Con Artists And Cowards Walk Hand-In-Hand, Verico the Mortgage Station and HomeEquity Bank

Most people know that con artists and cowards walk hand-in-hand. Look no further than George Santos, who quite rapidly went from being a shining new star of the freshly minted GOP majority to that of an expelled formerly "honourable"member of the United States Congress.

Santos' career in politics ended when two-thirds of his elite membership voted to expel him back to working at Starbucks, but his road to damnation started due to investigative journalists who continued to expose his deceptions and crimes against the American people.

It took a few months, but in the end, growing media exposure proved much more powerful than the con artist ever thought was possible. Now, due to the investigative efforts of professional journalists, Santos also faces 23 federal charges for various indictable offences including defrauding his constituents and stealing from the office he swore to serve.

According to most political pundits, if not for investigative journalists, Santos would have likely never have been discovered.

It is now a common saying that Trump's GOP is not your dad's Republican party. The same can be said of media today. No longer are people forced to accept the events of our world being passed through a filter by a very small group of mega-rich corporations that screen their content based on profit or political ideology.

The removal of chains from media started twenty-five years ago, and in earnest on January 17, 1998, just a couple of years after the Internet was deregulated and made available to everybody. That was when the 'Drudge Report' broke the news that Newsweek's investigative reporter Michael Isikoff was exposing the affair between President Bill Clinton and his young intern Monica Lewinsky.

What was not commonly known was that the report that became one of the biggest stories of the twentieth century was first released on a private independent media blog site that was owned by a friend of Linda Tripp, who had recorded conversations with Monica Lewinsky about the affair. It was the first time in history that a major breaking story was found and expanded upon by a media conglomerate based on the reporting of a much smaller independent source.

It would be far from the last.

When they were caught and exposed by investigative journalists, both former President Bill Clinton and expelled Congressman George Santos thought they could convince voters of their innocence through denial and evasion. However, as we all know, in both cases that strategy backfired. Hide and seek is a game for children to play, not politicians and those assigned to positions of trust.

All the electorate saw was that both men they had voted into a position of trust lacked the courage or strength of character that was needed to apologize, fix their mistakes, or resign. Both chose to lie and hide, whenever that was possible, in the hopes the exposure would just fade away. Instead, in both cases, the deception fuelled investigative journalists to dig deeper for evidence of the truth.

Despite being the President of the United States and holding the most powerful office in the free world, the results of the efforts of the investigative journalists put Bill Clinton before a hostile Senate for a gruelling and embarrassing 21-day long impeachment hearing. It also resulted in a ruling of civil contempt of court which brought a fine of $90,000.00. His license to practice law was also suspended in Arkansas for five years, and shortly thereafter, he was disbarred from presenting cases in front of the U.S. Supreme Court.

That is the power of investigative journalists, who David Flude, the Principal Broker at Verico the Mortgage Station, called "agitators"when asked about loan sharking seniors and lying to evade government regulations.

In this story, the supposed 'agitator' is a thirty-year veteran of international media and documentary production, the former Deputy Editor of a national European newspaper owned by the Washington Times, and a videographer who covered the wars in Bosnia and the Middle East for the British television equivalent of CNN.

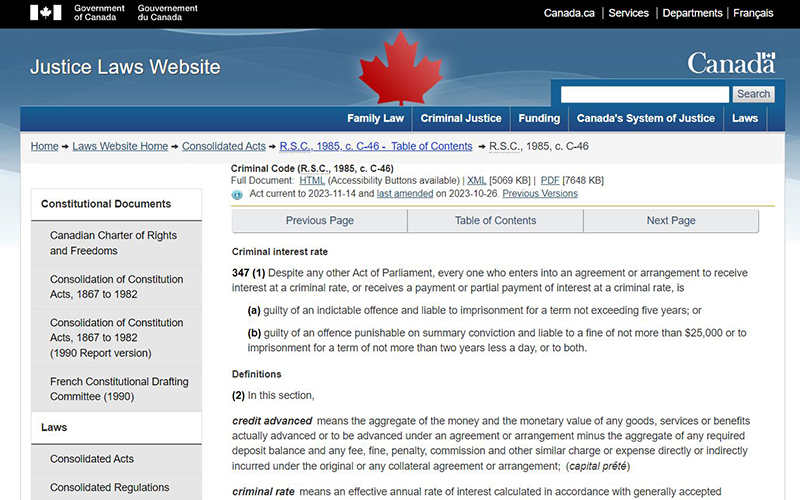

If either of these stories sounds familiar, it is likely because you read something similar here in our ongoing reports about how the brokers at Verico the Mortgage Station committed the indictable offence of usury, also known as loansharking, against a senior and veteran. Then, they lied, hid, violated "regulatory requirements" and even 'motivated' local police to omit evidence in a plot to escape accountability for their crimes, which under the Criminal Code of Canada carry a punishment of up to five years in prison.

