Loan Sharks Trapped In A Box Of Their Own Creation - Verico The Mortgage Station

The Loan Sharks of Lefroy - Verico the Mortgage Station

As we have previously noted, on December 27, 2023, an anonymous agent claiming to represent the brokers at Verico the Mortgage Station sent to our producer an unsigned "Notice" professing "Libel and Defamation". Not only was this notice unsigned, but the writer also sent it through the generic email address info@themortgagestation.ca that is not assigned to any of the brokers at Verico the Mortgage Station.

Now, due to their own inaction and cowardice, the brokers at Verico the Mortgage Station are trapped in a box of their own creation, and they apparently see no true path to escape.

The writer of the 'legal' document was quite obviously not a lawyer, nor anybody with even the smallest amount of understanding of the process of civil litigation. We include the full amateur attempt at intimidation here for all to see, as well as our producer's reply to the anonymous Notice of Libel and Defamation. Our producer has considerable experience as a self-represented litigant at various levels of jurisdiction, including the Superior Court of Justice and the Court of Appeal for Ontario. Within those forums, he has successfully defeated several threats of similar vexatious and abusive litigation as it is not uncommon for investigative journalists to face abuses of the court instigated by people who wish to hide their own bad behaviour. He also runs a community focused not-for-profit community media service, that exists to help the less fortunate, and of course there is all that pesky evidence of loan sharking and cover up as committed by the brokers at Verico the Mortgage Station.

So, we are not too worried about using what we have against whatever they want to make up for the benefit of a Justice of the Superior Court.

Why would a company like Verico the Mortgage Station, which boasts sales of five to six million dollars a year, even consider coming out of hiding after 18 months of chronic denial only to write their own lame legal threats? Was this just a pathetic penny-pinching attempt to dissuade us from reporting on the crimes committed by the brokers at Verico the Mortgage Station, or are they having trouble finding a lawyer who will so brazenly file Strategic Litigation Against Public Participation (SLAPP) litigation for the sole purpose of trying to stop us from reporting on the crimes committed by the brokers at Verico the Mortgage Station?

Suing somebody in an attempt to dissuade them from reporting crimes you committed is a form of obstruction of justice, and it is very much a criminal offence.

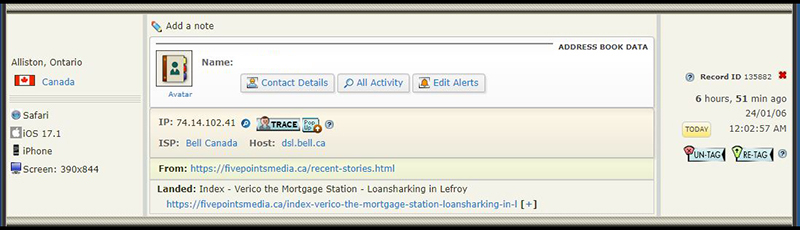

According to that cowardly covert attempt at intimidation, "You have until January 5, 2024, to remove the defamatory material from all your website and cease any further defamatory statements. "Well, David Flude, Lisa Purchase, and Renee Dadswell, we didn't lose any sleep over this flaccid low-budget attempt at intimidation. However, evidently one of you did as at 12:02, two minutes after your deadline, you were scouring our websites at fivepointsmedia.ca and themortgagestation.tv to see if we had kowtowed to your demands.

You all can be assured that neither we, nor our story and evidence are going anywhere.

We maintain that we have never needed to post any false statements, and we have not done so. We have supported all of our allegations with hard evidence, and according to the comments made about our reports and our social media posts, 97% of people agree that we have presented the facts using cross-referencing and evidence to substantiate our claims. That most likely explains why the brokers at Verico the Mortgage Station have all hidden from us for more than 18 months, and also why they have refused to disprove our allegations through the use of evidence during a video recorded interview or even via a without-prejudiced meeting.

This entire story has been written by David Flude, metaphorically speaking, as all we have ever done is relay the facts and present the evidence of his actions and those of his brokers.

He could have stopped this exposure in a plethora of ways during the past year and a half, but he has chosen to follow along a path of self-destruction. Sadly, he has also dragged along several other businesses and individuals whose only crime was listening to and believing the man who lied six times in two emails in order to evade government oversight and conceal the crimes committed by his brokers.

