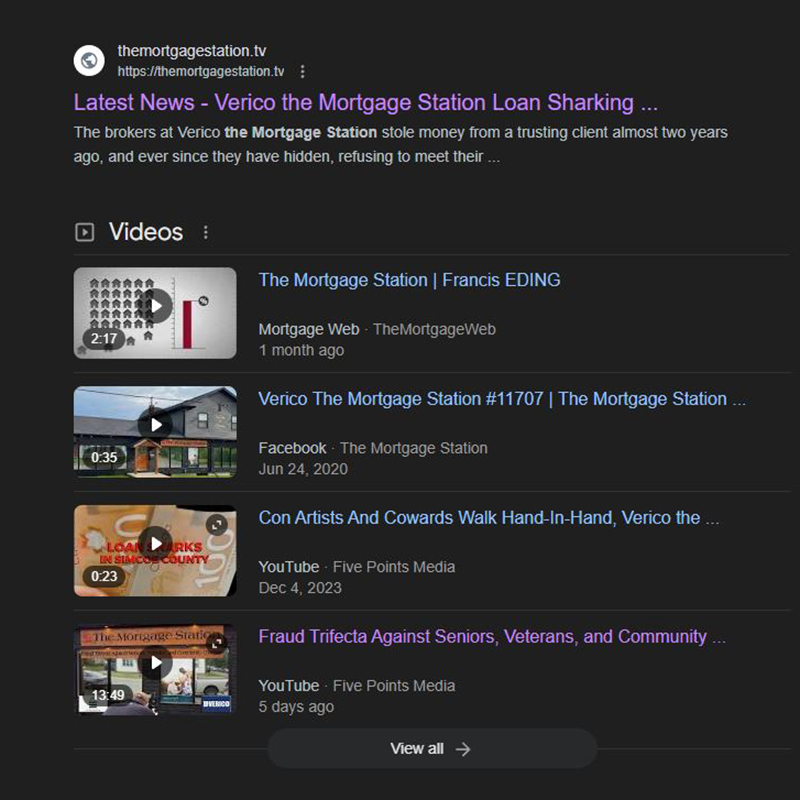

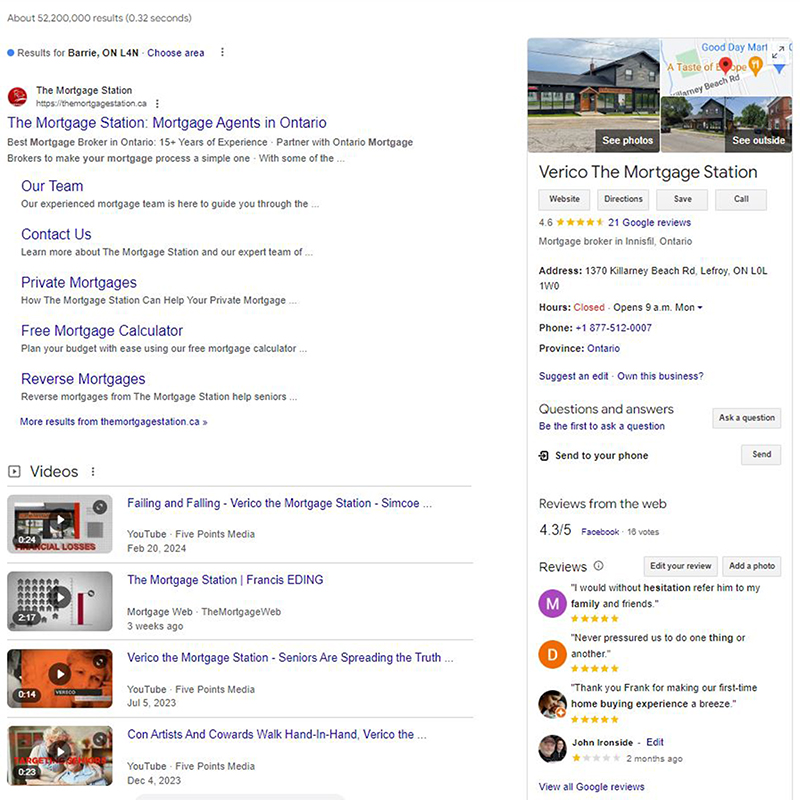

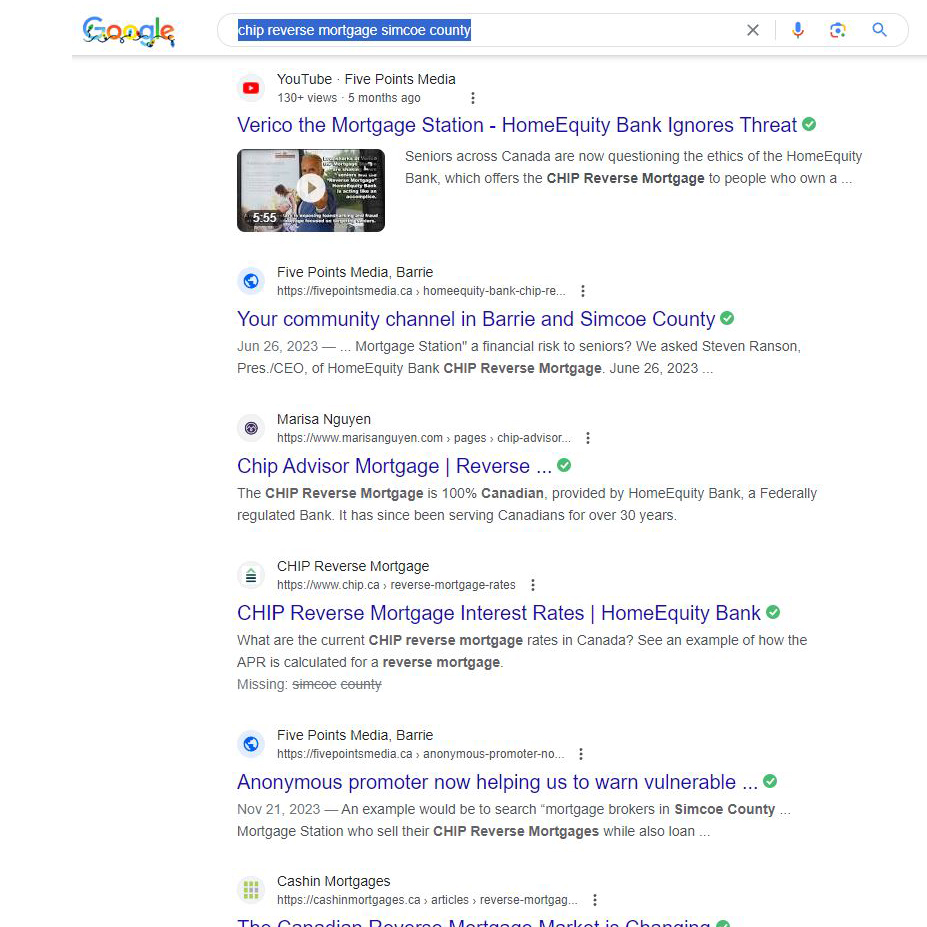

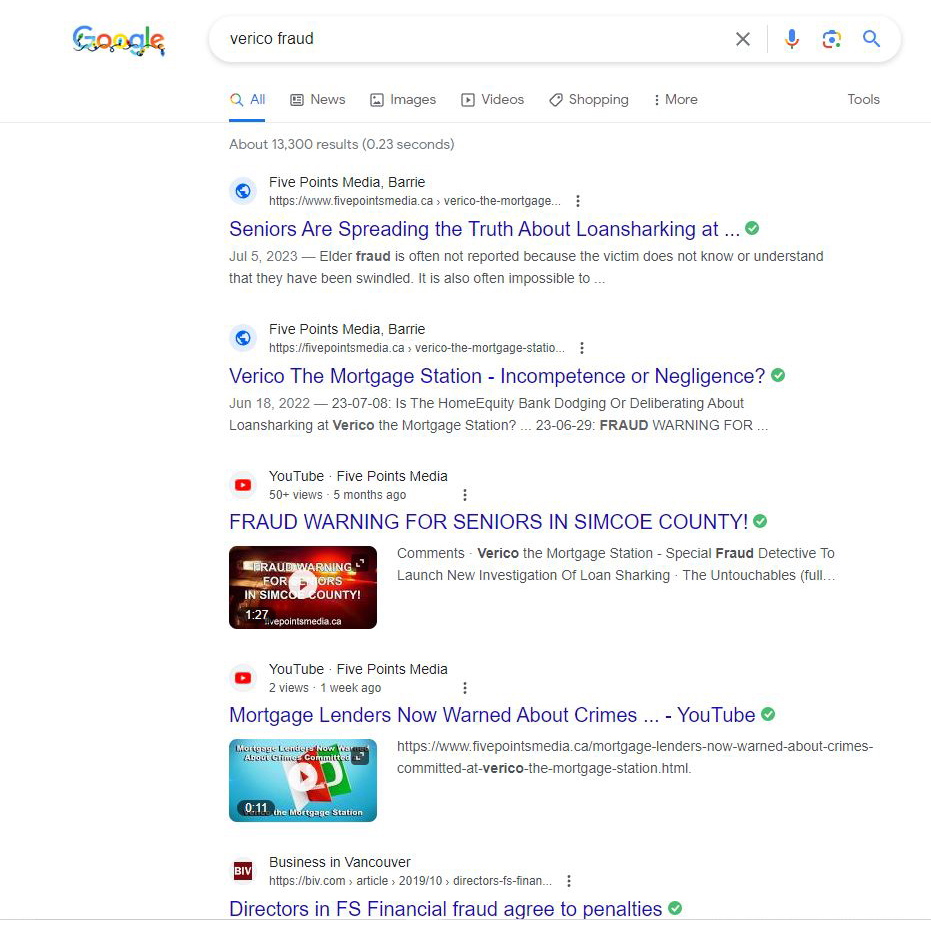

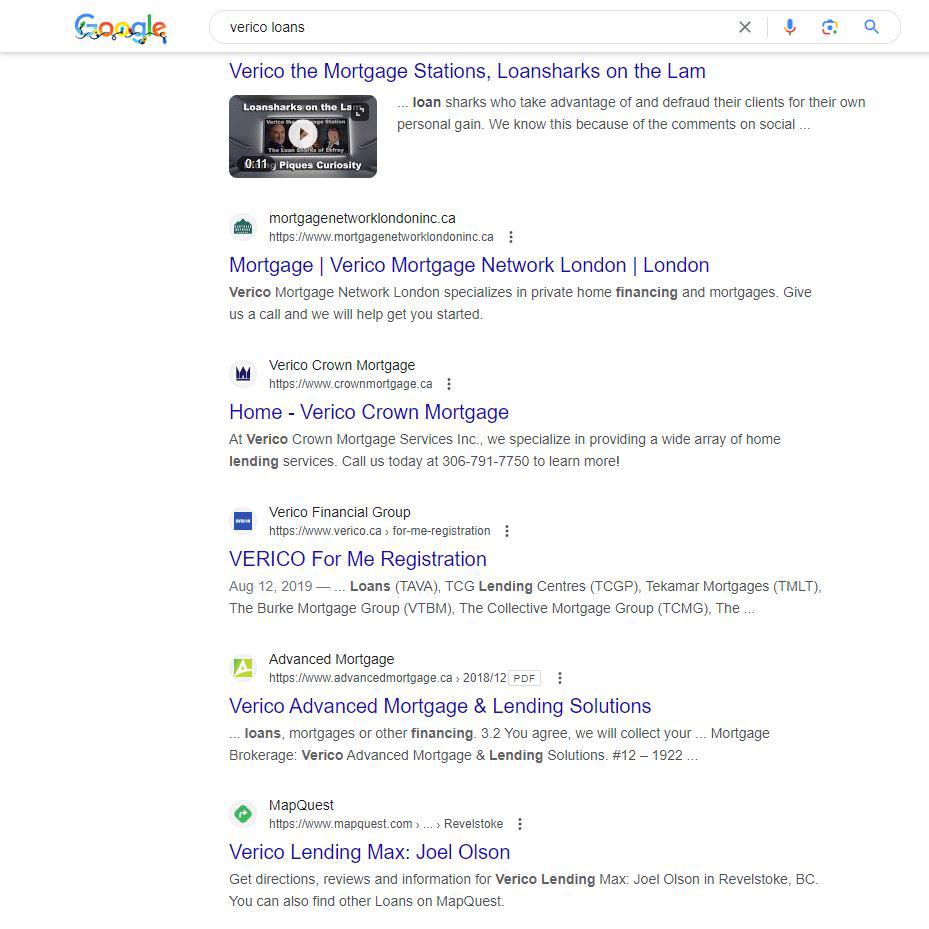

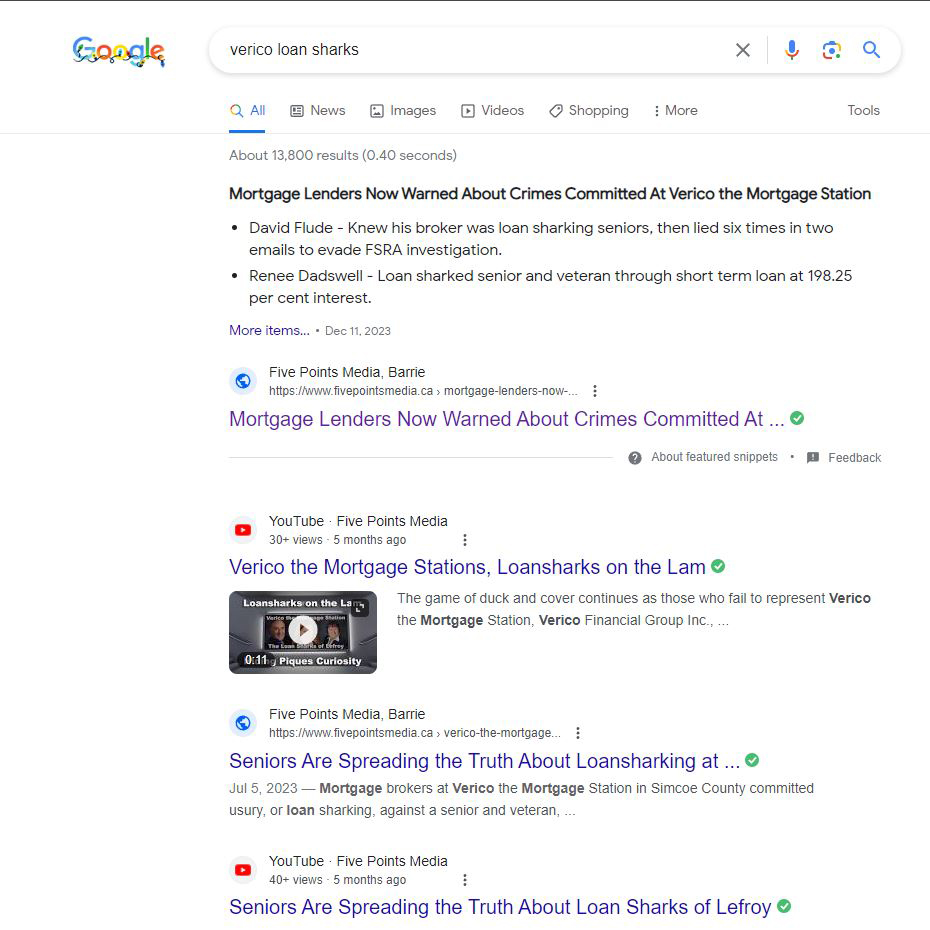

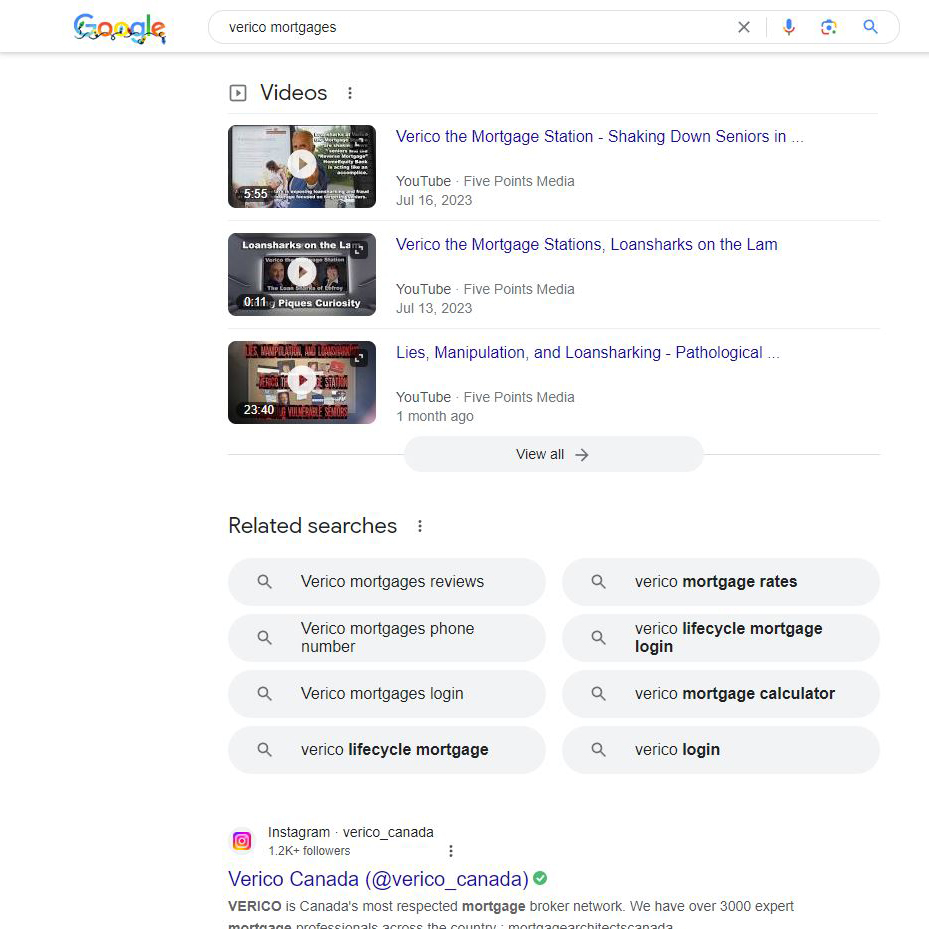

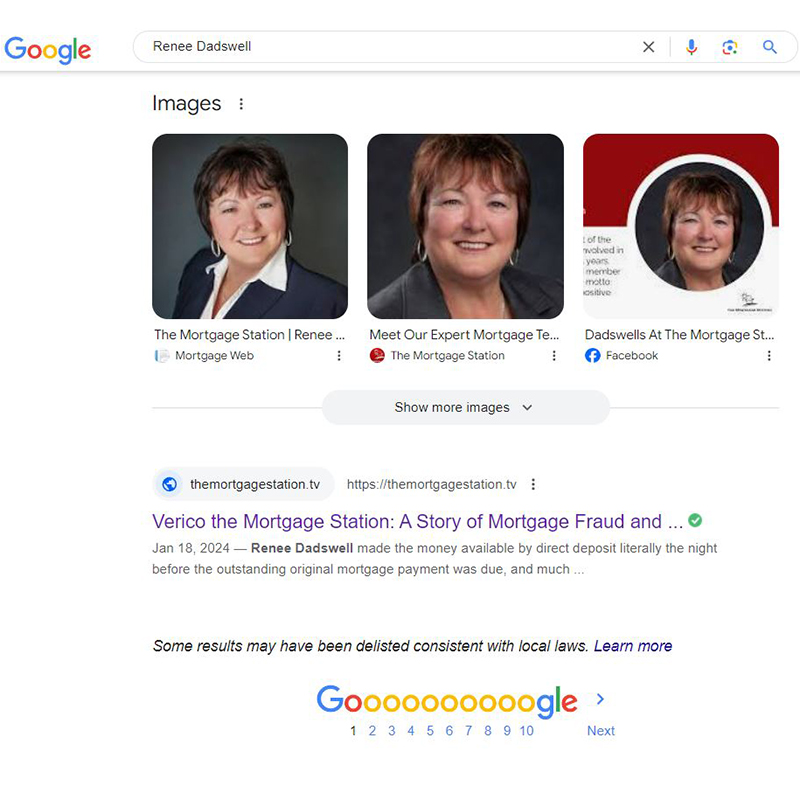

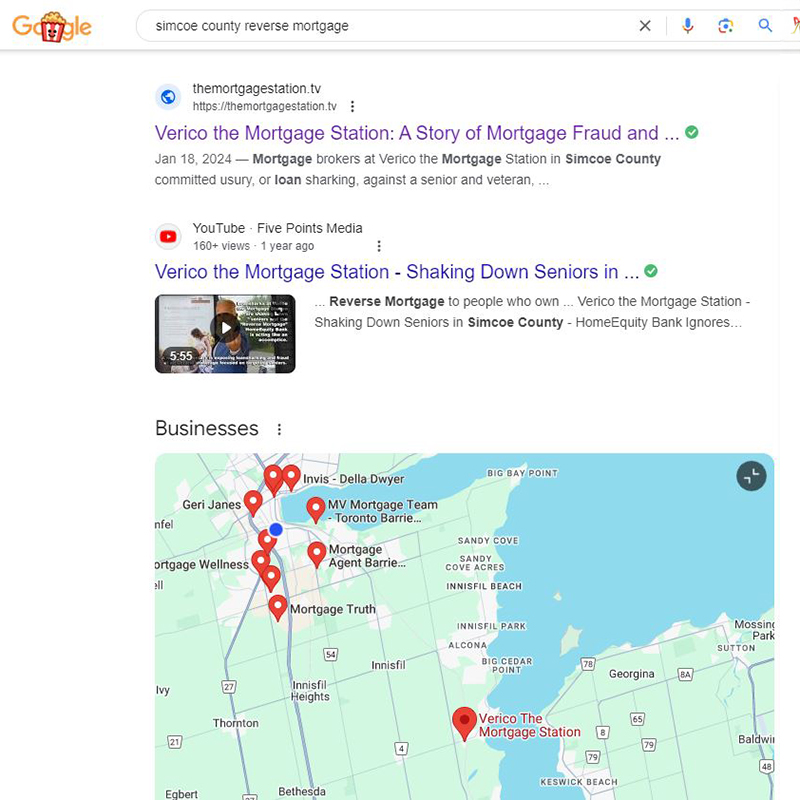

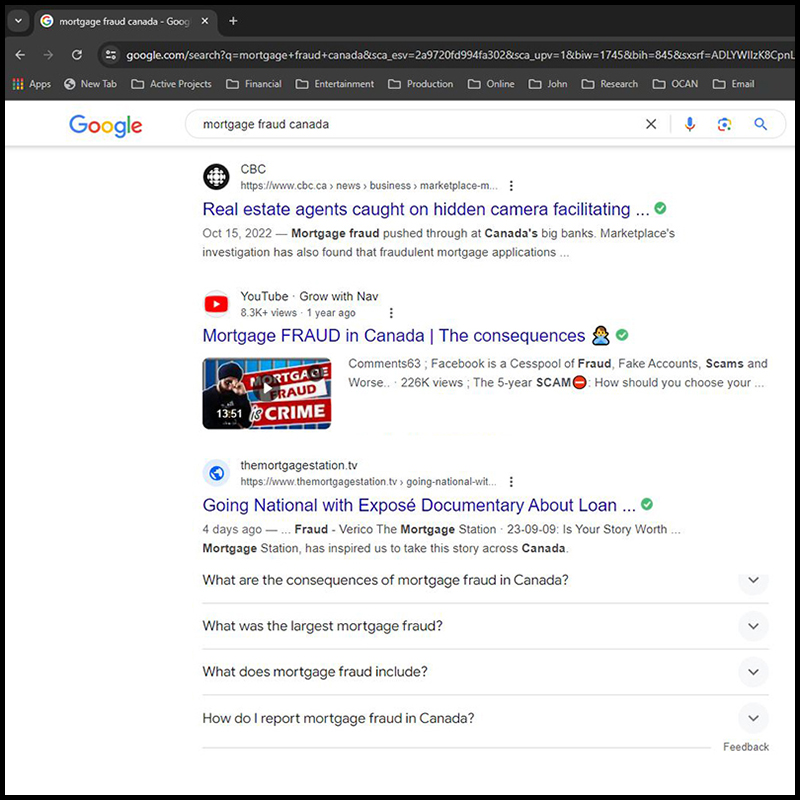

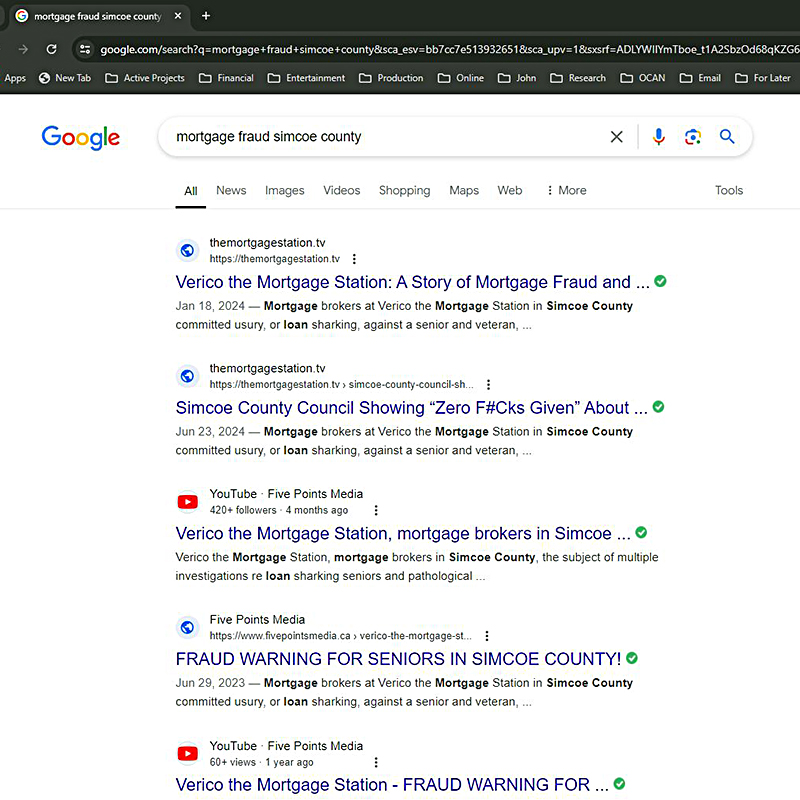