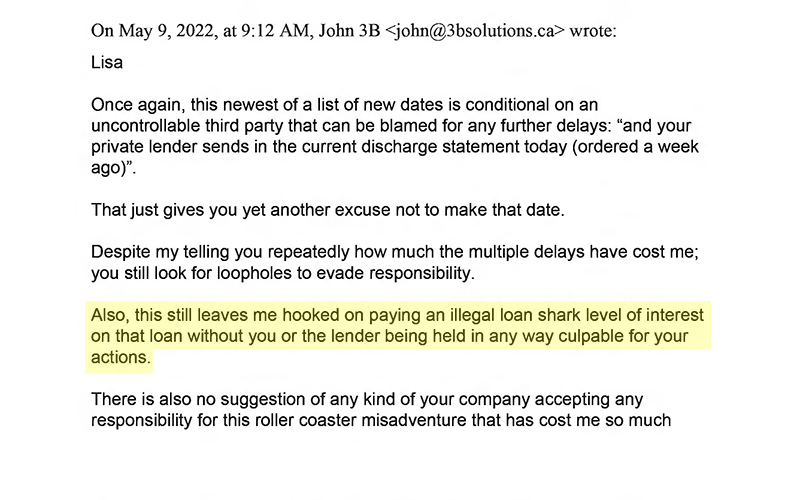

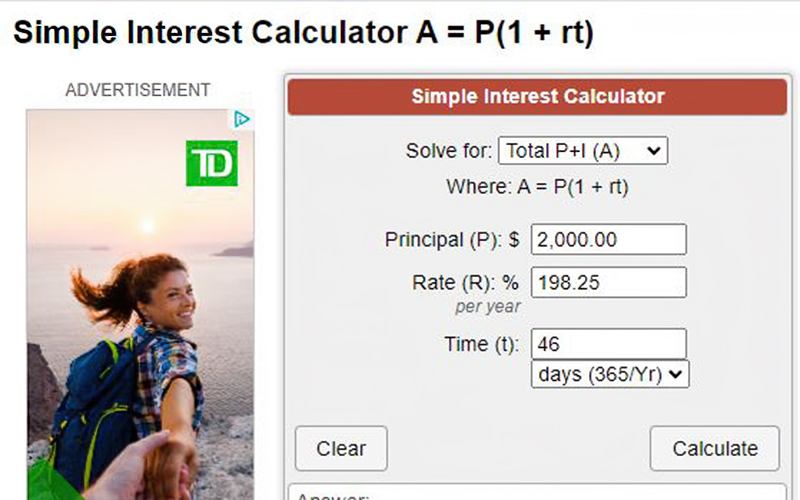

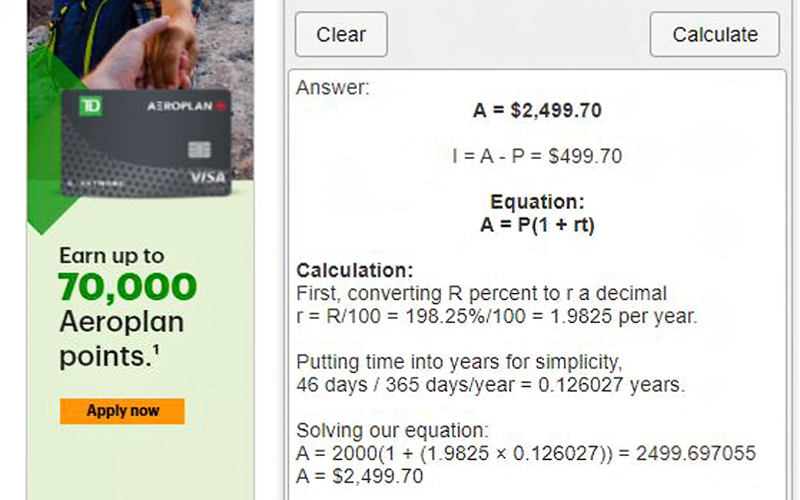

As is substantiated by empirical evidence, the provincially licensed and entrusted brokers at Verico the Mortgage Station skimmed the mortgage of their client, our producer, a senior and veteran, of a total of $499.75 in illegal fees and interest on a loan of $2,000.00 that was outstanding for a total of just 46-48 days, depending on if you include the day of the loan and the day it was paid back.

Those figures represent an illegal cost of lending of 198.25% when the legal maximum is 60%.

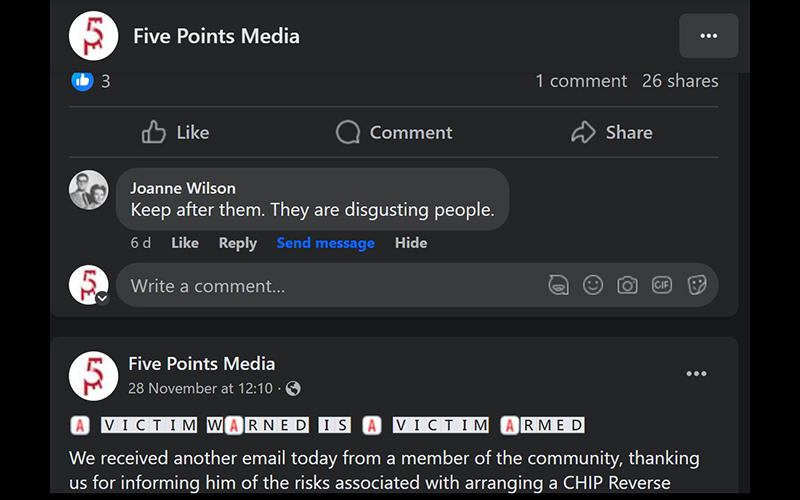

This documentary and our efforts are not about a $500.00 grift. This story is much bigger as the brokers at Verico the Mortgage Station promote themselves heavily as sellers of the CHIP Reverse Mortgage that is marketed to often vulnerable seniors by the HomeEquity Bank.

When informed of the fraud, the HomeEquity Bank did nothing to protect the financial security of their often-vulnerable clients. They have also now maintained for more than six months a policy of 'ignore and denial', and they showed a strong desire to protect the loan sharks through which they generated profits at the expense of and with indifference to the potential threat to the financial security of their clients.

Our reports and videos have been published here for more than 530 days, but our allegations and evidence remain 100% uncontested by either the brokers of Verico the Mortgage Station or HomeEquity Bank.

