HomeEquity Bank Panics After Threatening The Charitable Service They Helped To Defraud

This is what happened on Thursday, February 20, 2025, after our Producer advised HomeEquity Bank that if they wanted to default on our mortgage, as they have now threatened to do after two years of hiding from our evidence, they will have to do so through legal action. It is only there that the evidence will be brought before an impartial Justice of the Superior Court, who will not be so easy to 'motivate' as was a young detective of the South Simcoe Police Service, who arbitrarily chose to omit key evidence and falsified figures so he could create a 'get out of jail free' card for Renee Dadswell, Lisa Purchase, and David Flude, the loan sharking brokers of Verico the Mortgage Station who defrauded a senior, veteran, and philanthropist by skimming 198.25% interest for short-term bridge financing, from the mortgage payment owed to their trusting client.

That is what happens when small town cops deal with multi-million and multi-billion-dollar corporations.

This sudden massive increase in interest by known agents for Verico the Mortgage Station, Verico Financial Group Inc., or HomeEquity Bank is a strong indicator of panic.

On January 21, 2025, HomeEquity Bank, the Schedule 1 Canadian Chartered Bank that helped loan sharking mortgage brokers to defraud a senior, veteran, and philanthropist, sent a letter threatening to default on the CHIP Reverse Mortgage that has been at the center of our expose documentary about mortgage fraud in Canada. This action reeks of a last ditch, hail Mary grasp for control of a situation that is now fully out of their influence due to our growing exposure and uncontested allegations.

No reasonable person would believe that multi-million and multi-billion-dollar corporations that rely on their reputations would just allow a small, not-for-profit, social enterprise to accuse them of indictable offences.

The directors of HomeEquity Bank knowingly covered for the criminal offences of the brokers of Verico the Mortgage Station, and by helping the brokers through whom they make profit to conceal the indictable offence of usury, which carries upon conviction a prison sentence of up to five years, the directors of HomeEquity Bank committed the indictable offence of Fraudulent concealment, which carries a prison sentence of up to two years. Now, after more than two years of this exposure, fewer and fewer clients, colleagues, and competitors are willing to listen to tall tales of a 'serial agitator' who was lying about the three multi-million and multi-billion-dollar corporations, yet they clearly fear taking the claimed 'agitator' to court to obtain a restraining order or civil compensation.

347 (1) Despite any other Act of Parliament, every one who enters into an agreement or arrangement to receive interest at a criminal rate, or receives a payment or partial payment of interest at a criminal rate, is

(a) guilty of an indictable offence and liable to imprisonment for a term not exceeding five years; or

(b) guilty of an offence punishable on summary conviction and liable to a fine of not more than $25,000 or to imprisonment for a term of not more than two years less a day, or to both.

341 Every one who, for a fraudulent purpose, takes, obtains, removes or conceals anything is guilty of an indictable offence and liable to imprisonment for a term not exceeding two years.

The excuses for inaction by these multi-million and multi-billion-dollar corporations make less sense every day, as we have made it clear that it is not we who are not hiding or refusing to accept any kind of court challenge.

All we have asked is for people to do their own research and to consider the character of those telling this story. On one side you have a team that is dedicated to their community in which they actively help and support every benevolent group that comes to them for assistance. On the other, you have provincially licensed brokers who have all admitted to committing fraud by usury against a senior and veteran, then lied six times in two emails (1) (2) to evade investigation by the Financial Services Regulatory Authority of Ontario (FSRA), then hid for more than 30 months to evade having to answer for their actions, then 'motivated' an officer of the local South Simcoe Police Service to omit evidence and falsify calculations, and then 'threatened' our producer and specifically our twenty-something-year-old interns and apprentices with an unscrupulous Strategic Litigation Against Public Participation (SLAPP) lawsuit through a lame, legally unsupported, do-it-yourself allegation of libel which we so fully debunked, that the anonymous writer representing the interests of the multi-million and multi-billion-dollar corporations lost the courage to file the claim in any court throughout the past four hundred and fifteen days.

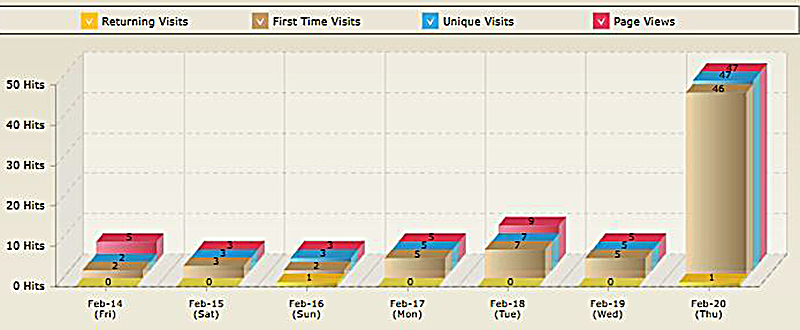

The statistics shown in the screengrab represent only the visiting legal and content researchers who we tagged as working on behalf of Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank.

