Content

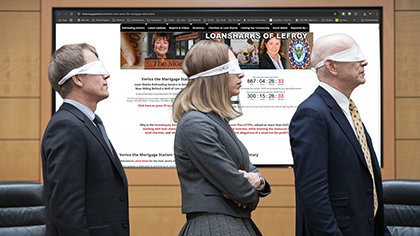

Verico the Mortgage Station - Loan Sharking in Lefroy

This documentary is being produced to protect often vulnerable seniors from being defrauded.

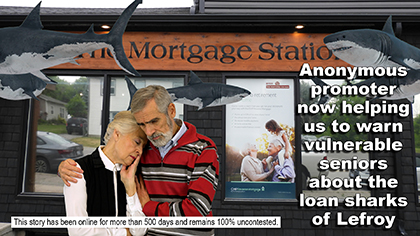

Our allegations remain 100% uncontested, and have in no way been challenged by any party.

This page is not updated daily. Please be sure to visit our Lastest News page.

The above window contains a playlist of multiple videos.

Select your choice in the upper right corner.

The associated articles and evidence are included below.

This 'Reports and Videos' page contains links to full stories and videos pertaining to our expose documentary about loan sharking at Verico the Mortgage Station and mortgage fraud in Canada, which is currently under development for broadcast television and streaming services.

This page is not as frequently updated as the Latest Updates page.

For the most recent information, including new developments, evidence, observations, and visitor feedback, which we update several times a week, please visit our blog page at 'Latest News'.

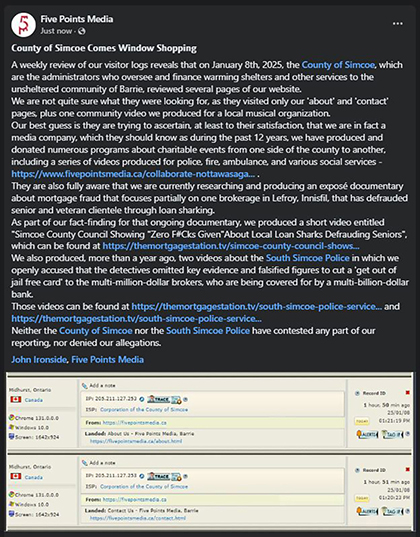

About a year ago, when we moved this story from the Five Points Media website to this standalone domain, we chose to limit discussing this project on our community programming social media. We wanted to see how the subject matter would stand on its own, and we are happy with the results. Yesterday, however, gave us little choice but to mention this documentary, as it is not every day that the County of Simcoe scours our domain, and given the crossover of issues about which we are currently focused, those being mortgage fraud and homelessness, and how they inevitably affect each other and the County of Simcoe, we needed to be open about why they might be visiting. That post can be found here.

The result was the most traffic we have seen in a single spike in many months, and it has inspired us to open 2025 with a bang through social media exposure. Let's see how well and for how long the loan sharking brokers of Verico the Mortgage Station, and their collaborating associates at Verico Financial Group Inc. and HomeEquity Bank can hide from multiple posts on a variety of platforms. Our previous posts on Facebook, that we boosted across the County of Simcoe, were viewed by between twenty to nearly fifty thousand people. Now, as Verico the Mortgage Station slowly fades into history, we will be boosting videos to densely populated regions acrosss Canada where seniors and veterans buy the CHIP Reverse Mortgage from HomeEquity Bank.

As we noted back on October 30, 2024, in the article entitled "Desperate Triad Resorts Again To Censorship", one of the companies involved in this uncontested story of fraud by usury, or loan sharking, and corporate cover-up, those being Verico the Mortgage Station, Verico Financial Group Inc. and HomeEquity Bank, has apparently been working to censor our ability to report on this story of their criminal and ethical breaches of trust, by unethically delisting our website on Google. That action would be a violation of our rights under Section 2B of the Charter of Rights and Freedoms, and also an act of blatant fraud and identity theft, and it stopped immediately after we outed them here for committing the offence.

This is all cloak and dagger, covert stuff, and the work of cowards, so it is hard to say which one did it.

We are able to confirm that in July of 2023, Facebook advised us that HomeEquity Bank had reached out to them, trying to censor our story of how they were collaborating with the loan shark brokers of Verico the Mortgage Station by helping them to conceal how they were defrauding senior and veteran clientele, and the community by defunding our not-for-profit, social enterprise, community channel, that has been responsible for raising awareness and hundreds of thousands of dollars worth of fundraising for hundreds of charities, not-for-profits, and benevolent community groups in Simcoe County and across Ontario.

It is likely we can all understand why they would not want potential clients to know about that.

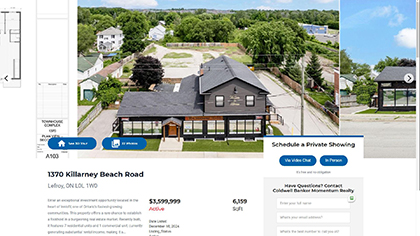

Back in early September, we started reporting about the apparent financial troubles that can be seen to be stifling operations at Verico the Mortgage Station. Those issues are public only because of their own public posts, which include the conversion of offices that were touted as intended for an expansion, being instead turned into apartments, apparently to generate cashflow, the loss of several brokers and agents who were not replaced, and more importantly, the application of a digital 'for sale' sign to the offices of Verico the Mortgage Station, which is at least for now located at 1370 Killarney Beach Road, Lefroy, ON, L0L 1W0.

It is the old story of the village idiot who destroyed his house trying to prove he could defeat a mouse.

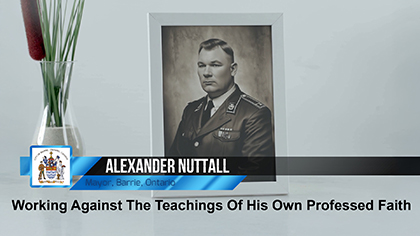

This video focuses on the hypocrisy demonstrated by Barrie Mayor, Alex Nuttall.

Premier Doug Ford's misguided and cruel war on the homeless of Ontario is catching a lot of attention from mainstream media. This also true of Alex Nuttall, the Conservative Mayor of Barrie, who wrote the letter to Doug Ford, asking him to abuse the Notwithstanding Clause to bypass the rights of the homeless community to 'life, liberty, and security of the person' as are guaranteed under Section 7 of the Charter of Rights and Freedoms and the January 27, 2023 ruling of Justice Michael J Valente, SUPERIOR COURT OF JUSTICE - COURT FILE NO.: CV-22-717. Download here.

This is relevant to this story because we are on the front lines and catching a lot of Google searches.

While these fraudsters take money from senior and veteran clientele, or conceal the crimes, our crew and other advocates donate our time and resources to help the victims, who are people just like you.

We apologise for having been away for a few days, and we hope nobody got excited, because neither we nor the truth of this story are going anywhere. During the past couple of weeks, we have found ourselves overwhelmed with advocacy work, trying to house, and also to provide a warming centre for those struggling to live without shelter in Barrie where temperatures are plummeting. Many of these people are victims of fraud, like that undertaken by the brokers of Verico the Mortgage Station, who target senior and veteran clientele, that was then covered for by their profit motivated collaborators at Verico Financial Group Inc. and HomeEquity Bank. So, their stories tie in well with our current documentary. View details of our various efforts at https://www.facebook.com/FivePointsMedia

Full details will be included in the next article, which we are hoping to have online by tomorrow.

Photo and names publish with consent

View original post

View original post

Yesterday, our Producer volunteer as an advocate for a senior couple, Doug and Linda, who are living in a tent in a public park and want simply to have a home so Linda can receive treatment for various medical issues. After that, the fifty-nine-year-old physically assisted for six hours in moving an encampment that was being evicted from private property. We also provided a safe place where they could store their meagre possessions.

Our documentary is exposing how seniors and veterans are being swindled of their life savings by unscrupulous mortgage brokers and lenders.

Each year, on November 11, our society gathers to demonstrate our collective gratitude to the veterans of our armed forces who laid down their lives, who were wounded, often with lifelong ramifications, who suffered from traumatic mental health issues like PTSD, and who lost their youth to the defence of their country.

The leaders of Verico Financial Group Inc. and HomeEquity Bank enjoy the freedoms and benefits that were paid for with the blood of veterans but would do nothing to help when one was defrauded.