How many people, mostly seniors and veterans, are being cheated every day by these loan shark brokers who will not hold themselves accountable, and who seem to have operated for several years free of scrutiny by the bank for which they act as agents and the government oversight at the Financial Services Regulatory Authority of Ontario that is supposed to be monitoring and scrutinizing their business practices? David Flude advised a woman who had reached out to him regarding a mortgage that he had informed the FSRA agent of our reporting, yet nobody from that office has made any attempt to reach out to us seeking our evidence or trying to broker a resolution.

It is almost like everybody, from the detectives and brass at the South Simcoe Police Service, to the members of the County Council, to the FSRA are all dining at the same large trough of 'motivation'.

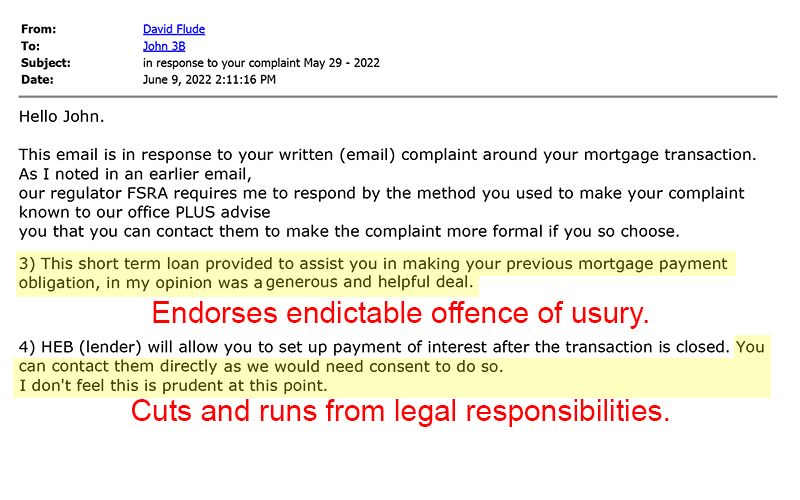

When confronted by the facts and the evidence, David Flude, the Principal Broker at Verico the Mortgage Station, violated the "regulatory requirements"of the FSRA by refusing to meet with the person his brokers had cheated. Flude was both ethically and legally obligated to address the crime(s) committed by his brokers, but he didn't want to, so he simply chose to ignore what he admitted were his obligations as a licensed broker in Ontario.

Then he cut off all communications with the senior and veteran they had defrauded and hid for the past 18 months. As was the plan of Clinton and Santos, Flude appears to have believed that time would obscure the truth of the crimes, unethical behaviour, abuse of trust and other issues raised by his actions and those of his brokers. However, all their cowardice has accomplished is to secure the guilt of the brokers in the minds of those who find our reports, including many of their potential clients.

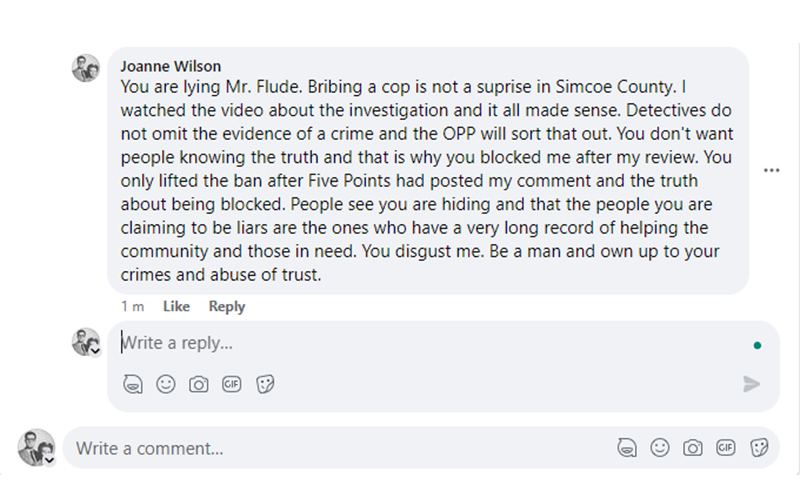

When our producer filed a report with the local "law enforcement", David Flude or one of the brokers at Verico the Mortgage Station managed to 'motivate' the detective or somebody higher up in the chain of command at South Simcoe Police Service to look the other way. At first, the Criminal Investigations Division of the South Simcoe Police Service chose to simply ignore the allegations by dropping the evidence in a box or on a shelf and ignoring it for a full year. Then when pushed to act through a letter to the Innisfil Town Council, they pretended to investigate but spoke only with the accused, ignoring the complainant completely. That completely one-sided farce of an 'investigation' was intended to allow the South Simcoe Police Service to brush the charges under a rug. Finally, when forced by public exposure to act, a supposedly specially trained financial detective, who did not know the difference between interest and percentage, simply omitted the evidence of the crime, and then claimed there was insufficient evidence to charge the brokers at Verico the Mortgage Station for usury.

Consider the response of the Crown Attorney if bags of heroin were to just magically disappear during a drug bust, and the detective decided to drop the charges based on a convenient lack of evidence.

There is in truth no difference between these two scenarios, and anybody who has been wrongfully arrested or who has gone through the process with a child or other family member should be outraged at how the wealthy brokers at Verico the Mortgage Station were able to so brazenly 'motivate' such a transparent abuse of the law. If undertaken by anybody but the police, that 'motivation' to abuse the law for people of influence would be an act of omission and obstruction of justice. It also violates the Police Services Act which governs all police forces in Ontario.