Every decision has been made by David Flude, including his 'threat' to sue our producer solely because he would not stay quiet after being defrauded, and he felt a desire to make sure the public knew the risks presented to seniors by loan sharks who so casually defraud their potentially vulnerable clients.

Oh, my God . . . it's 12:02. Hit the screen refresh key.

I want to enjoy this victory!!

OK. OK. It's four minutes after. He must have taken down the new website first.

I need to go there for my victory lap.

More than eighteen months ago, on May 29, 2022, David Flude was advised in detail about how his broker, Renee Dadswell, had, with the assistance of Lisa Purchase, defrauded a client of Verico the Mortgage Station by usury, or loan sharking by charging 198.25% in interest and fees on a personal loan that their client had been manipulated into being forced to accept. The legal limit is 60%, for extreme cases, and as they are all mortgage brokers, all three 'professionals' would know that. At that moment, David Flude had the ability to apologize, to return ALL the stolen money, and to make amends for the CRIME. Instead, David Flude wrote:

"This short term loan provided to assist you in making your previous mortgage payment obligation, in my opinion was a generous and helpful deal."

David Flude also had a legal and ethical obligation to meet with his client and forward a report of the CRIME to the Financial Services Regulatory Authority of Ontario (FSRA). In responding correspondence, David Flude noted: "As a reminder, this is a regulatory requirement so it won't be pushed aside,"and "You have not been kicked to the curb. We have to address this and report to our regulator so no chance of it being ignored."

Regardless, David Flude simply refused to schedule the meeting and the report of the CRIME was never filed.

As almost a month ticked by, our producer posted an article bearing his name about our producer's experience. The hope was that a bit of public exposure would spur David Flude to abide by his "regulatory requirements"and his promise that our producer had "not been kicked to the curb". Instead, David Flude simply ignored all emails and refused to even discuss the issue. Then he and his brokers went into hiding for more than a year, while somehow convincing the management teams of Verico Financial Group Inc. and HomeEquity Bank to support them despite both corporations having received fully unredacted copies of the documents that proved the crime of usury, or loan sharking, had been committed by the brokers at Verico the Mortgage Station. Depending on the circumstances, such action could be considered a criminal collusion.

A year had passed by the time our producer prodded the South Simcoe Police Service to investigate the CRIME of usury that had been committed by the brokers at Verico the Mortgage Station.

Chief John Van Dyke and Inspector Julio Fernandes were, to say the least, less than interested in investigating the wealthy brokers, and Inspector Fernandes was downright rude in his response to the allegations. It is funny how rich people can motivate small town authorities to do their bidding. Then our producer informed the mayor and council of Innisfil of the truth, and suddenly the South Simcoe Police Service was going to investigate again. The first investigator refused to even call our producer, the complainant, and relied completely on the word of the brokers at Verico the Mortgage Station. The second detective met with our producer but claimed "insufficient evidence"after omitting key documents like a non-redacted bank statement and the "Funds Disbursement Record"produced by the brokerage. He also knowingly and smugly fudged the figures with wrong formulas just so he could make the numbers look 'right'. That act of omission and likely obstruction of justice is now under review by the Office of the Independent Police Review Director, and will likely be investigated by the professional and less easily 'motivated' officers of the Ontario Provincial Police Financial Crimes Division.

Now, due to his demonstrated inability to stand up and take responsibility, David Flude and his brokers are the laughing stock of the brokerage industry, and our work is being used to boost competitors.

Are we supposed to believe now that the brokers at Verico the Mortgage Station have found a lawyer who will represent the business in such an obvious plan to hide their own crimes through a Strategic Litigation Against Public Participation (SLAPP) lawsuit? We doubt it because lawyers don't like to lose to a legal nobody in a very public way, and especially when the action is both ethically and morally reprehensible.

Lawyers literally live by their reputation, as victories mean more clients and higher hourly rates, while loses caused by a client 'forgetting' a detail ensures financial losses and damage to their reputation.

Our producer went through that scenario a few years ago, which resulted in the company paying out $400,000.00 in legal fees after hiring nine lawyers from three Bay Steet law firms to fight and lose one action after another in three different courts because the evidence did not support the claims that they never believed they would have to substantiate. They also lost half a million dollars in income due to the exposure of their abuses. Finally, their 'expert' lawyer was suddenly terminated from his lofty position at McCague Peacock Borlack McInnis and Lloyd Llp when it became obvious his ethics were questionable and his constant losses to a layman painted the law firm as incompetent.