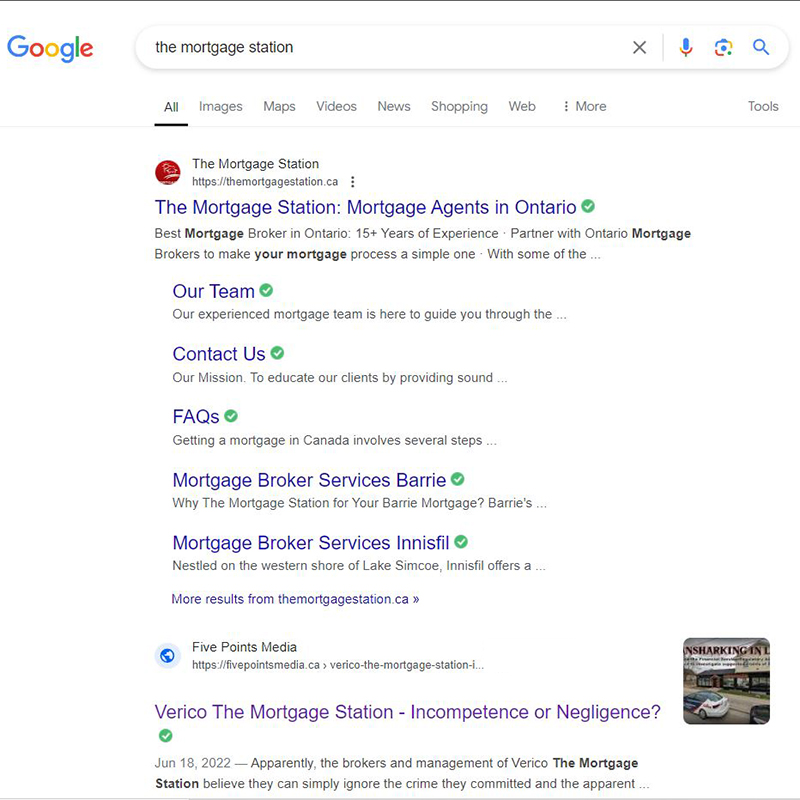

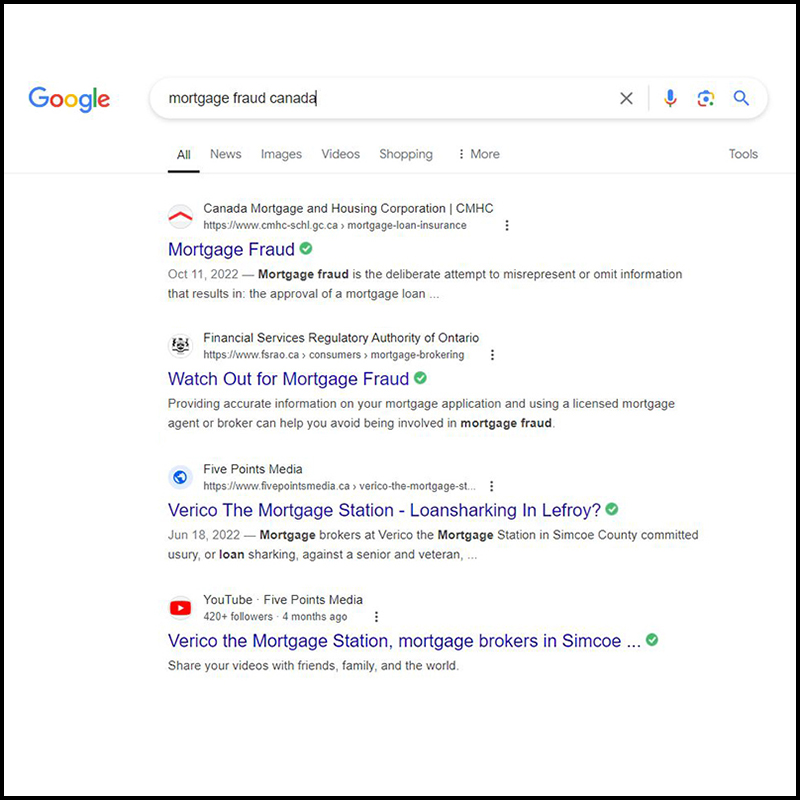

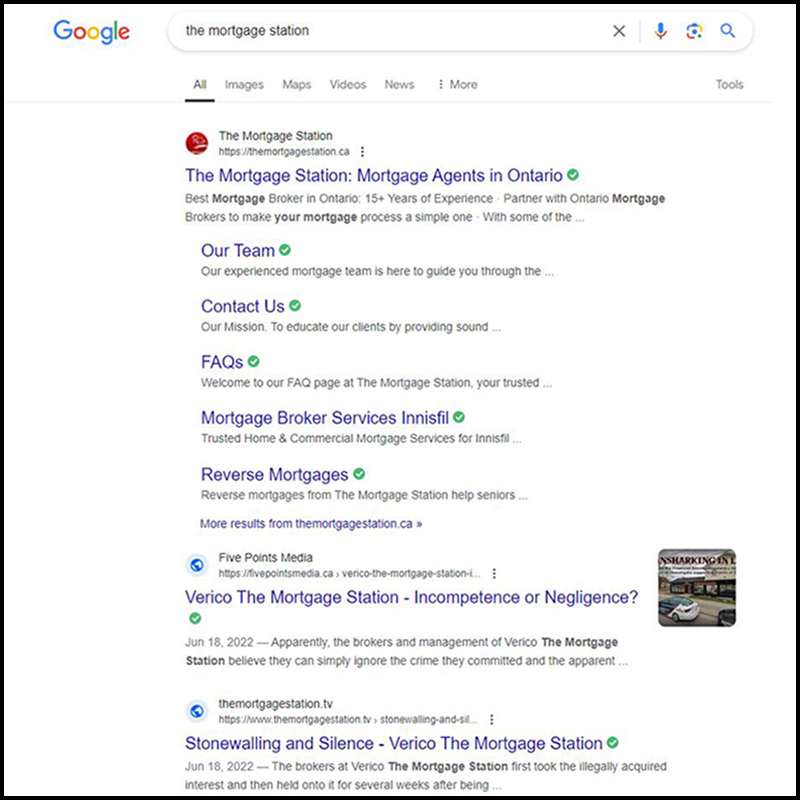

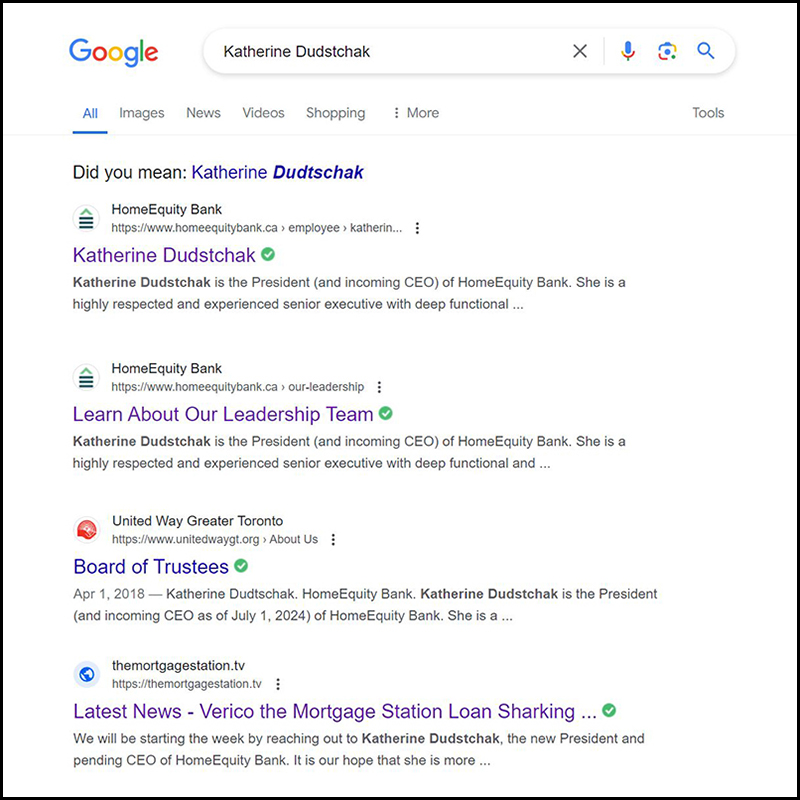

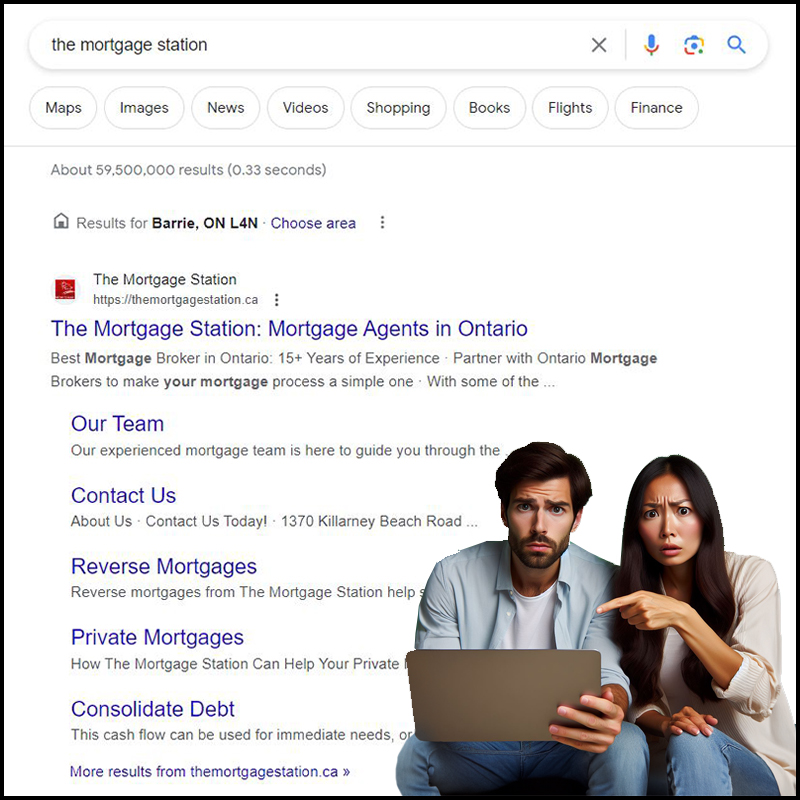

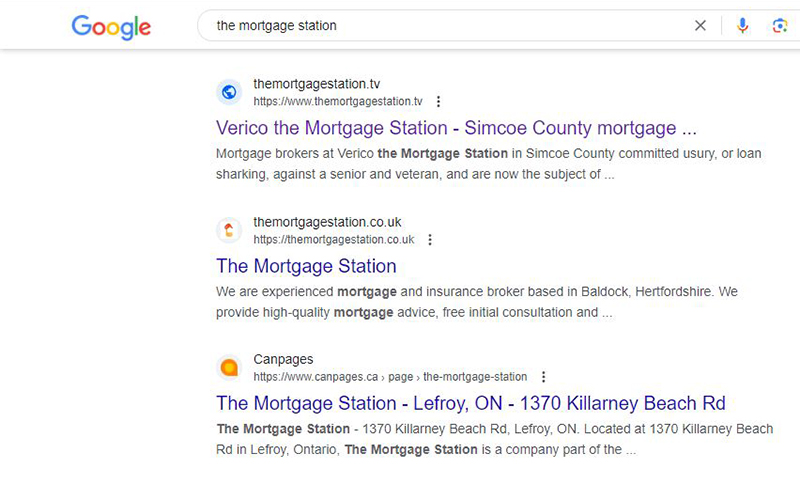

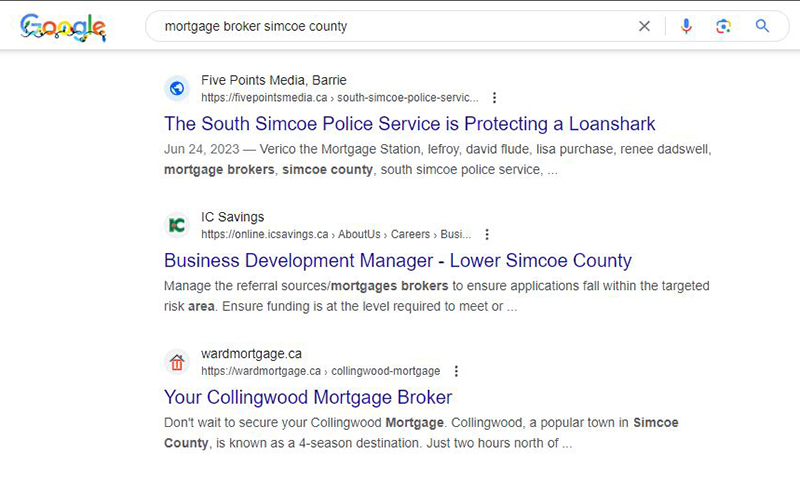

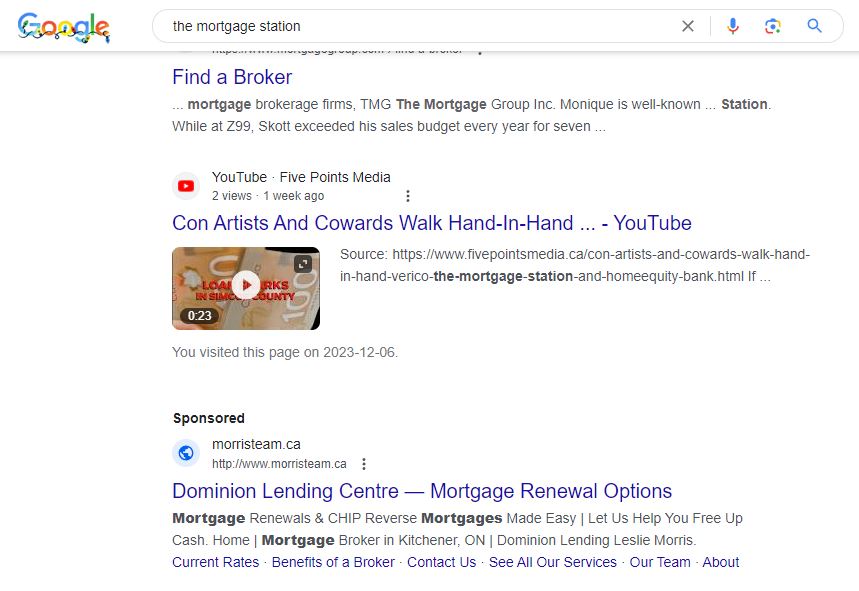

Our rightful status on the search engine is now mostly restored, which became necessary after an unidentified online hacker unethically, and in violation of the Charter of Rights and Freedoms, delisted our story from Google and the other search engines. That censorship then stopped immediately after we exposed it here. Techno gurus do not take such action unless they are hired, so which one of these 'professional financial corporations' stooped to this level to prevent the public from learning the truth of their own criminal and ethical breaches of trust?

