HomeEquity Bank: Aiding And Abetting Loan Sharks Or Committing Omission by Feigning Ignorance?

Under Canadian criminal law, individuals who facilitate or assist in the execution of a crime are treated as culpable as the person who physically carries out the act. This principle is commonly known as "aiding and abetting". Individually, they are defined as: "Aiding is assisting, supporting, or helping another to commit a crime. Abetting is encouraging, inciting, or inducing another to commit a crime. Aiding and abetting is a term often used to describe a single act."So, you ask, how does this relate to this story?

Well, if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

Our Producer, a senior and veteran of the Canadian Armed Forces, has repeatedly during the past year reported to the HomeEquity Bank that as their customer, he was defrauded by mortgage skimming and usury, also known as loan sharking, by brokers at Verico the Mortgage Station. He has also explained ad nauseam that the fraud occurred during the time he was arranging a CHIP Reverse Mortgages that was being provided by the HomeEquity Bank. He has also provided irrefutable evidence in the form of a bank statement and the trust ledger and commitment form that was produced by brokers at Verico the Mortgage Station which shows the disbursement of funds.

Regardless of the obvious risks to other seniors,

the HomeEquity Bank has manufactured multiple excuses to do exactly nothing.

In Canada, an omission is a failure to act, which generally attracts different legal consequences. In criminal law, an omission will constitute an actus reus (Latin for "guilty act.") and give rise to liability only when the law imposes a duty to act and the defendant is in breach of that duty. Section 21 of the Criminal Code delineates who is a party to an offence. It includes anyone who physically commits an offence, aids in the commission of an offence through an act or omission or abets any person in the commission of an offence.

So, if you know of a crime and you do nothing to prevent it, or if you aid somebody by omission, or by helping to conceal it, you are as guilty as the perpetrator of the offence.

On Monday, July 24, 2023, our Producer received an email from Akash Durbha, the Director of Client Relations at HomeEquity Bank, in which he noted: "I am confirming receipt of your emails regarding Verico, The Mortgage Station. As you've indicated your complaint is now the subject of a police investigation, we are constrained from providing any further comments or intervening in this matter."

Clearly, this statement is a convenient corporate lie as nothing is stopping the HomeEquity Bank from taking action to protect their senior clients other than the fear of losing profit.

"Constrained"is an adjective which has two related definitions: "appearing forced or overly controlled" and "severely restricted in scope, extent, or activity". We are assuming that in his email, Mr. Durbha is referring to the second definition as there is no evidence of any force being used to restrict the actions of the HomeEquity Bank. We also openly challenge the HomeEquity Bank to show how they are "severely restricted in scope", etc. Are they claiming that the South Simcoe Police Service has ordered them to take no action? Are they bound by some part of the Financial Services Regulatory Authority of Ontario Act, 2016, or the Mortgage Brokerages, Lenders and Administrators Act, 2006, or some other piece of legislation that restricts their ability to investigate claims of criminal-level fraud and loan sharking?

We are now reading through all the legislation pertaining to mortgages and mortgage brokers.

Our team members have never slept so well 😉

Are the professional bankers at HomeEquity Bank honestly going to claim that they do not have a clause in their contract with brokers that says they can investigate claims of criminal abuses? They requested and were provided with evidence that caused the top cops at the South Simcoe Police Service to cast aside the dubious first investigation and assign the fully supported claims to a specialist fraud detective for a thorough review of the evidence. The HomeEquity Bank works hard to project an image of a socially responsible business that cares about its senior clients, but its decision to wallow in omission reveals its true character. This documentary project started as a relatively small story of pandemic profiteering revealing how brokers at Verico the Mortgage Station defrauded a senior and veteran through mortgage skimming and loan sharking.

Those allegations have never been in any way refuted, despite being public for more than a year.

Now, however, this story has become much larger as management at the HomeEquity Bank, whom we approached with open hands as being likely unwitting additional victims, have revealed themselves to be apparent aiders and abettors who went so far as to censor our story in an attempt to stop us warning potential clients of Verico the Mortgage Station. They also seem quite content to wallow in denial and take little if any action based on the evidence they asked for and were provided nearly two weeks ago. We can also show the hundreds of times that a member of management at HomeEquity Bank or one of their agents has visited our website, regardless of their proxy servers and identity-changing digital toys. All these clandestine actions are classic examples of omission, which the management team of HomeEquity Bank apparently feel they can fall back on as plausible deniability rather than taking action to defend the financial security of their often vulnerable senior clients.

Each and every one of these actions make the HomeEquity Bank culpable for the criminal actions of the brokers at Verico the Mortgage Station because they took action to hide their awareness.

The HomeEquity Bank deals with hundreds if not more mortgage brokers across Canada so why would this one branch of the Verico chain be so important to them? We can understand a first impulse of disbelief, but they have had a month to see who we are, and we know they and their agents and likely their lawyers have been all over our website and that of our commercial division.