Just three days ago, December 1, 2023, the Barrie Police Service announced on social media that "A Senior Officer of the Barrie Police Service is facing a charge of Discreditable Conduct, contrary to Section 2(1)(a)(xi) of the Code of Conduct within the Police Services Act, R.S.O. 1990, after a recent investigation that was conducted by the Ontario Provincial Police (OPP) Office of Professionalism, Respect, Inclusion & Leadership."

So, police in Ontario are not above the law, and our exposure and evidence, now seen by several hundred thousand people, will help to ensure a fair and honest investigation into this matter.

To understand the level of influence we are investigating as journalists, consider the financially motivated co-dependent relationship that the brokers at Verico the Mortgage Station have developed with the HomeEquity Bank, providers of the CHIP Reverse Mortgage. That financial institution brings with it about 5.8 billion dollars' worth of potential influence, which could be used to 'motivate' assistance from small-town police officers. In aligning themselves with David Flude and the brokers at Verico the Mortgage Station, the board of directors of HomeEquity Bank chose to abandon their often-vulnerable senior clients, leaving them to fend for themselves despite having been provided with unredacted copies of our evidence of loan sharking by the brokers of Verico the Mortgage Station.

When considering the validity of that evidence, remember that our producer is the former Deputy Editor of a national European newspaper owned by the Washington Times, and he has worked as a technical specialist and evidence handler for private investigations.

Based on these facts, it is not a great a leap of faith to see how detectives or higher ranks of the South Simcoe Police Service could be 'motivated' by the multi-million or multi-billion-dollar corporations to first ignore the allegations, then to conduct a completely one sided whitewash, and then to omit all evidence of the crimes rather than investigate the allegations based on the facts rather than their self-interests?

During the past week, we have been compiling a report to be submitted to the Ontario Provincial Police (OPP) Office of Professionalism, Respect, Inclusion & Leadership, the Office of the Independent Police Review Director, the Financial Services Regulatory Authority of Ontario (FSRA), the Office of the Solicitor General, the Ministry Of Community Safety & Correctional Services, and the Canada Revenue Service. Our demand is that each office conduct a full and thorough investigation of the financial misconduct of the brokers at Verico the Mortgage Station and also the detectives and senior ranks of the South Simcoe Police Service, dependent upon their area of jurisdiction.

A copy of that report will be made available to the public so that everybody can see the facts of this case.

The detectives of the South Simcoe Police Service needed to omit the evidence of the crimes from their supposed investigation to claim insufficient evidence for charges, and they had to fake the math to make it look like they had reason to dismiss the allegations. To accomplish that, they used a calculation for percentage rather than interest, which is the basis of a charge for usury, and they completely ignored the limited timespan of the allegations, which is again part of the charge for loan sharking. Further, they stretched the timeframe of the crime from 46 days to a full year, just so they could amortize the amount of interest and fees charged over a much longer time.

We researched those choices, and not a single accountant or mortgage expert we spoke with could understand why the math used was so obviously flawed, and they called the erroneous calculations both suspicious and grossly misleading. Detective Constable Jason Muto was advised in writing after the interview of his errors, and he was provided with multiple links to the true formulas and calculations he should have used. However, the detective who had omitted the evidence of the crimes did not even reply, and simply pushed through his erroneous methods as if he was 'motivated' to do so. Now, we will see if any of the larger and less easily influenced investigative and enforcement agencies will take appropriate action.

Those deceptive actions by the detectives of the South Simcoe Police Service were no accident.

Throughout our reports, we have noted how we have offered several times to interview David Flude, Lisa Purchase, and Renee Dadswell, as we wish to ensure our reporting is accurate. Regardless of this opportunity, all three provincially licensed brokers have repeatedly declined to even reply. We have even offered to cancel this documentary and remove all posts on social media about our findings if they can show us, on camera, using empirical evidence, that we have in any instance reported inaccurately during the more than 530 days that we have been reporting about the crimes they committed. Of course, they have ignored that offer also. Finally, earlier this week, we offered to meet with them or with their legal counsel on a without prejudice basis to discuss the facts and evidence to ensure that we are consistently and fully telling the truth. Again, we have received no reply of any kind.

According to 97% of our growing audience of followers, it is obvious that while we are metaphorically crawling over broken glass to ensure we tell the truth, the brokers of Verico the Mortgage Station and management team at HomeEquity Bank are only able to 'protect' themselves by hiding from our evidence.