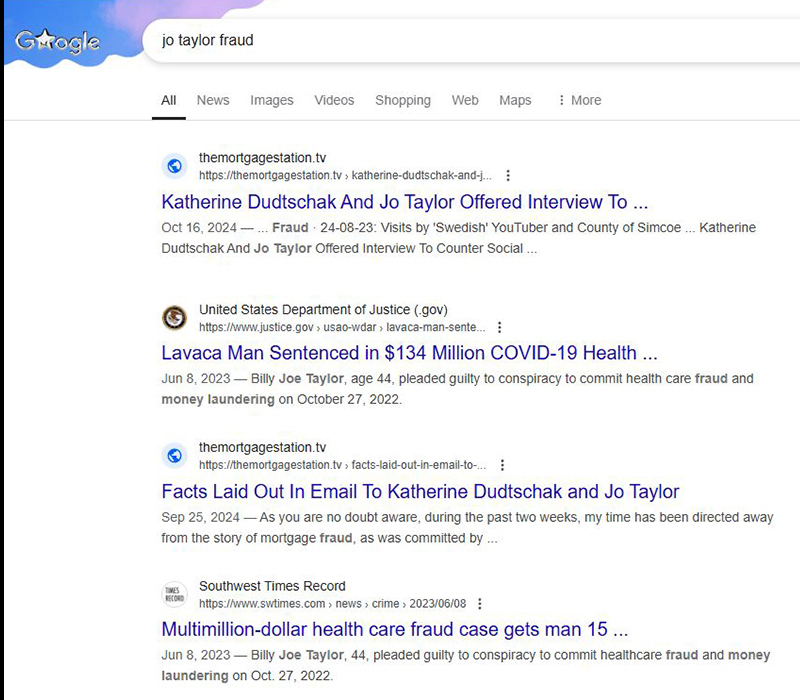

Katherine Dudtschak, CEO and President of HomeEquity Bank, and Jo Taylor, her counterpart at the Ontario Teachers' Pension Plan, have shown confused priorities by defending loan sharks.

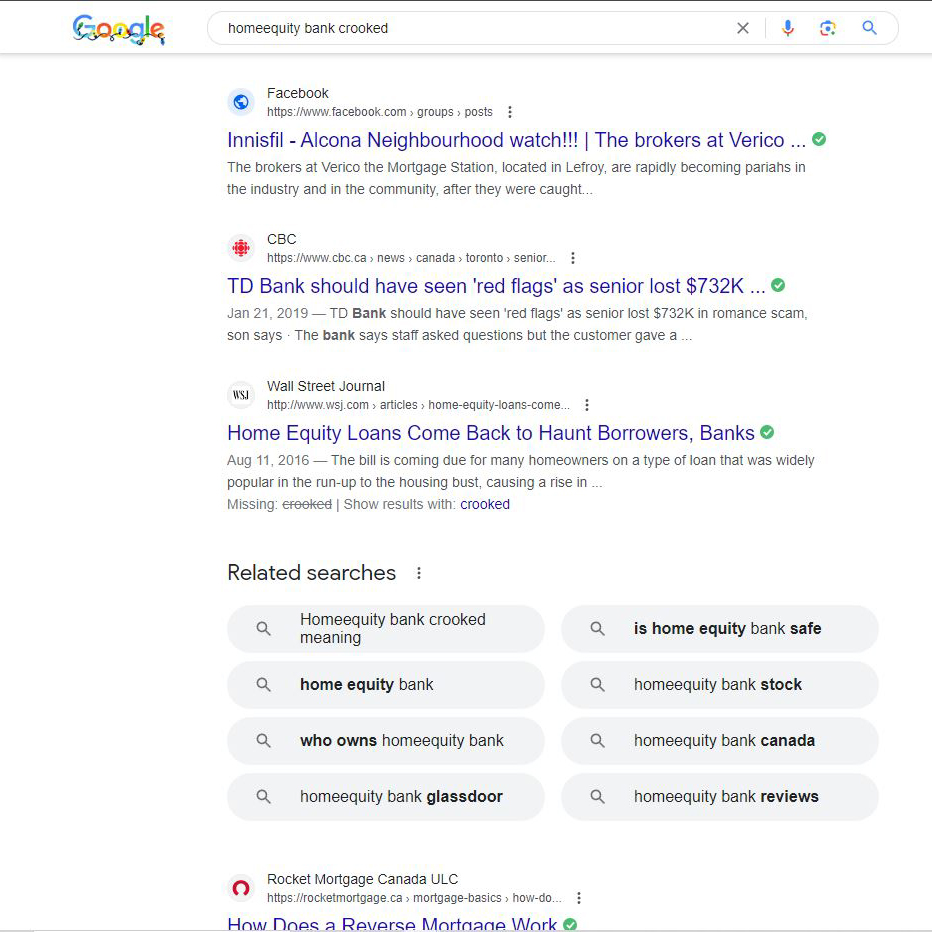

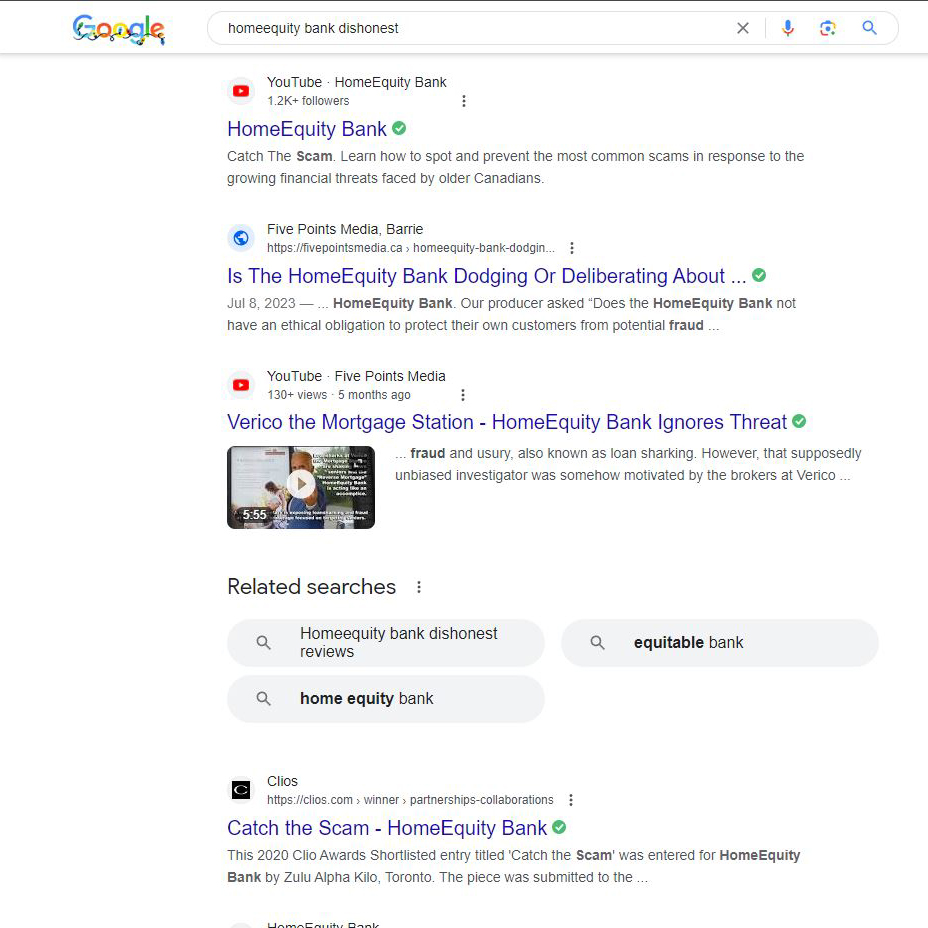

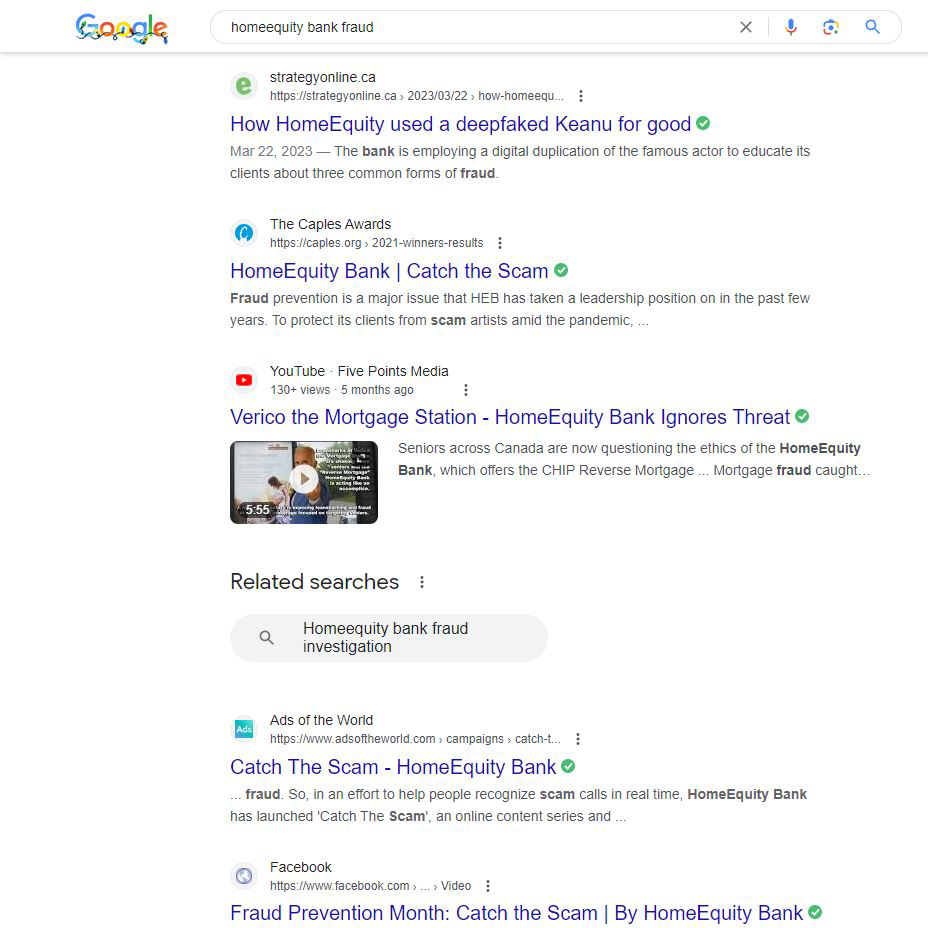

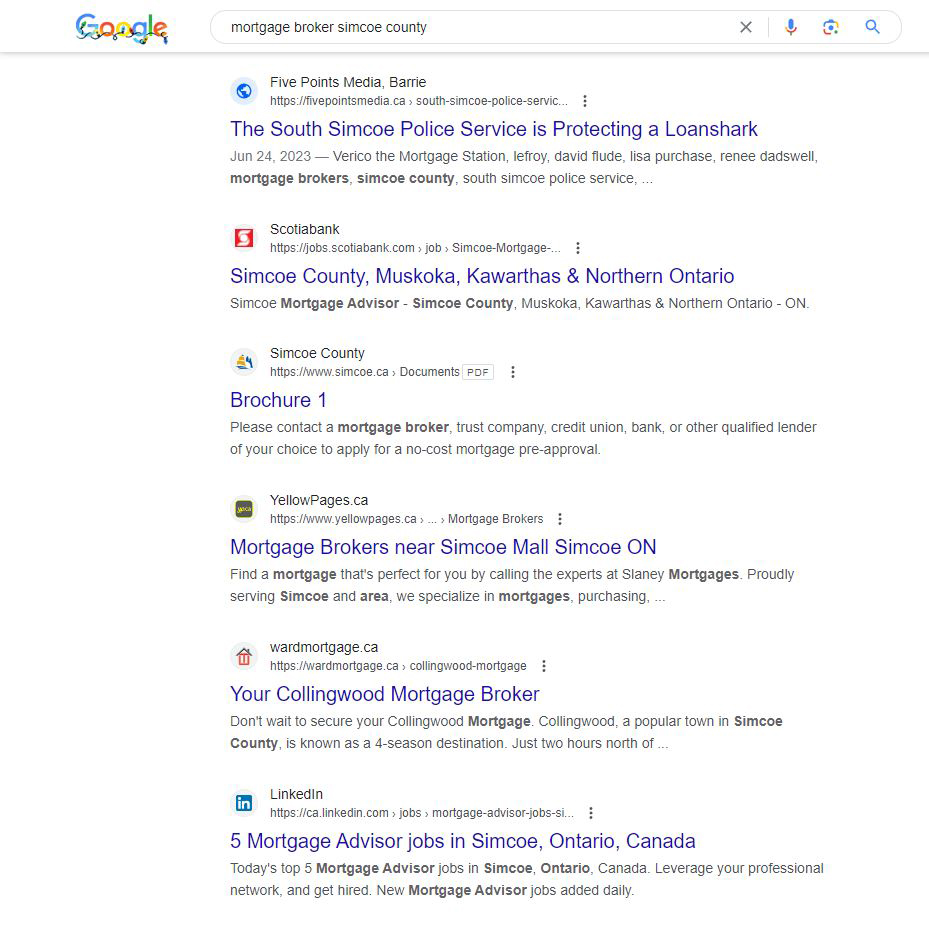

Search engine results.