They also have all of the evidence that they asked for and have had it for about two weeks.

They know we are an altruistic social enterprise that has donated more than 300 videos to greater than 180 charities and community groups, which are valued at more than $600,000.00. They also know that our team is highly respected and valued in our community, as can be seen by a recent outpouring of support to ensure we remain functional as a community channel during the Bill C-18 debacle that is harming all media in Canada. The management team of HomeEquity Bank also know that we are strong supporters of the union labour movement, including the Ontario Secondary School Teacher's Association and Elementary Teachers' Federation of Ontario, which are part of the Ontario Teachers' Pension Plan Board that now owns the HomeEquity Bank. The Ontario Teachers' Pension Plan Board is described as: "an independent organization responsible for administering defined-benefit pensions for schoolteachers of the Canadian province of Ontario."

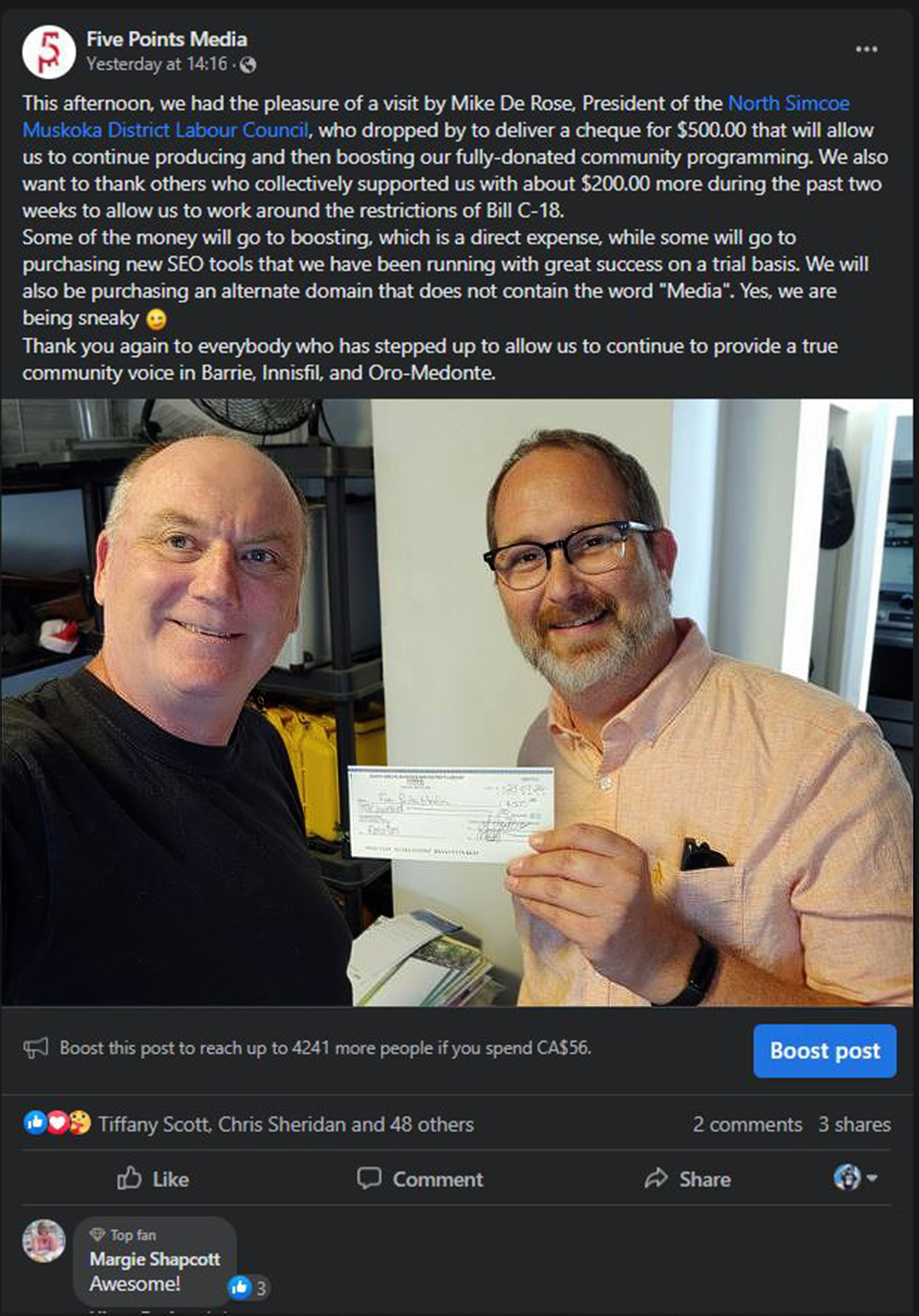

We are in fact so valued by the

North Simcoe Muskoka District Labour Council

that they ensured our community programming continues by donating $500.00 just yesterday.