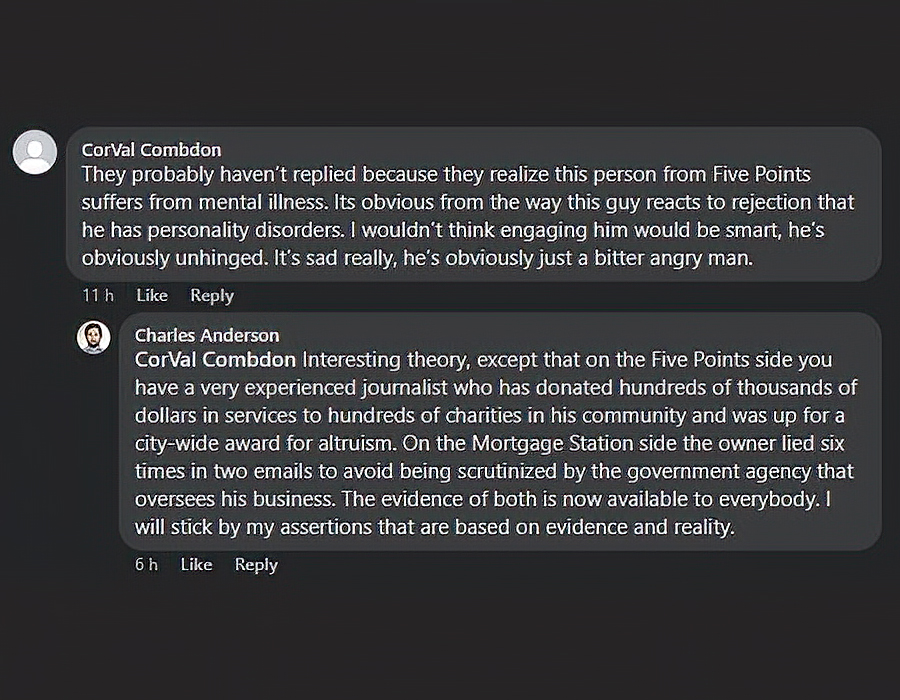

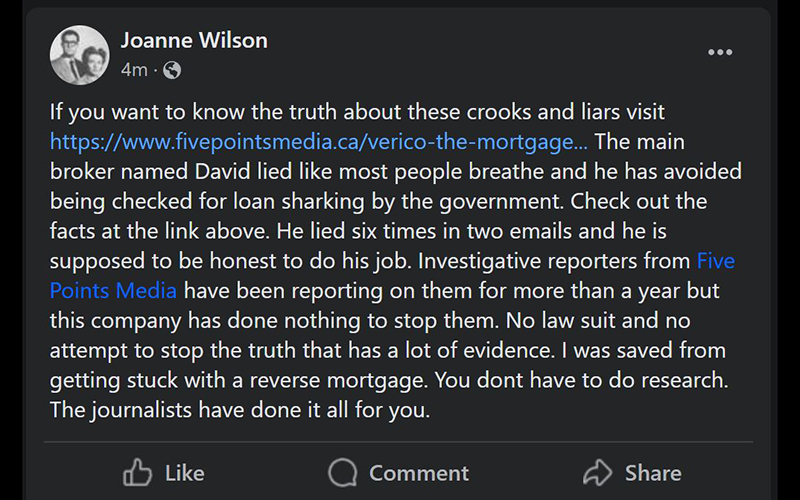

As a component of our reporting, we have shown, through the presentation of original emails, that David Flude lied to our producer at least six times in two emails when he promised to arrange a meeting to discuss the allegations of usury or loan sharking. From that meeting, a report was to be written and submitted to the Financial Services Regulatory Authority of Ontario. However, as that report could easily have resulted in criminal charges against the brokers at Verico the Mortgage Station, David Flude simply refused to set a date or even to discuss it, and the report was never written or submitted to the brokerage's government oversight. According to David Flude, that meeting, and the report, were both a "regulatory requirement" of the license held by Verico the Mortgage Station, meaning the violation could, and in our view should, cause them to lose their license.

What David Flude and his associates appear unable to understand is that it is their actions that have fuelled this investigation and the exposure of their crimes and unethical actions. If, 18 months ago, the provincially monitored brokers at Verico the Mortgage Station had acknowledged their liability, instead of just partial admissions of guilt by Renee Dadswell and Lisa Purchase, and if they had offered to make amends after being caught, nobody would ever have heard of this story. It is a simple cold hard reality that every single decision and action that has led up to this humiliating exposure for David Flude, Lisa Purchase, and Renee Dadswell, as well as their reputation as brokers at Verico the Mortgage Station has been made by them. All we have done is report the truth, support our claims with evidence, and request investigations by various agencies, which is what most people would do if they are defrauded and the provincially regulated business refuses to address the matter, or comply with 'regulatory requirements', or respond in any way.

Unfortunately for the loan sharks of Verico the Mortgage Station, this time they chose a journalist and media producer as their next mark, and they had no idea that their crimes and evasion would become so public.

The decision to evade the issue and hide is indicative of a guilty person, and never once have any of them denied the guilt or accountability that we alleged publicly throughout that time. They have also never refuted our allegations, meaning our claims hold a rare status in journalism as remaining 100% uncontested for an astonishing year and a half. They took this path so they could avoid our evidence in a court of law, and because no business wants to be the subject of media scrutiny or the bad guy in a movie about big corporations trying and failing to bully the little guy, especially when the 'David' in this mismatched battle against the corporate Goliath is a small not-for-profit that donates all services to those who need help in their community.

If we were publishing anything but the truth, the brokers at Verico the Mortgage Station, or the board of directors of HomeEquity Bank could have stopped our reporting through court-ordered injunctive relief. If even six months ago, David Flude had simply sat down one-on-one, as he was obligated to do a year earlier under "regulatory requirements", and at that time he explained what we might not have understood, this story, the videos, and other exposure would never have been warranted.

Now, instead of handling this 'mistake' quietly, the brokers and their bank are being seen for who they really are hundreds of times a day and by thousands of potential clients every month.

Instead of facing the facts and correcting their 'mistakes', David Flude and the brokers at Verico the Mortgage Station have been exposed for gross dishonestly, both in their practices and their tactics of evading responsibility, and they have been exposed for hiding as children do from monsters under their bed. Then, when forced to deal with their actions, these entrusted financial professionals who are supposedly governed by government oversight chose to inspire loyalty from the local detectives or senior brass at the South Simcoe Police Service, who omitted evidence to ensure that their new best friends were not charged for their various criminal offences.