These high-ranking financial professionals are willing to accept exposure for fraud, rather than accept any of our multiple offers to present opposing evidence, which could result in our cancelling the documentary.

Obviously, the bigger questions are:

- Why have these supposed 'professional financial corporations' resorted to hiding for more than two years, rather than disproving our allegations through an interview or in a court of law?

- Why have they all stonewalled all attempts at communication with their shared client, who the brokers of Verico the Mortgage Station have all admitted to defrauding (Renee Dadswell), (Lisa Purchase), (David Flude).

- Why did these multi-million and multi-billion-dollar corrupt corporations stoop to threatening our benevolent community service after they stole from us through the indictable offence of usury and then collaborated to cover it up, by falsely boasting that they would file a court scorned Strategic Litigation Against Public Participation (SLAPP) lawsuit that a year later has never been served

- Why instead of speaking with us, either on-camera or through a without prejudice meeting, did they turn to censorship of both the search engines and social media?

- What is the source of the fear about explaining their actions that is so important to the owners of Verico the Mortgage Station that they are willing to lose the newly custom built offices of Verico the Mortgage Station , which are once again on sale, now for a million dollars less than their original price, which they seem unable to sell, likely due to the reputation now associated with that building.

- Why is it that HomeEquity Bank, and by extension the Ontario Teachers' Pension Plan Board (OTPP), are willing to lose tens of millions of dollars a year in lost opportunity due to the exposure of their part in the coverup for the loan sharks of Verico the Mortgage Station?

We will continue to report on this story, and to warn potential victims, until somebody from one of these multi-million and multi-billion-dollar corporations shows the courage to face our evidence during an on-camera interview.

A Year In Reflection

As we approach the end of 2024, we reflect positively on the way the year has developed. We started telling this story about two and a half years ago, and with the exception of a vacuous 'anonymous' threat of using abusive Strategic Litigation Against Public Participation (SLAPP) litigation, that we swatted away with facts contained in a single email and never heard of again, nothing we have published has ever been contested by the loan sharking brokers of Verico the Mortgage Station, nor either of their corporate collaborators at Verico Financial Group Inc. and HomeEquity Bank.

Even that single response did not refute our charges, but simply threatened abusive civil action.

Based on their own posts, the loan sharks at Verico the Mortgage Station have lost numerous brokers and agents, without replacing them, they have been forced to convert offices to apartments, and to sell their offices, now for a million dollars less than the original ask. Meanwhile, our visitor logs show how the HomeEquity Bank is losing many millions of dollars in lost opportunities because of our ongoing exposure. In sharp contrast, our determination to tell the truth and present our evidence has resulted in thousands of dollars in donations, such as those seen here from North Simcoe Muskoka District Labour Council (left) and the Barrie & District Labour Council (right). We have also cemented our reputation as journalists and producers of socially relevant documentaries who will expose corporate abuses and corruption without yielding to threats of abuses of our civil court system.

North Simcoe Muskoka District Labour Council (left)

and the Barrie & District Labour Council (right)

We will, of course, be maintaining our vigilance going into 2025, and for as long as those who steal from their senior and veteran clientele continue to hide from the truth of their own criminal and ethical breaches of trust.

Censorship And Unethical Delisting Defeated - HomeEquity Bank

As we noted back on October 30, 2024, in the article entitled "Desperate Triad Resorts Again To Censorship", one of the companies involved in this uncontested story of fraud by usury, or loan sharking, and corporate cover-up, those being Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank, has apparently been working to censor our ability to report on this story of their criminal and ethical breaches of trust, by unethically delisting our website on Google. That action would be a violation of our rights under Section 2B of the Charter of Rights and Freedoms, and also an act of blatant fraud and identity theft, and it stopped immediately after we outed them here for committing the offence.

This is all cloak and dagger, covert stuff, and the work of cowards, so it is hard to say which one did it.

We are able to confirm that in July of 2023, Facebook advised us that HomeEquity Bank had reached out to them, trying to censor our story of how they were collaborating with the loan shark brokers of Verico the Mortgage Station by helping them to conceal how they were defrauding senior and veteran clientele, and the community by defunding our not-for-profit, social enterprise, community channel, that has been responsible for raising awareness and hundreds of thousands of dollars worth of fundraising for hundreds of charities, not-for-profits, and benevolent community groups in Simcoe County and across Ontario.

It is likely we can all understand why they would not want potential clients to know about that.

The most recent attempt at censorship came in the form of delisting, which is a cheap hack used by unscrupulous online promoters to remove the listing of a company's competitor on the search engines. Essentially, it is a fraudulent lie through which a business tells Google that the website of their competitor is no longer online and should be removed from all lists. In this case, the attempt was sloppy, as the deletion was only partially effective. The perpetrator, who we hope was paid very well, neglected to remove our domains from many of the online lists, and now Google and the other top search engines are fully aware of the scam, meaning it won't work again.

We are back on page one of Google and other search engines,

and again, we are rising for all key words.

As can be seen in the screengrab, using random words like "Katherine Dudtschak HomeEquity Bank fraud", results in our story being listed in three out of the top five results on page one of Google.

Deck The Halls With Scheming Loan Sharks

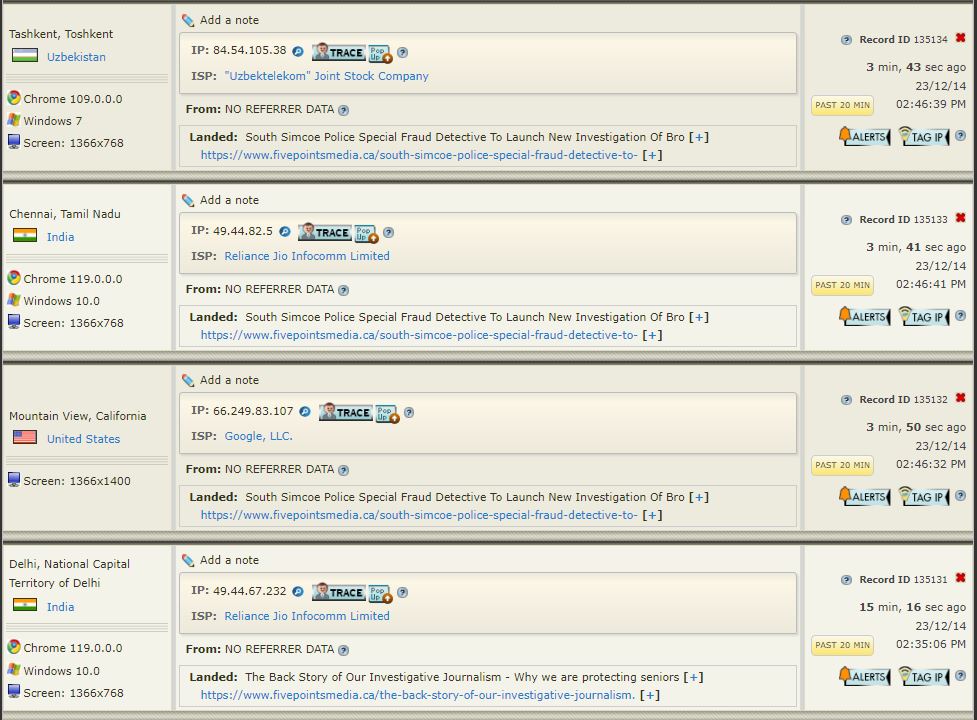

On the afternoon of Christmas, away from our house, a creature was stirring, and it was using a mouse ;-) This screengrab of our visitor logging service shows that on the afternoon of Wednesday, December 25th, 2024, within the 96 second time span between 02:48:03 to 02:49:39 PM (Eastern Time Zone), an automated data mining system, pretending to be located in Quincy, Washington, visited 56 pages of this website, where it scratched, clawed, and harvested every detail possible about our reports of mortgage fraud that was committed against senior and veteran clientele by the brokers of Verico the Mortgage Station, with the collaboration and see-no-evil support of the boards of directors of Verico Financial Group Inc. and HomeEquity Bank. These allegations have never been challenged.

Given the holiday, it is likely that the proxy server protected miners were located somewhere in Asia.

The self-admitted corporate collaborators will not speak with us or face our evidence. However, they will not deny investing in hackers and online censors who unethically and in violation of the Charter of Rights and Freedoms, work to block our ability to tell this story, which is of genuine interest to any senior considering signing up for a CHIP Reverse Mortgage. They have also not denied using third party data mining companies to dig deep trying to find exploitable flaws in the $700,000.00 worth of fully donated services that we have gifted to more than 180 local charities, not-for-profits, and benevolent community groups. Those frequent datamining attacks have been committed against the website of our not-for-profit, social enterprise Five Points Media and its social media. These self-admitted loan sharks, who target seniors and veterans, have also, for more than two years, hidden from our evidence while ignoring the crimes committed against one of their mutual client, by agents working for profit on their behalf.

The loan sharking brokers of Verico the Mortgage Station, and their collaborating partners at Verico Financial Group Inc. and HomeEquity Bank, will hide, attempt to silence us through censorship, and try to find something they think they can use to coerce us into silence, but they won't disprove our allegations of loan sharking and Fraudulent Concealment based on the evidence in a court of law.

It is truly disturbing that any of these supposed "ethical financial professionals", including David Flude, Verico the Mortgage Station, Mark Squire, Verico Financial Group Inc., and Katherine Dudtschak, HomeEquity Bank, can even pretend to have anything resembling ethics or morals.

Desperation Sets In As The Offices Of The Mortgage Station Are Once Again On The Block

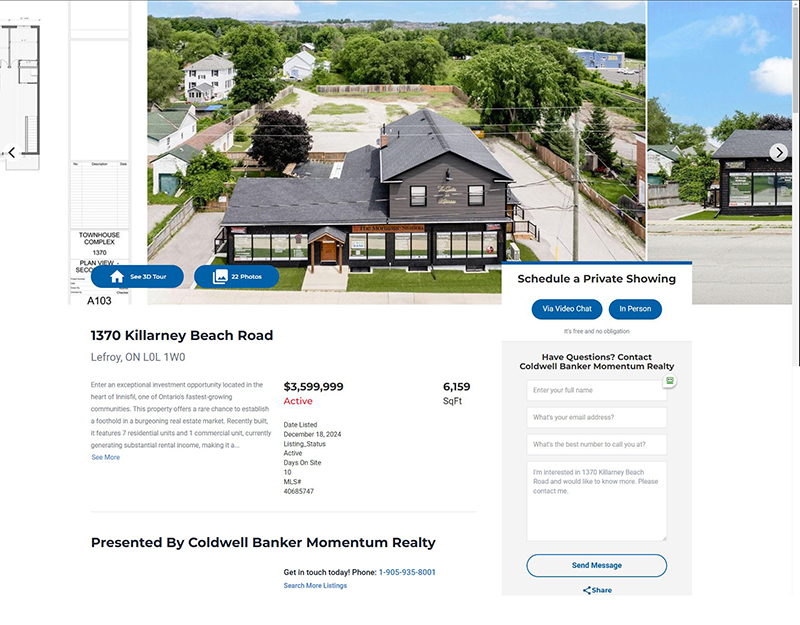

Back in early September, we started reporting about the apparent financial troubles that can be seen to be stifling operations at Verico the Mortgage Station. Those issues are public only because of their own public posts, which include the conversion of offices that were touted as intended for an expansion, being instead turned into apartments, apparently to generate cashflow, the loss of several brokers and agents who were not replaced, and more importantly, the application of a digital 'for sale' sign to the offices of Verico the Mortgage Station, which is at least for now located at 1370 Killarney Beach Road, Lefroy, ON, L0L 1W0.

