Fake Outs and Fraud on Facebook - Verico the Mortgage Station and HomeEquity Bank

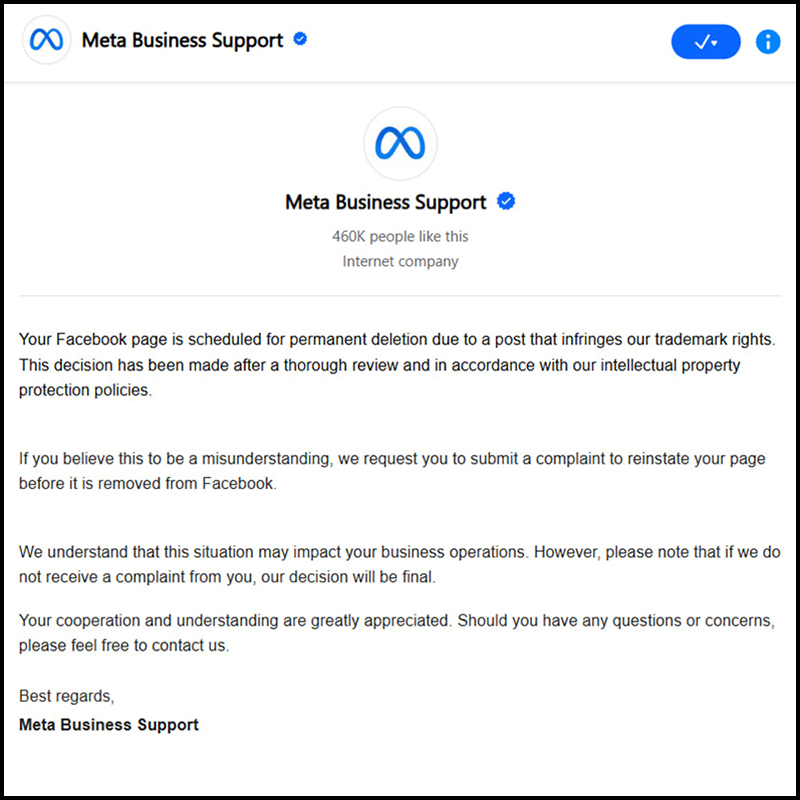

People who use Facebook to promote their business will be familiar with these 'warning' posts. They are scam posts from fake representatives of Facebook or 'affiliated' companies who use the threat of deleting your page to draw you into clicking a link to a harmful page, to convince you to pay them a "fine", or to get you to log into your page so they can steal your log in and password.

They are also used by unscrupulous corporations to intimidate, threaten, or extort smaller competitors.

We noticed that the number and variants of these scam bots suddenly exploded, by a factor of at least ten times, first on our new page entitled "Mortgage Fraud Canada", which we will be using to promote this story across Canada, and then to a lesser degree on our Five Points Media page. Simultaneously, we were notified by our AI tools that those two Facebook pages are also being visited very frequently but without any activity by visitors from outside Facebook who appear to be looking for something; likely anything they think they can use to dissuade us from reporting on these criminal abuses. This could be coincidental, but it all started during the weeks after we moved our story to this standalone website, about six months ago.

Good luck with your likely expensive trip down our rabbit hole, and please enjoy our social message.

The giveaway that they are scam posts, and not a true complaint from Meta, is that there is no information. In July of 2023, HomeEquity Bank filed a complaint with Facebook claiming we were using their logo in contradiction to the copyright act. That claim was a lie, not a mistake, as thirty seconds worth of research conducted by any minion of that multi-billion-dollar corporation would have revealed that the 'Fair Dealing Clause', or section 29 of the Copyright Act of Canada, exempts news reporting, aka media, from any obligation to seek permission to use copyright protected materials in their reporting if their actions are relevant.

The services of these online con-artists are used by unethical and unscrupulous corporations who hire them to intimidate, threaten, or extort smaller competitors, and journalists.

"The fair dealing provisions in sections 29, 29.1, and 29.2 of the Copyright Act permit dealing with a copyright-protected work, without permission from or payment to the copyright owner, for specified purposes. These purposes are research, private study, education, parody, satire, criticism, review or news reporting."

The HomeEquity Bank is a Schedule 1 Canadian Chartered Bank, and we are a small, not-for-profit, social enterprise community media company that donates all services to local charities, not-for-profits, and benevolent community groups. So why, if they are not guilty of bad behaviour like collaborating to protect criminal colleagues, were they playing around lying to Facebook rather than dealing with the issue of elder fraud by loan sharks in Lefroy? They will hide for two years, ignore pathological levels of lying by brokers who sell their mortgages, and ignore all requests for assistance from their clients, as seems to be embedded within the corporate policies of Verico the Mortgage Station, Verico Financial Group Inc., and HomeEquity Bank. That seems likely why a full two years after we started reporting on this story, they are still hiding and refusing to face our allegations while remaining clearly terrified by the idea of facing our evidence while under oath if they ever file the court scorned and Supreme Court denounced Strategic Litigation Against Public Participation (SLAPP) lawsuit that David Flude threatened more than six months ago (see the timer above) while hiding behind anonymity that he never found the courage to file with the court.