Water is the most powerful force on earth, as it not only cuts lines through rock, but also tears down mountains. The effect of erosion is bonded to the incalculable power of persistence. Likewise, the inaccurately named "Chinese water torture" is one of the most effective means of coercion, as random drips of cold water fall over time onto the scalp, forehead, and face of the subject, creating a mentally painful process that generates anxiety, fear, and mental deterioration.

The same can be said about exposure of the truth.

We received a message on the weekend from a visitor who had a few questions, the most pressing of which, to them, is why are these multi-million and multi-billion-dollar financial corporations not suing into silence our small, not-for-profit, social enterprise community media service that donates all services to any charity, not-for-profit, or benevolent community groups that asks.

The reasons are not hard to understand.

For a few weeks in September and October, in kind of an off and on pattern, the brokers of Verico the Mortgage Station, the management team of Verico Financial Group Inc. and the board of directors of HomeEquity Bank all very deliberately stopped viewing our website. The apparent hope was that if we lost what they perceive to be our audience we would stop publishing, like when the Simpsons defeated out of control advertising monsters by ignoring them.

These supposed 'financial professionals' don't seem to understand that they are not our target following.

It is appropriate that tomorrow is Halloween, because it certainly looks like somebody at Verico the Mortgage Station, Verico Financial Group Inc. or HomeEquity Bank is acting very creepy. We know that they don't want you, their prospective client, seeing or hearing about the criminal and ethical abuses of trust they committed, and they sure don't want us speaking about it, and rather than standing up and defending the 'good name' of their businesses, somebody is once again trying to CENSOR the truth to prevent you from being forewarned.

In response, we are spreading the truth over a much larger canvas, to reach more potential victims.

Thank you to those who notified us on Sunday, October 28, 2024, that our domain was not accessible.

Don't worry, we are not going anywhere until the loan sharks who swindle seniors, and those who collaborated to cover for them, are held accountable.

The downtime was caused by a glitch in the system, when our payment for yearly renewal of the domain did not end up where it should have. We could have fixed it immediately, but we were busy donating our time and resources to limit the pain and suffering of those who are forced by greed and social indifference to live unsheltered.

It has been an interesting couple of days for Simcoe County Council and the South Simcoe Police Service as Premier Doug Ford called out Councillors for giving themselves a one-hundred-and-sixty-seven percent increase in salary, and the South Simcoe Police Service announced that a long-term veteran of the force faces discreditable conduct charges amid a sex assault allegation.

Due to Google's search technique of cross-referencing algorithms, both stories have resulted in a dramatic upswing in traffic to our related reports and videos.

Yesterday, we emailed Katherine Dudtschak, the President and CEO of HomeEquity Bank, and Jo Taylor, the President and CEO of the Ontario Teacher's Pension Plan (OTPP), an international mega-corporation worth around a quarter-trillion-dollars which holds that Schedule 1 Canadian Chartered Bank in its dossier of corporate assets. We also carbon copied all the relevant brokers of Verico the Mortgage Station, and W. Mark Squire, the President and CEO of Verico Financial Group Inc., and various members of management at HomeEquity Bank. The Blank Carbon Copy list is private but includes multiple members of the mainstream media who have shown interest in our work, representatives of the banks and other lenders that finance the mortgages sold by Verico the Mortgage Station, and a few select government agencies.

As the brokers, the branders, and the bankers persist in hiding, we are well within our rights to contact whoever we feel might have useful information.

Yesterday, Thursday, October 10, 2024, the Toronto Dominion (TD) Bank was hit hard by the US criminal justice system when they agreed to pay a $3 billion dollar fine in response to fully supported allegations by the Department of Justice that claimed the once trusted bank was laundering money for organized crime that was financed by the sale of fentanyl.

In response, traffic to our story surged overnight as our story just kept popping up in the search engines.

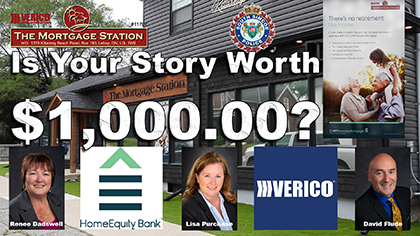

In June 0f 2022, now more than two years ago, David Flude, the Principal Broker and presumed owner of Verico the Mortgage Station decided to ignore the indictable offence of usury, also known as loan sharking, that was committed by his broker, Renee Dadswell, with the assistance of her colleague Lisa Purchase.

David Flude has never denied the crime occurred, nor has he ever defended himself or his brokers against our allegations of committing this indictable offence.

It may have been David Flude who let his pride write a cheque the bank of public opinion bounced due to insufficient ethics, but it seems most likely that HomeEquity Bank will get stuck paying to clean up the mess left behind by the hide and seek brokerage.

The apparently inevitable closing of Verico the Mortgage Station will not be the end of this story.

Given the history of this story, we really must ponder over a title like 'ethical financial professionals', especially when dealing with Verico the Mortgage Station, as all David Flude and his brokers have accomplished is to destroy their own business, dreams of prosperity, and their professional reputations. In his anonymous threat of a contemptuous Strategic Litigation Against Public Participation (SLAPP) lawsuit the too scared to sign his name Principal Broker pompously touted:

" . . . certainly no one here is attempting to get rich from your $200 "

At 02:36, in the wee hours of Saturday, September 28, 2024, we had a visit on our Five Points Media website from a first-time visitor from Oshawa. On the surface this is certainly not uncommon, but this visitor stuck out, because they were not hiding behind a proxy server, they dropped by at the 'too much on my mind to sleep' hour when they really should have been in bed, and they came directly from Google, as if told what to look for. They also only visited one page, about when we flatlined in one email a well-respected lawyer from a prestigious Toronto law firm who threatened to sue us if we did not retract a fully supported story and video about a negligent slumlord who contributed to the untimely death of a disabled man.

"Pride goes before destruction, a haughty spirit before a fall."

Anybody who has ever taken even the basic level of high school physics knows that fire burns up and out, and it does not self-extinguish until ALL available fuel is exhausted. Then, as time passes, it gets bigger. Those with forestry experience know that in a wildfire, the flames usually start with small kindling and work their way up to the massive trees that burn longer and slower, but still end up as coals.

As the bear in the ranger hat is known to say,

"Only you can prevent forest fires."

On December 27, 2023, David Flude sent an anonymous email to our Producer in which he threatened to file an abusive Strategic Litigation Against Public Participation (SLAPP) lawsuit and to attain injunctive relief preventing us from reporting the truth of this story, that he was oh so very confident he would be granted.

However, no court action was ever filed.

As part of his rant, which included threats of legal action that was never acted upon, the Principal Broker and presumed owner of Verico the Mortgage Station noted as follows:

Today we sent an email to Katherine Dudtschak, the President and CEO of HomeEquity Bank, and Jo Taylor, the President and CEO of the Ontario Teachers' Pension Plan (OTPP), which owns the Schedule 1 Canadian Chartered Bank. We also carbon copied it to about thirty representatives of the various banks and financial companies that provide financing for mortgages to the brokers of Verico the Mortgage Station. It is worthy to note that NONE of those lenders has ever blocked our emails or deleted them unread, and most of them are in the habit of forwarding our information to a as many as ten other members of their team.

Several have also reached out in confidence seeking more information.

There was a time, just two years ago, when the criminal and ethical abuses of the brokers of Verico the Mortgage Station seemed so well covered by Verico Financial Group Inc. and HomeEquity Bank that they openly displayed how much they felt invulnerable to being exposed for the crimes they had committed. That is understandable as they believed they were fully backed by another multi-million-dollar corporation and a muti-billion-dollar Schedule 1 Canadian Chartered Bank that was owned by the Ontario Teachers' Pension Plan (OTPP), a quarter-trillion-dollar international megacorporation. They had also managed, somehow, to 'motivate' a detective of the South Simcoe Police Service to omit key evidence and falsify figures to evade charges of fraud by usury, or loan sharking, as was committed against a senior, veteran, and philanthropist who has donated more than $700,000.00 worth of services to greater than 180 local charities, not-for-profits, and benevolent community groups.

Being 'above accountability' did not last long.

Currently, and by a wide margin, the most viewed pages on our website are those pertaining to the involvement of the Ontario Teachers' Pension Plan (OTPP). We can tell some of them are most likely lawyers or researchers working for that quarter-trillion-dollar corporation, but there are also a lot of visits by people not hiding behind proxy servers, from locations across Ontario, which likely represent the teachers who have spent their entire professional careers feeding that beast.