It is the old story of the village idiot who destroyed his house trying to prove he could defeat a mouse.

We virtually disappeared for about a month, between November 15 and December 25, 2024, and it seems like on a few fronts the loan sharking brokers of Verico the Mortgage Station, and their supposedly no-longer-associated collaborators at Verico Financial Group Inc. and HomeEquity Bank, thought we have given up on reporting this story. Not only did we learn that Lisa Purchase, the apparent under-the-bus scapegoat for this ongoing story of criminal and ethical breaches of trust, has in fact returned to the good graces of both Verico Financial Group Inc. and HomeEquity Bank (more on that shortly). It also appeared that the offices of Verico the Mortgage Station were suddenly and unexplainably no longer for sale as a commercial or residential complex.

With our reporting 'gone', it appears they thought it was time to get back to defrauding seniors.

Verico Brokers and HomeEquity Bank Picking From The Bones of Charity

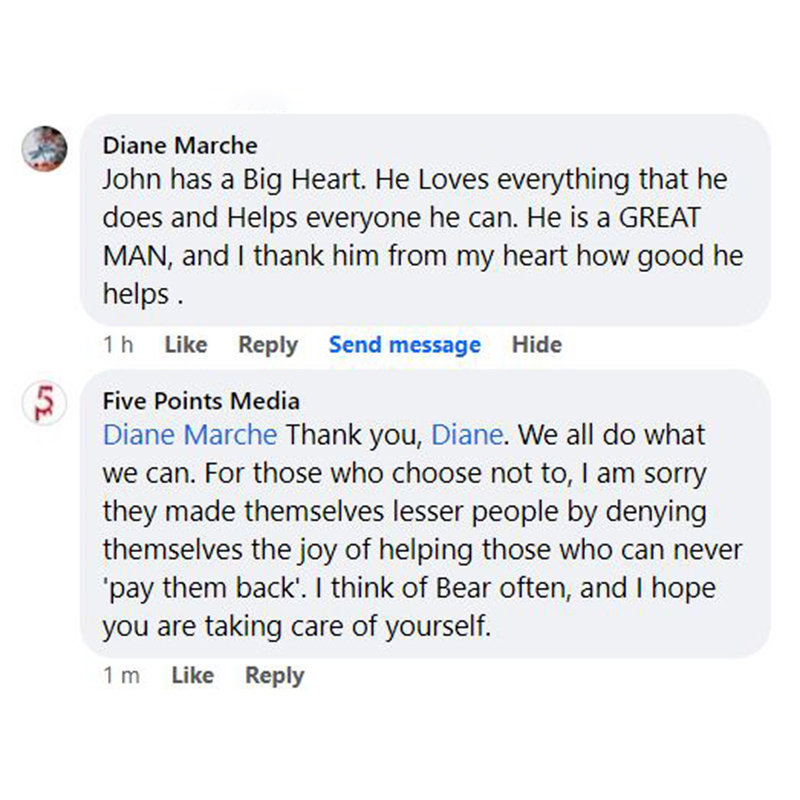

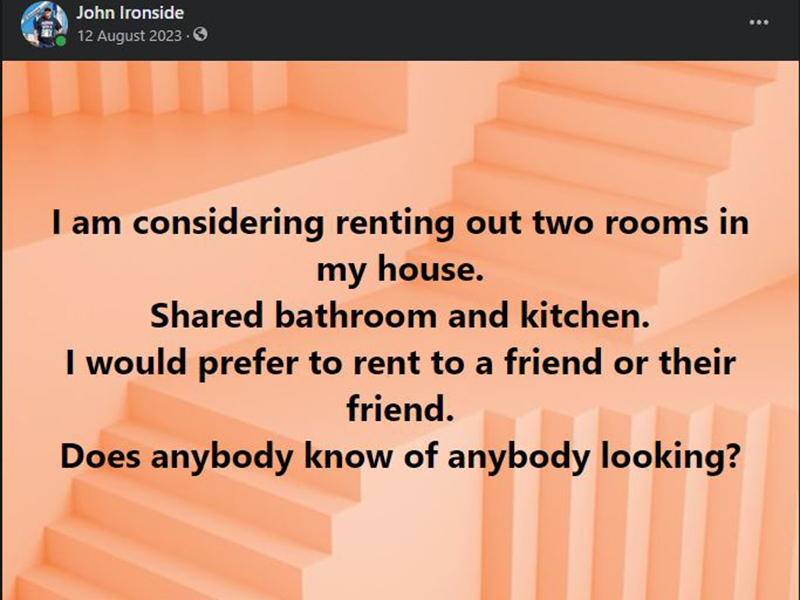

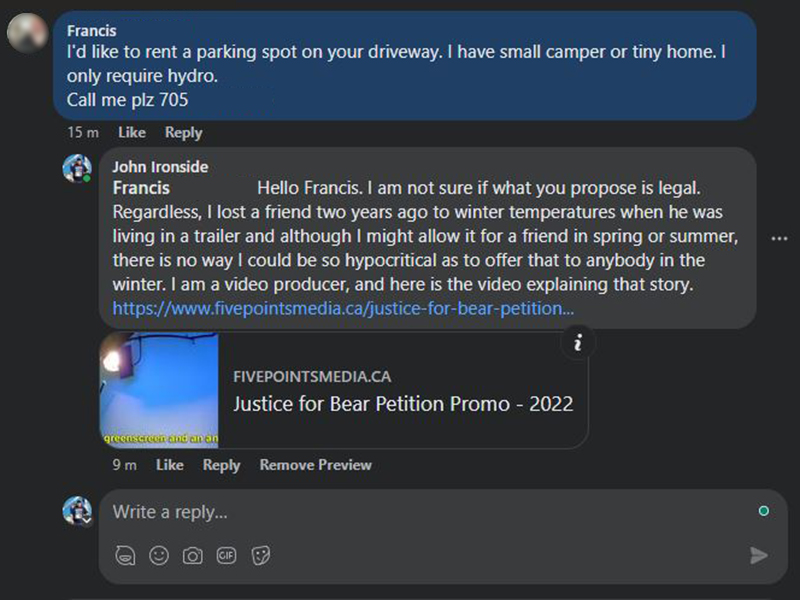

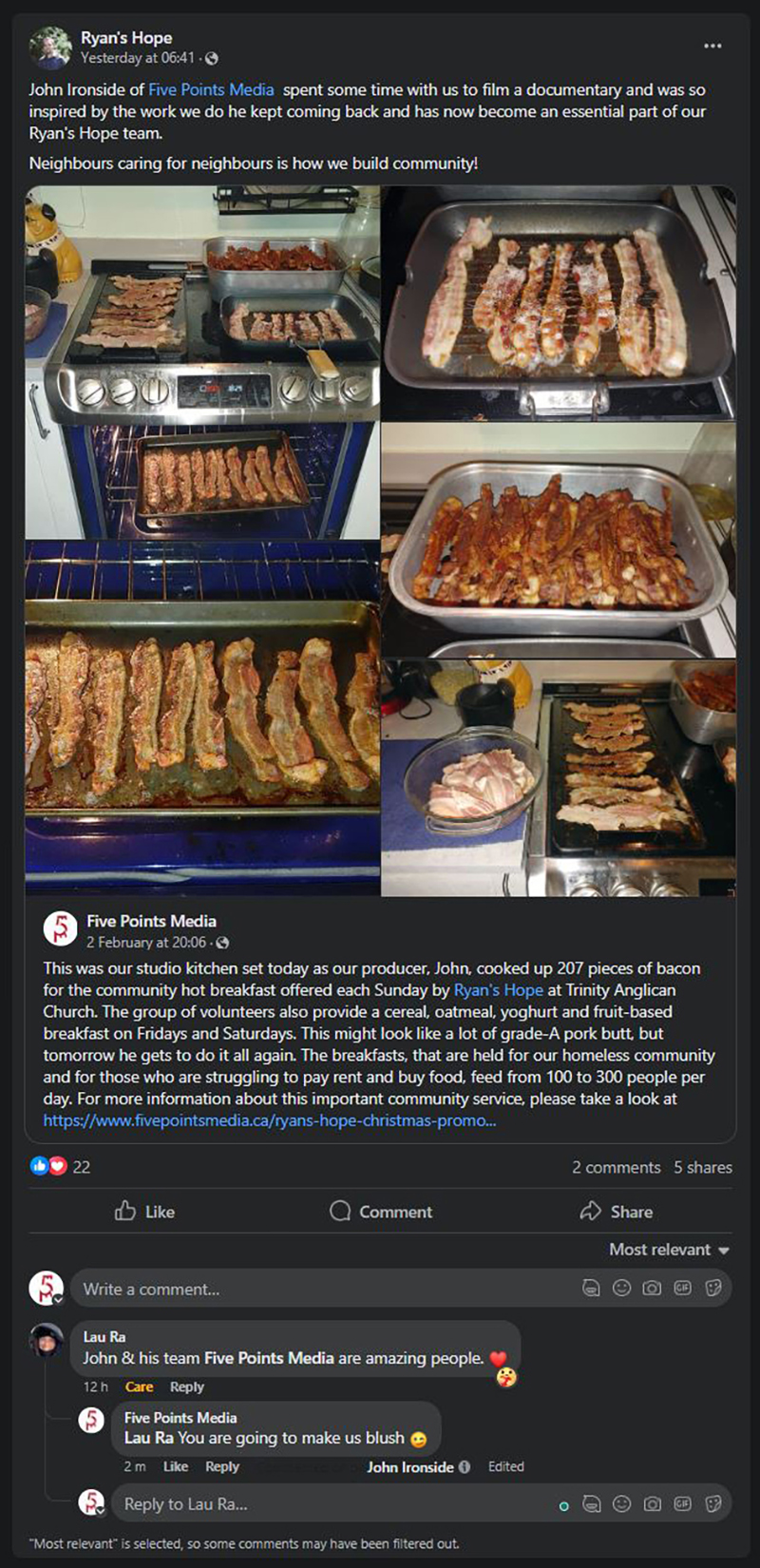

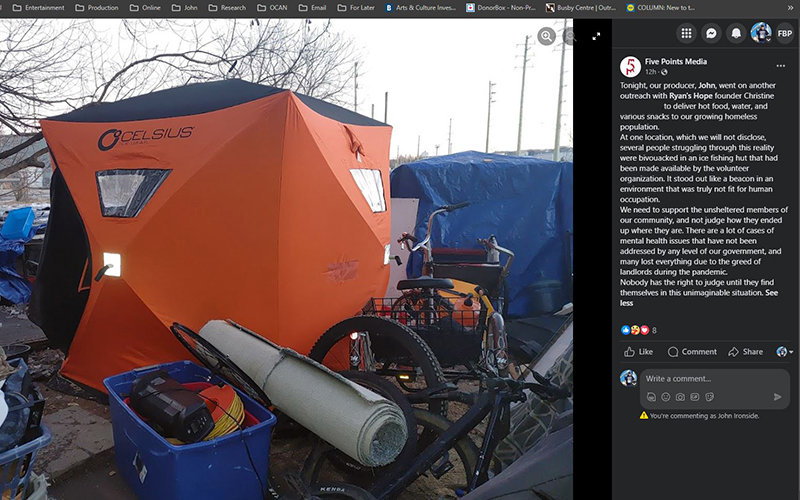

Below is the content of a Facebook post from December 24, 2024, which shows who we are, which is not the 'repeat serial agitator' David Flude invented to excuse his brokers' criminal and ethical breaches of trust to another potential client. This easily proven reality is a big part of the reason why the loan sharking brokers of Verico the Mortgage Station, and their co-conspirators at Verico Financial Group Inc. and HomeEquity Bank, will not take this matter before a Justice of the High Court, as we have repeatedly asked them to do if they contest our allegations.

They can 'motivate' government agencies and lie to stockholders, but they cannot back false claims with evidence, which is why they fear going to court.

It is easy to lie to people who are not aware of the situation, and we have shown how David Flude lied six times in two emails (1) (2) to evade investigation by the Financial Services Regulatory Authority of Ontario (FSRA), and how Katherine Dudtschak, President and CEO of HomeEquity Bank, and her counterpart, Jo Taylor, President and CEO, of the Ontario Teachers' Pension Plan Board (OTPP) will not even reply to our letters (Letter 1) (Letter 2) (Letter 3).

"Christmas is a time for giving, and today, our team from R---- H--- was on the streets feeding the hungry, providing support to those in the greatest of need, and spreading Christmas cheer to the people in our society who have the least reason to be festive.

While we may be programmed to expect expensive gifts and to stuff ourselves with a feast worthy of a king, these people were overjoyed with a pair of socks and donated Swiss Chalet dinners.

In total, we delivered 60 dinners that were donated by the great management and teams at both the Swiss Chalet in the north end at 397 Bayfield St, and its counterpart in the south end at 85 Barrie View Dr.

Our sincerest thanks to these two locations who provided an amazing gift to a lot of people who truly needed it. We also provided pastries donated by the Salvation Army Barrie Bayside Mission Centre, and goody bags of treats and essentials provided by both R---- H--- and a generous donation by a caring Barrie resident.

This Christmas outreach is always special and important, as it is the time of year when those who are forced to live without shelter feel their isolation the strongest, without family, nor the comforts most of us take for granted.

That is why each December 24th, we pull out all the stops to remind them that they are not alone, and others care about them.

Merry Christmas to all of our friends, from the team members of R---- H--- and Five Points Media.