This graphic representation of our traffic does not reflect on the visits of our legitimate followers, which we know includes competing brokers, bank mortgage specialists, and other lenders. Their number continues to grow daily, especially as we are posting again new material. We know that at least one brokerage firm has tagged our website for automated update detection, and they are clearly advising their agents and brokers to visit new material as it is posted. Those sharing our materials on social media have also started returning to the trough for new content to share. During the time when we slowed down on updates, the number of the investigative corporate visitors also declined, as there was nothing new to review, and the 'gotta find something' researchers shifted their interest to the stories on our Five Points Media website, where they are presumably looking for something they think they can use to defame us in a court of law.

Suddenly, after two and a half years of hiding, ignoring our letters, and arrogantly refusing even to discuss the criminal abuses of trust, management at HomeEquity Bank urgently wanted to talk with us.

A couple of weeks after the January 21, 2025, letter, an agent for HomeEquity Bank emailed our Producer, expressing a need to discuss their intent to claim us to be in default. Then, on Thursday, February 20, 2025, they called, offering to 'help' us to avoid them pulling the mortgage after we had spent two and a half years exposing their crimes, while the management team of the multi-billion-dollar Schedule 1 Canadian Chartered Bank had hidden in the dark, apparently praying that we just stop telling potential clients what they had done. Our Producer declined the offer, after advising the agent that he had written to Katherine Dudtschak asking for a meeting, not just once but twice, and had also written to the then new CEO and President of HomeEquity Bank and Jo Taylor, her counterpart at the Ontario Teachers' Pension Plan Board which owns the bank and had been consistently ignored. Now, suddenly, they wanted to talk, and the reason is obvious.

By refusing their sudden desire to assist the owner of the charitable organization they helped to defraud, our Producer is forcing the HomeEquity Bank to face their greatest fear, answering to their crimes in a court of law.

Any claim by the HomeEquity Bank can be defended through a counterclaim or simply replied to through the use of evidence. Either way, we will be able to prove at least the crime of Fraudulent Concealment, and the HomeEquity Bank is a Schedule 1 Canadian Chartered Bank, governed by not only the easily distracted Financial Services Regulatory Authority of Ontario (FSRA), but also the Financial Consumer Agency of Canada (FCAC), and the Office of the Superintendent of Financial Institutions (OSFI). The Financial Services Regulatory Authority of Ontario (FSRA) has proven itself to be easily swayed by wealthy players they are supposed to be monitoring, but we doubt the same is true of the federal agencies. A ruling by a Provincial Superior Justice of the High Court ruling that HomeEquity Bank had breached their ethics to help loan sharks defraud senior and veteran clientele, not to mention a charitable organization, will likely not sit well with any of those investigative and prosecutorial agencies. Once the cat is out of the bag at that level, not even the Ford 'Open For Business' Government controlled Financial Services Regulatory Authority of Ontario (FSRA) will be able to look the other way to help the multi-billion-dollar bank evade criminal prosecution or even accountability.

That ruling will also attract a high level of media interest, especially when we use our connections and expertise as advocates for the unsheltered community to link high levels of homelessness to mortgage fraud in Ontario.

As journalists, who are reporting on this story from a personal perspective, we look forward to watching and reporting on Katherine Dudtschak, and her boss Jo Taylor explaining to a judge the ethics of a bank that not only got into bed with loan sharks who target senior and veteran clientel, but also how they knowingly nearly bankrupted the owner of a self-financed charitable service that is so respected, that in 2020 their intended victim and his crew were nominated for and voted to the highest levels for the City of Barrie and Barrie Chamber of Commerce award for altruism due to having produced and donated more than 350 promotional and educational videos for greater than 180 local charities, not-for-profits, and benevolent community groups, valued at more than $700.000.00.

The problem is that these people seem incapable of seeing past their own egos, and the appear oblivious to the loss business that is costing them all everything they have worked for.

The one-sided pointless need to save face reminds us of the story of Mustang Investigations, a private investigations company that sued our Producer in a vain attempt to stop him from exposing how they had defrauded more than 800 employees of hundreds of thousands, or potentially millions, of dollars in overtime, and how every Justice of the High Court suddenly stopped listening to the manufactured reason for their action once the evidence the company thought they had seized came out in court. Our Producer proved the truth through the use of evidence, as he will do in this matter, and he showed the real motivation for the family run corporation's utterly self-destructive unsuccessful attempt to abuse the courts to cover for their own wrongdoing. The end result was the company falling into bankruptcy, the family lost of everything they had invested in their ten-year established business, they were landed with legal fees of $400,000.00 owing to three Bay Street law firms, they lost potential income estimated at $500,000.00 as clients distanced themselves based on our very public exposure, they destroyed their own reputations, and they lost their multi-million dollar Victorian house in the Beaches.

"Pretend inferiority and encourage his arrogance."