To Those In Hiding, A Genuine Offer Of Detente - Verico the Mortgage Station

Every day, lawyers are retained by individuals and corporations to sue others for defamation, which is defined as: "the act of communicating false statements about a person that injure the reputation of that person."Few solicitors decline to accept a retainer for these civil claims, as they are usually easily proven.

Based solely on the very public allegations made by our team, in our own names, most lawyers would assume a claim by either the brokers at Verico the Mortgage Station or the Board of Directors of HomeEquity Bank would be a slam dunk. After all, what kind of financial service, which works on trust, would not defend against allegations of loan sharking, lying at a pathological level, and evasion of the very government regulatory requirements that are intended to protect the public from what we are reporting were undertaken by the brokers Verico the Mortgage Station and ignored by the board of directors of the HomeEquity Bank?

Why would any entrusted professional allow those charges to flow freely on the Internet for more than a year and a half, knowing that the allegations are reaching hundreds of thousands of potential clients, and not only theirs but also those of the company that brands them and the provider of the hundreds of thousands of dollars they need to broker the mortgages they sell. Why would any of those companies do nothing to prevent competitors from using readily available professionally produced videos to pull away their customers and profits? The only viable answer is the company's directors know they are guilty, and they know they will lose if a judge looks at the evidence against them.

Our online reporting of this story has been ongoing for more than 520 days, or almost a year and a half, and neither the multi-million-dollar brokers of Verico the Mortgage Station, nor their multi-billion-dollar allies at HomeEquity Bank, have taken any action to contest our findings and evidence.

In simple terms, this story, our allegations, and our evidence remain 100% uncontested.

Just imagine how fast a lawyer's perspective would change when they learn the following list of discerning facts about the parties, the claims, and the evidence.

- the publisher is a well-established and respected media service, with extensive local and international credits and awards for community support.

- the publisher is telling the truth, and can prove it using tangible evidence that they have openly shared with the public.

- the publisher has more than enough evidence to prove their allegations in any court of law, and is eager to have the evidence reviewed by a judge.

- the publisher has offered to withdraw the story if the client can disprove their claims using evidence, but the client did not even reply to the offer.

- the publisher can show that the client 'motivated' police officers to omit the evidence of their crimes and that this omission is not normal police practice.

- the publisher has not defamed the client, and they welcome a civil claim as they have defeated similar abuses in both federal and provincial courts.

- the publisher is fully aware and educated about abusive Strategic Litigation Against Public Participation, or SLAPP lawsuits.

- the publisher has through their defence against abuses of civil procedure humiliated prominent Bay St. law firms that engaged in SLAPP litigation.

- the publisher operates a benevolent not-for-profit service that exists to help the community that has been doing so for nine years, since 2014.

- the publisher has donated more than $700,000.00 in services to local charities through the creation of more than 330 fundraising and educational videos.

- the publisher was a nominated in 2020 and voted to finalist status for an award for altruism presented by the Chamber of Commerce and City of Barrie.

- the client has chosen to hide from the issues they created for more than 520 days rather than face the evidence, refusing to even reply to emails.

- the client has not in any way contested any of the allegations made by the publisher, making all of the allegations 100% uncontested.

- the client has repeatedly declined the publisher's offer to refute any claims through an interview, which contradicts any feigned victimhood.

- the client has admitted in writing twice to essentially every allegation made publicly by the publisher.

- the client acknowledged a 'regulatory requirement' to meet the publisher to discuss allegations of loan sharking, but evaded doing so for more than a year.

- the client lied six times in two emails, making multiple promises regarding accountability to the FSRA government oversight, but did nothing.

- the client admitted in writing to charging excessive fees on a short-term loan, also known as usury, and under pressure, returned some of the illegal fees.

- the client endorsed in writing the crime of usury, or loan sharking, as was committed by a broker, and tried to brush it off as ethical and fair.

- the client defamed the publisher in writing, a copy of which the publisher has posted online, by making false claims about litigation that never happened.

When considering this list of realities, all of which are supported by empirical evidence, that retainer would likely become far less inviting, at least to any ethical lawyer who holds to their oath as an officer of the court.