The members and board of the OTPP are not likely happy being associated with loan sharking seniors.

Samuel Johnson, the English writer, is credited as saying: "The true measure of a man is how he treats someone who can do him absolutely no good." That statement is very relevant to our reporting of this story. For the same reason registered sex offenders are not permitted to work at daycares, those who have been caught and exposed using tangible evidence after willfully and knowingly defrauding potentially vulnerable seniors should be banned from providing services to them.

When discussing loan sharks, fraud, concealment, and illegal abuses of trust, that ruling should apply to all.

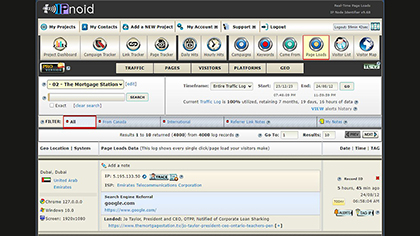

Late on August 28, 2024, less than 36 hours ago, we posted the story "Learning It Is Not Paranoia If They Really Are Watching You - HomeEquity Bank", and last night, it was scanned and indexed by the Bing search engine. As can be seen in the image below, Google got there yesterday, just a few short hours after the post.

We were happy with the four-day turnaround on indexing of our stories, and this is truly outstanding.

Yesterday, Monday, August 27, 2024, was one of the busiest days on our website during the past six months, and much of the credit would seem to go to researchers or executives of the Ontario Teachers' Pension Plan (OTPP) which holds the HomeEquity Bank as an asset within its massive international, quarter-trillion-dollar holdings. They did not appear to be scanning our pages in search of content about the Schedule 1 Canadian Chartered Bank. Their interest appeared to be rooted in what we have had to say about the Ontario Teachers' Pension Plan (OTPP). It is only speculation, but it would appear from their content choices, that the big dogs are most interested in how Katherine Dudtschak has handled, or mishandled, her response to our fully supported allegations of loan sharking by the brokers of Verico the Mortgage Station which were committed while they were arranging a CHIP Reverse Mortgage sold by the HomeEquity Bank. We can only guess that the Ontario Teachers' Pension Plan (OTPP) is concerned about why they are now being discussed, and what harm the truth can do to their corporation as we are now openly reporting about the mega-corporation that holds the bank's leash. Some of the articles they reviewed include:

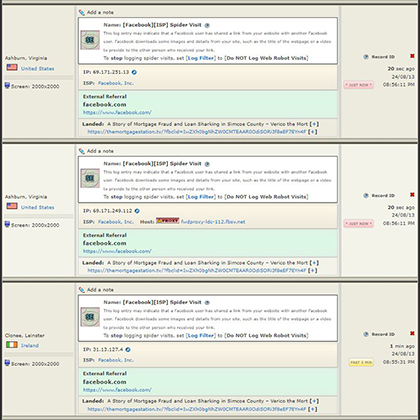

This short snippet of some visits yesterday provides insight into how different this situation is now than a few months ago. They also say something about how our exposure is affecting those who are being exposed for loan sharking seniors through a provincially licensed mortgage brokerage. We freely admit that we omitted other visits that occurred during this time period, as these are the only ones we wanted to talk about.

We have the right to withhold details until we release the documentary to all potential victims in Canada.

This short snippet of some visits yesterday provides insight into how different this situation is now than a few months ago. They also say something about how our exposure is affecting those who are being exposed for loan sharking seniors through a provincially licensed mortgage brokerage. We freely admit that we omitted other visits that occurred during this time period, as these are the only ones we wanted to talk about.

We have the right to withhold details until we release the documentary to all potential victims in Canada.

When Lisa Purchase suddenly departed from Verico the Mortgage Station, we could not tell if her decision was indeed hers, or if David Flude and Renee Dadswell had 'thrown her under the bus' to protect themselves against repercussions for their own criminal and ethical breaches of trust.

To go from an office in a brokerage to working as an online broker seemed like a big step down.

We know that there are disgruntled ex-employees at every business, and especially so at huge corporations. However, to be fair, we looked at a few review sites, and in the case of HomeEquity Bank, the ONLY good reviews we found were by currently active managers. From what we read of EVERY former employee; it is little wonder that those who want to continue working there are saying nice things.

Former employees described a metaphorical Dickensian sweat shop of unreasonable demands.

We noticed a new pattern during the past week to ten days. It is one of chronic denial, and the vain hope that if those who we are exposing for having committed criminal and ethical abuses of trust don't acknowledge the existence of this expose documentary, then magically, nobody else will either. We see it every day on the news currently, as Trump is repeatedly refusing to accept that he is mistaken about almost dying in a helicopter crash with Willie Brown, even though that former mayor of San Francisco flatly denounces it and laughs whenever asked about it by the media. Trump has, in fact, taken his denial of error so far as to threaten to sue the New York Times for exposing his denial and the reality, and former Mayor Brown is cautioning Trump to stop telling the lie on threat of civil action.

Denial is a short-term sense of security, not a solution.

It came as a bit of a surprise yesterday morning, when we logged onto Facebook and found ourselves invited to six different private mortgage funding groups. Our memberships were confirmed this morning. Although anonymous, the invitations were obviously all from the same source, as we had never received such private group invitations before. The invitations were likely from somebody in the mortgage industry, and likely a competitor to Verico the Mortgage Station, Verico Financial Group Inc., or HomeEquity Bank. This fits with our notice yesterday of our content being shared on Facebook. Details are in our article from yesterday, entitled "Plans in Play to Use Social Media to Ensure the Greatest Exposure".

We accepted all six invitations and did a little snooping around, which is where we found our content shared in several places on four of the groups.

Last night, we were notified for likely the tenth time this week that somebody had shared content from our website to their Facebook page. This time, the person posting our content was behind a proxy server, which we understand given the subject matter and the fact that one of the corporations being reported on is the quarter-trillion-dollar Ontario Teachers' Pension Plan (OTPP), which holds the HomeEquity Bank in its dossier of assets. In the notification, Facebook advised:

This log entry may indicate that a Facebook user has shared a link from your website with another Facebook user. Facebook downloads some images and details from your site, such as the title of the webpage or a video to provide to the other person who received your link.

Although we are happy with the traffic to our website, we think now is the time to push on social media.

Just five days ago, on August 7, 2024, our Producer wrote to Jo Taylor, the President and CEO of the Ontario Teachers' Pension Plan (OTPP). He also made the letter available for download. That corporation is a massive international conglomerate of companies and investments valued at about a quarter of a trillion dollars. Amongst its assets is the six-billion-dollar HomeEquity Bank, which as a result of their actions has made itself a central figure in our expose documentary.

So, it came as little surprise that this morning somebody found that story through Google.

A few weeks ago, while volunteering as part of a street outreach team helping the homeless and unsheltered community with food and the necessities of life, our Producer came across a distraught man who was sitting in a park cutting himself with a knife. After some conversation, trust was earned, and the man revealed that he had recently lost everything and had just been discharged from mental health care at the local hospital. Now, he advised, he was seriously considering suicide. The team immediately reached out to their contacts in the crisis management section of emergency services and waited with the man until help arrived in the form of an ambulance and several specially trained police officers.

That is what responsible adults do, and not just walk away, hoping everything will be alright.

Yesterday, our Producer reached out to Mr. Jo Taylor, President and CEO of the Ontario Teachers' Pension Plan (OTPP), a mega, quarter-trillion-dollar, international conglomerate that holds the HomeEquity Bank as an asset of their corporate empire.

We could never have imagined two years ago when we started research for this expose documentary that we would ever have to go this high in any corporate food chain. However, David Flude refused to take any action about the deception and fraud by loan sharking that took place at Verico the Mortgage Station. Following that, W. Mark Squire, the President and CEO of Verico Financial Group Inc. turned a blind eye in his own best interests and refused to investigate. Then, Yvonne Ziomecki-Fisher, the Executive Vice President, Marketing and Sales at HomeEquity Bank refused to do anything other than assign a minion to arrange a patronizing phone call during which he 'explained' to the former international journalist and college instructor how 198.25% in interest and fees is not loan sharking.We saw hope for a revival of ethics when HomeEquity Bank hired Katherine Dudtschak as CEO and President, but she turned out to be just another 'one of the boys'.