That lawyer was forced to open his own practice as he was essentially blacklisted and could not find a position at any other established law firm.

That experience is why a past investigative report by us about legal threats from a lawyer representing a slumlord has been read more during the past two months than the Butterball Cookbook on Christmas Day. Literally, dozens of professional IP addresses from towns and cities across Ontario have accessed that article and then simply disappeared once they realized who and what they are dealing with. Are we also supposed to accept that the brokers at Verico the Mortgage Station, who were so cheap they wrote their own threat of legal action, are putting up a retainer of likely $20,000.00 to $50,000.00 to whatever lawyer might be desperate or new enough to endure or not understand the inevitable humiliation?

Lawyers don't do a thing without a retainer, and it is a tap that flows fast and free.

Usury, or loan sharking, is an indictable offence, and Renee Dadswell is a professional broker who deals with interests rates every day. The CRIME carries a prison sentence of up to five years, or at least it does when it is investigated by police officers who are not 'motivated' to help the wealthy brokers. David Flude admitted in a letter from his personal email account that he knew about Renee Dadswell's criminal abuse of trust, meaning at the very least, he can be charged as an accessory or accomplice after the fact. That offence also brings with it a term in prison, as does 'motivating' a police officer.

We have made our allegations about the South Simcoe Police Service very publicly through two videos and articles, and no representative of that department has contacted us to dispute our allegations.

What has the 18-month long stalemate accomplished but to allow more people to find the truth and see the evidence? In the anonymous Notice, the clandestine writer complained about the number of articles written, which have caused our audience to grow to ten times what it was two months ago. How many will know the truth in six months or a year as viewership continues to grow with details of the now committed legal action and the help of our anonymous promoter who clearly has a personal agenda to push this story out into the public?

What will be the public reaction if the writer of the Notice does not go forward with their threats?

Are we to believe that now, suddenly, the brokers at Verico the Mortgage Station have deluded themselves sufficiently that they truly believed that we were going to be uncharacteristically frightened by their anonymous bundle of vacuous threats and demands? We invite our readers to read the Notice, and especially from the bottom of page four through to page six.

The mystery writer singles out actions that annoyed them, like:

- reaching out to the lenders, who most would agree, have a right to know the truth. We will be doing so again this week.

- crosslinking to other stories and the evidence as a means of backing up our claims and allegations.

- questioning the ethics of the brokers at Verico the Mortgage Station and the directors of the HomeEquity Bank, even after all three of the brokers have admitted to the crimes of which we accuse them.

- presenting the fact that any attempt to conceal the truth of these crimes through vexatious litigation would qualify as a Strategic Litigation Against Public Participation (SLAPP) lawsuit.

- warning the public about loan sharking, manipulation, and lies that are confirmed by their own emails.

- that the brokers at Verico the Mortgage Station could have stopped this story before it started by simply complying with the 'regulatory requirements"of the Financial Services Regulatory Authority of Ontario (FSRA) instead of evading the legally obligatory meeting that would have exposed the crime of usury.

- seeking some kind of appreciation for loan sharking a senior and veteran by charging illegal levels of interest on a personal loan, rather than acknowledging the action as being an indictable offence that is punishable by a prison term of up to five years.

- we have been open and honest, and have shown that we have nothing to hide, and we prove that fact with every report and video we post.

The rant reads like a rat caught in a box from which they cannot escape.

The threats did not work, which will surprise nobody. Now the owners and brokers at Verico the Mortgage Station, and possibly their allies at Verico Financial Group Inc. and HomeEquity Bank, will have to pony up and support their fraudulent defences, knowing that the evidence will cause them to lose the case and be humiliated as was the lawyer in the Mustang case, and also the owners and directors of the company who lost everything they had worked eight years to build.

Meanwhile, we have made it clear that we are EAGER to have the evidence reviewed by a Justice of the Superior Court, whose judgement cannot bo easily swayed as was the case with the South Simcoe Police Service.