Lawyers in Canada are not the despicable characters often depicted in movies. Nor are most like those who are turning the US courts into a circus trying to trip justice for Donald Trump. Their tactics can be aggressive and confrontational, as they are sworn to represent the best interests of their client, but lawyers are held strictly to cannons of ethics. Being exposed for unscrupulous actions or abuses of the civil court system, such as initiating Strategic Litigation Against Public Participation, or a SLAPP lawsuit, could result in damage to their professional reputation or even sanctions by the court. Also, in this age of instant push-button access to information, they can face both professional and public humiliation.

We feel it is likely that the brokers at Verico the Mortgage Station and the board of directors at HomeEquity Bank are finding it difficult to find a lawyer who they hope can just make this story disappear. For the reasons noted above, we are, as Winston Churchill once proclaimed, "a conundrum wrapped in an enigma".

We are protected as journalists, and if we are hit with a SLAPP lawsuit, this story will become a subject of great interest to both mainstream and independent media, as any unjustified ruling against us could be used as a precedent against them. That will simply increase the amount of awareness, which is the last thing the the brokers at Verico the Mortgage Station or the board of directors at HomeEquity Bank want to happen. We also have the evidence to support our claims, and it is the the brokers at Verico the Mortgage Station who provided most of it, before they decided to hide for more than 520 days. Remember, these are multi-million and multi-billion-dollar corporations, and we are a small, not-for-profit media company. So, if we are lying, what is holding them back?

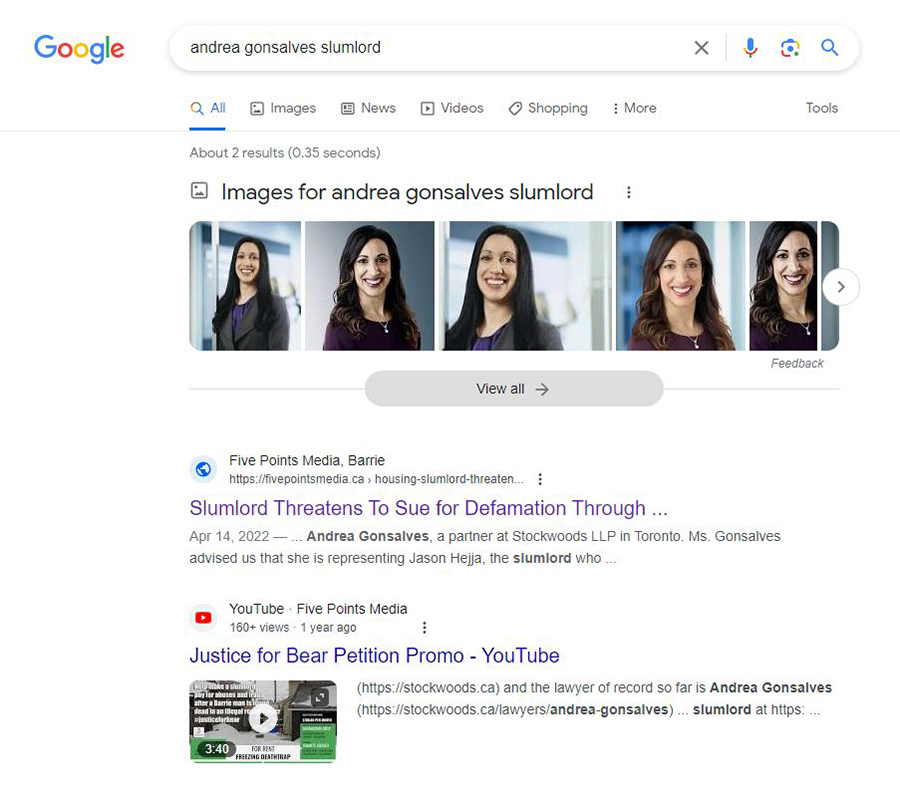

Throughout the past four to six weeks, we have become the subject of intense scrutiny by visitors using mostly professional static IP connections rooted in cities across central and southern Ontario. We believe the visitors are most likely lawyers because many have started their review of our reports, videos, and evidence by visiting a past report called "Slumlord Threatens To Sue for Defamation Through Obvious SLAPP Civil Action, 2022"

That report is dated April 24, 2022, so it is about a year and a half old. It details our response to threats from a lawyer in Toronto who tried to intimidate us through the threat of a SLAPP lawsuit. Such vacuous tactics of intimidation are an unscrupulous abuse of the civil court system, and they are frowned upon by law societies and the courts. In September 2020, the Supreme Court issued rulings that were very limiting regarding this kind of abusive courtroom bullying that is usually used by the rich to silence criticism.