For more than a year, most likely third party contractors working on behalf of some or all of Verico the Mortgage Station, Verico Financial Group Inc., and/or HomeEquity Bank have been scrounging the content of our various websites, looking for something . . . anything they think they can use to coerce us to stop warning seniors and other potential victims about the loan sharking, fraud, and cover up they have committed. For example, while writing this article, somebody from Barrie, running a Mac from an often-seen Bell Canada IP address, is researching an article by Five Points Media from February of 2022, that has nothing to do with this story. It is about how our team exposed a negligent absentee slumlord who the evidence supports contributed to the death of a disabled man.

That apparently obsessed 'researcher' is now on their sixth visit to the same story within the past hour.

It was more than eight months ago when David Flude lamely tried to 'serve' upon our Producer a legally unsupportable and pathetic attempt at intimidation disguised as a do-it-yourself 'Notice under the Liable and Slander Act' regarding our fully supported allegations of lies, manipulation, and loan sharking. Not only did the Principal Broker of Verico the Mortgage Station neglect to retain council to send the huff, puff, and bluff best bid at bullying, he sent his bluster and blather anonymously through a generic email address. Then, based on our fully supported push back reply, David Flude turned tail and ran away from ever filing his pompous prognostications with any court.

That seems to be when he learned that threats of civil action only work against those who are doing wrong.

Following the publication yesterday of our article "Did Lisa Purchase Jump Ship, Abandoning Verico the Mortgage Station?" some of our industry insiders contributed that Verico the Mortgage Station has become known not only for loan sharking, and charging interest rates of nearly two hundred percent to senior and veteran clientele, but also for appeasing the corporate powers above by sacrificing those most loyal to them. Sorry, loan sharks, but that will not silence our reporting about your crimes, nor about the legal and ethical violations of your allies.

We know that is commonly called 'under the bus' or 'walk the plank', but we liked this graphic. 😉

We learned a few days ago from one of our industry insiders that about two weeks ago, Lisa Purchase left David Flude and the brokers of Verico the Mortgage Station. This action, we are told, was likely made to salvage the tattered shards of her career and reputation, both of which, according to sources, are now virtually destroyed by our exposure of the loan sharking by Renee Dadswell that Lisa Purchase forced upon her client, and the cover up and pathological level of lying by David Flude.

It could also be that due to pressure from above, somebody had to be thrown under the bus.

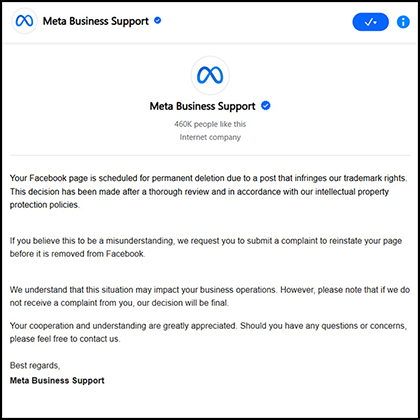

People who use Facebook to promote their business will be familiar with these 'warning' posts. They are scam posts from fake representatives of Facebook or 'affiliated' companies who use the threat of deleting your page to draw you into clicking a link to a harmful page, to convince you to pay them a "fine", or to get you to log into your page so they can steal your log in and password.

They are also used by unscrupulous corporations to intimidate, threaten, or extort smaller competitors.

We noticed that the number and variants of these scam bots suddenly exploded, by a factor of at least ten times, first on our new page entitled "Mortgage Fraud Canada", which we will be using to promote this story across Canada, and then to a lesser degree on our Five Points Media page.

We cannot say for sure, but it appears that the multi-million and multi-billion-dollar corporations have now been reduced to hiring online con-artists to send new daily versions of these easily filtered 'threats', and if that is true, we truly feel pity for how far the once mighty have fallen.

Recalls and corporate policy corrections happen regularly in virtually every ethical Canadian company, and not only when it becomes known that the corporation faces possible liability for errors made in the production of their products, or there is potential harm to customers. We received this notice about Naloxone due to our direct boots-on-the-ground street outreach charity work with the unsheltered community in Barrie, to whom we distribute Naloxone when providing essential food, clothing, and tools of survival like tents and sleeping bags.

. . . in this metaphor, the HomeEquity Bank is the dirty cops, protecting the street dealers, and Katherine Dudtschak is the idealistic rookie who was going to 'make a difference', at least until she accepted 'motivation' to ignore her ethics and became part of the problem.

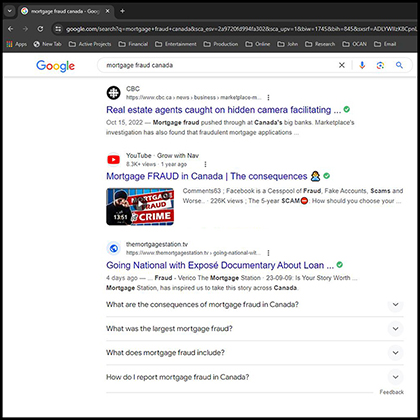

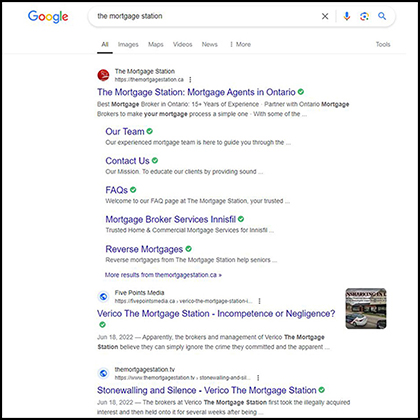

A couple of days ago, we were split testing our search engine optimization and were delighted to see that a Google search for "Mortgage Fraud Canada"brought up our website on page one. This enables us to better warn potential victims of the lies, manipulation and loan sharking by the brokers of Verico the Mortgage Station, and the negligence and lack of customer protections demonstrated by Verico Financial Group Inc. and HomeEquity Bank. Then we noticed that the discovery of the search was not related to one of our older, more well-established pages, but was linked to "Going National with expose Documentary About Loan Sharking at Verico the Mortgage Station" which was uploaded just four days previous.

We are editing those videos now and will soon be boosting them to Canada's most populated regions.

Our story was the third post on page one, appearing after a two-year-old story by the CBC, and a year-old YouTube video called 'Mortgage Fraud in Canada'. So, we were quite happy with our results, especially since that article had been online for only four days. Our link also referred to other relevant links within our ongoing presentation of the truth of this story of usury and criminal collaboration.

The tactic used by the loan sharks and their allies has been to hide, but now exposure is unavoidable.

Today, July 20, 2024, the Teddy bears of South Simcoe will once again be marching to the beat of fun, as children from across the region play, dance, parade with their stuffed buddies, and have a great day with their families and new friends. We are showing this because videos like this one, which we produced about the first picnic held two years ago, is exactly the kind of service that we donated to every charity, not-for-profit, and benevolent group that asked, but which we can no longer provide due to the actions of the brokers of Verico the Mortgage Station, and because of the decisions by their allies at Verico Financial Group Inc. and HomeEquity Bank who have covered for their crimes these past two years.

Does it get any sleazier or more reprehensible than robbing multiple generations of families of cherished memories because as a 'trusted financial professional' you defrauded a philanthropist by loan sharking?

The borderline criminal attitude demonstrated so far by Katherine Dudtschak, the supposedly ethical new CEO and President of HomeEquity Bank, as demonstrated by her decision to perpetuate a policy of protection for the loan sharks of Verico the Mortgage Station, has inspired us to take this story across Canada.

That is, after all, where our documentary will be seen on broadcast television and streaming services.

This Story of Loan Sharking and Deception is Simply Not Going Anywhere - Verico the Mortgage Station

As we noted yesterday, David Flude and the brokers of Verico the Mortgage Station, along with their allies at Verico Financial Group Inc. and HomeEquity Bank seemed to be working under the impression that if they hide from reality we will go away. Apparently, last night they changed their tactics, once again, as although they will likely claim they are not working together, representatives of two out of the three main collaborating corporations suddenly dropped by last night, one quite late.

Then we had multiple hidden visitors overnight, evidently playing catch-up of what they missed.

Throughout the past few days, each and every one of the criminals and collaborators who have been exposed through our fully supported reporting have conspicuously all suddenly stopped reviewing updates on this website. Apparently, once again, they are falling back on the repeatedly tried and consistently failed tactic of hiding under the covers like children trying to evade the monsters of their own creation by believing that 'If I can't see you, you can't see me.'