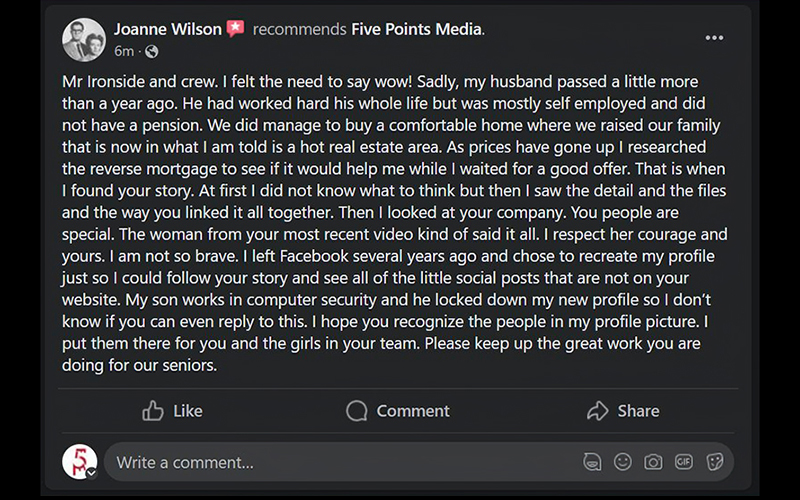

As was the case with former US President Bill Clinton and expelled US Congressman George Santos, the more the culprits denied the reality in the face of hard evidence while choosing not to support their position, the more people see the truth. As a result, our audience continues to grow. Currently, about 97% of those following this story have posted comments or sent direct messages or emails supporting our expose documentary. We also have support from brokers and others in the mortgage industry who want to see the scourge of their industry removed to avoid the stain spreading.

Eighteen months ago, the Principal Broker at Verico the Mortgage Station laughed at our Producer when he suggested suing or exposing the criminal tactics used to defraud the philanthropist through loan sharking.

We have to wonder if David Flude still finds this funny.

All it took to sway those who were loyal to disgraced former US Congressman, George Santos, was the release of the House Ethics Committee Report. Our report, to be sent today, December 4, 2023, to the agencies listed above, contains sufficient evidence to force a serious and thorough review of the crimes committed by the brokers at Verico the Mortgage Station. It should also point a spotlight on both the HomeEquity Bank and the South Simcoe Police Service. It will not be so easy for David Flude or his associates to 'motivate' a whitewashed investigation when past use of that tactic is part of what is being investigated.

It will also be obvious to various investigators that if we were lying, either the multi-million-dollar brokerage at Verico the Mortgage Station or multi-billion-dollar HomeEquity Bank would have been able to easily silence our small, not-for-profit media service. However, the brokers at Verico the Mortgage Station have chosen to hide from the facts and evidence rather than defend their brand and reputation.

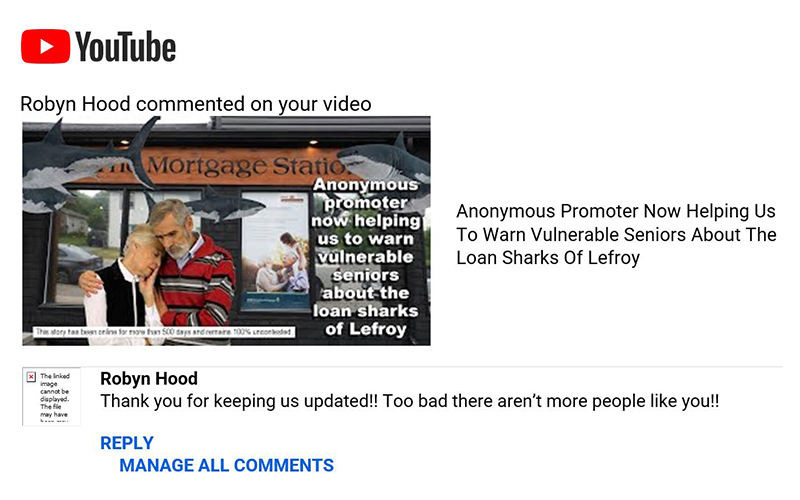

We know that somebody is promoting our stories, and we are pretty sure as to why. Companies make money by finding and exposing the secret lies and dirt of their competition. They may be cordial and even pretend to be supportive on the surface, but mortgage brokerage is big business, and as we have seen from the abusive and criminal actions of the brokers at Verico the Mortgage Station, and the decision by the HomeEquity Bank to continue working with those loan sharks, . . .

. . . when money talks ethics walk.

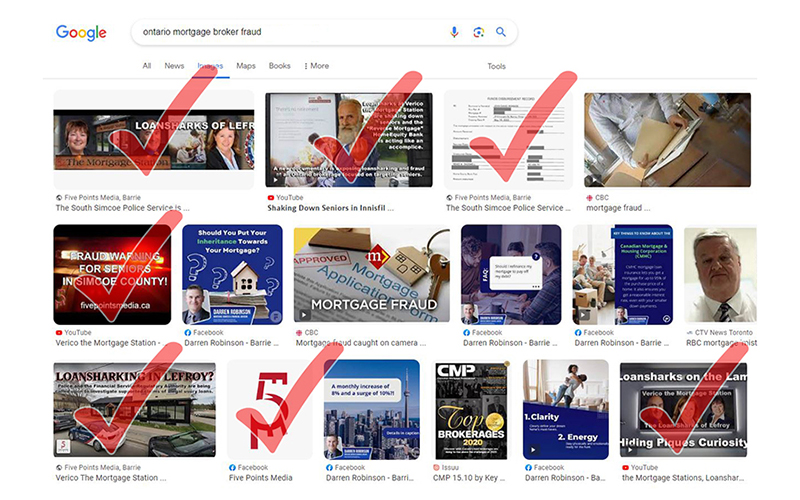

We don't have to reach every Canadian with our reporting to protect local seniors, just those looking for a mortgage in Simcoe County or those considering the CHIP Reverse Mortgages provided by the HomeEquity Bank. That is where our mysterious new promotions friend comes in, as they are pushing us out to the public more every day. Today, we searched "the Mortgage Station"with no other references and saw nine references to our stories on the first page of Google. We can say with confidence that the promoter is most likely a competitor of the brokers at Verico the Mortgage Station or the lenders at HomeEquity Bank.