John Ironside, Five Points Media, and proud member of R---- H---"

Desperate Datamining

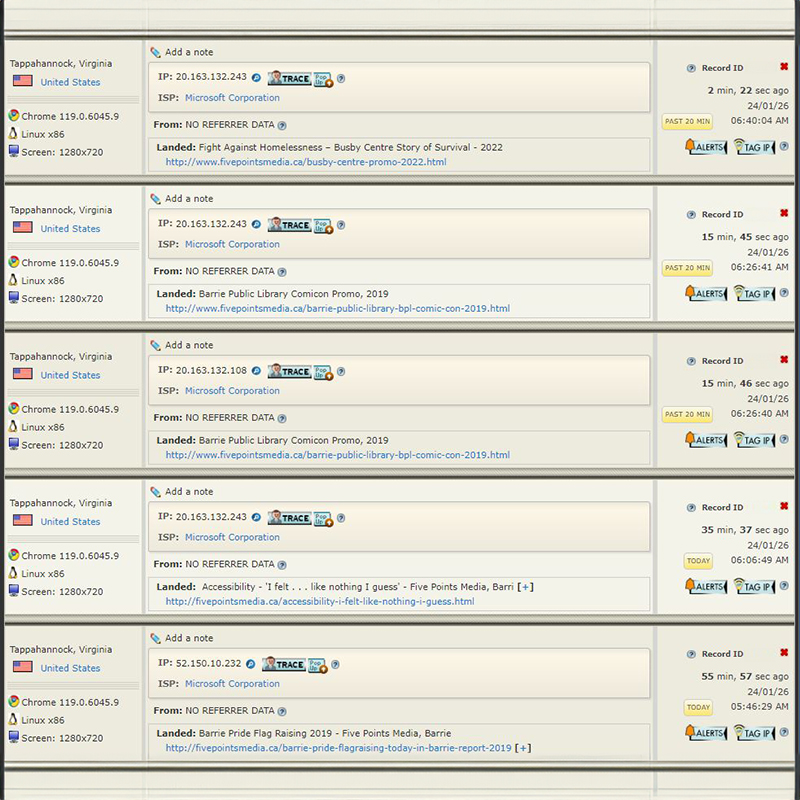

On the morning of December 22, 2024, a Sunday, between the start time of 07:41:33 AM to the end time of 07:42:04 AM, about 60 pages of the website of Five Points Media were 'viewed' by a single point of contact that was hidden behind a proxy server, pretending to be based in Washington, Virginia. Within that short time of about 30 seconds, no person could click on all those links, and it seems unlikely, to say the least, that the pages would visualize within half a second, nor allow interaction with the visitor that would be in any way meaningful or productive. Needless to say, at a rate of one click every half a second, no person would attain any useful information.

The IP address for all sixty plus visits remained the same, but the resolution of the screens used changed.

So, why are the brokers of Verico the Mortgage Station, or the management team of Verico Financial Group Inc., or more likely, the board of directors of HomeEquity Bank, who will not defend against our fully supported allegations, or even reply to our letters (Letter 1) (Letter 2) (Letter 3), now using an obvious datamining service to scour massive amounts of our community service videos that we donate to any charity, not for profit, or benevolent community group that asks?

Multi-million and multi-billion-dollar corporations that have done no wrong do not slither around in the darkness, looking for crumbs they believe they can use to evade responsibility for their own criminal and ethical breaches of trust.

Although on a smaller scale, this desperate form of scratch and poke 'research' is now a daily event on both this website and the one for Five Points Media, as visitors from various towns and cities in Ontario, and others hiding behind proxy servers, review, scrutinize, and share our content with others, or post links on social media.

Our Absence Made Your Hearts Grow Fonder

As our frequent and returning followers know, we spend time analysing the data of our visitors to this story, and we change our practices accordingly to improve the likelihood of their return. Afterall, our primary concern here is to warn seniors and veterans of potential fraud, as has been committed and confessed to by the brokers of Verico the Mortgage Station and covered for by the boards of directors of Verico Financial Group Inc. and HomeEquity Bank.

The data relating to our short time away from this story is quite interesting, and in some ways surprising.

In the middle of November 2024, we diverted our focus and resources to defend the rights of the homeless citizens of Canada living in Barrie, many of whom are the victims of mortgage fraud. Except for a couple of minor articles posted here when we were able, this story was left to forge forth under its own steam.

Much to our surprise, it didn't flounder but flew.

The graph shown here is as close to an accurate correlation of the data as our AI art tools would generate. As is clear, in January our viewership was much smaller than now. However, our focus currently is on that last sector, starting with the short dip in the middle of the last quarter.

An interesting series of factors actually caused our readership to increase while we were away.

It seems obvious that despite unethical and likely illegal attempts to delist this story, against which the corporations will not defend, our audience has reached critical mass and will now grow on its own.

They Would Rather Burn It All Than Face Their Criminal and Ethical Abuses of Trust

Multi-million and multi-billion-dollar corporations are not used to being exposed for criminal and ethical abuses of trust, and especially not by a small, not-for-profit, social enterprise community media outlet that donates all services to local charities, not for profits, and benevolent community groups. It also must be hard to explain away how the producer and crew of which were honoured during the height of the pandemic by being nominated and voted to the highest levels for the City of Barrie 'Paying if Forward' award for altruism, that was presented by the Chamber of Commerce.

Clearly, as the flames grow, these mega-corporations are showing that they just don't know what to do.

The recently built customized offices of Verico the Mortgage Station, located at 1370 Killarney Beach Road, are now for sale, and have been on the market for many months during which time, they dropped the price by nearly half a million dollars. They have also converted offices, that were touted as being needed for a planned expansion, into apartments, apparently to generate cashflow due to a dramatic drop in sales. If that is not enough, they have lost several brokers and agents, who they have not replaced. That is not a good sign of continued longevity.

The directors of Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank all likely wish we had stayed away, but we are back and not going anywhere.

These facts are all indicators of the public response to our reporting and evidence, and how none of these much larger corporations have mustered the courage to challenge our claims, or even to discuss it on the phone.

As was noted in our story 'Left Holding The Bag - HomeEquity Bank' that Schedule 1 Canadian Chartered Bank, worth six billion dollars, is also losing millions of dollars a year now due to our exposure of their decision to protect, or at the very least ignore, the criminal acts of loan sharks who are selling their CHIP Reverse Mortgage. As is noted in our story 'Desperate Triad Resorts Again To Censorship' their only response has been to try to silence our exposure through unethical and legally questionable methods of censorship on both social media and the search engines.

Those actions are unethical and likely criminal, as the Charter of Rights and Freedoms protects our right to report the truth, and no honourable business will lose that kind of money without challenging the allegations.

"Using the updated number of twelve drive-by visits per week, and the same 50% ratio of lost opportunities, which is conservative, the HomeEquity Bank experiences a loss of opportunity, valued at $250,000.00 in potential income over a ten-year period, every time a visitor to this story chooses to buy into another option that is not a CHIP Reverse Mortgage. That adds up to $1,500,000.00 per week, or $78,000,000.00 per year. In the case of HomeEquity Bank, the lost sales, valued at $213,693.63 per day, are not restricted to those generated by Verico the Mortgage Station. People are frequently visiting our pages looking for information about HomeEquity Bank and the CHIP Reverse Mortgage, and they are coming from every province in Canada. That will only get worse when we launch our social media campaign focused on major population centres across the country. That will be launched soon, when the weather cools consistently, and more people are spending time on social media".

The obvious ongoing need to hide, rather than facing the allegations, is a clear indicator that HomeEquity Bank fears the evidence being presented in court where it would become public and determined to be factual.

Mainstream Media Checking All Angles As Provincial War On Homeless Heats Up

Premier Doug Ford's misguided and cruel war on the homeless of Ontario is catching a lot of attention from mainstream media. This is also true of Alex Nuttall, the disgraced former Conservative Member of Parliament and now Mayor of Barrie, who wrote the letter asking Ford to misuse the Notwithstanding Clause so he could bypass the rights of those suffering in the homeless community, who are protected as to 'life, liberty, and security of the person' under Section 7 of the Charter of Rights and Freedoms, and also bypass the January 27, 2023 ruling of Justice Michael J Valente, SUPERIOR COURT OF JUSTICE - COURT FILE NO.: CV-22-717. Download here.

We are on the front lines and catching a lot of interest.

In addition to the production of this documentary about mortgage fraud, as committed by the brokers of Verico the Mortgage Station, and covered for by Verico Financial Group Inc. and HomeEquity Bank, we are reporting regularly about the utterly unconscionable actions of the provincial government, and the minority of Ontario Mayors who have chosen to goosestep over the rights of the poor, rather than correct the crisis that they have collectively created through rent deregulations and the virtual elimination of mental health and addiction services.

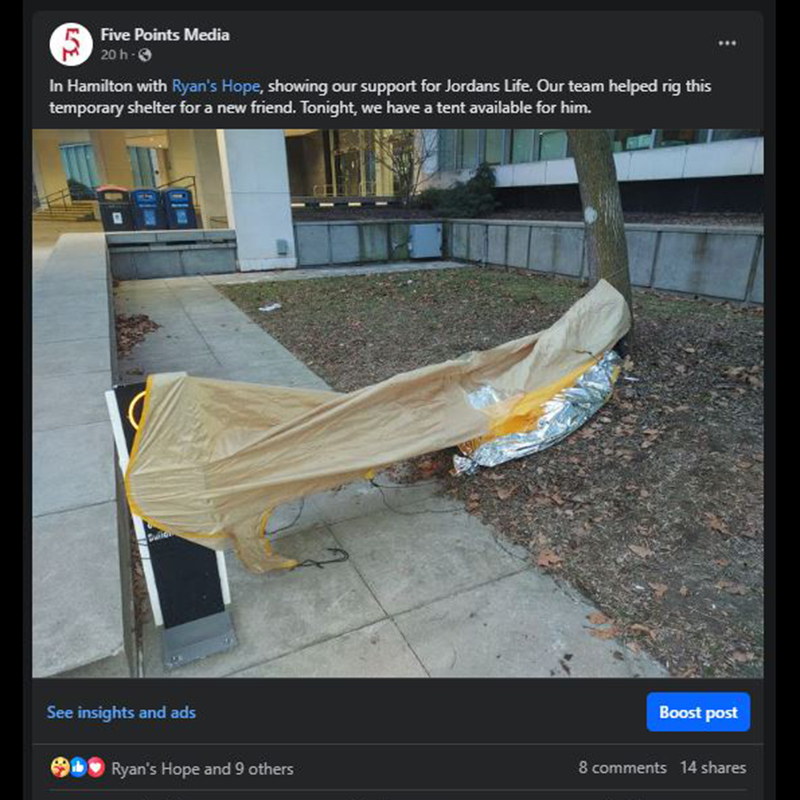

Sorry For Our Absence, But We Have Been Busy Saving Lives

We apologise for having been away for a few days, and we hope nobody got excited, because neither we nor the truth of this story are going anywhere. During the past couple of weeks, we have found ourselves overwhelmed with advocacy work, trying to house, and also to provide a warming centre for those struggling to live without shelter in Barrie where temperatures are plummeting. Many of these people are victims of fraud, like that undertaken by the brokers of Verico the Mortgage Station, who target senior and veteran clientele, that was then covered for by their profit motivated collaborators at Verico Financial Group Inc. and HomeEquity Bank. So, their stories tie in well with our current documentary. View details of our various efforts at https://www.facebook.com/FivePointsMedia

Full details will be included in the next article, which we are hoping to have online by tomorrow.

The brokers of Verico the Mortgage Station, seem quite comfortable with their decision to defraud their senior and veteran clientele through loan sharking. After all, despite the self-admitted harm done to their business by our uncontested claims of criminal and ethical breaches of trust, and also to their allies at Verico Financial Group Inc. and HomeEquity Bank who now both appear to have abandoned them, neither David Flude nor Renee Dadswell have shown enough ethics or character to return the money they have admitted they stole.

While fraudsters, like those at Verico the Mortgage Station, and their collaborators at Verico Financial Group Inc., HomeEquity Bank, and the Ontario Teachers' Pension Plan work together to take money from senior and veteran clientele, or conceal the crimes, our crew and other advocates donate our time and resources to help the victims, who are people just like you.

Advocacy For Homeless Drawing Attention To Mortgage Fraud Documentary

During the past two years, our team at Five Points Media has become extremely well known as the voice of the homeless or unsheltered community. Our reputation for defending their rights is not only local, but well known across the country, and this week we learned that two organizations representing labour, both locally and on a larger scale, have chosen us for a sizable financial donation to continue standing up for the weakest and most undefended sector of our population.

Sadly, the fastest growing demographic of the homeless community is seniors, and many of them signed up for a CHIP or other reverse mortgage.

Yesterday, our Producer volunteer as an advocate for a senior couple, Doug and Linda, who are living in a tent in a public park and want simply to have a home so Linda can receive treatment for various medical issues. After that, the fifty-nine-year-old physically assisted for six hours in moving an encampment that was being evicted from private property. We also provided a safe place where they could store their meagre possessions.

Our documentary is exposing how seniors and veterans are being swindled of their life savings by unscrupulous mortgage brokers and lenders.