The allegations of defamation came from Andrea Gonsalves, a respected jurist and partner at Stockwoods LLP in Toronto, who advised us that she was representing the slumlord who rented an uninsulated and poorly heated trailer that our friend, known to us as Bear, was found dead inside on February 26th, 2022.

Ms. Gonsalves opened with a load of threats, and she ordered us to retract our stories completely. She also provided us with a copy-and-paste apology that she demanded we post on our website and social media accounts under the threat of expensive civil action if we did not obey her demands. As you can see from the links provided, we did neither, and that story is still very much online and unaltered. Also, upon receiving our reply, which is a pretty good read, the huff-and-puff lawyer was never heard from again. We did not even receive a reply.

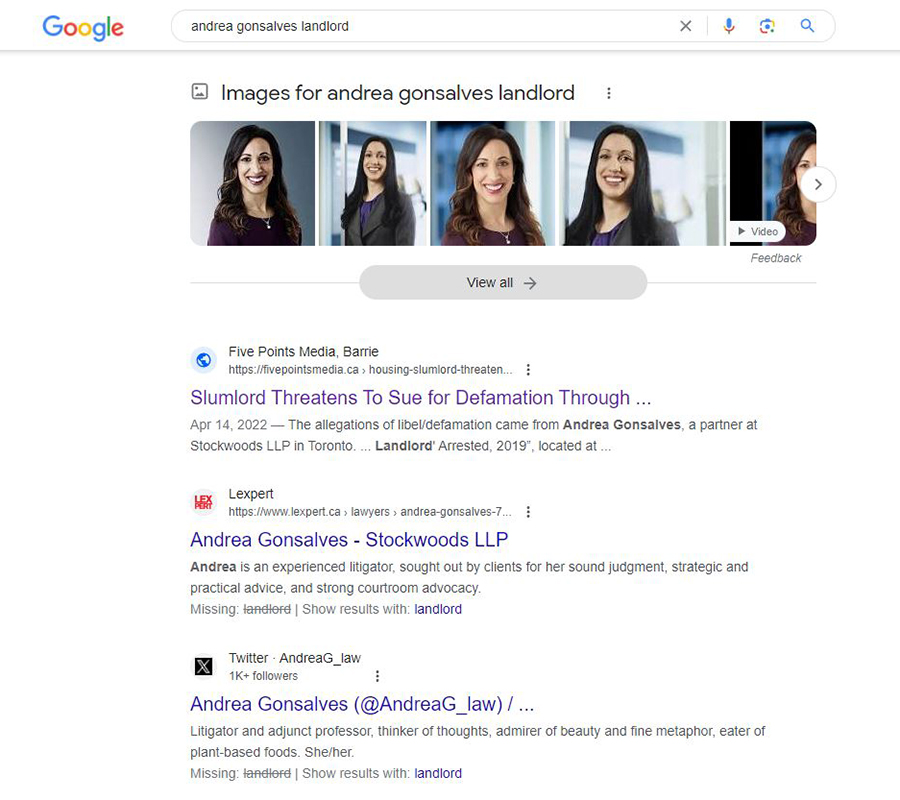

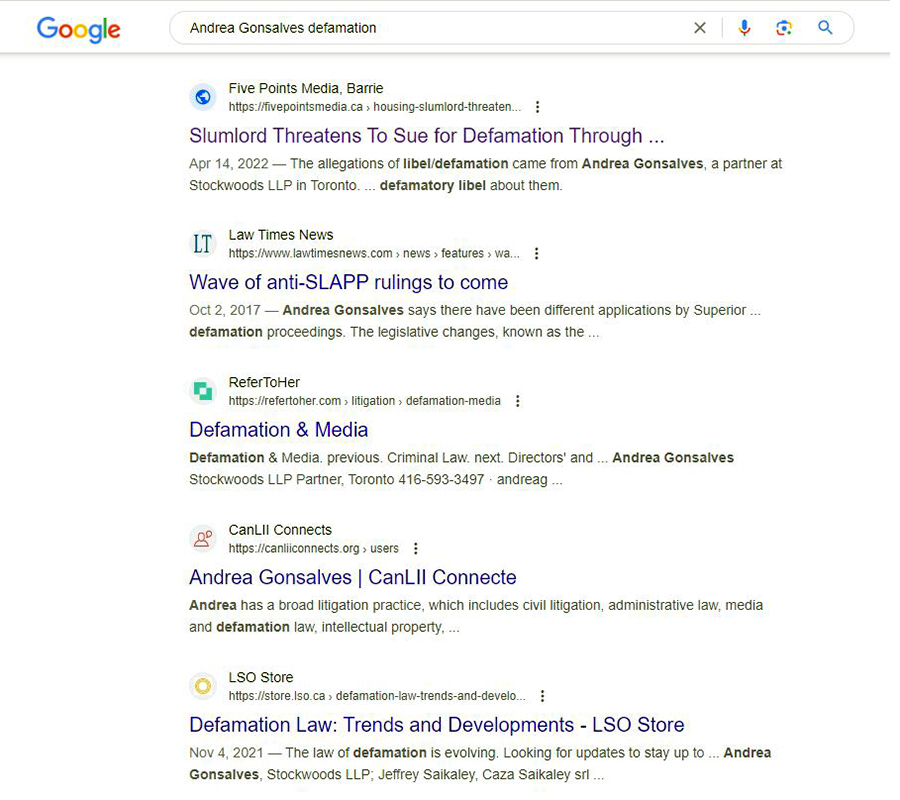

To add insult to her injuries, Ms. Gonsalves was rewarded with humiliation. From her threatening statements, it was clear that the respected lawyer wanted to keep her methods of litigation a secret. So, naturally, we scanned her letter and put it online for the entire world to see. Now, if any prospective client wants to look her up, they will find our story very easily. In fact, using the words "Andrea Gonsalves"followed by "landlord", "slumlord", or "defamation"will display our story prominently on page one of Google.

We have no doubt that Ms. Gonsalves would like to see our response to her threat of a SLAPP lawsuit simply disappear, as from now on, every time she faces another lawyer in court they will know that she tried to bully a small not-for-profit media company, and was humiliated for her efforts.

The lawyers visiting our website now, if that is what they are, have been coming directly to the details of that past threat of litigation, as if they were sent a link in an email by somebody with an interest in this story. From there, some went to "The Back Story of Our Investigative Journalism", where they found details about other civil abuses we have exposed and defeated without the need of a lawyer. Then came short visits to some of our community stories, and often to our testimonials page. Then, one after another, they left the website, usually never to return. The pattern has been repetitive and mostly consistent, but always from different locations.