Despite the 'threat' of the obviously inexperienced invisible man who 'just knows' he will attain injunctive relief to stop our expose documentary, that simply is not going to happen. The Justice will see ALL of the evidence, including that which supports fully that the brokers at Verico the Mortgage Station committed multiple offences, some indictable, and he or she will not stop the reports and videos that are being produced in the best interests of the community and seen by an ever-increasing number of clients for for not only Verico the Mortgage Station, but also Verico Financial Group Inc., and HomeEquity Bank.Those who do business with these companies absolutely have the right to know the truth about the crimes that were committed and how they tried to cover it up.

No Justice of the Superior Court is going to review documented evidence of several crimes having been committed by the brokers at Verico the Mortgage Station and decide that it is in the best interest of society to stop people from learning that there are loan sharks in Innisfil preying on potentially vulnerable seniors. Then, add to that scenario, Five Points Media is a nine-year-old provincially registered media company, with a strong history of helping our community, and any attempt to silence our reporting will only accomplish drawing the attention of major news outlets that would then take interest in the story for their own best interests.

Now, according to the whining of the anonymous writer, the brokers at Verico the Mortgage Station still appear unaware that the box that is now closing in around them is absolutely of their own creation.

We will not remove any of our content based on vacuous threats, but we remain open to a peaceful and hopefully productive without prejudice meeting at which time the brokers at Verico the Mortgage Station could provide their evidence to counter our claims. They will eventually have to do the exact same thing in a court of law, but they wont be paying $500.00 an hour for the privilege, while also facing likely criminal prosecution, and a sizable order of costs by the court against them for filing a Strategic Litigation Against Public Participation (SLAPP) lawsuit. If they lack the courage or maturity to accept our offer, what are they going to do when called upon to face the evidence at their own legal proceeding while sworn to tell the truth under threat of a charge of perjury? We reluctantly accept the inevitability of the final closing of the box that will happen when the brokers at Verico the Mortgage Station, and their allies at Verico Financial Group Inc. and HomeEquity Bank, challenge reality when all that matters is the tangible evidence presented in the Superior Court of Justice.

What will that level of humiliation do to the reputations of these currently still respected corporations, and how will their competitors use that exposure to their favour?

It also seems likely that some or several of the banks and lenders we reached out to seeking information about their relationship with the brokers at Verico the Mortgage Station are less than impressed with being linked to such well-supported allegations of usury, and to the evidence that originated from the brokers which substantiates their various attempts to conceal or cover up the crime. This week, we will be reaching out to each of the financiers again, seeking feedback regarding what they believe should be included as part of the page we are creating for each lender. We will also be sending to each of them full and un-redacted copies of our principal evidence, that being the bank statement showing the deposit of the loan of $2,000 and the "Funds Disbursement Record"produced by the brokerage that shows the interest of $499.75, charged at a rate of 198.5%, that was skimmed from the mortgage after just 46 days.

We have started researching some of the lenders as their ethics and morals reflect on why they would continue to do business with loan sharks who have defrauded their senior and veteran clientele.

We know now that the ripple effect of our reporting is spreading out to have an effect on other brokers who operate under the Verico banner as they and their clients can see the facts of our reporting and the cowardice of the brokers at Verico the Mortgage Station who have resorted to risking the reputation of all Verico franchises by simply refusing to take responsibility for their actions instead of playing hide and seek and sending weak and laughable 'threats' to our not-for-profit, benevolent community channel from the darkness of anonymity.

As the brokers at Verico the Mortgage Station have chosen to make it necessary, we will hold them to their threats, and we have a plethora of question for each of them.

We also look forward to summonsing the testimony of W. Mark Squire, President and Chief Operating Officer, Verico Financial Group, Yvonne Ziomecki - Fisher, Executive Vice President, Marketing and Sales at HomeEquity Bank, and Steven Ranson, President and CEO of HomeEquity Bank. That testimony, undertaking during discovery or in an open court of law, will be done under oath, and we will be asking amongst other things why they each declined to take any action to defend the best interests of their senior and veteran clientele by investigating our producer's claims of usury that were fully supported by non-redacted copies of the evidence.

The lid on that box is getting heavier every day as these trust-dependent brokers and bankers struggle to accept that more time means greater exposure, and that one day they must face their wrongdoing, in a public forum, and stalling is just ensuring that more people learn the truth.