This 'tactic' of denial has been tried many times, and two years later we are still here, stronger than ever.

We are now walking the path that would be taken by any investigative journalist seeking to learn the truth about unethical lending practices and collaborative corruption within the mortgage industry. It is also the path of denial and obstruction that would have to be followed by any senior with a complaint regarding being defrauded, which is why we are producing this expose documentary. So far, we have worked our way up from the minions to their management, to the money managers, and now to their masters, and we are learning new details and picking up allies along the way.

Nobody hides for more than two years if they have done nothing wrong.

When Katherine Dudtschak was hired as President and CEO of HomeEquity Bank, replacing the retiring Steven Ranson, a twenty-seven-year veteran of those positions, she did so with a flare and style of her own, and the promise that the bank that caters to seniors might just have a reboot of ethics coming its way.

However, what seems to have happened is capitulation, as she has lined up with the fellas to continue covering for brokers who defraud seniors.

We received a message yesterday from a self-identified 'frequent visitor' to our website who asked, "Your story is interesting and clearly supported so why is it not on mainstream?". The answer is simple and two-fold. First, we have been contacted by several corporate network media sources, but we have declined them the ability to steal our story or to misrepresent the facts. One right-wing US network wanted to do a feature piece, but their reputation is abhorrent, and we did not want to sully our reputation through association. Second, we frankly don't trust any of them as they are all corporate, and as we have seen through the morally corrupt actions of the brokers of Verico the Mortgage Station, the management team of Verico Financial Group Inc., and the board of directors of HomeEquity Bank, selfish is as corporate does.

On one side, you have the Ontario Teachers' Pension Plan valued at C$241.6 billion, and on the other a small, not-for-profit community media channel.

People know who the snakes are in this story. However, those who defrauded a senior and veteran, and committed the indictable offence of usury, or loan sharking, and 'motivated' a detective to omit key evidence and falsify figures to conceal their crimes; well, they are still feigning innocence, anonymously, lying about the philanthropist who they defrauded, professing innocence but refusing to prove it, covering for criminal and unethical activity, and working to hide their crimes through censorship, all while hiding from their responsibilities to a client.

So, now we are rolling the dice on a game of corporate snakes and ladders.

Yesterday, our Producer , a well-known and highly respected philanthropist within our community, met with a long-term friend who, after close to thirty years of service had retired this year from teaching. Our friend had worked with our crew on several charitable community projects before the pandemic. The friend, who we will not in any way identify, is also what David Flude would fraudulently describe as an 'agitator', as sometimes when you are helping those in the greatest need, you have to rock the boat of complacency. Each collaboration resulted in successfully raising awareness and funds for various charitable and community organizations, and our friend has continued to follow our work. That loyalty includes the story of loan sharking by the brokers at Verico the Mortgage Station and the coverup attempts by Verico Financial Group Inc. and HomeEquity Bank.

That was when our friend connected the dots to the Ontario Teachers' Pension Plan (OTPP).

One thing we have not been able to figure out from day one of this story, more than two years ago, is why the management teams at Verico Financial Group Inc. and HomeEquity Bank initially chose to support the loan sharks, and of course now, why they continue to do so. To the best of our knowledge, the only person who made any money from committing the crime of usury was Renee Dadswell, and she certainly did not earn enough to justify the fully supported, uncontested, public allegations we have made against all three companies that they are clearly too fearful to contest in court. It would have been infinitely wiser for everybody if two years ago David Flude had instructed his broker to pay back what she skimmed, instead of trying to justify her crimes, and for W. Mark Squire and Yvonne Ziomecki-Fisher to have investigated the brokerage for other potential issues of trust, especially regarding seniors.

Back then, that would have been the end of it.

Are the knives coming out now that somebody must be blamed? After two full years of hiding and denial, will David Flude the Principal Broker at Verico the Mortgage Station be forced to admit he knowingly allowed his brokers to defraud senior and veteran clientele who were buying a CHIP Reverse Mortgage from HomeEquity Bank? Will W. Mark Squire, President and CEO of Verico Financial Group Inc., be able to excuse his refusal to investigate fully supported allegations of fraud by usury that he knew were being committed by brokers working under the flag of Verico Financial Group Inc.? Will HomeEquity Bank finally act honourably?

Or will this be like a financial and banking industry slasher movie with every corporation for itself?

It seems that our educated guess about a pending judgement (June 27, 2024, on the Latest News page 'It Might Just Be That Judgement Is Pending - Verico the Mortgage Station) might have been right on the money, because Thursday night and all day yesterday, our traffic was the busiest we have seen in several weeks. During the wee hours of the morning, during the hours of 2:00, 3:00, and 5:00, one, or possibly two, insomniac visitor(s) viewed more than 140 pages on both this stand-alone domain and our website for Five Points Media. The final totals, as of midnight last night, were 97 visits to the Five Points Media page and 102 look-sees of this stand-alone domain.

Research was clearly the intent of the visit.

It is the pinnacle of cowardice to break the law by stealing from your trusting client, and then to breach your ethics by refusing to abide by the regulatory requirements that compel you to meet with them, and then to hide from your responsibilities for more than two years. It is also embarrassing to everybody when the exposed thieves try to threaten their victim, but then turn and run away when their target of bullying not only holds their ground, but publicly exposes the true nature of cowardice behind the grandiose but vacuous threats. Remember, this is a story of three multi-million and multi-billion-dollar corporations being afraid to challenge a small, not-for-profit, social enterprise, community media service.

How much longer will their billion-dollar buddies wallow in the muck to support obvious criminals?

One of the most dangerous issues when dealing with an egocentric person, such as a narcissist or a pathological liar, is that they see nothing wrong with ANYTHING they do, and they have no issue with dragging innocent others into their criminal and ethical abuses and then 'throwing them under the bus' to save themselves.

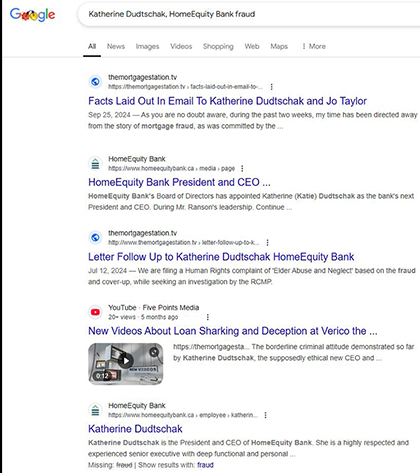

Katherine Dudtschak, the new President and pending CEO of HomeEquity Bank, is now firmly linked by Google to loan sharking and other criminal and ethical breaches of trust, which makes us ask if she is next in line to be 'run over' by the loan sharks of Lefroy.

On June 12, 2024, we posted on the 'Latest News' page a true copy of an email from our Internet hosting company, in which we were advised that we had once again exceeded our bandwidth limitations. Upon examination of our cPanel, it became clear that essentially all the increased traffic was creditable to the website at www.themortgagestation.tv.

That email was the sixth of it's kind since we moved this story to a dedicated domain in January of 2024.

Once again, as we have done each time we were notified of similar levels of unbridled interest, we doubled the available bandwidth to accommodate the increasing quantity of visitors. For those who did not major in math related studies, those numbers mean we have doubled our traffic every month for the first half of the year, updating our bandwidth on an exponential curve, which represents . . .

. . . an increase of thirty-two times our original level of traffic, and in six more months that will be by a factor of 204,800 times, and in another year 1,307,200, etc.

The HomeEquity Bank, which caters to seniors seeking to remain in their homes, have been at the centre of this story since day one, as it was their CHIP Reverse Mortgage that was used by the brokers at Verico the Mortgage Station to coerce loan shark levels of interest and fees from our Producer . Under Steven Ranson, the well-established President and CEO, their management team, under the direction of Yvonne Ziomecki-Fisher, Executive Vice President, Marketing & Sales, did NOTHING to investigate the criminal acts or to protect the financial security of their client, a senior and veteran. Instead, they chose to ignore the evidence provided, mirroring the see-no-evil tactics of the 'motivated' detectives of the South Simcoe Police and the 'couldn't care less' councillors of Simcoe County Council. HomeEquity Bank refused to acknowledge the complaint which according to their own public propaganda should have been resolved pursuant to a structured process.