If our analysis and educated guesswork are correct, this pattern speaks volumes as experienced lawyers do not turn down retainers for civil litigation unless they know it is a lost cause that will most likely become an embarrassment to their firm and professional reputation. For them, it is a no-win scenario, no matter what ruling is made by the court. The last thing they want is their name attached to abuses of the law. We are also the ones who want to see this matter heard by a Justice of the Superior Court who would rule based on the evidence and not based on whatever influence caused the detectives of the South Simcoe Police Service to abandon their professional standards by omitting evidence of the crimes. If we were lying, they could easily end our reporting through a court order seeking injunctive relief. It is our evidence and their lack of any that is maintaining this one-sided stalemate.

It is not surprising that competing brokers or loan providers are now taking advantage of the cowardice of the brokers at Verico the Mortgage Station. They are our best guess as to who is promoting our story to a much bigger audience because they are the ones who stand to profit from doing so. We have provided them with a risk-free opportunity to expose their competition and profit by taking away clients.

Our videos are professionally produced by a well-established and credible media company with deep roots in the community and a long history of giving back to those in need. So, why wouldn't they use our fully supported and uncontested allegations to improve their own bottom lines? You cannot be sued for sharing a post found on social media, and clearly, the brokers at Verico the Mortgage Station and the HomeEquity Bank are afraid to try to silence the truth of our allegations.

Every day we climb higher in the search engines, meaning the potential clients of both Verico the Mortgage Station and the HomeEquity Bank are finding our reports and evidence. HomeEquity Bank is the most well-known name for the CHIP Reverse Mortgage in Canada, but given the sudden uptick in our Google ratings, people are going to look for alternatives based on our fact-driven and fully supported allegations against the brokers at Verico the Mortgage Station who won't even come out into the light to protect their own 'good name' and the professional reputation of HomeEquity Bank. Who needs friends like that, and who wants to borrow money from a bank that is associated with loan sharks?