That donation was inspired by our unsolicited support of their causes, which we contributed with no expectation of reward through two videos, "Abuse of Power by Doug Ford - CUPE Protests in Barrie, Orillia, and Bracebridge, 2022"and "Enough is Enough, 2023". We donated those services because we are a benevolent community service that is driven by a desire for progressive change rather than financial gain.

For reasons we we are not able to comprehend, the management team at HomeEquity Bank has turned its back on its own supporters, and they are ignoring the laws governing their industry and their obligation to public trust so they can protect loan sharks who skimmed hundreds of dollars from one of their own mortgage and also charged 120% interest on a loan to one of their clients. That makes them a possible accessory after the fact because they know about it and have seen irrefutable evidence that the allegations are true, yet they continue to allow the risk to seniors to continue representing them.

The North Simcoe Muskoka District Labour Council donated $500.00 to ensure our continued ability to support our community through fully-donated progressive videos that help those who do not have a voice, or who are oppressed by those in power.

Below is the content of the email our producer sent in response to Akash Durbha, the Director of Client Relations at HomeEquity Bank, So far, the HomeEquity Bank has not responded, and has chosen instead to simply ignore their legal, ethical, and moral obligations to their client and to the vulnerable seniors who they are fully aware could also be defrauded by mortgage skimming and loan sharking.

Good Morning:

I met last night informally with a friend who is a lawyer, and I discussed with her your claim: "As you've indicated your complaint is now the subject of a police investigation, we are constrained from providing any further comments or intervening in this matter."

My friend is much better versed with regard to the law than me, but she assured me that there is nothing constraining you from taking appropriate action, other than likely greed and a desire to brush this matter under the rug as quietly as possible. Sadly for you, that is no longer an option.

I am your client, and I am paying for your services, be it now or deferred to a later date. As such, you are bound by the regulations of the Financial Services Regulatory Authority of Ontario.

One of the obligations to which the HomeEquity Bank is bound by law is to ensure the security of the money entrusted to them by their clients. Another is to take appropriate action to ensure that your clients do not fall victim to fraud as a result of dealing with HomeEquity Bank.

Your team is doing neither, and in fact, your staff members have taken action that serves only to silence me and to prevent me from warning other potential victims by referencing the fraud and loan sharking I experienced when dealing with brokers at Verico the Mortgage Station.

As your client, I reported to you last year that the brokers who acted as your arm's length agents defrauded me by skimming illegal fees and charging usury levels of interest on a loan. Both are criminal offences. Your bank did nothing.

Then when I pushed the matter, you asked for the evidence as you said you could not do anything without it. So, I sent the evidence to you that you acknowledged receiving. That evidence is very conclusive and is not easy to misinterpret. You have also never questioned its authenticity.

Now, instead of moving forward to better ensure the financial security of your often vulnerable senior clients, you are using the ongoing police investigation as a shield against taking any action. In reality, one has very little if anything to do with the other.

I have no doubt that when Renee Dadswell is charged, you will claim you cannot move forward with any action until after she is convicted, with the hope being you could disregard her actions if she pleas to a lesser charge etc.

So, as your client, I ask which statute, provincial or federal law, case law, or legal precedent "constrains"the HomeEquity Bank from taking action in defence of your clients who are being put at financial risk by crimes you know have been committed by the brokers of Verico the Mortgage Station, regarding which you have received evidence you have not contested.

By your logic, an employee can be determined to have stolen from your bank, and you could have as evidence irrefutable official documentation, as I have provided to you.

However, you could not fire them until after the police investigation and subsequent trial was over, perhaps two years later.

That is ludicrous both legally and when challenged by common sense, and no honourable financial institution would pander to any such suggestion of inaction if it was their money that was at risk.

Be advised that I am creating another promotional video similar in nature to the extremely popular overview video found at seniors-across-canada-are-now-questioning-the-ethics-of-the-homeequity-bank.html which will detail your bank's position on this issue.

The evidence now supports that the abuses and crimes committed by the brokers at Verico the Mortgage Station might be the result of a trickle-down effect of the true corporate culture of HomeEquity Bank, which appears to condone and make excuses for the crimes committed against vulnerable seniors.

Please provide me with the information I request, and I hope you understand that the laissez-faire attitude demonstrated by the HomeEquity Bank with regard to the financial security of seniors is now becoming much more important in the storyline of our documentary and promotional materials.

I reserve the right to include all or part of this correspondence in our upcoming documentary and within both printed and electronic promotional materials.

Regards,

John Ironside

Producer / Director

Five Points Media

A division of the Ontario Community Awareness Network

A registered not-for-profit

Studio: 705-828-5605

Cell: 416-996-2786

Email: jironside@fivepointsmedia.ca