We can say without hyperbole that at least 40 mortgages ended up diverted to other brokers due to our reporting and that most of them did not go to other agents of the Verico Financial Group Inc.

That may not sound like much, but those are only the ones we have been told about directly. Very few people tell a journalist about their buying decisions, especially when it involves a controversial story. Those forty are only the ones who did so. Well over a hundred people have written or messaged to say thanks for exposing the risks, or to ask for more details, and in forty or more cases they got back to us and let us know how our reporting likely saved them a lot of money. We estimate that less than 5% of people who have seen our articles have communicated with us about their mortgage journey.

The twenty-five interlinked reports of this ongoing story have been visited by more than 120,000 distinct IP addresses, and then there is the traffic on social media, so an estimation of 5% is very conservative.

According to real estate statistics, the average mortgage in Ontario for first-time buyers is around $425,000.00. The average commission that a broker earns is between 0.5% and 1.2% of the total mortgage amount. So, for purposes of simplifying the math, we will average that to 0.8%. Forty mortgages at $425,000.00 would total $17,000,000.00 in mortgage sales, which represents $136,000.00 in known lost commission. By using the standard rules for projected extrapolation, that viable 5% report estimation represents about $340,000,000.00 in unrealised sales and $2,720,000.00 in potential lost commissions.

So, can anybody explain to us why, after a year and a half, we have not been served with a legal action . . . unless of course it is because we have the receipts to back up our claims, which is why they are hiding.

Every time somebody finds our reports and decides not to call the brokers at Verico the Mortgage Station, the loan sharks lose thousands of dollars in commission. Also, the ethically challenged see-no-evil lender of this story, HomeEquity Bank, has competition, and now with the help of our new promoter, whoever they are, our story is ranking higher every day on the search engines and more people are finding the truth and going elsewhere.

Those fact-based decisions represent potentially hundreds of thousands of dollars in interest and fees for each client lost by HomeEquity Bank due to their public association with the loan sharks at Verico the Mortgage Station. So, we will not be at all surprised if the HomeEquity Bank chooses soon, under the light of scrutiny by multiple less easily 'motivated' investigators, to cut all ties with the brokers at Verico the Mortgage Station and choose instead to work with another local broker that is currently not selling their financial services. What, other than guilt or fear of exposure through the evidence we hold, would inspire these supposedly ethical financial professionals to hide in the dark and continue to lose so much income because they are too afraid to take on a small not-for-profit media company?

Also consider, that if we were not being truthful in our reporting, and if they did not know we can back it up, the South Simcoe Police Service would have found reason to 'justify' raiding our studio and arresting our producer.

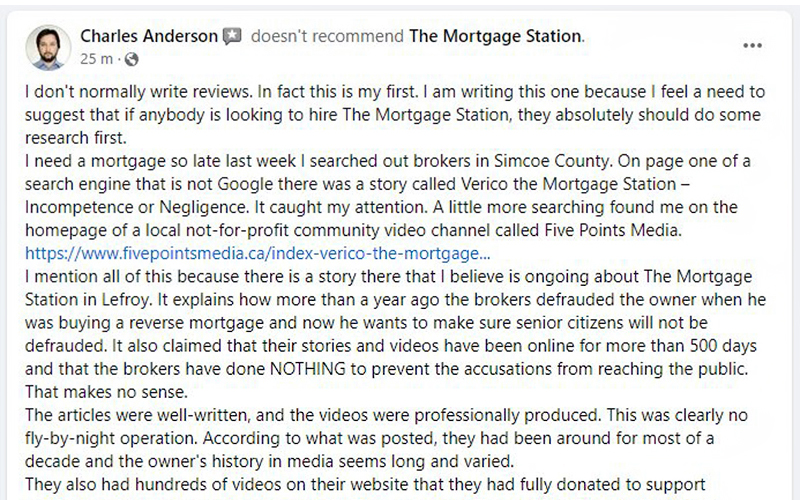

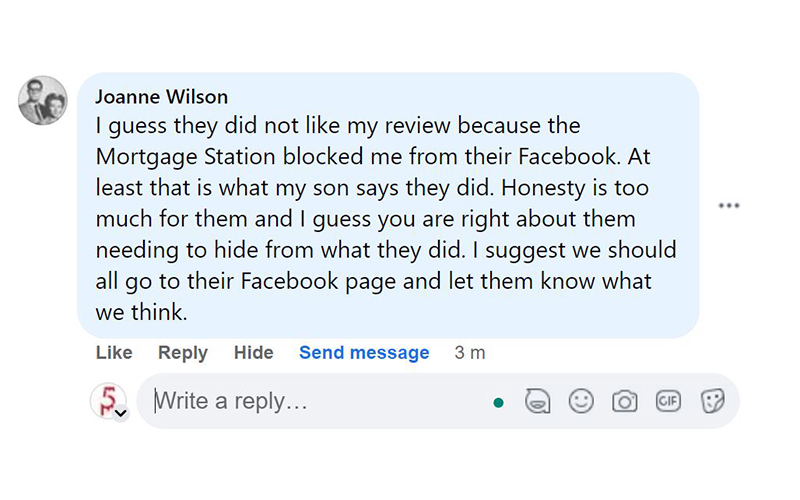

In reality, not one person has written to us to say we are wrong, or that they are siding with the brokers at Verico the Mortgage Station. There have been a few comments on social media from people who said they were happy with the service they received, and we are happy for them. However, a quick look around the review boards like Yelp or ZoomInfo will bring up various reviews citing experiences like that endured by our Producer.