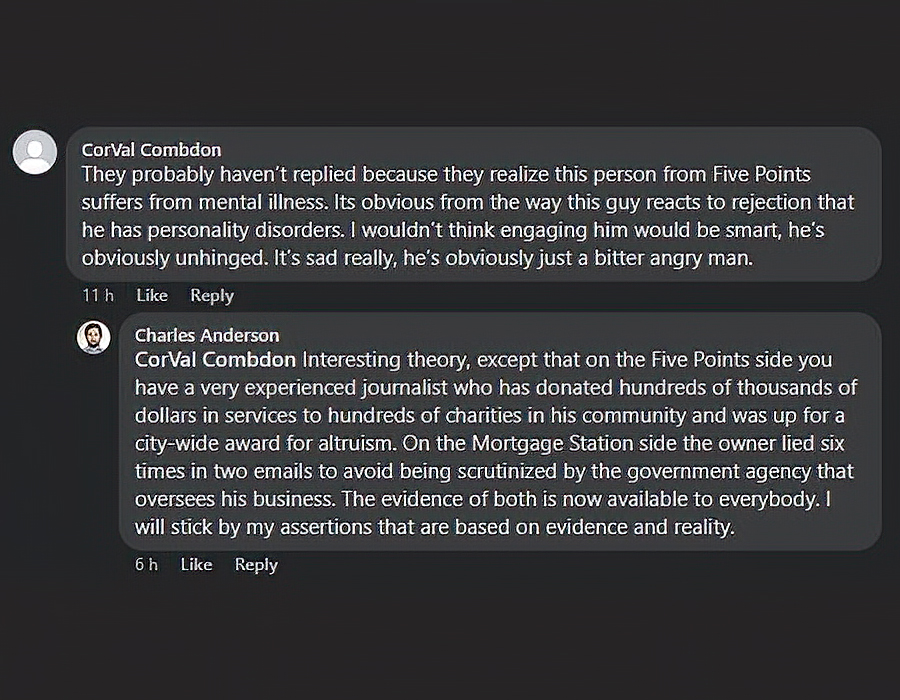

As can be seen through the comments on our social media platforms, and on their own, David Flude, Lisa Purchase, and Renee Dadswell are fooling nobody. They can say what they want when they know it will not be contested, and we know from reading an email from a client they lost that libel is acceptable to them. However, the evidence presented publicly will always win out over whining of victimhood. Look no further than the US Trump trials, where the Orange Autocrat makes all matter of wild claims, but the judges are giving the would-be dictator enough rope that when they snap it back, he will think he is bungy jumping.

In an email sent by David Flude to a woman named Elizabeth, the principal broker at Verico the Mortgage Station made various statements that are simply untrue and libellous. "The info you and everyone else can see is from a repeat serial agitator. He has been to court numerous times against neighbours, local politicians and we have had nothing but support from our mortgage associates."

The truth is that none of this is in any way factual, and it shows once again just how easily the brokers at Verico the Mortgage Station fall back on lies they cannot support. Our Producer reported, as a journalist, about a story involving a local slumlord, but there was never any legal action. He has also never taken a politician to court. He did manage to secure an order of vexatious litigation against an abusive Barrie man who filed frivolous civil claims against dozens of people, businesses, and even a charity. That man, who admitted in writing that he 'rode Welfare' to do whatever he wanted, admitted his goal was to attain what he called a 'settlement' for vacuous claims of damages. It is also untrue that all mortgage associates support the brokers at Verico the Mortgage Station, as those same supposed allies are reaching out to us with facts and evidence and liking our social media in order to keep up with updates.

Eighteen months ago, David Flude knew that his brokers were loan sharking seniors, as he admitted to it in writing. He also had a legal obligation to meet with his client and to file a report with the Financial Services Regulatory Authority of Ontario (FSRA). Instead, he chose to lie six times in two emails to evade his legal obligation. He did not want to write or submit that report because the evidence showed he had known his broker, Renee Dadswell, had committed the crime of usury and that Lisa Purchase had helped to administer the illegal loan which became necessary only because of the extended delays she orchestrated.

Clearly, the brokers at Verico the Mortgage Station and the board of directors at HomeEquity Bank don't know where to go or how to get there. If they could have filed for injunctive relief, or silenced us through litigation, they would have filed their claim many months ago. If we were doing anything illegal, including lying about public services, the South Simcoe Police Service would have taken action the second we released the video in which we very publicly discuss how their detectives were motivated to omit evidence in order to ensure the brokers at Verico the Mortgage Station were not charged with usury. That action is a crime in itself that is now pending investigation by the Ontario Provincial Police Financial Crimes Division and the Office of the Independent Police Review Director.

