Blindly Fumbling For An Escape Route - HomeEquity Bank

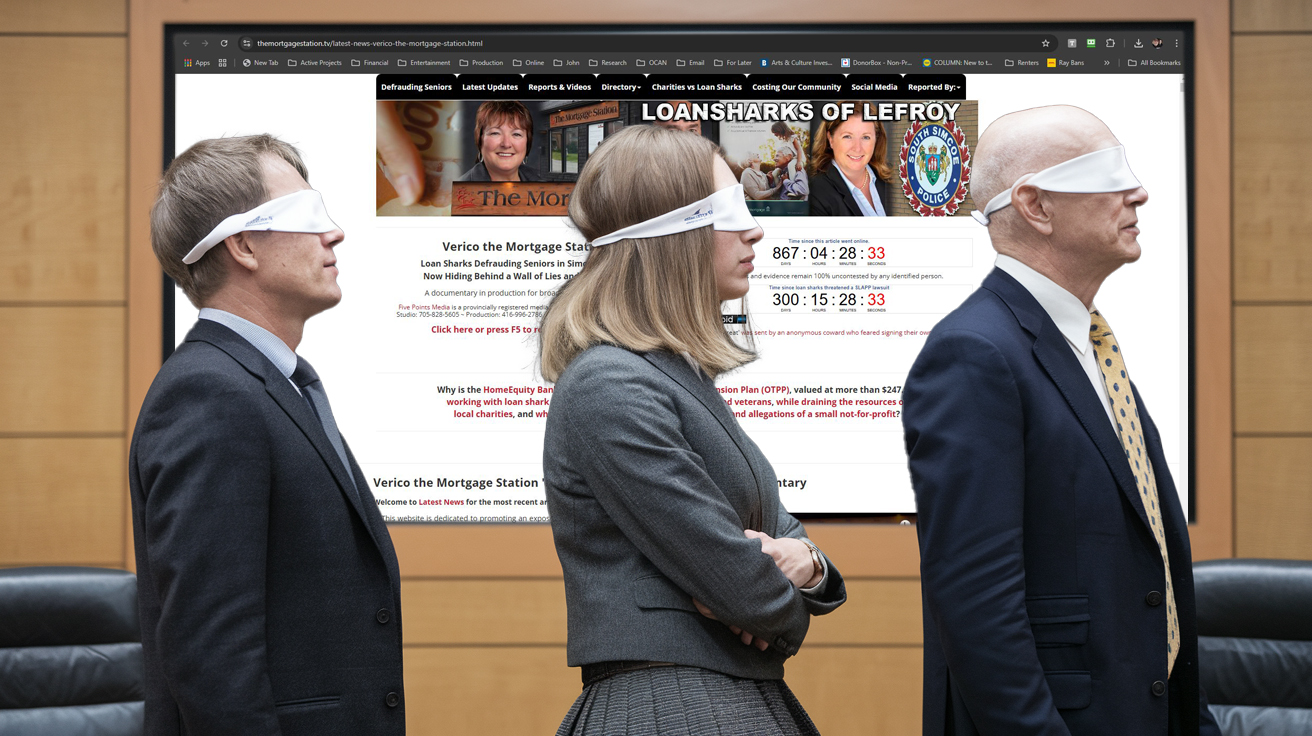

For a few weeks in September and October, in kind of an off and on pattern, the brokers of Verico the Mortgage Station, the management team of Verico Financial Group Inc. and the board of directors of HomeEquity Bank all very deliberately stopped viewing our website. The apparent hope was that if we lost what they perceive to be our audience we would stop publishing, like when the Simpsons defeated out of control advertising monsters by ignoring them.

These supposed 'financial professionals' don't seem to understand that they are not our target following.

We could not care less if David Flude, W. Mark Squire, or Katherine Dudtschak follow our reporting, just as long as we reach the potentially vulnerable seniors who could be defrauded and then left flapping in the wind by these corrupt corporations. We are also focused on the adult children who care for the seniors who are not capable of handling their own affairs.

Then, on October 25, 2024, all hell broke loose, with a lot of interest in HomeEquity Bank and their owners.

Turning a blind eye, hoping the truth of their criminal and ethical abuses will just go away.

We cannot discern from the available evidence what exactly it was that caused the 120+ page spike of new interest from several anonymous content reviewers who seem to have a special interest in articles about HomeEquity Bank and the Ontario Teachers' Pension Plan Board (OTPP). We had posted during the previous weeks an article entitled "Left Holding The Bag - HomeEquity Bank" in which we laid out the details of how HomeEquity Bank was losing about $1.5 million a week, or $78,000,000.00 per year, in lost potential opportunity due to our reporting of their decision to side with loan sharks who defrauded senior and veteran clientele. It seems likely that the board of directors of Ontario Teachers' Pension Plan Board (OTPP), which holds HomeEquity Bank as a corporate asset, are not impressed with that reality. They also presumably don't like that they have limited legal recourse to silence this story, as we are telling the truth, we have the evidence to support our claims, and we have a 100% track record of winning in court when our reporting has been wrongfully challenged by the wealthy and the politically connected.

Simply put, these multi-million and multi-billion-dollar corporations are trepidatious about the idea of challenging our not-for-profit, social enterprise in a court of law, where the evidence is all that matters.

