Visible and Publicly Accountable - Verico the Mortgage Station

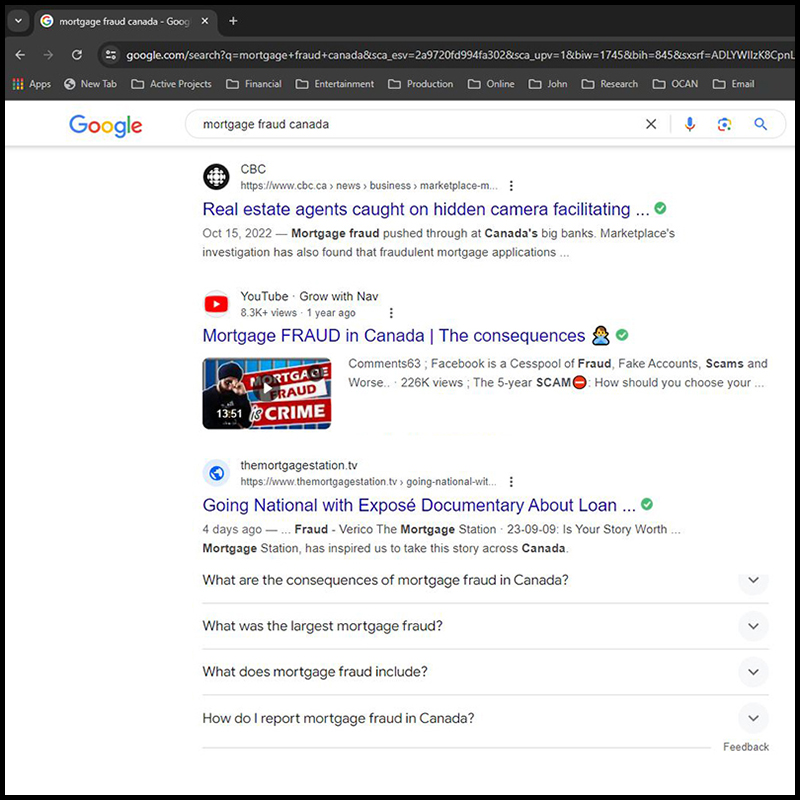

A couple of days ago, we were split testing our search engine optimization and were delighted to see that a Google search for "Mortgage Fraud Canada"brought up our website on page one. This enables us to better warn potential victims of the lies, manipulation and loan sharking by the brokers of Verico the Mortgage Station, and the negligence and lack of customer protections demonstrated by Verico Financial Group Inc. and HomeEquity Bank. Then we noticed that the discovery of the search was not related to one of our older, more well-established pages, but was linked to "Going National with expose Documentary About Loan Sharking at Verico the Mortgage Station" which was uploaded just four days previous.

We are editing those videos now and will soon be boosting them to Canada's most populated regions.

Our story was the third post on page one, appearing after a two-year-old story by the CBC, and a year-old YouTube video called 'Mortgage Fraud in Canada'. So, we were quite happy with our results, especially since that article had been online for only four days. Our link also referred to other relevant links within our ongoing presentation of the truth of this story of usury and criminal collaboration.

The tactic used by the loan sharks and their allies has been to hide, but now exposure is unavoidable.

In both of those online reports, the journalists focused on mortgage fraud as committed by the customer. Our story exposes mortgage fraud as committed through loan sharking by the brokers, and criminal colaboration by the head office of a brokerage chain and a Schedule 1 Canadian Chartered Bank. Then added to our mix is the abusive 'investigation' undertaken by the South Simcoe Police Service, who were 'motivated' to ignore the crime for a full year, then to move only after a public letter was sent to the Innisfil Mayor and Council, to then only speak with the accused and not the victim, and then to omit key evidence and to falsified figures to provide a pass to the multi-million-dollar brokerage.

As we have every expectation to see results like this for every existing and pending post, it will not be long until every Google search reference to any and all businesses and people being exposed through this expose documentary will be prominent and a subject of public scrutiny.

Our perseverance is paying off, as we are attracting more followers and mainstream media attention every day.

The story of a family lying about their income to get a house for their family is nowhere near as compelling in the eyes of most people as brokers defrauding senior and veteran clientele by loan sharking and then the corporate oversight and bank turning a blind eye and refusing to investigate, despite having received unredacted copies of the evidence and having a legal and ethical obligation to do review the facts and evidence. So, we think it is time to shake the tree, and using more than a Human Rights complaint against all three corporations, which is currently being reviewed, and videos being distributed and boosted in every major populated region in Canada. We think it is time to start sending out a fully supported synopsis of our story to every major media service in Canada, and to every independent media organization that has ever produced videos about this subject, as well as all members of the media sharing group we joined several months ago.

There is a reason why lions only hunt elephants as a pride.

We theorize that David Flude has somewhat maintained control of this situation because he has been able to convince those at Verico Financial Group Inc. and HomeEquity Bank that he has control of the situation, and by assuring them that nobody is reading our reports or viewing our videos. Well, page one number three on Google after just four days should show these educated professionals that they have been deceived, as we did nothing to promote that page that we are not now using on every page of our constantly growing story. Also, any person with reasonable knowledge of Search Engine Optimization, which is not usually small-town mortgage brokers, knows that if a website is not hosting a lot of traffic, they will never rise to the highest positions on Google or the other search engines. Uber high levels of traffic is the most important component of search engine rankings against other more established competing websites of similar products or subject matter.

An argument that our newest story hit page one of Google after just four days, but 'nobody is reading', is like pitting an electric scooter against a Ferrari, and trying to convince others it will win.

This website at www.themortgagestation.tv is now scanned daily by the robots and spiders of various online search utilities, including Google, which is something normally reserved for much larger media services like the CBC and CTV. Now that we have breached that professional barrier, all our materials will continue to climb within the public eye, resulting in questions that cannot be answered by the brokers at Verico the Mortgage Station, and the management teams of Verico Financial Group Inc. and HomeEquity Bank. Scrutiny will demand that they come out of the darkness and into the light, where they will not be able to hide from their easily proven criminal collaboration. Once they realise the level of exposure, which will happen rapidly, David Flude, W. Mark Squire, and Katherine Dudtschak will not be able to evade responsibility for the various ethical and potentially criminal abuses of trust so far committed by the brokers at Verico the Mortgage Station and the management teams of Verico Financial Group Inc. and HomeEquity Bank.

We continue to offer an on-camera interview or without prejudice meeting to the Presidents and CEOs of Verico Financial Group Inc. and HomeEquity Bank should either see the wisdom of not waiting for the oncoming storm.

There are varying levels of guilt in this matter, from the reprehensible loan sharks who stole by usury from a senior, veteran, and highly respected philanthropist to the collaborators who covered for them, most likely based on lies. We hope Katherine Dudtschak, the new President and CEO of HomeEquity Bank sees that she does not have to endure professional scrutiny any longer over something she did nothing to cause. Her only area of accountability, so far, is her negligent decision not to review this matter when she took the reigns of the Schedule 1 Canadian Chartered Bank that caters to the needs of especially vulnerable seniors.

It is time for a leader of one of these multi-million and multi-billion-dollar corporations to step up and take a stand, either by talking to us on camera and telling the truth, or taking this public issue to court to try to disprove our evidence, which they have not found the courage to challenge in more than two years.