Despite their backroom bravado, the brokers at Verico the Mortgage Station have been reduced to the level of posting positive reviews about themselves and setting up fake Facebook accounts from which they have adored themselves through worthless positive reviews of their own company. It truly is becoming just that sad and embarrassing for them. Neither hiding nor lying is helping them, and as can be seen from our growing audience, Verico the Mortgage Station has become that car accident people cannot resist to slow down to have a good look. We are told they are becoming pariahs in their industry, and all because their denial and hiding are not working and they lack the ability to see that they are slowly but surely being destroyed by the truth of their own actions that they will not face.

We know directly of about two dozen mortgages that were diverted away from Verico the Mortgage Station due to our reporting and evidence. However, there is no way that every person who learned the truth from our reporting told us about it. We would be lucky if one per cent told us of their decision. Most have asked not to have their names associated with the articles, which we understand fully, while others gave us free license to include their comments in the hope of warning more seniors.

In his reply to Elizabeth, David Flude whined: "I'd love to speak with you and work on your mortgage needs too. This is my livelihood so it's important to me. I have nothing to hide and will be upfront with you."

Regardless, people see that David Flude, the Principal Broker at Verico the Mortgage Station, lied six times in two emails to avoid government oversight and he has done nothing to stop us from reporting the facts about his business. The truth and evidence are out there, publicly available, so who is going to trust their biggest investment to a man who acknowledged he endorses loan sharking by his brokers and who lies as easily as most people breathe? Elizabeth's reply was swift, cutting, and demeaning, as she called David Flude a liar, insulting, and other less than complimentary terms.

An Offer Of Detente

As accredited journalists and producers of documentaries, we have an ethical and professional obligation to ensure that we continue to tell the truth that can be supported with evidence. As such, since they are all too afraid to come out into the light and speak on camera, we are offering the brokers at Verico the Mortgage Station, and the management teams at Verico Financial Group and HomeEquity Bank a limited period of détente.

We propose a meeting in a neutral space that would hold a without prejudice status. At that time, we can chat about our allegations, and view whatever evidence, if any, they hold that might disprove our claims. We can also discuss whatever they wish. The agreement would be that the meeting is not recorded in any way by either side. Also, with the possible exception of any threats made (hopefully not), nothing from the conversation will be published or referred to in any way as part of our story. Of course, the parties can bring their lawyer, or send one in their stead, which given the history of this matter is the most likely scenario. Also, all communication, written, verbal, or otherwise regarding setting up this meeting, will be treated as fully confidential and bound by the without prejudice status of the meeting.