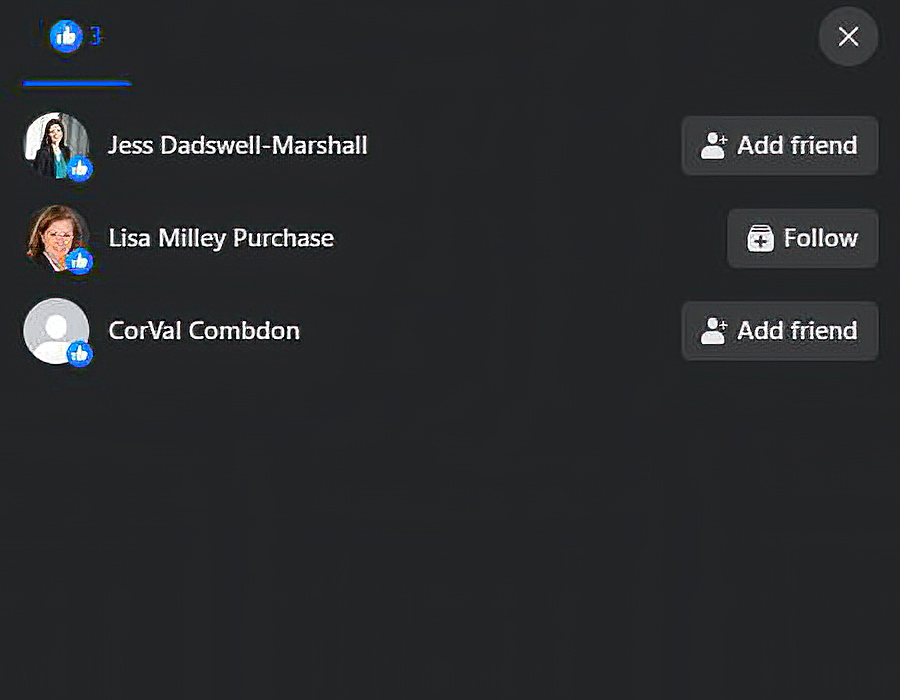

We also have a heckler of sorts, but a quick look at her Facebook page showed that she is personally associated with one of the brokers at Verico the Mortgage Station. It is also a sad reality that the brokers at Verico the Mortgage Station are now the people posting most of the reviews on the Facebook page of their company and on each other's 'professional' pages.

It is like a sad little pep rally of criminals trying to convince themselves they are still good despite the exposure of their boss' crimes and those of their colleagues. They have even resorted to creating fake accounts to gently assuage their own need for adoration from clients and a public that has turned on them with scorn.

Meanwhile, based solely on the quality of the video reports we have produced, and our ethical desire to ensure the truth in our reporting that is protecting seniors, we have received several requests for quotes on new projects through our commercial division.

We are a not-for-profit media service that has donated more than $700,000.00 in skilled labour and the use of production facilities to our community by providing, free of charge, at least 350 videos to more than 180 charities, not-for-profits, and benevolent community groups. We have many glowing reviews from those we have helped on a strictly volunteer basis, but we have limited sources of income. As such, this kind of financial support is always appreciated. We are also becoming very well-known to other local brokers, builders, developers, and sources of financing, many of whom have complimented our ethics, openness, accountability, and tenacity. We expect to hear back from them in 2024, after the brokers at Verico the Mortgage Station are fully exposed by the legitimate and non-'motivated' investigations by truly professional investigators.

That is when mainstream media will suddenly try to swoop in and claim the story as their own, and likely transmit it across the country to even more clients of HomeEquity Bank.

No matter how many lies, fake Facebook reviews, or other stunts are pulled by the brokers at Verico the Mortgage Station, the public now knows who and what they truly are. As we showed in our last report, it does not matter if it is unscrupulous lawyers, a morally bankrupt private investigations company who are defrauding employees, or people in our industry who abused the authority of a corrupt politician, we have a rather well-established history of standing our ground against unethical abuses of the civil court system and even for taking on and causing the demotion of corrupt police officers. Despite their delusions, the brokers at Verico the Mortgage Station and the board of directors of HomeEquity Bank cannot evade ongoing and growing scrutiny of their poor choices. They have had multiple chances to do the right thing, but they chose by their own decisions to endure the scrutiny, exposure, and humiliation.

They chose, based on greed and a false sense of privilege, to act in an ethically and legally repugnant manner.

As journalists and producers of social documentaries, we will continue to report the facts and promote our documentary in progress until government oversight through the Financial Services Regulatory Authority of Ontario or law enforcement in the form of the Ontario Provincial Police Financial Crimes Division, and the Office of the Independent Police Review Director act to protect the seniors and veterans of Simcoe County, which we maintain was not the goal or intent of the detectives of the South Simcoe Police Service who were motivated to assist the brokers at Verico the Mortgage Station by omitting evidence and using incorrect formulas even after being advised of their 'mistake'.

As the brokers at Verico the Mortgage Station and the board of directors of HomeEquity Bank have chosen not to challenge our allegations and evidence, even though a no-risk 'without prejudice meeting', we will be leaving our reports and videos, that have remained uncontested for more than 530 days, online indefinitely. We will also be watching both the brokers at Verico the Mortgage Station and the management team at HomeEquity Bank for changes in their branding, renaming, and other means of hiding from criminal abuses and past mistakes. That means that even after we have finished our documentary and it has been on air, people will find our facts about this story, and they will be forwarded to the completed project.

We remain open to meeting with any party involved in this story of criminal abuses, either on camera or for a "without prejudice"conversation. The choice, for now, is theirs.