Censorship And Unethical Delisting Defeated – HomeEquity Bank

As we noted back on October 30, 2024, in the article entitled "Desperate Triad Resorts Again To Censorship", one of the companies involved in this uncontested story of fraud by usury, or loan sharking, and corporate cover-up, those being Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank, has apparently been working to censor our ability to report on this story of their criminal and ethical breaches of trust, by unethically delisting our website on Google. That action would be a violation of our rights under Section 2B of the Charter of Rights and Freedoms, and also an act of blatant fraud and identity theft, and it stopped immediately after we outed them here for committing the offence.

This is all cloak and dagger, covert stuff, and the work of cowards, so it is hard to say which one did it.

We are able to confirm that in July of 2023, Facebook advised us that HomeEquity Bank had reached out to them, trying to censor our story of how they were collaborating with the loan shark brokers of Verico the Mortgage Station by helping them to conceal how they were defrauding senior and veteran clientele, and the community by defunding our not-for-profit, social enterprise, community channel, that has been responsible for raising awareness and hundreds of thousands of dollars worth of fundraising for hundreds of charities, not-for-profits, and benevolent community groups in Simcoe County and across Ontario.

It is likely we can all understand why they would not want potential clients to know about that.

The most recent attempt at censorship came in the form of delisting, which is a cheap hack used by unscrupulous online promoters to remove the listing of a company's competitor on the search engines. Essentially, it is a fraudulent lie through which a business tells Google that the website of their competitor is no longer online and should be removed from all lists. In this case, the attempt was sloppy, as the deletion was only partially effective. The perpetrator, who we hope was paid very well, neglected to remove our domains from many of the online lists, and now Google and the other top search engines are fully aware of the scam, meaning it won't work again.

We are back on page one of Google and other search engines,

and again, we are rising for all key words.

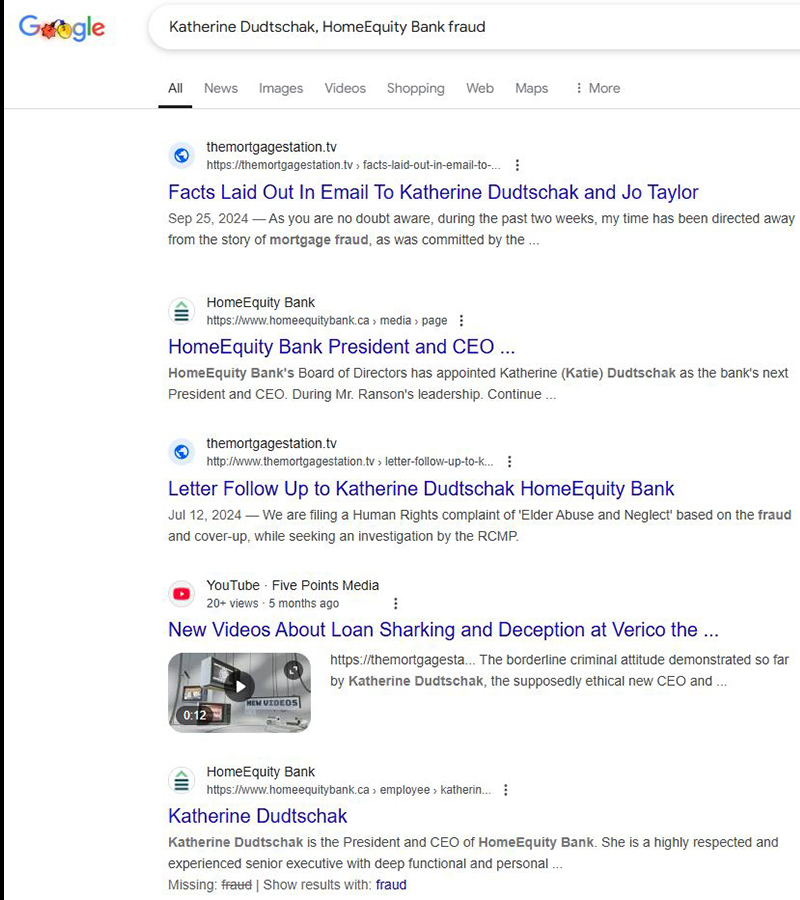

As can be seen in the screengrab, using random words like "Katherine Dudtschak HomeEquity Bank fraud", results in our story being listed in three out of the top five results on page one of Google.

It is not hard for prospective clients to understand why a multi-billion-dollar corporation would resort to censorship, multiple times, rather than defend against fully supported allegations by challenging the claims in court, or even communicate with their accuser, who happens to be an internationally experienced journalist and former licensed private investigator, turned philanthropist, who has donated more than $700.000.00 in services to greater than 180 charities, not-for-profits, and benevolent community groups in his community.

These corrupt corporations are so terrified by the prospect of facing the evidence, and likely losing their ability to work in the financial sector, that they are willing to lose tens of millions of dollars in lost opportunity.

Verico the Mortgage Station is giving every indication that they are going down hard, and are willing to take their supposedly former collaborators with them, as they are losing staff at a phenomenal rate and not replacing them, they have been forced to convert offices that were intended for an expansion into apartments, apparently to generate cashflow, and their offices are once again for sale at an even greater discount, having been reduced by about a million dollars since first being put on the block.

No multi-million-dollar corporation that has done no wrong does nothing to protect their largest investment.

As we noted in our story, "Left Holding The Bag - HomeEquity Bank" the HomeEquity Bank is also losing tens of millions of dollars due to their decision, by two CEOs, to cover for and protect the loan sharks of Verico the Mortgage Station. They now appear to have withdrawn all association with the loan sharking brokers, who we have very publicly accused of going so far as to 'motivate' officers and detectives of the South Simcoe Police Service so they would omit key evidence and financial records while falsify figures so they could manufacture a fraudulent 'get out of jail free' card for those who charged 198.25% in interest and fees on bridge financing to senior and veteran clientele.

No representative of any of the corporations nor the South Simcoe Police Service nor Simcoe County has ever contested in any way these fully supported allegations of criminal and ethical breaches of public trust.

"Using the updated number of twelve drive-by visits per week, and the same 50% ratio of lost opportunities, which is conservative, the HomeEquity Bank experiences a loss of opportunity, valued at $250,000.00 in potential income over a ten-year period, every time a visitor to this story chooses to buy into another option that is not a CHIP Reverse Mortgage. That adds up to $1,500,000.00 per week, or $78,000,000.00 per year. In the case of HomeEquity Bank, the lost sales, valued at $213,693.63 per day, are not restricted to those generated by Verico the Mortgage Station. People are frequently visiting our pages looking for information about HomeEquity Bank and the CHIP Reverse Mortgage, and they are coming from every province in Canada. That will only get worse when we launch our social media campaign focused on major population centres across the country. That will be launched soon, when the weather cools consistently, and more people are spending time on social media".

When considering the lack of response by the South Simcoe Police Service and the county itself, there is cause for these corrupt corporations to be afraid to take legitimate action to silence our story, and why those being exposed will try ANYTHING to minimize public awareness, including multiple attempts at censorship.