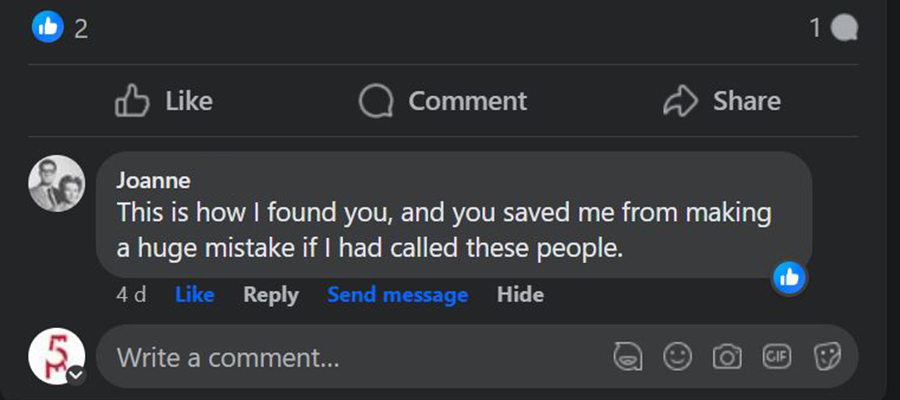

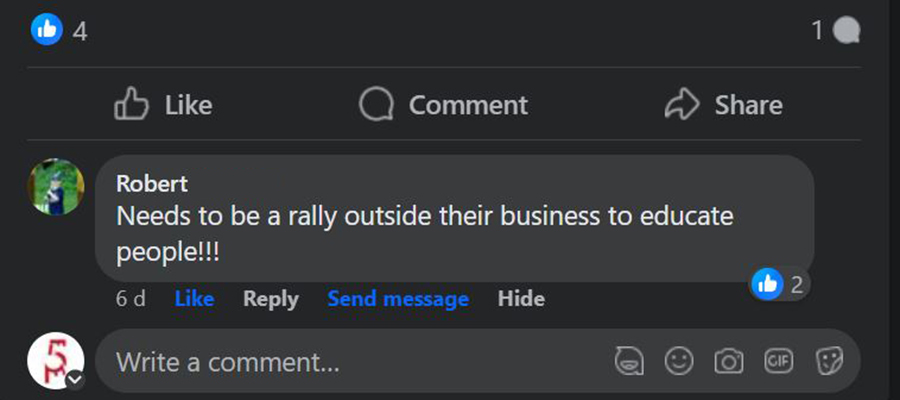

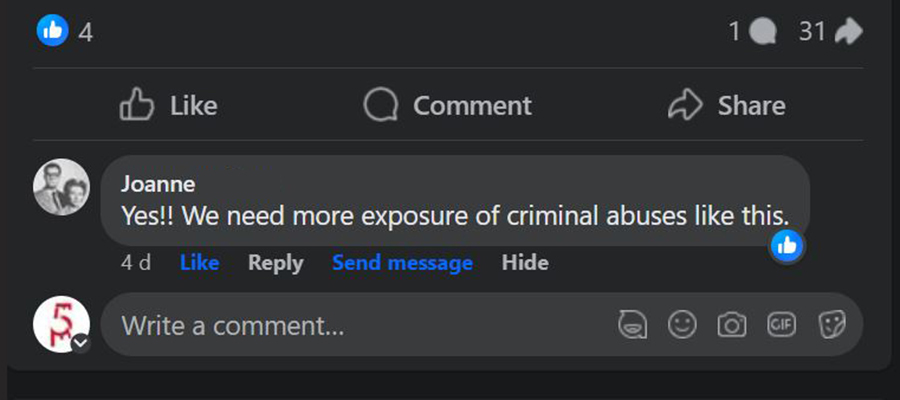

Clearly, as can be seen through our reporting and the posts of our followers (Review by Joanne) (Review by Charles), the truth of this story has been found by many potential clients of all involved companies. Not only have readers told us their stories, but some have gone so far as to post poor reviews on the social media accounts of Verico the Mortgage Station. When that occurred, the brokers were quick to refute our allegations without even discussing our evidence, just like when David Flude libelled our producer through email to Elizabeth. Regardless, they will not stand up and provide their views or evidence on camera. This meeting will grant them an opportunity to remain hidden but still say their piece so that we can maintain truth in our reporting.

We fully expect that the brokers at Verico the Mortgage Station and the management teams at Verico Financial Group and HomeEquity Bank will refuse to meet, or even respond, and that they will most likely use the excuse that they don't trust our offer, or us. However, about 97% of our followers and first-time readers have indicated that we are the ones being honest and supporting our allegations, while these big corporations are seen to be wallowing in denial and refusing to defend themselves. Only the guilty hide, so meeting in this way might help them to save face.

We will also remind them to take a look at our Testimonials Page. Regardless of what the brokers and bankers might tell others in secrecy, we hold a hard-earned trusted place in the hearts of those who help vulnerable people in Simcoe County, and we will keep our word about this meeting as we always have when working with all of those sensitive groups.

The brokers at Verico the Mortgage Station and the management teams at Verico Financial Group and HomeEquity Bank can continue to hide under the premise that our offer is not going to better their stake in this story, or they can view our suggestion of armistice as an olive branch offered to ensure our claims about them remain accurate.

After all, everyone, including their competitors and potential clients, can see that we have consistently supported everything we have said while they hide, and that we have made this offer despite being in a much stronger position than is true of them. The truth is just that important to us.

John IronsideProducer / Director

Five Points Media

A division of the Ontario Community Awareness Network

A registered not-for-profit

Big Blue Box Studios

1-310 Innisfil St. (corner of Essa Rd.)

Barrie, Ontario, L4N 3G3

Studio: 705-828-5605

Cell: 416-996-2786

Email: jironside@fivepointsmedia.ca

Web: www.fivepointsmedia.ca

FB: https://www.facebook.com/FivePointsMedia/

Throughout 2014-2023, our crew has been identified as the "Best Videography in Barrie"by Three Best Rated; an independent consumer advocacy group that bases their ratings on testimonials and referrals from local businesses.