Essentially every day throughout the past eighteen months, some employee or contractor, most likely on the payroll of HomeEquity Bank, has perused the content of this website, and/or the one for Five Points Media, or for our commercial division at 3B Solutions. From the randomness of their meandering and the repetitious nature of their journey, it seems clear they are vainly hoping to find something they missed during the previous hundreds of visits undertaken by them and dozens of others. These visitors are essentially always hidden behind a proxy server, pretending to come from various places in the United States, or from countries in Europe and Asia. Yesterday, the focus of the visits was our commercial location services, our team, our studios, our production facilities, and the testimonials of our clients.

The purpose of that visit seemed to be about confirming we are a real video and media production facility, and this was by no means the first time they had visited to confirm that reality.

The true nature and capabilities of our production facilities could easily have been confirmed by Lisa Purchase, who we met as a client through the production of self-promotional videos. She even visited our facilities during the massive rebuild undertaken during the pandemic. Of course, that would have been easier if the one-time top broker had not suddenly departed from Verico the Mortgage Station in a rather indignant manner, or was possibly "thrown under the bus" by David Flude to deflect blame from himself and Renee Dadswell, the broker who actually committed the crime of usury, or loan sharking. Despite 'moving on', for whatever reason, Lisa Purchase is still linked to this story on page one of Google when referencing just her name. That is true of all primary people of focus in this story, and it will remain so until somebody from Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank shows the courage to answer some questions about the indictable offence of Usury, or loan sharking that they committed and then tried to conceal through an other indictable offence of Fraudulent Concealment.

347 (1) Despite any other Act of Parliament, every one who enters into an agreement or arrangement to receive interest at a criminal rate, or receives a payment or partial payment of interest at a criminal rate, is

(a) guilty of an indictable offence and liable to imprisonment for a term not exceeding five years; or

(b) guilty of an offence punishable on summary conviction and liable to a fine of not more than $25,000 or to imprisonment for a term of not more than two years less a day, or to both.

341 Every one who, for a fraudulent purpose, takes, obtains, removes or conceals anything is guilty of an indictable offence and liable to imprisonment for a term not exceeding two years.

Last week, we renewed the domain on which this story is being told, and we have ten other domains in holding that we will be using to counter the most recent wave of illegal censorship, so two years can become ten.

Clearly, hiding is not working, no matter how low they sink, and we know every countermeasure to any attempt by them to illegally censor our right to tell this story. As promised, this month we are engaging in a massive social media campaign that will reach hundreds of thousands of people in high-density regions. We have also advised the search engines of the illegal tactic of delisting that is apparently being used by Verico the Mortgage Station, Verico Financial Group Inc. and/or HomeEquity Bank, most likely the latter, which we have been assured is being addressed. Competitors for all three corporations are now sharing our content, including our videos, and traffic from mainstream media is on the increase. The story of money laundering by TD bank, and recent events in Simcoe County, including the charging of a veteran officer and the Premier calling out the Council for giving themselves unethical raises, are causing more people to find our reports and videos.

Legitimate corporations do not fear filing civil action against a small not-for-profit, they do not hide for more than two years, and they do not resort to illegal and unethical censorship to evade responsibility.

These are the actions of the guilty and the desperate. From their own postings, it is evident that Verico the Mortgage Station is slowly and painfully dying due to a dramatic decrease in business. They have reduced their staff from the mid-twenties to just 16, they have been forced to convert offices intended for an expansion into apartments, presumably to generate cashflow, they appear to have been abandoned by their former allies, and they are now selling their newly-built customized office complex, pitching it as a possible apartment complex in a village of just 700 people.

These realities do not generate confidence in professionals at banks or in the lending market, so they will fall further as one stone after another is yanked from their foundation.

HomeEquity Bank is also clearly being affected adversely by the truth of their own criminal and ethical abuses of trust, no matter whether they want to admit it or not. As we noted in our article "Left Holding The Bag - HomeEquity Bank"

Using the updated number of twelve drive-by visits per week, and the same 50% ratio of lost opportunities, which is conservative, the HomeEquity Bank experiences a loss of opportunity, valued at $250,000.00 in potential income over a ten-year period, every time a visitor to this story chooses to buy into another option that is not a CHIP Reverse Mortgage. That adds up to $1,500,000.00 per week, or $78,000,000.00 per year. In the case of HomeEquity Bank, the lost sales, valued at $213,693.63 per day, are not restricted to those generated by Verico the Mortgage Station. People are frequently visiting our pages looking for information about HomeEquity Bank and the CHIP Reverse Mortgage, and they are coming from every province in Canada.

Hiding from accountability and refusing to defend their actions are the actions of children, not 'ethical financial professionals', which is most likely why so many people are declining their services.

David Flude, the Principal Broker and presumed owner of Verico the Mortgage Station, W. Mark Squire, the CEO and President of Verico Financial Group Inc, and Katherine Dudtschak, the CEO and President of HomeEquity Bank, can hide for as long as they wish, but the uncontested truth of their illegal and unethical abuses of trust are not going anywhere. They can also spend untold hours reviewing every detail of our ethical, respected, and community acknowledged contributions to those in need, investing huge amounts in human resources and third part companies trying to find something that is not there.

Or they can start acting like responsible 'professionals' and explain the reasoning behind their decision to defraud senior and veteran clientele, and to then conspire to conceal the criminal and ethical abuses of trust.