So, we introduced ourselves to Ms. Dudtschak, and relayed to her a few facts about the loan sharks who her new management team have been protecting for almost two years, hoping she might change the status quo.

Nine days from now, Tuesday, June 18th, 2024, marks two years since we posted our first article about the how the brokers at Verico the Mortgage Station committed the crime of usury, or loan sharking, as a means of defrauding a client who is a senior, a veteran, and philanthropist who has helped hundreds of charities to raise money and educate the population. There is one very powerful reason why this website, that was created to support our documentary in production about Mortgage Fraud, is still here.

We are telling the truth, and we have the evidence.

The only strategy used so far by the brokers at Verico the Mortgage Station and their allies at Verico Financial Group Inc. and HomeEquity Bank has been to run and hide, refusing to reply to the concerns of their shared client, and ignoring the crimes that were committed by provincially licensed entrusted 'professionals'

Those are hardly the actions of the innocent.

Neither the Wealthy nor Powerful Are Above the Court of Public Opinion - Verico the Mortgage Station

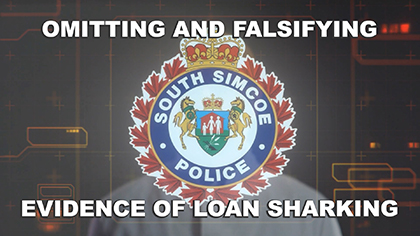

We have been busy for the past few days, working on various projects pertaining to a subject that is directly relatable to our ongoing expose documentary about fraud by usury, or loan sharking, as was committed by the brokers at Verico the Mortgage Station, and an abuse of public trust undertaken by detectives of the South Simcoe Police Service who were somehow motivated by the multi-million-dollar brokers or their multi-billion-dollar allies to omit key evidence that proves conclusively that the wealthy and influential small town business owners committed the indictable offence of usury that brings with it a prison term of up to five years.

It is obvious why neither The Mortgage Station nor the South Simcoe Police Service has contested any of our allegations, nor challenged our evidence in any court.

What kind of business defrauds seniors and veterans, and knowingly defunds a benevolent community-focused not-for-profit that provides fully donated services to any charity that asks? If you live in Simcoe County, you have a right to know. Canadian families are enduring difficult times, and we all know it is the corporations that are making life harder through artificially manufactured inflation and other scams that pick all our pockets. That is why we are producing an investigative documentary about mortgage fraud in Canada, with one story based in Simcoe County.

Ours is a story of criminal fraud, deception, loan sharking, and lack of accountability as committed by the brokers at Verico the Mortgage Station, located in Lafroy

It is a strange marketing strategy to brand yourself in the public eye as being the local business that syphoned into their greedy pockets the operational resources of a benevolent community social enterprise that helped every charity, not-for-profit, and benevolent community group that asked. However, that is evidently the image desired by David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and by association their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank. Fortunately for them, their plan is working, and that brand is sticking to them like glue.

Maybe next time they can take money from sick kids, the disabled, the infirmed, or injured puppies . . . except, they have already done all that.

Although not factually accurate, fear is the reason elephants are fabled to hide from a mouse. In this case, the trepidation being displayed by David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank, is a self-protective response to evidence they know we have that proves both individual and collective criminal and ethical violations of public trust.

Why else would these multi-million and multi-billion-dollar corporations be so afraid of a small, not-for-profit, social enterprise, community media service?

The online media sharing tools we signed up for on April 17, 2024, see details on this Latest News page, include an analysis tool for reviewing the content reviewed and the online journey of those who visit our website. We copied over the data from our visitor analysis tools that have for several months kept track of who visited where, for how long, and where they went from there. The results were interesting, but not overly surprising.

The first recommendation by the AI tool was to produce more of the longer and more detailed videos.

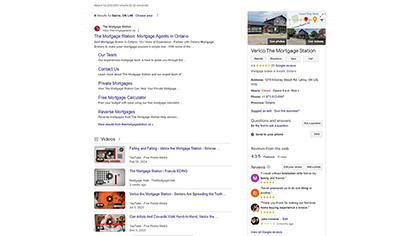

We were quite surprised last night to be advised by our AI-driven online analysis tools that our videos on YouTube had suddenly jumped in rank quite dramatically, and also with regards to searches for 'Verico the Mortgage Station' and other keywords and phrases. On Thursday, when we first experimented with the tools, we ranked below the posts for the Loan Sharks of Lefroy, as either they have been posting anywhere and everywhere, or they have hired an SEO consultant, or both.

Last night, our videos jumped to top positions at two, four, and five, second only to their paid advertising.

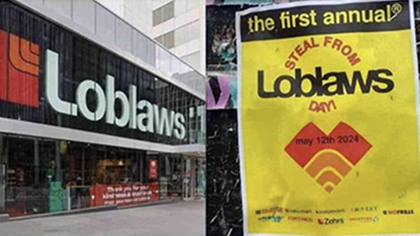

There is now a rapidly growing social media-spawned political movement being generated and perpetuated by struggling Canadians who are tired of paying more, getting less, and being told to simply accept being screwed without complaining.

That is why our expose documentary about mortgage fraud against seniors in Canada is so perfectly timed.

Posters like this one, targeted specifically at Loblaws, are popping up all over Toronto and in other major cities, as activists are educating the public about the empowerment provided by being part of a movement to draw attention to the fraud of inflated food prices.

Last night, in a post by a very respected Simcoe County charitable organisation that helps the homeless community, the leader noted the following about our Producer

. The public post can be found here.

"Heartfelt thanks to our awesome outreach volunteers Ashleigh and John for going above and beyond tonight and staying with our friend at hospital till she felt comfortable. You being there and advocating for her made the difference between her staying and getting the care she needed or leaving the hospital before getting the help she needed. This is how we care for each other. We have a beautiful team!"

An altruist who spends hours in a hospital helping a stranger make it through tough times is hardly how David Flude described him when lying to a client.

We had an interesting weekend of traffic, with new and established visitors coming to our reports and videos from all over Canada. One thing we could not help but notice is that although the iOS operating system is used by about 60% of the mobile online market, more than 92% of our weekend visitors were mobile Apple users . . .

On January 16, 2024, 90 days or exactly three months ago, we released an article about how hundreds of other Verico brokers appeared to have visited our homepage on masse, apparently based on the invitation of their head office at Verico Financial Group Inc. That time period is often used in legal agreements, such as a promise to end this ongoing criminal exposure by a certain date, by whatever means. Essentially, every one of those assumed brokers used the latest iPhone running the most recent iOS.

We are still here, which could be why we are once again drawing so much attention from those with a vested interest in this story.

Charles Caleb Colton, an English cleric and writer, is often cited for his quotes and observations of the human condition. One such pearl of knowledge is this 19th-century reflection:

"The mistakes of the fool are known to the world, but not to himself. The mistakes of the wise man are known to himself, but not to the world."

The general consensus, including that of a business banker at one of Canada's Big Five Banks, is that David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank, are making fools of themselves by perpetuating the need for our ongoing and growing exposure of their ongoing criminal activity and unethical abuses of trust.

Psychology has shown that people make a conscious choice to be one of the good guys in a story or one of the villains. The decision is governed by a basic understanding of ethics. The classic western comedy "Rustlers' Rhapsody" asked the question 'what would happen if two white-hatted 'good' cowboys were on opposing sides', but that seldom happens. In any story of conflict, such as our expose documentary, there are thieves, liars, loan sharks, con artists, or other despicable villains, and then there are people of conscience working to stop them from harming others or taking advantage of more victims.

This wheelchair is a perfect metaphor for discussing the relevant roles in this story.

The question has been asked why are we so diligently pursuing David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank for committing the crime of loan sharking, turning a blind eye to the criminal abuse of a client who is a senior and veteran, or then trying to cover it up, especially as the outstanding amount from the crime is not a high dollar value.

We think that if you understand ethics,

the first reason should be obvious to everybody.

Yesterday we received a message from an unidentified man who said he was doing some research on buying a house in Simcoe County when he found our fully supported reports and videos. "I thought journalists like you were a thing of the past. Good job!!! You probably saved my family a lot of trouble and money. It takes balls to take on these lenders but what the hell is stopping the police and local council from finding you dead in a ditch? You must know some powerful people."

Our first thought was a threat, but we backtracked it to a five-year-old account based in the GTA.

The old idiom "hold his feet to the fire"alludes to an ancient test of character that, sadly, David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank, appear to be failing in a very public and humiliating way.

Everybody knows that it is only those who are ashamed of their actions who wallow in the darkness.

We have heard some of the stories that are reportedly being told about us by David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station, and their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank. We say let the evidence show the truth.

We are not the ones who are hiding,

nor are we afraid to present our evidence in a court of law.

Why would several multi-million and multi-billion-dollar corporations be so obviously afraid of a small, not-for-profit, social enterprise media company that they will threaten to sue us as a method of oppressing the truth, but are terrified by the prospect of balancing their threats and any evidence they might have against our fully supported allegations in a court of law?

The innocent has no reason to fear judgment, nor the scrutiny of their evidence.

People make mistakes, and sometimes they unknowingly break the law. However, the moment they perpetuate the crime, it is no longer a mistake, and they have chosen a path of immorality and unethical behaviour that can ultimately lead to self-destruction. In law school, the example is given that a doctor is called while in a restaurant for an emergency procedure that only they can perform, and when they cannot find the waiter to pay, they simply leave. If they come back later, explain the emergency and pay the bill, no charges would ever be laid. However, if they remember the bill, and have the opportunity to pay it, but choose not to, then they are a criminal as they have demonstrated 'mens rea' or 'a guilty mind'.

On March 27, 2024, our Producer was in downtown Barrie, meeting with a representative of one of Canada's 'Big Five' banks to discuss short-term investments that would help to strengthen the larger part of the budget we are due to receive forthwith to complete research and production of this documentary about mortgage fraud in Canada. It did not take long for the subject of the production to be raised or for the jaw of the banking professional to hit the floor. The next words out of their mouth were: "Is this person mentally ill? I mean you don't let something like that be told about you. If it is true, you fix it, and if not, you silence it."

On March 15, we sent an email to all of the brokers listed as providers of funding for the brokers at Verico the Mortgage Station. This action is fully ethical and legal, especially as the brokers at Verico the Mortgage Station continue to illegally withhold money that they stole from our producer through usury, or loan sharking, and they have chosen to hide for more than a year and a half, and to not reply to his emails even though, by their own admission, they are legally and ethically required to do by the regulations of the Financial Services Regulatory Authority of Ontario (FSRA). Many of the lenders read the email immediately, and several forwarded the content to as many as twenty others within their company. We are only guessing, but this response would suggest that the lenders are growing tired of the excuses and misinformation being relayed by the brokers at Verico the Mortgage Station and supported by their allies W. Mark Squire, President and Chief Operating Officer, Verico Financial Group Inc. and Yvonne Ziomecki-Fisher, Executive Vice President Marketing and Sales of HomeEquity Bank.

According to real estate statistics, the average mortgage in Ontario for first-time buyers is around $425,000.00. The average commission that a broker earns is between 0.5% and 1.2% of the total mortgage amount. So, for purposes of simplifying the math, we will average that to 0.8%. That means each mortgage sold is worth to the brokers at Verico the Mortgage Station approximately $3,400.00. Verico the Mortgage Station claims sales of $6,000.000.00, meaning they sell approximately 1765 mortgages per year. So, if we go with the lower number for lost opportunities, eight losses per week would represent 416 mortgage sales per year which represents 23.57% of sales, or $1,414,200.00.

That, by anybody's standard, is a lot of money to lose just to avoid having to testify in court or present your evidence on camera, unless of course, you are guilty of the allegations, and potentially more.

How low does a person need to sink into depravity to 'justify', at least in their mind, cheating seniors, and veterans, and stealing resources from charities? Also, what is missing from the morality of anybody who becomes an accomplice after the fact by helping that person who is so devoid of conscience? Most people are not so morally bankrupt, as they have ethical guardrails in place that compel them to fix or at least accept the wrongs they know they have done to others.

This is especially true when a high level of professional trust and ethics are issues of concern.

Most large companies hold an annual convention where their top salespeople and other movers and shakers meet to congratulate each other for another 'best year ever' and give each other awards that mean nothing to anybody but their inner circle. This year, it seems the brokers who work under the banner of Verico Financial Group Inc. met in Barrie, Ontario, on the homepage of our website. If not, maybe it was their competition?

Since Friday, January 12, 2024, we have been visited by several hundred new visitors from across the country, and we have now analyzed some of the data to better understand who most of them were.

We got a bit of a surprise yesterday when we received a call from somebody identifying themself as a producer of social issues reports for a very prominent American media conglomerate. We will not name them here, as this is all very preliminary, and we are very open to saying that the network that is interested is most definitely not our first choice for collaboration, and we told them so.

We are not sure why, but this offer is tripping our 'Spidey Sense' and we are hoping to get some feedback from our followers, many of whom have known us and our work for up to 14 years.

On Friday, January 12, 2024, our producer once again wrote to the 'ethically responsible' bankers and lenders who provide the funding for the mortgages provided by the brokers at Verico the Mortgage Station. We acquired the list from a public posting by Renee Dadswell that we later confirmed through an online post by David Flude. All contact information was published online and was available to the public. Contrary to the whining of an anonymous spewer of flaccid threats, it is neither illegal nor unethical for journalists to do online research, nor to contact people who have a vested interest in learning the truth about those who have abused the rights of others by breaking the law.

If it was, there would be no media, no checks and balances, and no social safeguards against those who abuse others.

We have been asked multiple times to post a synopsis of our reports so people can read an overview of the story before delving into the evidence and links to other pages that focus on one specific component. We also know from our research into Search Engine Optimization that it is much better to cover a lot of material in your home page and provide links to every important page on your website. That way, when Google and the other search engines come to visit, and they are doing so frequently now on this new domain, each page gets copied into the search database, and the content is recorded.

So, somehow, we managed to create links to every page, every informative video, and every piece of important evidence.

As we have previously noted, on December 27, 2023, an anonymous agent claiming to represent the brokers at Verico the Mortgage Station sent to our producer an unsigned "Notice"professing "Libel and Defamation". Not only was this notice unsigned, but the writer also sent it through the generic email address info@themortgagestation.ca that is not assigned to any of the brokers at Verico the Mortgage Station.

Now, due to their own inaction and cowardice, the brokers at Verico the Mortgage Station are trapped in a box of their own creation, and they apparently see no true path to escape.

As noted in our 'Latest News' section, dated December 28, 2023, the day prior our producer received via email a PDF file entitled "Libel and Slander Notice Ironside". The document was written by somebody with little if any knowledge of the law, it was not signed, there was no name associated with the authorship, and the email address was generic.

The question we have to ask is who exactly is this 'brave' and 'bold' issuer of ridiculous rants who hides in the shadows and is too scared to affix their name to their own threats?

Through our research regarding Search Engine Optimization, we learned that maintaining and frequently updating a subject-relevant blog is one of the best ways to attract the 'robots' and 'spiders' of the search engines, which improves your website's footprint on the Internet.

So, we thought we would kill two birds with one stone.

Our new Daily Updates page includes short stories and pertinent facts that are better suited to short posts rather than full reports or articles. It will be updated more frequently than adding new pages and will be organized with the most recent updates at the top.

A few of our regular followers immediately noticed that last night we made some minor changes to the operational side of our website, most obviously in the form of a date-optimized drop-down menu. We did this to gain room for more articles and videos, as clearly, the brokers at Verico the Mortgage Station are intent on continuing to hide from their own criminal and ethical abuses, and it now seems inevitable that this story will go the long way around to get to the full truth. That is 100% their choice, and clearly, they don't care if their mortgage funding companies get hurt in the process, as has occured to HomeEquity Bank.

These lenders and the shareholders who finance them also have a right to know the truth about those with whom they do business.

Regardless of this wall of denial, we are moving forward, and on Friday, December 8, 2022, we exercised our right as journalists to contact the various lenders who provide mortgage funding to the clients of Verico the Mortgage Station. We would have preferred to leave them out of this, as they are not direct parties to the crimes, but then we realized we have an obligation past that of just the potentially vulnerable seniors who buy CHIP Reverse Mortgage from the see-no-evil HomeEquity Bank.

These lenders and the shareholders who finance them also have a right to know the truth about those with whom they do business.

Most people know that con artists and cowards walk hand-in-hand. Look no further than George Santos, who quite rapidly went from being a shining new star of the freshly minted GOP majority to that of an expelled formerly "honourable"member of the United States Congress.

If either of these stories sounds familiar, it is likely because you read something similar here in our ongoing reports about how the brokers at Verico the Mortgage Station committed the indictable offence of usury, also known as loansharking, against a senior and veteran. Then, they lied, hid, violated "regulatory requirements" and even 'motivated' local police to omit evidence in a plot to escape accountability for their crimes, which under the Criminal Code of Canada carry a punishment of up to five years in prison.

Every day, lawyers are retained by individuals and corporations to sue others for defamation, which is defined as: "the act of communicating false statements about a person that injure the reputation of that person."Few solicitors decline to accept a retainer for these civil claims, as they are usually easily proven.

Based solely on the very public allegations made by our team, in our own names, most lawyers would assume a claim by either the brokers at Verico the Mortgage Station or the Board of Directors of HomeEquity Bank would be a slam dunk. After all, what kind of financial service, which works on trust, would not defend against allegations of loan sharking, lying at a pathological level, and evasion of the very government regulatory requirements that are intended to protect the public from what we are reporting were undertaken by the brokers Verico the Mortgage Station and ignored by the board of directors of the HomeEquity Bank?

In this segment, entitled "Anonymous Promoter Now Helping Us To Warn Vulnerable Seniors About The Loan Sharks Of Lefroy", we discuss how an unidentified expert in Search Engine Optimization is covertly helping us to improve the reach of our various videos and articles by using a state-of-the-art technique known as "long-tail keywords". The results, so far, have been nothing short of remarkable, as now our facts and evidence about Verico the Mortgage Station and their profit motivated allies at HomeEquity Bank are coming up aces on page one of Google and other search engines. This will enable us to warn more potentially vulnerable seniors about the risks posed to their financial security by the brokers of Verico the Mortgage Station and their 'turn a blind eye' allies at HomeEquity Bank, the providers of the CHIP Reverse Mortgages

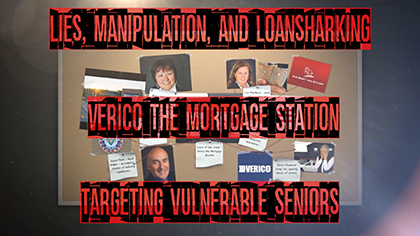

In this segment, entitled "Lies, Manipulation, and Loansharking", we show how after committing the indictable offence of usury, or loan sharking, the brokers of Verico the Mortgage Station were called upon to prove the validity of their actions to their governing body, the Financial Services Regulatory Authority of Ontario (FSRA). However, instead of substantiating their illegal actions, they simply walked away, ignoring what they admitted were "regulatory requirements"that are intended to ensure they are honest enough to maintain their license.

Many in Simcoe County now know our story about how detectives of the South Simcoe Police Service omitted evidence and figures through deliberately inaccurate calculations to ensure that the wealthy and well-connected brokers of Verico the Mortgage Station were not charged with committing the criminal act of usury, or loan sharking, against potentially vulnerable seniors. Details can be found at https://www.fivepointsmedia.ca/south-simcoe-police-service-now-omitting-and-falsifying-evidence-to-protect-loan-sharks.html

Earlier this month, our producer, a former international journalist and technical support specialist for private investigations, replied directly to the detective's deception, and when doing so he copied every member of Simcoe County Council to the email.

Christmas is coming, and in today's economy, who can't use an extra hundred dollars? Even better, you would be winning that money by helping protect vulnerable seniors from the threat of financial fraud. We need your help to spread the word about our efforts to shut down loan sharks who prey on seniors in Simcoe County. That could be your parents or grandparents, aunts and uncles, friends, or just seniors you know. So, each month, during the time we are working on this project, we will give away one gift card valued at $100.00 to the top provider of likes, shares, and group posts that promote our journalistic expose. The stories to be promoted can be found at www.fivepointsmedia.ca/loansharks. If you know your way around social media, you could share our stories in a hundred places in an hour.

Our team at Five Points Media is producing an expose documentary about fraud through usury, or loan sharking, that is being used against seniors and veterans in Simcoe County. For the back story watch https://www.fivepointsmedia.ca/south-simcoe-police-service-now-omitting-and-falsifying-evidence-to-protect-loan-sharks.html

This indictable offence, which is punishable by a prison sentence of up to five years, was committed against a senior and veteran by the mortgage brokers at Verico the Mortgage Station. We are also exposing why the detectives and top brass at the South Simcoe Police Service are transparently protecting these wealthy and influential brokers who claim sales of five to six million dollars a year. Details can be found at https://www.fivepointsmedia.ca/south-simcoe-police-service-cook-the-books-to-help-rich-crooks.html

We know this is a weird thing to say, but today our Producer had a Zoom meeting with a Producer and financier of social documentaries, and if our lawyer says it is good, then we have more than enough money available to produce our ongoing documentary about loan sharking at Verico the Mortgage Station. We will also be addressing how Verico Financial Group turned a blind eye, how HomeEquity Bank showed no concern for the financial security of their often vulnerable senior clients, and how the South Simcoe Police Service have been going out of their way to just ignore the facts and evidence in this case while becoming increasingly creative in how to justify the obvious crimes committed. Our new best friend was impressed with how fast the story has developed, and what we have kept back for now about a few things local residents and the population at large should find very interesting.

Reaction to our most recent video, found at "South Simcoe Police Service Now Omitting and Falsifying Evidence to Protect Loan Sharks", has quite clearly caught the attention of tens of thousands of Simcoe County taxpayers, and with good reason.

We have shown through the presentation of evidence that detectives and top brass at the South Simcoe Police Service seem very eager to protect the loan sharks at Verico the Mortgage Station, as they have so far tried to ignore the claims of criminal activity, and then dismiss the fully supported allegations, and most recently omit the facts and alter calculations in favour of the accused.

At what point do the one-sided and blatantly biased actions of a police department become an act of obstruction of justice, and when does a detective become so motivated to help the criminals that he becomes an accomplice after the fact?

These are the questions we are now researching and bringing to light after a special fraud detective assigned by the South Simcoe Police Service to review the case of usuary committed by the wealthy brokers of Verico the Mortgage Station told our producer that he is omitting key evidence based on nothing but his personal desires while also knowingly using the wrong mathematical formula that will alter the rate of interest charged so that it does not appear to be usury or loan sharking. The first action is unethical, while the second is a crime.

Under Canadian criminal law, individuals who facilitate or assist in the execution of a crime are treated as culpable as the person who physically carries out the act. This principle is commonly known as "aiding and abetting". Individually, they are defined as: "Aiding is assisting, supporting, or helping another to commit a crime. Abetting is encouraging, inciting, or inducing another to commit a crime. Aiding and abetting is a term often used to describe a single act."So, you ask, how does this relate to this story?

Well, if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

HomeEquity Bank Turns To Censorship - Far Too Little, and Much Too Late

A Pathetic and Futile Attempt to Silence the Truth

Last night, July 22, 2022, we were advised by Facebook that the HomeEquity Bank had filed a copyright complaint against several of our posts, with the goal being to hide them from the public and their existing and potential clients. This must be the weakest and most pathetic action ever taken by a bank to silence the truth and stop public questions about their ethics and trustworthiness.

The strong stand tall in the light of day while the weak and guilty lurk in the shadows.

So, to be clear, for about a month we have been publicly questioning the ethics of the HomeEquity Bank, which is owned by the Ontario Teachers' Pension Plan Board, and which boasts assets exceeding $5.7 billion.

Five Points Media - Who We Are

Why we are exposing the crimes committed by brokers at Verico the Mortgage Station

We have noticed a trend amongst the many visitors who are now coming to our website repeatedly, sometimes several times on the same day. They often review an article, linking to it from social media, a search engine, or an email or other link, and then they go to our "Testimonials"or the "Our Team"page. Sometimes they go to our commercial services website and review the counterpart pages there. This is natural as people want to know who is making the allegations.

However, when we see the same visitor go to those same pages eight, nine, ten, or more times, it becomes clear that they are trying to figure out for themselves who we are and if we are telling the truth.

The stain of corruption is spreading rapidly to both Verico Financial Group and HomeEquity Bank, which created the CHIP Reverse Mortgages that is targeted at seniors who own their own homes. Both are coming in hot with Google and other search engine results, mostly due to the traffic being drawn in by concerned seniors and groups, with a little help from our new SEO tools that are working very well.

Good companies that continue to associate with criminals will be painted as accessories or aiders and abettors.