Multi-million and multi-billion-dollar corporations do not hesitate to defend against actual libel, so why are we the only ones willing, and in fact eager, to obtain a judgement based solely on the evidence?

At that time, the story was still being reported through the Five Points Media website, but we had also launched a series of videos to Facebook. They included details of the negligence being shown by HomeEquity Bank or the probability that they were collaborating with the loan sharks of Verico the Mortgage Station who they knew had defrauded their own senior and veteran clientele through usury; an indictable offence that warranted upon conviction a prison sentence of up to five years. The HomeEquity Bank complained to Facebook, citing violations of their copyright as is the most often used allegation in the scam notices. So far, we have received about 200 of the scam threats during the past six months, all of which were sent to our pages associated with our story about mortgage fraud, and none to our commercial Facebook, or our studio page, or to any of a dozen pages on which we are upgraded to administrators so we can help volunteer charity groups and friends to achieve success through social media. As part of their vacuous claim, the HomeEquity Bank was required to provide their legal status as being eligible to file a complaint, the nature of the fraudulently claimed offense, the date of the post, details of the purported copyright violation, and other information, all of which was then sent to us.

Our response, included below, resulted in Facebook restoring our page with the post intact.

We are journalists and have been established as such in Ontario for nine years, since 2014. We have to our credit more than 300 news and community videos which can be found at HTTPS://www.fivepointsmedia.ca/recent-stories.html.We are also held in high regard within our community as can be seen at HTTPS://www.fivepointsmedia.ca/testimonials.html

We are currently working on a story about how a mortgage brokerage in Lefroy Ontario is defrauding seniors and veterans through loan sharking and skimming of mortgages. The HomeEquity Bank is a legitimate part of the story as it is their product that is being sold by the brokerage, and it is the nature of their product that attracts often vulnerable seniors to the brokerage. The HomeEquity Bank can stop the fraud and hold the brokers accountable, but clearly, their lust for money outweighs their concern for their elderly clients.

As HomeEquity Bank is irrefutably a component of the story, our use of copyright material is protected by the Fair Use provisions of the Copyright Act of Canada.

"The fair dealing exception in the Copyright Act allows you to use other people's copyright material for the purpose of research, private study, criticism, review, news reporting, education, satire or parody provided that what you do with the work is "fair". Whether something is "fair" will depend on the circumstances."

Ever since this resolution was ruled in our favour, based on hard evidence instead of easily disproved deception, neither the brokers of Verico the Mortgage Station nor their criminal collaborators at Verico Financial Group Inc. or HomeEquity Bank have taken any follow up action to further embarrass themselves by stepping into our domain of media. They have also backed down from threatening to challenge our evidence and experience fighting in a court of law where we have consistently succeeded in defending our right to 'freedom of the press', as are guaranteed by Section 2B of the Charter of Rights and Freedoms. If you want to understand why these multi-million and multi-billion-dollar corporations have never managed to muster the courage to challenge our small, not-for-profit, social enterprise community media service that donates all services to charities, not-for-profits, and benevolent community groups, read what happened when David Flude, the Principle Broker of Verico the Mortgage Station 'threatened' us with a reprehensible and abusive form of civil litigation, while hiding behind anonymity. This 'threat' of litigation was sent to us in December 2023 via a generic email account but was never acted upon. More than six months later, we are still waiting.

We welcome these multi-million and multi-billion-dollar corporations to file vexatious litigation against us, so we can subpoena every connected party, and through the authority of the court, compel them to tell the truth under oath against our evidence, while we also report publicly the truth of their actions, as is our right.

To understand the trepidation of these multi-million and multi-billion-dollar corporations, check out the back story of our international experience in Investigative Journalism which details how we have used evidence to disprove the claims of various abusers of our system of criminal and civil justice to secure our right to tell the truth as journalists. Also, review this page to learn what happened when a top lawyer from Toronto threatened to sue us through the same kind of repugnant and abusive SLAPP litigation when we started reporting the truth about how a slumlord contributed to the death of a disabled man who was made to pay absurd levels of rent to live during the coldest period of winter in an uninsulated and poorly maintained summer trailer that provided neither sewage or cooking facilities.

Despite her status as a top Toronto litigator, and a full partner in a prominent law firm, the highly experienced lawyer ran away with her tail between her legs based solely on our reply, never to be heard from again.

Lawyers are huff, puff, and bluff, and very few ever want their case to go to trial. This is especially true when the intended target of abuse can prove usury, or loan sharking, using hard evidence in the form of financial documents provided by the broker that were also provided to the bank. Then, there is the issue of claiming criminal or civil malfeasance against an altruist and philanthropist who not only undertakes boots on the ground support for the homeless community but has also opened up his home to help six otherwise unsheltered people to advance with recovering their lives. Then they will have to discredit to a judge the victim of their clients' crimes, who has donated more than $700,000.00 in services to more than 180 charities, not-for-profits, and benevolent community groups, many of which will stand in support of his desire to expose elder fraud by loan sharking brokers and a bank that chose to support and defend their actions.

We cannot say for sure, but it appears that the multi-million and multi-billion-dollar corporations have now been reduced to hiring online con-artists to send new daily versions of these easily filtered 'threats', and if that is true, we truly feel pity for how far the once mighty have fallen.