Desperation Sets In As The Offices Of The Mortgage Station Are Once Again On The Block

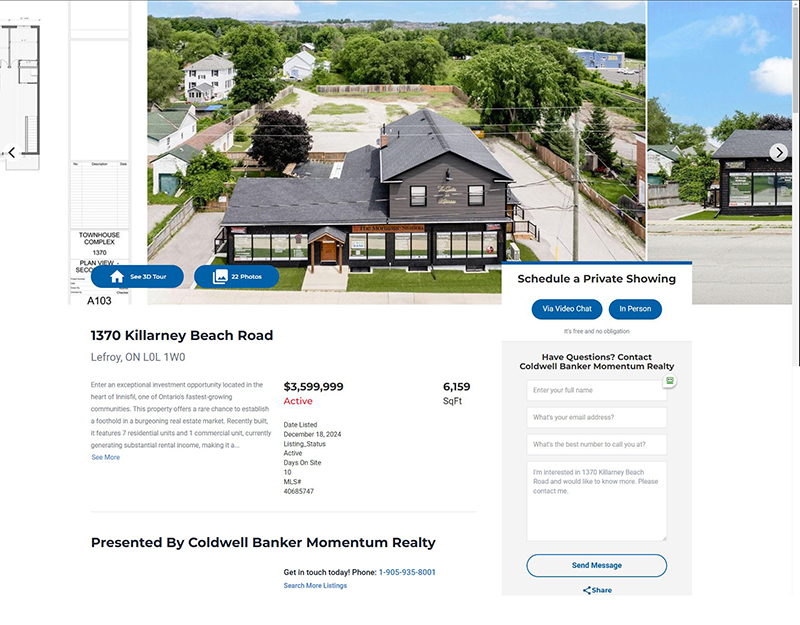

Back in early September, we started reporting about the apparent financial troubles that can be seen to be stifling operations at Verico the Mortgage Station. Those issues are public only because of their own public posts, which include the conversion of offices that were touted as intended for an expansion, being instead turned into apartments, apparently to generate cashflow, the loss of several brokers and agents who were not replaced, and more importantly, the application of a digital 'for sale' sign to the offices of Verico the Mortgage Station, which is at least for now located at 1370 Killarney Beach Road, Lefroy, ON, L0L 1W0.

It is the old story of the village idiot who destroyed his house trying to prove he could defeat a mouse.

We virtually disappeared for about a month, between November 15 and December 25, 2024, and it seems like on a few fronts the loan sharking brokers of Verico the Mortgage Station, and their supposedly no-longer-associated collaborators at Verico Financial Group Inc. and HomeEquity Bank, thought we have given up on reporting this story. Not only did we learn that Lisa Purchase, the apparent under-the-bus scapegoat for this ongoing story of criminal and ethical breaches of trust, has in fact returned to the good graces of both Verico Financial Group Inc. and HomeEquity Bank (more on that shortly). It also appeared that the offices of Verico the Mortgage Station were suddenly and unexplainably no longer for sale as a commercial or residential complex.

With our reporting 'gone', it appears they thought it was time to get back to defrauding seniors.

It was on the very same day, December 18, 2024, that we made it clear why we had been away and that we were definitely back, that management at Verico the Mortgage Station posted that their offices were once again back on the real estate market. It could be coincidence, such as simply changing their sales agent or broker, or it could be because for as long as the truth of their abuse of senior and veteran clientele are made available to the public, they have virtually no chance of staying in business without rebranding, rebuilding, and relocating, and we are ready for any of those actions. In his 'anonymous' frivolous threat of abusing the civil court system to scare us off, now almost a year old and unfulfilled, which we retorted so fully that David Flude ran away without resurfacing, the Principal Broker for the slowly dying brokerage boasted about how nobody at his brokerage was getting rich off what they stole by usury, which he said included the officers of the South Simcoe Police. Those officers and detectives have been accused now for more than eighteen months, in a very public way, of being 'motivated' to omit key evidence and of using fudge figures and fake math to be able to manufacture cause to cut the then multi-million dollar brokers a 'get out of jail free card', but they have never contested the allegations.

Only financial 'professionals' and police officers who have something to hide refuse to defend their own names.

Clearly, for David Flude and any partners or investors at Verico the Mortgage Station, it is better for them to sell their property, and oversee the sale, than to surrender all control to a receiver assigned by the bank. That could be why the building, original posted for approximately $4.5 million, was reduced by $500,000.00, and has now, according to the newest listing, been reduced again by that same amount, totalling $1,000,000.00 in direct real estate losses. That means, no matter how you cut it, this ongoing crisis for this once prosperous business, which could have been settled over a cup of coffee more than two years ago, has now festered to a point where the management and owners of Verico the Mortgage Station are directly losing tens of thousands of times more on the sale of an office than it would have cost them to simply do the right and honourable thing. According to several statements made by David Flude through emails etc., it certainly seems that the customized building is only for sale because of the public backlash against their criminal and ethical breaches of trust committed against their trusting senior and veteran clientele, that has been caused by our ongoing exposure of their criminal and ethical breaches of trust.

What kind of a idiot flushes his life's work down the toilet over a few hundred dollars of grift?

Our exposure of their struggles caused by treachery are also easily found by prospective buyers, which is no doubt bringing down the value further as everybody can quickly learn it is a fire sale fuelled by desperation, being peddled by loan sharking and spineless crooks who cannot afford to maintain the business for which it was built, mostly because they refuse to stand up and do the right thing, or challenge the fully supported allegations in a court of law. This entire situation was created because the brokers of Verico the Mortgage Station who have each acknowledged in writing their part in stealing money from senior and veteran clientele, (Renee Dadswell), (Lisa Purchase), (David Flude), and they have chosen to hide for more than two years instead of acting professionally and addressing the issue. Then, their criminal and ethical abuses of trust rippled upward to their see-no-evil colleagues at Verico Financial Group Inc. and HomeEquity Bank who were evidently conned into the lie that if they hid and ignored their crimes, the story would just fade away.

Instead, have lost millions of dollars due to the exposure.

Both Verico Financial Group Inc. and HomeEquity Bank invested considerable effort to strip all association with the brokers of Verico the Mortgage Station, and one or both stooped so low as to try to censor the truth of their collaboration in the indictable offences of both usury and Fraudulent concealment.

347 (1) Despite any other Act of Parliament, every one who enters into an agreement or arrangement to receive interest at a criminal rate, or receives a payment or partial payment of interest at a criminal rate, is

(a) guilty of an indictable offence and liable to imprisonment for a term not exceeding five years; or

(b) guilty of an offence punishable on summary conviction and liable to a fine of not more than $25,000 or to imprisonment for a term of not more than two years less a day, or to both.

341 Every one who, for a fraudulent purpose, takes, obtains, removes or conceals anything is guilty of an indictable offence and liable to imprisonment for a term not exceeding two years.

All the management teams of Verico Financial Group Inc. and HomeEquity Bank have accomplished is to sully their own reputations and to reveal themselves as unethical to hundreds of thousands of potential clients. For example, we will be posting, most likely tomorrow, how Verico Financial Group Inc. and HomeEquity Bank have publicly realigned themselves with Lisa Purchase, who suddenly vanished from the website of Verico the Mortgage Station back in July, seemingly as a scapegoat for the collective criminal and ethical abuses. Apparently, her willingness to take one for the team is being rewarded. If their own posts are true, this change of heart would suggest deliberate deception, which failed back in July due to our exposure.

We are far from done, and the brokers of Verico the Mortgage Station, and the boards of directors of Verico Financial Group and HomeEquity Bank can be assured that as they deceive, we will expose.