Photo and names publish with consent - View original post

Social Media Shares On Steep Increase

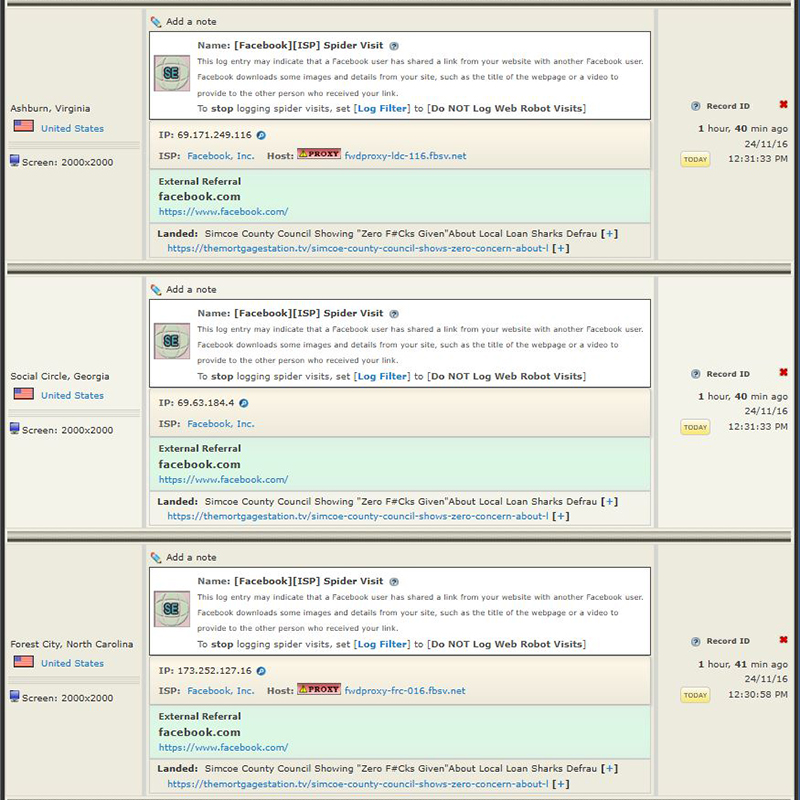

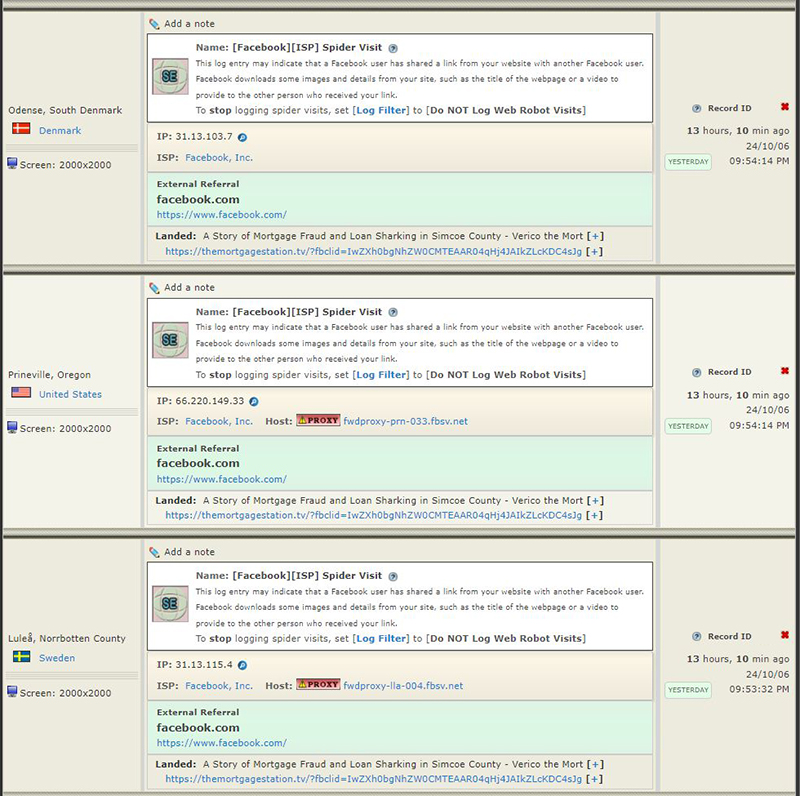

We are not sure what has sparked the sudden desire to share our content on social media, but over the weekend it became obvious that somebody seems to be making our case for us, and to a much bigger and more directly connected audience. If that is not the pattern we are seeing, then somebody researching our content is sharing it with others through Facebook messenger, which is not exactly the most secure method of communications, especially when dealing with sensitive or legal matters.

That kind of sloppiness is a sign of desperation, or that somebody is down to the slim pickings for legal counsel.

Either way, the visitor(s) are reviewing and sharing materials from all three of our websites, regardless of the fact that two of the three pages they shared have nothing to do with the indictable offence of usury that was committed by the brokers of Verico the Mortgage Station, or how Verico Financial Group Inc. and HomeEquity Bank committed the indictable offence of Fraudulent Concealment by knowingly and willfully helping the loan sharks to conceal the facts of their criminal and ethical breaches of trust.

On Saturday there were a few dozen visits, and on Sunday the flood gates opened to many more new visitors flowing in from Facebook to various pages.

The pages they were most interested in, at least initially, were about our Producer challenging and defeating the threats of abusive litigation by the lawyer for a slumlord who's negligence contributed to the death of a disabled man, which was on our Five Points media website, details about our studios, which were on our commercial video website, and finally, closer to home, our popular story "Simcoe County Council Showing 'Zero F#Cks Given' About Local Loan Sharks Defrauding Seniors", which we are told is being used as evidence in an unrelated civil claim against the county being heard in the Superior Court of Justice, but that is not confirmed."

Then, on Sunday, that visitor came back, and they brought a lot of friends, both local and from much further away.

A few visitors came from the area between Toronto and Barrie, but by far the largest group was from population centres across the country, from Halifax to Victoria BC. Some were on PCs, while others used Macs, Android phones, and various Apple iPhones and iPads. Some went just to those pages, while others perused further content, and some even wrote to us with questions. Our best guess is that somebody posted links to our pages on a Facebook page, and curiosity did the rest. We are still trying to determine what page it is, but we are guessing an investments advice page, or maybe a well-establish realtor. As most of the visitors who did go past the three linked articles visited pages about HomeEquity Bank and the CHIP Reverse Mortgage, it seems safe to say that the person who posted the links had written an overview of our story with a specific focus on the ethically questionable sellers of that specific reverse mortgage. What our studios have to do with it is anybody's guess, but perhaps they were trying to show that we are a legitimate media production company, that was able to out the County without repercussions, while we can stand up to lawyers, as demonstrated in the slumlord case.

That is speculation, but sometimes that is what we are left with when the directors of multi-million and multi-billion-dollar corporations are afraid to even discuss the matter with our small, not-for-profit, social enterprise community media service, and they all choose instead to hide for more than two years.

The Loan Sharks Targeting Veterans Were Protected By HomeEquity Bank

Each year, on November 11, our society gathers to demonstrate our collective gratitude to the veterans of our armed forces who laid down their lives, who were wounded, often with lifelong ramifications, who suffered from traumatic mental health issues like PTSD, and who lost their youth to the defence of their country.

The leaders of Verico Financial Group Inc. and HomeEquity Bank enjoy the freedoms and benefits that were paid for with the blood of veterans but would do nothing to help when one was defrauded.

Few people would ever think of sinking so low as to take advantage of these brave men and women. However, that is exactly what happened when the brokers of Verico the Mortgage Station, knowingly defrauded their senior and veteran clientele. Then, in a surprising display of disdain for decency, their actions were supported actively by Verico Financial Group Inc. and HomeEquity Bank, who refused to investigate the fully supported allegations of usury, or loan sharking.

Water drops erode mountains not because of their size, but their persistence

Water is the most powerful force on earth, as it not only cuts lines through rock, but also tears down mountains. The effect of erosion is bonded to the incalculable power of persistence. Likewise, the inaccurately named "Chinese water torture" is one of the most effective means of coercion, as random drips of cold water fall over time onto the scalp, forehead, and face of the subject, creating a mentally painful process that generates anxiety, fear, and mental deterioration.

The same can be said about exposure of the truth.

Water also collects from microscopic sources to create the largest surface on the Earth. Dew develops on a leaf, forming a single dribble, that trickles onto the ground, collecting with others into a puddle or stream, which makes its way to a river, and finally to a lake or the sea. Similarly, the decision by the directors of Verico the Mortgage Station, to ignore their own criminal and ethical abuses of trust, has caused with time for the exposure and self-inflicted damage to grow, not only for them, but also for their now apparently former allies at Verico Financial Group Inc. and HomeEquity Bank. It is our persistence in reporting the truth of these criminal acts of Usury and Fraudulent Concealment that has washed away all credibility for these multi-million and multi-billion-dollar corporations.

Cross-referencing allows one story to blend with others to present a bigger interconnecting tapestry of facts and evidence, the content of which has never been contested or challenged by any identifiable representative of any of the accused individuals or corporations.

People understand that multi-million and multi-billion-dollar corporations that have done no wrong would not accept being 'libelled', so we all understand who is telling the truth and who is afraid to challenge the evidence.

Why Are They Not Suing You? - HomeEquity Bank

We received a message on the weekend from a visitor who had a few questions, the most pressing of which, to them, is why are these multi-million and multi-billion-dollar financial corporations not suing into silence our small, not-for-profit, social enterprise community media service that donates all services to any charity, not-for-profit, or benevolent community groups that asks.

The reasons are not hard to understand.

- We are telling the truth, and contrary to dramatic storylines in the movies and TV, the courts are based on evidence, which we have in abundance.

- Recently, the Supreme Court of Canada issued new law to dissuade Strategic Litigation Against Public Participation (SLAPP), which is abusive civil action filed by a wealthy person or corporation to silence the truth about themselves. Such a dismissal would be costly and humiliating.

- We are a benevolent community organization that has donated hundreds of thousands of dollars in services to our community's charities and other not-for-profit groups. In sharp contrast, Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank have defrauded senior and veteran clientele, or they have helped to cover up the indictable offence of usury. The exposure of using civil action to conceal would be self-damaging.

A Lot Of Interest In An Older Article

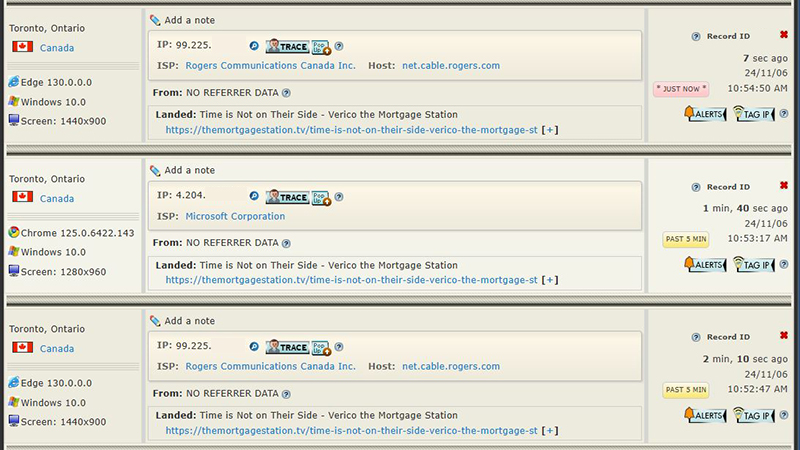

The most recent 'researchers' scouring our website have shown a lot of renewed interest in an article posted on May 31, 2024, entitled "Time is Not on Their Side - Verico the Mortgage Station". This screengrab shows two of the most recent touch downs, as the top and bottom are the same computer, but there have been many more flybys to it during the past week.

It seems lawyers might be trying to show that there is no abusive path to shutting down our reporting.

In that article, we show how it is the brokers of Verico the Mortgage Station who committed the indictable offence of usury, which is punishable by a prison term of up to five years, and it is the management team of Verico Financial Group Inc. and the board of directors of HomeEquity Bank who committed the indictable offence of Fraudulent Concealment by helping them to cover it up. All we have done is report the truth about their collaborative criminal and ethical abuses of trust, which is why none of these multi-million or multi-billion-dollar corporates have been able to file fraudulent claims against us, under the pretense of either criminal or civil, because it is not illegal to tell the truth about a crime that has been committed, especially if you are the victim, or to let the public know about a possible risk.

Given the depths and reach of our exposure of the South Simcoe Police Service and the Simcoe County Council, which nobody expected, it seems likely any such requests for further abuses would be replied to with a click.

The brokers of Verico the Mortgage Station, and their allies at Verico Financial Group Inc. and HomeEquity Bank have never shown the slightest concern about the senior and veteran client they defrauded and ignored, or the not-for-profit community service that had contributed hundreds of thousands of services to charities, that they defunded through a con-game used to compel their victim to accept illegal rates of lending. That instantly changed after we showed them how exposure of their criminal and ethical abuses of trust has cost Verico the Mortgage Station essentially everything, including their reputation and their offices, and is costing HomeEquity Bank millions of dollars in lost opportunities. In our fully researched article "Left Holding The Bag - HomeEquity Bank", posted on October 07, 2024, more than four months after we published "Time is Not on Their Side - Verico the Mortgage Station", we showed in detail how HomeEquity Bank is now losing upwards of $78 million dollars a year due to their decision to protect the loan sharks and then hide to evade responsibility. Specifically, we noted: